Market Recap for Thursday, January 3, 2019

Just about every market-related discussion since Wednesday's close has centered around Apple (AAPL, -9.96%)....and for good reason. AAPL is a U.S. stock market icon. Some might argue it is THE icon. When they lowered their revenue guidance substantially on Wednesday evening, it marked the first time in 17 years that AAPL lowered its revenue guidance. They are the poster child of conservative guidance and traders know that AAPL will beat estimates. It's simply how the market goes 'round. I've discussed on several occasions how everything seemed to just fall off a cliff at the start of Q4. We could discuss the massive drop in crude oil prices ($WTIC). Or how about the 10 year treasury yield's ($TNX) sudden plunge? What about the transports ($TRAN)? Banks ($DJUSBK)? The list goes on and on.

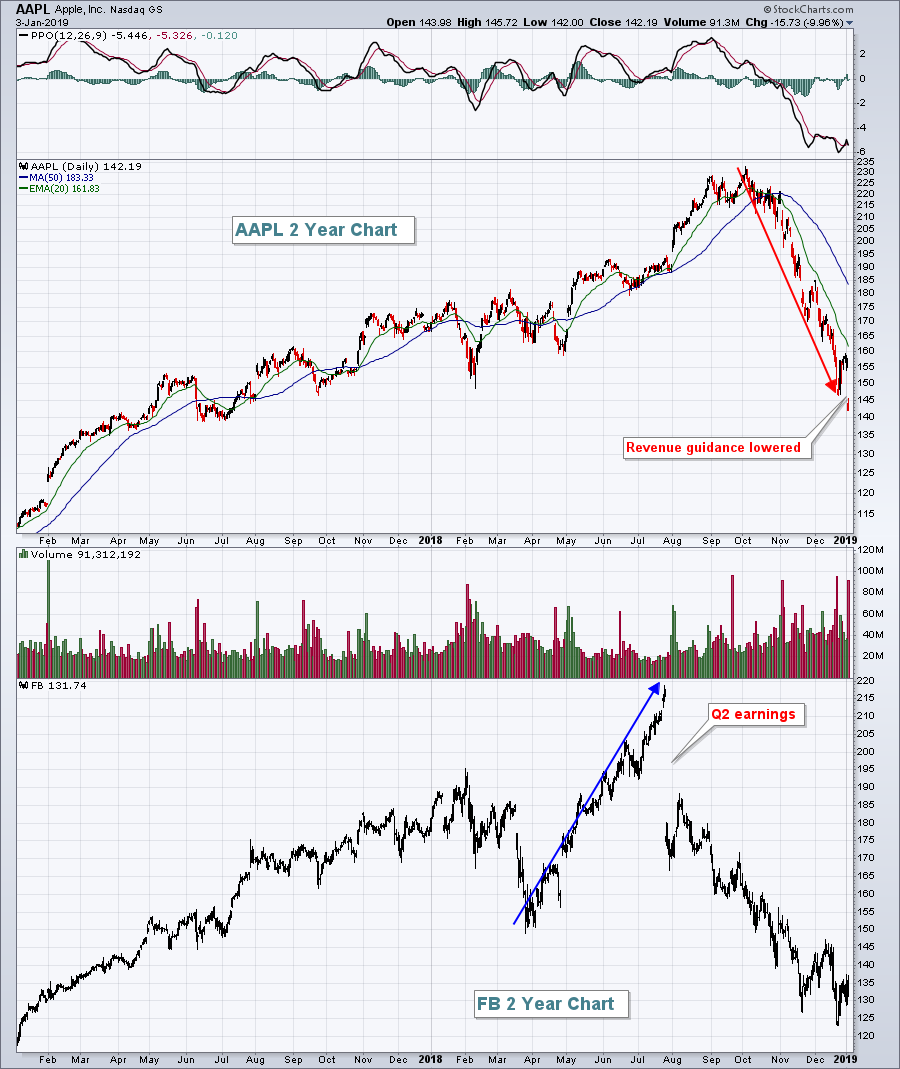

Well, this sudden change in economic conditions caught AAPL off guard too. They didn't see it coming. They did do one thing, however, that Facebook (FB) didn't do. They were communicating something to the big investment firms and they warned prior to their earnings report. FB just strolled into its quarterly earnings report as if nothing at all was wrong, then delivered a devastating blow that their margins were going to drop over the next two years! Listen, there's no easy way to tell those counting on you that you were wrong.....and wrong by a mile! But, being honest and upfront, in the end will help to restore confidence with the investing community much more quickly. AAPL handled an awful shortfall the right way. To illustrate the difference between AAPL and FB, look at their charts and see how the two were trading in the months leading up to their weak announcements:

AAPL was transparent, FB was not. Do you believe that FB would have been trading at an all-time high if the investment community had an inkling of their margins falling from 45% to 35% over the next two years? There's absolutely NO WAY. FB would have been downtrending into their announcement, not uptrending and setting all-time highs. In my opinion, it was incompetence/arrogance on the part of management, starting at the top with Zuckerberg. There's no excuse for what FB did. In AAPL's case, the stock was already taking a major hit prior to its announcement. And then they warned before they released their quarterly earnings. No company ever wants to admit that they failed, but there were circumstances that quite honestly were out of AAPL's control, the U.S.-China trade dispute being a big one. Personally, I think AAPL's track record and their handling of lowered guidance gives them a pass. FB? Not so much.

AAPL was transparent, FB was not. Do you believe that FB would have been trading at an all-time high if the investment community had an inkling of their margins falling from 45% to 35% over the next two years? There's absolutely NO WAY. FB would have been downtrending into their announcement, not uptrending and setting all-time highs. In my opinion, it was incompetence/arrogance on the part of management, starting at the top with Zuckerberg. There's no excuse for what FB did. In AAPL's case, the stock was already taking a major hit prior to its announcement. And then they warned before they released their quarterly earnings. No company ever wants to admit that they failed, but there were circumstances that quite honestly were out of AAPL's control, the U.S.-China trade dispute being a big one. Personally, I think AAPL's track record and their handling of lowered guidance gives them a pass. FB? Not so much.

AAPL has a huge weighting on the Dow Jones (-2.83%), S&P 500 (-2.58%) and NASDAQ 100 (-3.36%), so it's not shocking that performance on those indices was weak on Thursday. I believe a lot of the weakness was already built in as 2018 Q4 saw rapidly-deteriorating price action across most areas of the market. The small cap Russell 2000 was not directly impacted by AAPL's weakness, although it is affected by smaller companies that would experience some fallout from the news. The RUT lost a slightly more palatable 1.85% on the session.

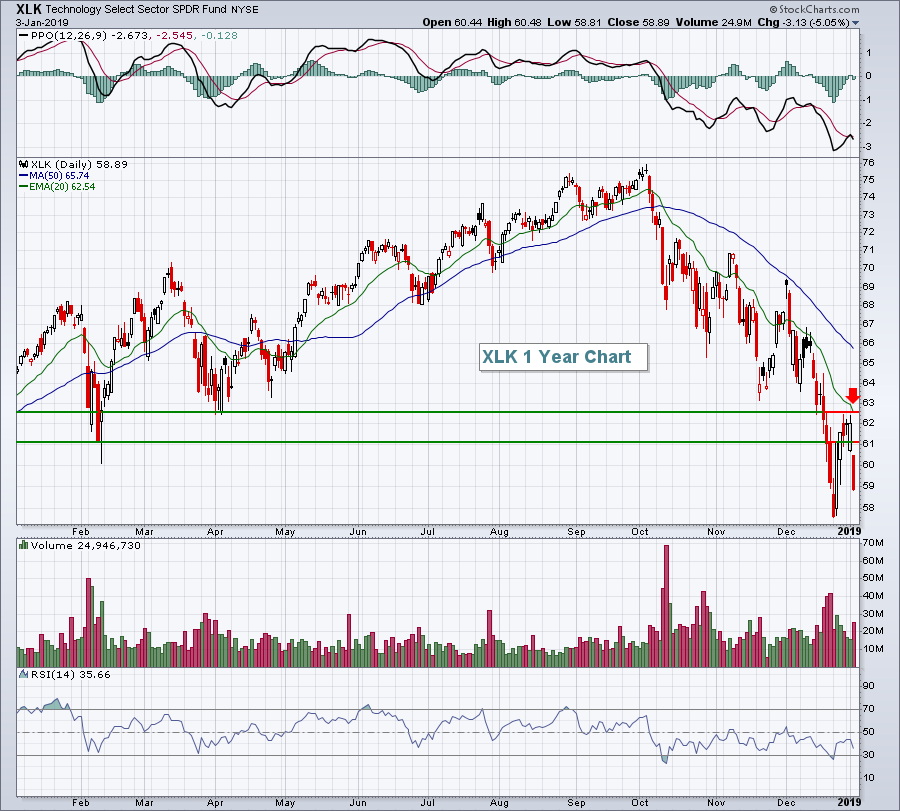

Among sectors, technology (XLK, -5.05%) was easily the hardest hit, as we would expect. Within technology, computer hardware ($DJUSCR, -9.06%) and semiconductors ($DJUSSC, -6.00%) were crushed. The timing of AAPL's announcement lined up almost perfectly technically as the recent bounce enabled the XLK to test overhead price resistance and near its declining 20 day EMA, a likely pivot area for prices to decline:

The two prior price lows in 2018 at 61.00 and 62.50 marked key support that was lost during the high-volume December meltdown in equity prices. That range then served as overhead price resistance, which was tested on Wednesday.

The two prior price lows in 2018 at 61.00 and 62.50 marked key support that was lost during the high-volume December meltdown in equity prices. That range then served as overhead price resistance, which was tested on Wednesday.

While all the focus yesterday was on AAPL and technology stocks, it should be noted that only the defensive real estate sector (XLRE, +0.46%) finished in positive territory and 6 of the 11 sectors lost at least 2%. It wasn't just isolated selling in AAPL and its suppliers. Nearly every nook of the stock market is being impacted by the sudden economic slowdown.

Pre-Market Action

I have to admit, looking at the stock market over the past few months and seeing several market leaders warning while job growth explodes makes very little sense. That's why I simply follow the charts. The impressive nonfarm payrolls for December (312,000 vs 175,000) followed a solid ADP employment report yesterday, and Dow Jones futures are currently higher by 291 points with roughly 30 minutes left to the opening bell.

The 10 year treasury yield ($TNX), which has been under intense pressure to the downside (from money rotating into the defensive treasury market), is much higher this morning to 2.62%, up 7 basis points on the solid jobs report. Crude oil ($WTIC) is continuing to rebound, up another 2.23% to $48.14 per barrel this morning.

There was a wild overnight session in Asia with the Tokyo Nikkei ($NIKK) tumbling more than 2%, while China's Shanghai Composite ($SSEC) and Hong Kong's Hang Seng Index ($HSI) both rallied more than 2%. European markets this morning are very solid with the German DAX ($DAX) up 168 points, or 1.61%, at last check.

Current Outlook

The good news from yesterday's action, if there was any, is that such a shocking event was handled fairly well in terms of the Volatility Index ($VIX). It was further confirmation that a lot of bad news was already priced in to the stock market. This, in my opinion, is a very solid signal in the very near-term. If we do weaken further and test the lows from December 2018, I suspect we'll see a much bigger rally. Here's a chart on the VIX:

While yesterday's news resulted in a short-term breakdown on the benchmark S&P 500, the VIX managed to maintain its downtrend. As long as this downtrend continues, we could primed for a further rally.

While yesterday's news resulted in a short-term breakdown on the benchmark S&P 500, the VIX managed to maintain its downtrend. As long as this downtrend continues, we could primed for a further rally.

Several days ago, I wrote an article titled "Support Has Been Established, Now How High Might We Bounce?". This would be a great time to revisit that article as I discussed reaction highs after bear market breakdowns during the previous two bear markets.

Sector/Industry Watch

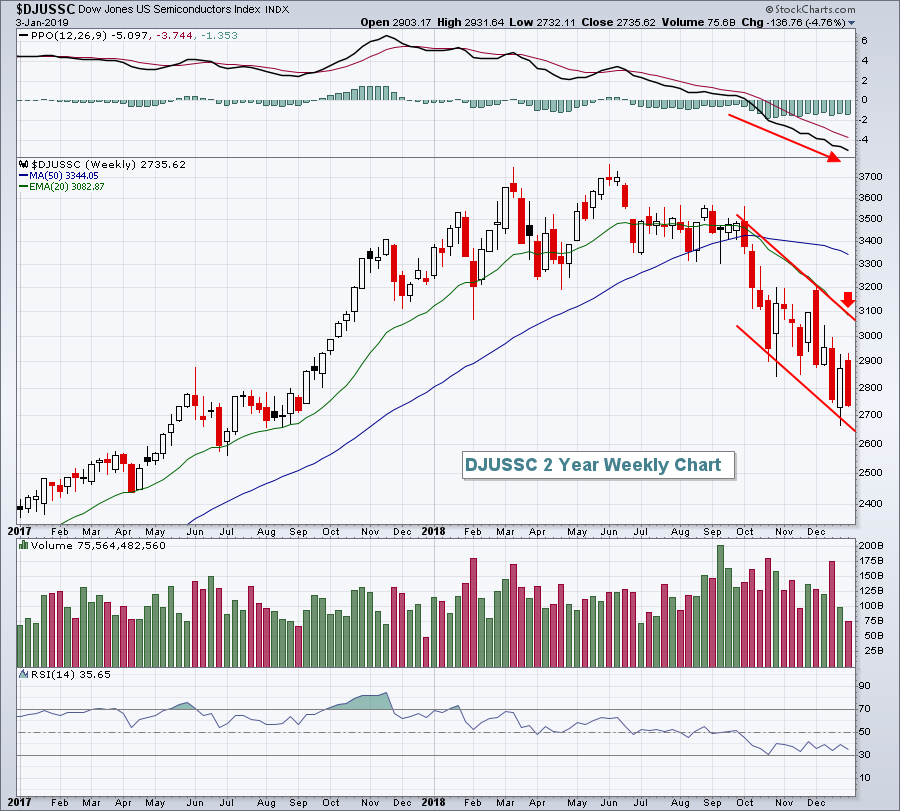

The Dow Jones U.S. Semiconductor Index ($DJUSSC) failed to sustain its Wednesday rally and tumbled during Thursday's session. There's still plenty of work left on the DJUSSC technically as you can see on the weekly chart below:

Weekly momentum is horrid, but there is plenty of room higher before testing its key 20 week EMA, currently at 3082. Given the VIX in the 20s, it's very difficult to predict short-term movements in the DJUSSC or any other area of the market for that matter. I'd continue to watch the longer-term weekly charts and especially those declining 20 week EMAs as major potential reversal points. While shorting is the name of the game now, you must realize there will be swings in both directions and these swings will take their toll emotionally. Trade smaller position sizes and do so with caution.

Weekly momentum is horrid, but there is plenty of room higher before testing its key 20 week EMA, currently at 3082. Given the VIX in the 20s, it's very difficult to predict short-term movements in the DJUSSC or any other area of the market for that matter. I'd continue to watch the longer-term weekly charts and especially those declining 20 week EMAs as major potential reversal points. While shorting is the name of the game now, you must realize there will be swings in both directions and these swings will take their toll emotionally. Trade smaller position sizes and do so with caution.

Historical Tendencies

Today marks the end of a historical bullish period. The next few days typically provide headwinds for the S&P 500 as the following annualized returns (since 1950) would suggest:

January 7 (Monday): -27.89%

January 8 (Tuesday): -66.38%

January 9 (Wednesday): -33.87%

Key Earnings Reports

(actual vs. estimate):

LW: .80 vs .70

RPM: .52 vs .66

Key Economic Reports

December nonfarm payrolls released at 8:30am EST: 312,000 (actual) vs. 175,000 (estimate)

December private payrolls released at 8:30am EST: 301,000 (actual) vs. 175,000 (estimate)

December unemployment rate released at 8:30am EST: 3.9% (actual) vs. 3.7% (estimate)

December average hourly earnings released at 8:30am EST: +0.4% (actual) vs. +0.3% (estimate)

December PMI services index to be released at 9:45am EST: 53.4 (estimate)

Happy trading!

Tom