Market Recap for Tuesday, October 16, 2018

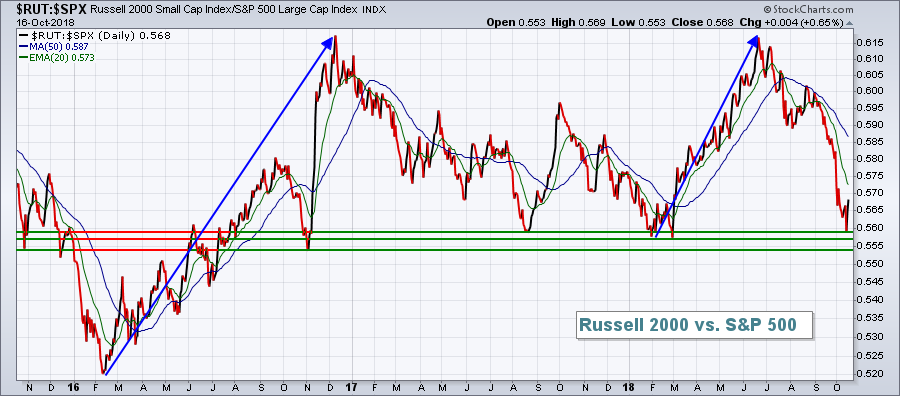

Wall Street welcomed a trend day to at least temporarily pause the violent downtrend we've experienced the past couple weeks. A trend day typically starts with a gap higher and then gains are extended throughout the session. We clearly saw that as the Dow Jones finished with a gain of 547 points, or 2.17%. Money rotated back towards aggressive areas of the market as the NASDAQ outperformed, climbing a very solid 215 points, or 2.89%. The small cap Russell 2000 ($RUT, +2.82%) outperformed the benchmark S&P 500 (+2.15%) for a second consecutive day, helping to thwart off a potential relative breakdown between the two indices:

The blue directional lines show the significant outperformance of small caps throughout 2016 and again from the February lows through early summer. That was not only the result of traders seeking risk, but also what can happen when the dollar rises substantially and money rotates away from multinational companies found on the S&P 500 (their EPS declines from foreign currency translation losses).

The blue directional lines show the significant outperformance of small caps throughout 2016 and again from the February lows through early summer. That was not only the result of traders seeking risk, but also what can happen when the dollar rises substantially and money rotates away from multinational companies found on the S&P 500 (their EPS declines from foreign currency translation losses).

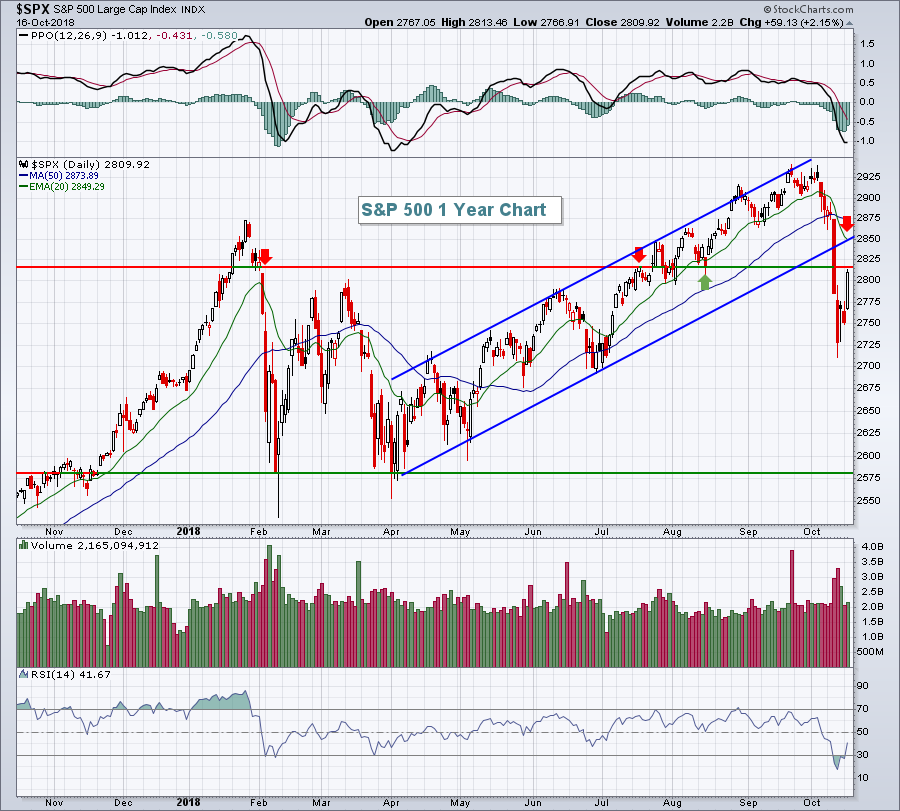

Despite the solid performance on Tuesday, the market remains firmly in the bears' grip. Longer-term I maintain my bullish view, but short-term I'm bearish and simply cautious from an intermediate-term perspective. An unusually high Volatility Index ($VIX) is my biggest concern right now as sudden selling episodes can arrive without warning. Technically, here's the S&P 500 daily chart with levels to watch for possible reversals:

The 2815-2820 area has provided key tops and bottoms on a few occasions during 2018 so I wouldn't ignore this level. Also, the declining 20 day EMA, currently at 2849, often times provides critical resistance during a downtrend. A backtest of the channel breakdown also would occur close to this 20 day EMA. So, if the S&P 500 continues to strengthen, it'll likely face key overhead resistance from 2815-2850.

The 2815-2820 area has provided key tops and bottoms on a few occasions during 2018 so I wouldn't ignore this level. Also, the declining 20 day EMA, currently at 2849, often times provides critical resistance during a downtrend. A backtest of the channel breakdown also would occur close to this 20 day EMA. So, if the S&P 500 continues to strengthen, it'll likely face key overhead resistance from 2815-2850.

Software ($DJUSSW, +3.66%) is a technology (XLK, +3.01%) industry group that was really beaten down the past couple weeks, but this group recovered a sizable amount yesterday after Adobe Systems (ADBE, +9.52%) raised its revenue guidance for next year. The DJUSSW has been a leader on Wall Street for the past few years, so that group climbing back above its 20 day EMA would be a solid start in rebuilding technical strength in the overall market.

Solid earnings from several Dow Components including Unitedhealth Group (UNH, +4.73%) and Johnson & Johnson (JNJ, +1.95%) seemed to kick start U.S. equities at the opening bell and that bullish momentum carried right through the closing bell.

Pre-Market Action

Asian markets were mostly higher overnight, while European markets are currently mixed. Despite a few more solid earnings reports out this morning in the U.S., it appears our equity markets will open down. Dow Jones futures are lower by 122 points with 30 minutes left to the opening bell.

Current Outlook

Transportation stocks ($TRAN) are featured here often - either reviewing their absolute performance or occasionally their relative performance vs. utilities ($UTIL). It's a very important area of the market that tells us much about our future economic conditions. The stock market looks ahead 6-9 months so if transportation stocks remain healthy technically, that's generally a good sign about economic growth. So where do we stand now?

Transportation stocks have been hit hard during this latest selling binge, dropping more than 10% in a month. But an uptrend is a series of higher highs and higher lows. In my opinion, the TRAN remains in a bullish uptrend so long as price support near 10000 holds. Trendlines are quite subjective as different points can be connected to prove a point. However, I believe the uptrend line drawn above is important as it intersects close to price support.

Transportation stocks have been hit hard during this latest selling binge, dropping more than 10% in a month. But an uptrend is a series of higher highs and higher lows. In my opinion, the TRAN remains in a bullish uptrend so long as price support near 10000 holds. Trendlines are quite subjective as different points can be connected to prove a point. However, I believe the uptrend line drawn above is important as it intersects close to price support.

Sector/Industry Watch

The Dow Jones U.S. Internet Index ($DJUSNS, +3.09%), led by the likes of Twitter (TWTR, +4.40%), Netflix (NFLX, +3.98%) and Facebook (FB, +3.43%), is now approaching its declining 20 day EMA with a very weak PPO. These tests typically fail, though not always. Nothing is a guarantee. But I'd be a bit careful for sure. FB, in particular, looks quite vulnerable as it trades in an ugly, topping head & shoulders pattern:

I've been bearish on FB since the earnings disaster in late July. I expected the neckline to form at 150, which we recently saw. Now I'd expect to see short-term strength in FB to form a pivotal right shoulder. A weak attempt at a rally would land FB back in the 165-170 range. If the overall market continues to strengthen and FB manages to escape its next quarterly earnings report relatively unscathed, avoiding a neckline breakdown, perhaps we could see FB move as high as 190. But make no mistake about it, this chart is technically broken and I believe it's just a matter of time before neckline support at 150 is lost. If I'm right, we could easily see FB back to 100 in time.

I've been bearish on FB since the earnings disaster in late July. I expected the neckline to form at 150, which we recently saw. Now I'd expect to see short-term strength in FB to form a pivotal right shoulder. A weak attempt at a rally would land FB back in the 165-170 range. If the overall market continues to strengthen and FB manages to escape its next quarterly earnings report relatively unscathed, avoiding a neckline breakdown, perhaps we could see FB move as high as 190. But make no mistake about it, this chart is technically broken and I believe it's just a matter of time before neckline support at 150 is lost. If I'm right, we could easily see FB back to 100 in time.

Historical Tendencies

Over the past two decades, basic materials (XLB) has been the best relative performer among sectors - and it hasn't been close. The XLB has outperformed the S&P 500 by 0.6%, 1.6% and 1.3% during October, November and December, respectively.

Key Earnings Reports

(actual vs. estimate):

ABT: .75 vs .74

ASML: 1.86 vs 1.90

MTB: 3.56 vs 3.35

NTRS: 1.58 vs 1.60

USB: 1.06 vs 1.04

(reports after close, estimate provided):

CCI: 1.38

KMI: .20

URI: 4.54

Key Economic Reports

September housing starts released at 8:30am EST: 1,201,000 (actual) vs. 1,216,000 (estimate)

September building permits released at 8:30am EST: 1,241,000 (actual) vs. 1,272,000 (estimate)

FOMC minutes to be released at 2:00pm EST

Happy trading!

Tom