Market Recap for Friday, April 26, 2019

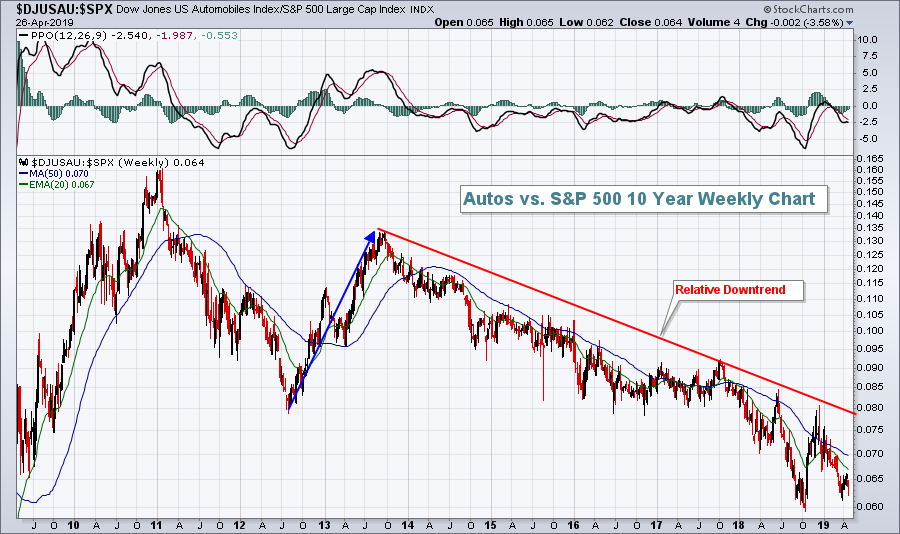

When was the last time I suggested Ford Motor Co (F, +10.74%) was a catalyst for any bull market advance? Ummm, probably never. But F was exactly that on Friday as much better than expected earnings lifted the stock and the automobile group ($DJUSAU, +2.42%). The DJUSAU was the best performing industry within consumer discretionary (XLY, +0.79%) as well. The history of relative strength among automobiles is not a good one, however:

It's not easy to trust a group that's performed so abysmally vs. the S&P 500 over the past 8 years, especially the last 5 1/2. But we also shouldn't ignore what could be taking place on Ford's chart:

It's not easy to trust a group that's performed so abysmally vs. the S&P 500 over the past 8 years, especially the last 5 1/2. But we also shouldn't ignore what could be taking place on Ford's chart:

9.50 has been a key pivot point on F's chart throughout the last 10 years. So long as that support level now holds, I could be more bullish F. But if it fails, don't lose sight of this relative chart. I have to be honest, though. Seeing F move more than 10% higher on more than 150 million shares is difficult to ignore. There was a lot of institutional buying on Friday. But will support hold? That will be the question when selling begins to kick in, as it inevitably will at some point.

9.50 has been a key pivot point on F's chart throughout the last 10 years. So long as that support level now holds, I could be more bullish F. But if it fails, don't lose sight of this relative chart. I have to be honest, though. Seeing F move more than 10% higher on more than 150 million shares is difficult to ignore. There was a lot of institutional buying on Friday. But will support hold? That will be the question when selling begins to kick in, as it inevitably will at some point.

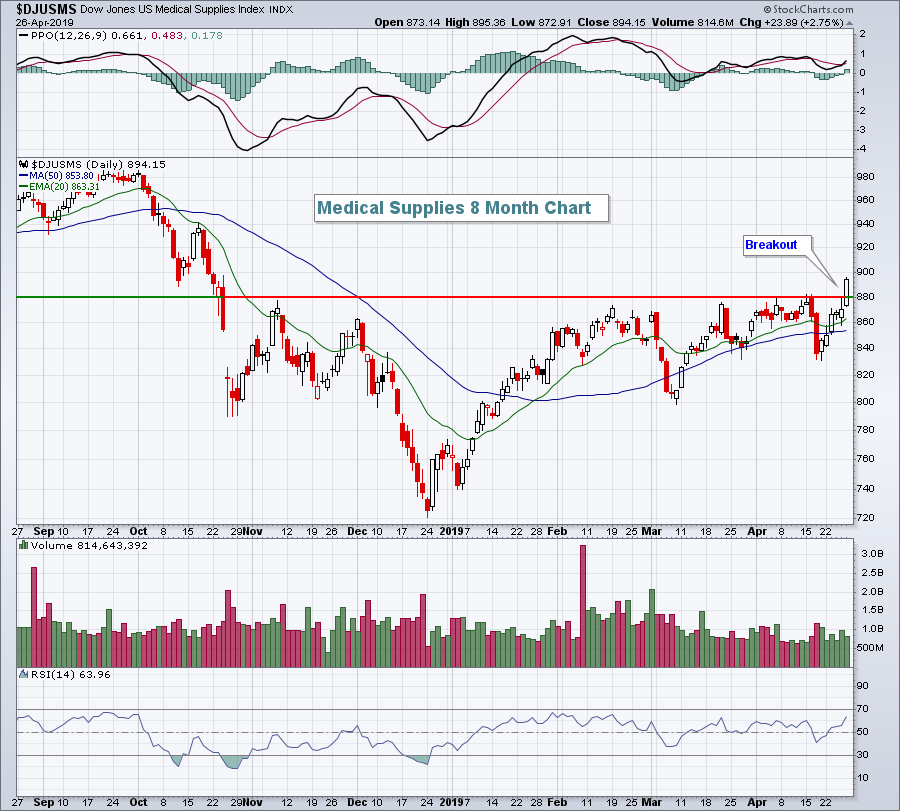

Healthcare (XLV, +1.00%) was actually the leading sector on Friday. Medical supplies ($DJUSMS, +2.75%) and health care providers ($DJUSHP, +2.38%) gave the sector a boost and Friday's breakout in the DJUSMS suggests this could be a key turning point for an industry that has struggled since reeling in Q4 2018:

There had been multiple failures between 870-880, so the emphatic breakout on Friday was a welcome sign for the DJUSMS and also for healthcare.

There had been multiple failures between 870-880, so the emphatic breakout on Friday was a welcome sign for the DJUSMS and also for healthcare.

Energy (XLE, -1.30%) was the obvious laggard on Friday, and while I expect to see the XLE rise over time, I suspect the strong U.S. Dollar ($USD) will keep relative pressure on the sector, along with relative pressure on materials (XLB, +0.83%) as well.

Pre-Market Action

Global markets were mixed overnight and this morning, but Dow Jones futures are currently bucking that trend, up 14 points, as we approach the opening bell.

Crude oil ($WTIC) is down fractionally, while the 10 year treasury yield ($TNX) is up 2 basis points to 2.53% at last check. The bump in yields could provide headwinds to financials (XLF) as we start a new week, chock full of earnings reports.

Current Outlook

Given the S&P 500 advance to fresh all-time highs, it's time to once again view the relative relationship between consumer discretionary (XLY) and consumer staples (XLP). The former is the more aggressive component in consumer stocks and typically outperforms its staples counterpart during bull market advances. Here's the latest view:

The Q4 selling, a distant memory now, actually tested a key XLY:XLP trendline and it held. During the S&P 500 recovery in 2019, the XLY:XLP ratio has been trending higher right along with the benchmark index. That's a very bullish development and should be respected. It supports the notion of a long-term secular bull market and higher prices ahead. We have a dovish Fed, and with Friday's better-than-expected Q1 GDP release, we could be looking at a much higher S&P 500 later in 2019.

The Q4 selling, a distant memory now, actually tested a key XLY:XLP trendline and it held. During the S&P 500 recovery in 2019, the XLY:XLP ratio has been trending higher right along with the benchmark index. That's a very bullish development and should be respected. It supports the notion of a long-term secular bull market and higher prices ahead. We have a dovish Fed, and with Friday's better-than-expected Q1 GDP release, we could be looking at a much higher S&P 500 later in 2019.

Sector/Industry Watch

The mobile telecommunications industry ($DJUSWC) has fallen more than 6% over the past month, failing to keep pace with a very strong communications services sector (XLC). Broadcasting & entertainment ($DJUSBC), media agencies ($DJUSAV), and internet ($DJUSNS) have all gained more than 13%, 11%, and 9%, respectively, over the same period so the relative weakness of the DJUSWC is quite obvious. However, if we step back and look at the bigger picture, the DJUSWC could be poised to regain a leadership role:

That relative trendline looks strong so don't be shocked to look back one month from now and see a completely different relative strength picture among communication services industry groups.

That relative trendline looks strong so don't be shocked to look back one month from now and see a completely different relative strength picture among communication services industry groups.

Monday Setups

I'm sticking with internet stocks ($DJUSNS) for my pick this week as the group has been a consistent relative outperformer in 2019 thus far. Snap Inc. (SNAP) recently posted very strong quarterly results and has sold off in typical "buy on rumor, sell on news" fashion. Here's the chart:

I'd be careful on a close below 10. Otherwise, I'm expecting SNAP to make another run towards 12.50.

I'd be careful on a close below 10. Otherwise, I'm expecting SNAP to make another run towards 12.50.

Historical Tendencies

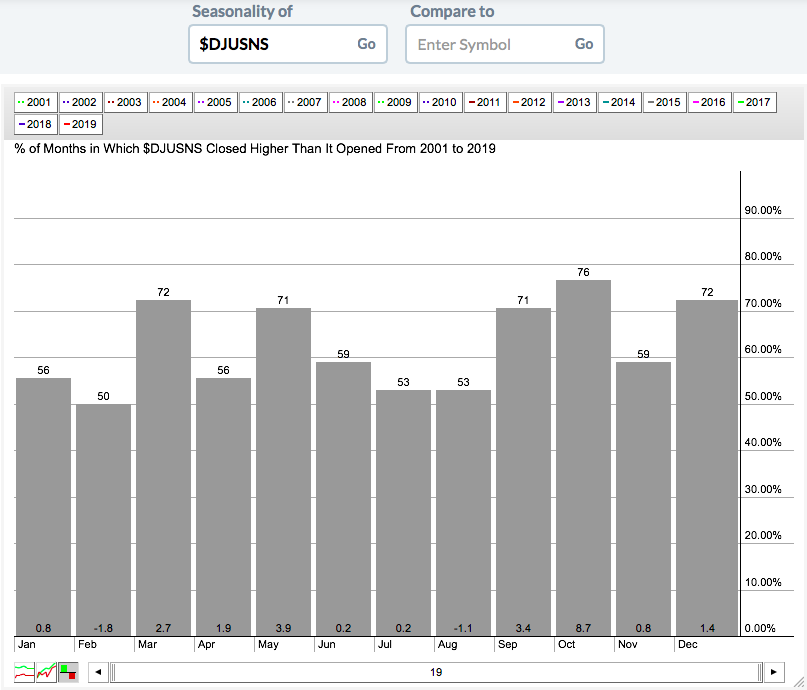

Internet stocks enjoy strong seasonality in May:

The only other calendar month to perform better for the DJUSNS over the past couple decades has been October, producing an average October return of +8.7%.

The only other calendar month to perform better for the DJUSNS over the past couple decades has been October, producing an average October return of +8.7%.

Key Earnings Reports

(actual vs. estimate):

CNA: 1.17 vs 1.04

FMX: .62 - estimate, awaiting results

L: 1.27 vs .96

NSP: 1.88 - estimate, awaiting results

ON: .43 vs .40

QSR: .55 vs .59

SPOT: (.90) vs (.37)

(reports after close, estimate provided):

ARE: 1.68

CACC: 7.93

CGNX: .16

CLR: .47

CNI: .89

GOOGL: 10.57

LOGI: .30

MGM: .16

MKSI: 1.07

MOH: 2.41

NBIX: (1.05)

NXPI: 1.55

RGA: 2.68

RIG: (.29)

SBAC: 1.99

VNO: .91

WDC: .49

WWD: 1.05

YUMC: .53

Key Economic Reports

February personal income released at 8:30am EST: +0.2% (actual) vs. +0.3% (estimate)

February personal spending released at 8:30am EST: +0.1% (actual) vs. +0.3% (estimate)

March personal income released at 8:30am EST: +0.1% (actual) vs. +0.4% (estimate)

March personal spending released at 8:30am EST: +0.9% (actual) vs. +0.7% (estimate)

Happy trading!

Tom