Market Recap for Monday, July 17, 2017

It seems that every major U.S. index is taking its turn at all-time highs and on Monday small cap stocks stepped up to the plate, closing at 1431.60, its highest close ever. It's interesting because it did so on a day when late day selling spoiled what would have been all-time highs for both the Dow Jones and S&P 500. It's also very interesting because this fresh high occurred in July, historically the start of very poor action for small caps as their summer performance is typically much weaker than the other major indices. For instance, over the past 20 years, the S&P 500 has outperformed the small cap Russell 2000 index by an average of 1.2% during the calendar month of July. It's the start of a three consecutive month period where small cap stocks are trashed. Here are the average monthly returns for the Russell 2000 since 1998:

July: -0.9%

August: -1.2%

September: -0.7%

Despite the seasonal weakness, here's what the RUT was able to do on Monday:

There have been several attempts to clear 1430, but the RUT finally did so on Monday, perhaps leading to continuing strength to challenge the upper end of its recent up channel. History and seasonal patterns make me suspicious, but I'm not one to argue with bullish price action. So let's just say I'm cautiously bullish small cap stocks at this time.

There have been several attempts to clear 1430, but the RUT finally did so on Monday, perhaps leading to continuing strength to challenge the upper end of its recent up channel. History and seasonal patterns make me suspicious, but I'm not one to argue with bullish price action. So let's just say I'm cautiously bullish small cap stocks at this time.

Utilities (XLU, +0.46%) seem to be using weakness in the 10 year treasury yield ($TNX) of late as a catapult to higher short-term prices. The XLU is at 52.16 and its now-declining 20 day EMA resides at 52.19 so a technical battle could surface later today. The falling TNX helped to spur REITs to nice gains on Monday as well, but weakness in banks ($DJUSBK) held back the financial sector (XLF, -0.32%). Only healthcare (XLV, -0.36%) performed worse on Monday.

Pre-Market Action

Today will be an interesting day to watch treasury prices and yields. The 10 year treasury yield ($TNX) is trading below its rising 20 day EMA this morning, a short-term bearish development for yields and the U.S. stock market. Gold ($GOLD) and crude oil ($WTIC) are both higher this morning, no doubt benefiting from the weak U.S. dollar ($USD) which yesterday closed beneath 95 for the first time in nearly a year.

U.S. futures have reversed and are pushing lower, down 41 points with 30 minutes left to the opening bell.

Current Outlook

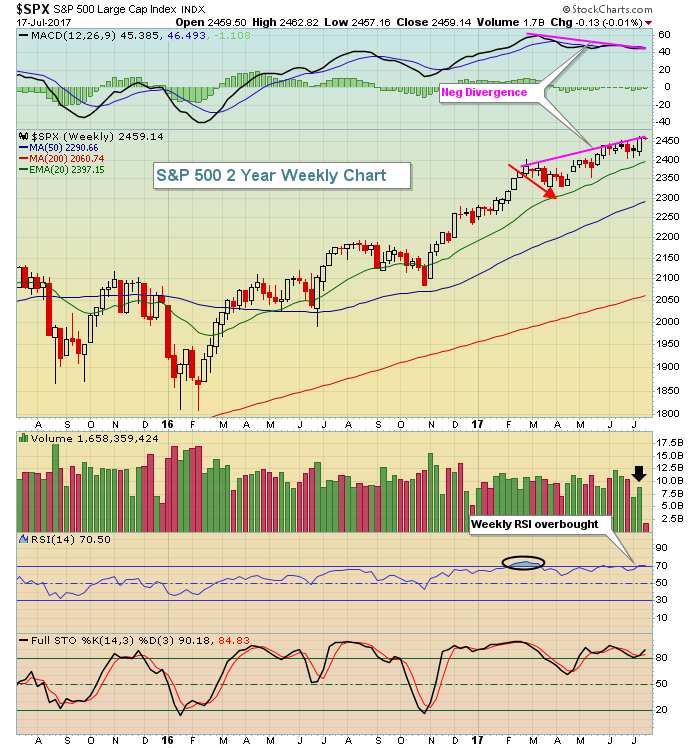

The U.S. stock market is searching for a catalyst to support higher prices. Earnings season is upon us and will likely be the determining factor as to whether this bull market pauses or continues its ascent. Last night after the closing bell, Netflix (NFLX) reported excellent subscriber growth, and despite missing its earnings estimate (.15 vs .16), the stock surged and is up nearly 10% in pre-market trading. While on the surface that's clearly bullish for NFLX, it did little to help the high-flying NASDAQ as futures are pointing to a mostly flat open. Meanwhile, many companies like Bank of America (BAC), Goldman Sachs (GS) and Johnson & Johnson (JNJ) reported strong bottom line beats this morning, yet U.S. futures are pointing lower. I realize we're very early into earnings season, but the very initial reaction to solid earnings results has been somewhat muted and that concerns me - especially given the seasonal weakness (July 18th through September 27th) that we have a tendency to see.

Let's not forget that bullish price momentum is weakening on the long-term weekly charts. If earnings can't provide us a catalyst to eliminate those negative divergences, what will?

Overbought oscillators, underwhelming volume, seasonal underperformance and the benchmark indices nonchalant attitude toward bottom line earnings beats tells me to be very careful in the next several weeks.

Overbought oscillators, underwhelming volume, seasonal underperformance and the benchmark indices nonchalant attitude toward bottom line earnings beats tells me to be very careful in the next several weeks.

Sector/Industry Watch

The Dow Jones U.S. Pharmaceuticals Index ($DJUSPR) has been consolidating in sideways, rectangular fashion for the past two years. While it's been frustrating for those on the long side, the pattern is most definitely bullish and I expect a bullish breakout - perhaps sooner rather than later:

Pharmas were overbought much of the 2013-2015 period, helping to lead the bull market. They've taken a turn as laggard the past two years as money had rotated away from healthcare stocks (XLV). Healthcare has returned to its leadership role recently, however, and the recent price action here on the DJUSPR has been quite bullish with bounces off the rising 20 week EMA as the MACD puts in higher highs. Bullish momentum appears to be accelerating and a weekly close above 540 would confirm a bullish resolution to the pattern and measure up to the 620-625 level.

Pharmas were overbought much of the 2013-2015 period, helping to lead the bull market. They've taken a turn as laggard the past two years as money had rotated away from healthcare stocks (XLV). Healthcare has returned to its leadership role recently, however, and the recent price action here on the DJUSPR has been quite bullish with bounces off the rising 20 week EMA as the MACD puts in higher highs. Bullish momentum appears to be accelerating and a weekly close above 540 would confirm a bullish resolution to the pattern and measure up to the 620-625 level.

Historical Tendencies

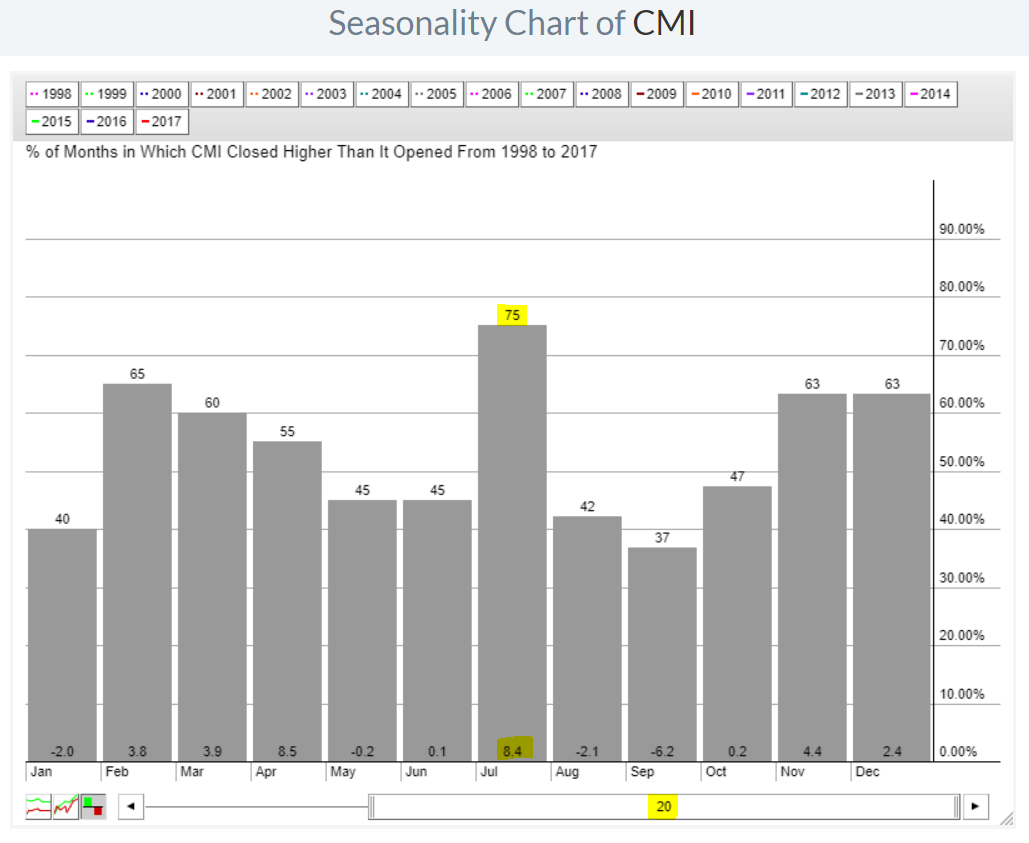

Cummins, Inc. (CMI) is a $28 billion industrial goods company that, for some reason, loves the calendar months of April and July. Over the past 20 years, CMI has averaged gaining 8.5% and 8.4%, respectively, during these two calendar months. Furthermore, July has produced gains 75% of the years over the past two decades so while other stocks begin suffering from the summer heat, CMI simply turns up the heat. Here are the seasonal results for this industrial giant:

CMI is overbought on its weekly chart so it could certainly see a bit of profit taking anytime, but the powerful seasonal tailwinds suggest that pullbacks should be considering solid entry points.

Key Earnings Reports

(actual vs. estimate):

AMTD: .44 vs .41

BAC: .46 vs .43

CMA: 1.15 vs 1.07

ERIC: .02 vs .05

GS: 3.95 vs 3.51

HOG: 1.48 vs 1.37

JNJ: 1.83 vs 1.79

LMT: 3.23 vs 3.09

NVS: 1.21 vs 1.16

UNH: 2.46 vs 2.38

(reports after close, estimate provided):

AMX: .32

CSX: .59

IBM: 2.73

UAL: 2.47

Key Economic Reports

July housing market index to be released at 10:00am EST: 68 (estimate)

Happy trading!

Tom