Market Recap for Thursday, June 21, 2018

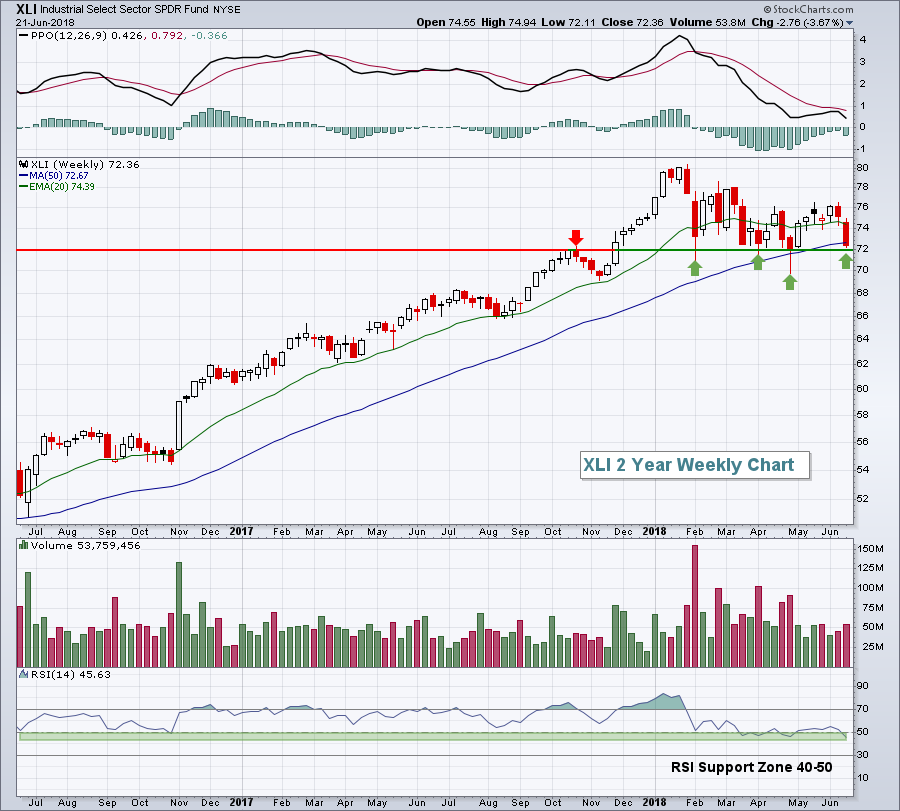

The Dow Jones closed lower for the 8th consecutive trading session, this time falling 196 points. It's been a steady decline, spurred by fears of a trade war with China and a rising U.S. Dollar Index ($USD). Trade tensions tend to simmer down over time as the headline news fades and the USD failed at a critical price resistance level (see Current Outlook section below). These two factors have driven the industrials (XLI, -1.26%) significantly lower in recent sessions. The XLI has declined more than 5% since the Dow Jones began its 8 day tumble as many companies in this space have been targeted by sellers due to both trade fears and a rising dollar. The good news? The XLI is nearing clear price and moving average support on its weekly chart. Look for a bounce:

Elsewhere, energy (XLE, -1.85%) led Thursday's decline and joined both industrials and materials (XLB, -1.06%) as sectors that have dropped approximately 5% during the recent large cap rout.

Elsewhere, energy (XLE, -1.85%) led Thursday's decline and joined both industrials and materials (XLB, -1.06%) as sectors that have dropped approximately 5% during the recent large cap rout.

Consumer discretionary (XLY, -0.71%) has avoided the carnage of late, instead rising throughout the past couple weeks to lead both the NASDAQ and Russell 2000 to all-time highs at the same time that larger cap multinational companies have been thoroughly discarded. Many retailers have avoided the sellers and this is clearly reflected in the widely diversified retail ETF (XRT):

Internet stocks ($DJUSNS) in the technology sector (XLK, -0.77%) have produced gains over the past week as well, aiding the tech-laden NASDAQ.

Internet stocks ($DJUSNS) in the technology sector (XLK, -0.77%) have produced gains over the past week as well, aiding the tech-laden NASDAQ.

Pre-Market Action

Asian markets were mixed overnight, this time with relative weakness emerging in Tokyo's Nikkei Average ($NIKK). In Europe, however, equity markets are higher with the German DAX ($DAX) now trying to move back above 12600 after closing beneath that previous support level for the first time in two months.

Crude oil ($WTIC), at last check, was at $66.62 per barrel, up 1.65% and trading above its 20 day EMA ($66.53). A close above its 20 day EMA would be the first such close since late May.

The Dow Jones is looking to end its 8 day losing streak as futures are currently pointing to a higher open. Dow Jones futures are higher by 135 points a little more than one hour before the opening bell.

Current Outlook

The U.S. Dollar Index ($USD) was on the verge of what I considered to be a major breakout on Thursday, but it failed and closed near its low of the session. That could prompt a period of consolidation, or possibly even selling, in the USD, which would be a short-term headwind for small cap stocks and relief for the larger cap indices like the Dow Jones and S&P 500. It would also likely provide a lift to the beaten-down industrials sector (XLI). Check out the USD's reversal at neckline resistance:

I don't believe small cap outperformance has ended. In fact, I believe it's just starting. But a short-term reversal in the dollar would suggest it's time to ring the register on small caps and wait for either a pullback to key support like the rising 20 day EMA....or to see the dollar make that breakout above 95.

I don't believe small cap outperformance has ended. In fact, I believe it's just starting. But a short-term reversal in the dollar would suggest it's time to ring the register on small caps and wait for either a pullback to key support like the rising 20 day EMA....or to see the dollar make that breakout above 95.

Sector/Industry Watch

The recent stock market bifurcation may best be reflected by simply comparing price performance of each sector vs. the S&P 500 over the past seven trading sessions. The S&P 500 topped seven days ago and has fallen roughly 1.5% over that span. The swings by industry, however, have been much more pronounced:

The march lower has been unabated for both the XLI and XLB and they could use some short-term relief, which I expect they'll get - perhaps as early as today. It's not surprising to see the XLU and XLP lead during periods of market weakness, but continuing strength and leadership from the XLY has been a hallmark of 2018 and that bodes well for the second half of the year in my opinion.

The march lower has been unabated for both the XLI and XLB and they could use some short-term relief, which I expect they'll get - perhaps as early as today. It's not surprising to see the XLU and XLP lead during periods of market weakness, but continuing strength and leadership from the XLY has been a hallmark of 2018 and that bodes well for the second half of the year in my opinion.

Historical Tendencies

Alexion Pharmaceuticals (ALXN), a recent Monday trade setup from my June 4th blog article, "Strong Jobs Report Powers NASDAQ To Near Record Close", is following its historical track record. ALXN is one of the strongest stocks on the NASDAQ 100 in terms of June performance and its quickly closing in on a 10% gain this month. The best news of all? ALXN performs even better historically during July, as does the entire biotechnology industry ($DJUSBT), which ranks 1st among all industry groups in July.

Key Earnings Reports

(actual vs. estimate):

BB: .03 vs. .00

KMX: 1.33 vs 1.21

Key Economic Reports

June PMI composite flash to be released at 9:45am EST: 56.3 (estimate)

Happy trading!

Tom