Market Recap for Thursday, March 2, 2017

Thursday was a day of profit taking as all of our major indices retreated with the small cap Russell 2000 taking the biggest hit, falling 1.27%. Every sector finished lower with the exception of the defensive utilities sector (XLU), which actually gained 0.72%. Consumer staples (XLP, -0.02%), another defensive sector, was also able to weather the profit taking storm. Both the XLU and the XLP have completed their cup formations with a potential handle (short-term weakness) to come. Here's the longer-term weekly look at both sectors:

Financials (XLF, -1.55%) took the biggest hit yesterday, but that sector also had the biggest gain on Wednesday so it wasn't unexpected. Industrials (XLI, -1.08%) and materials (XLB, -1.07%) also were quite weak on a relative basis. Airlines ($DJUSAR) fell 2.65% and failed to hold their breakout level and that failure comes with a negative divergence forming on the weekly chart - and also right at price resistance. Take a look:

Financials (XLF, -1.55%) took the biggest hit yesterday, but that sector also had the biggest gain on Wednesday so it wasn't unexpected. Industrials (XLI, -1.08%) and materials (XLB, -1.07%) also were quite weak on a relative basis. Airlines ($DJUSAR) fell 2.65% and failed to hold their breakout level and that failure comes with a negative divergence forming on the weekly chart - and also right at price resistance. Take a look:

I'd be careful with this group as it hits resistance with a negative divergence in place.

I'd be careful with this group as it hits resistance with a negative divergence in place.

Pre-Market Action

Dow Jones futures are flat as we kick off a new trading day. Global markets were mostly lower overnight in Asia and this morning in Europe. Crude oil prices ($WTIC) have rebounded after a rough session on Thursday. The 10 year treasury yield ($TNX) has moved slightly higher this morning and is now at 2.49%.

Current Outlook

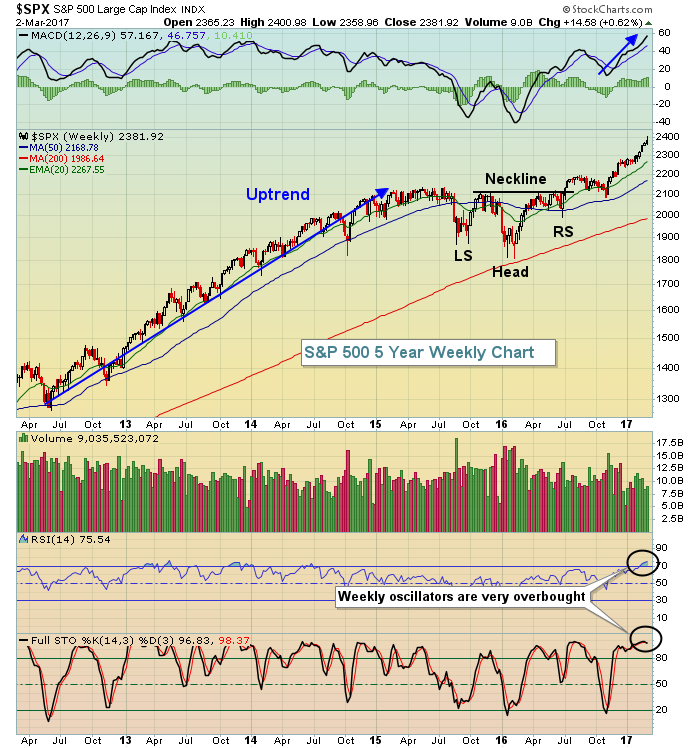

It's difficult to mark potential tops and I'm not going to attempt to do that. However, the S&P 500 did have a technical pattern in play (bullish inverse head & shoulders pattern) that once broken suggested we'd see the 2400 level reached - and that's exactly where the S&P 500 has gone. Have a look at the weekly chart and the pattern that developed prior to this bull market rally:

While we expect the market to continue to go up week after week, we really could use a pause - or the eventual correction will likely be much steeper. Weekly RSI at 75 and weekly stochastic at 97 doesn't occur often. When we saw that back in 2013 and 2014, it was followed by 20 week EMA tests. Currently, the 20 week EMA resides at 2267. From a longer-term perspective, it would actually be solid action to see the oscillators unwind with a 20 week EMA test.

While we expect the market to continue to go up week after week, we really could use a pause - or the eventual correction will likely be much steeper. Weekly RSI at 75 and weekly stochastic at 97 doesn't occur often. When we saw that back in 2013 and 2014, it was followed by 20 week EMA tests. Currently, the 20 week EMA resides at 2267. From a longer-term perspective, it would actually be solid action to see the oscillators unwind with a 20 week EMA test.

Sector/Industry Watch

One theme of bull markets is that money continually rotates and simply doesn't leave the stock market. So as groups become overbought and take breathers, other beaten down groups see money rotate their way. Over the past month, heavy construction ($DJUSHV) has actually lost ground and has been soundly outperformed by the benchmark S&P 500 over the past 2-3 months. Here's the proof:

Symmetrical triangles are bullish continuation patterns, meaning that they tend to break in the direction of the prior trend. Clearly, that prior trend was higher. The relative underperformance of the DJUSHV provides a much better reward to risk entry as the group finishes its consolidation phase. Despite the bullish technical pattern, we do have to realize that not all patterns work so a move in this index beneath 450 would begin to suggest the symmetrical triangle can be ignored, while a price break below 440 (January low) would really bring the overall uptrend into question.

Historical Tendencies

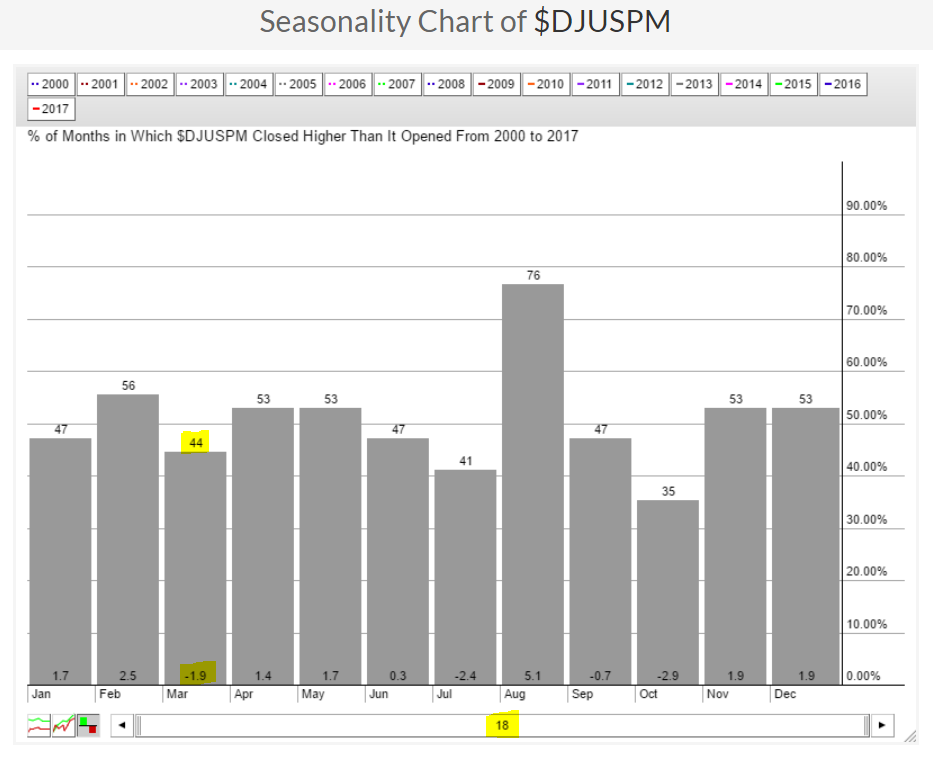

I think it's time to be very cautious with respect to precious metals. I spend much of my time pointing out the bullish historical tendencies in various areas of the market, but it's also a good idea to occasionally look at what to avoid from a historical perspective. During March, the worst performing industry group is the Dow Jones U.S. Gold Mining Index ($DJUSPM). Here's how this industry performs throughout the calendar year:

Gold mining performs worst in July and October, but March is another very poor month. Gold mining is one of only two industry groups that averages losing more than 1% during the month of March. The other is transportation services ($DJUSTS), but that group does look solid technically. The DJUSPM, on the other hand, has a very questionable long-term weekly chart and a break beneath 65 would be a significant loss of support.

Gold mining performs worst in July and October, but March is another very poor month. Gold mining is one of only two industry groups that averages losing more than 1% during the month of March. The other is transportation services ($DJUSTS), but that group does look solid technically. The DJUSPM, on the other hand, has a very questionable long-term weekly chart and a break beneath 65 would be a significant loss of support.

Key Earnings Reports

(actual vs. estimate):

CQP: .39 vs (.07)

LUK: .37 vs .23

Key Economic Reports

February ISM non-manufacturing index to be released at 10:00am EST: 56.5 (estimate)

Happy trading!

Tom