The Mindful InvestorJune 14, 2024 at 07:27 PM

There is no denying the strength of the bullish primary trend for stocks off the April low. The Nasdaq 100 index continues to make new all-time highs, closing just under $480 on Friday after gaining about 3.5% over the last week...Read More

The Mindful InvestorJune 07, 2024 at 07:33 PM

There is no denying that the primary trend for the S&P 500 remains bullish as we push to the end of Q2 2024...Read More

The Mindful InvestorMay 31, 2024 at 06:55 PM

While the S&P 500 did manage to finish the week above tactical support at 5250, one of the most widely-followed macro technical indicators recently registered an initial sell signal for the second time in 2024...Read More

The Mindful InvestorMay 24, 2024 at 02:45 PM

Dow Theory is based on the foundational work of Charles Dow, considered the "Father of Technical Analysis...Read More

The Mindful InvestorMay 17, 2024 at 05:36 PM

As the S&P 500 and Nasdaq 100 have once again made new all-time highs, and the Dow Jones Industrial Average has briefly broken above the 40,000 level for the first time, how should we think about further upside for our equity benchmarks? There are two general ways to play a chart...Read More

The Mindful InvestorMay 10, 2024 at 04:30 PM

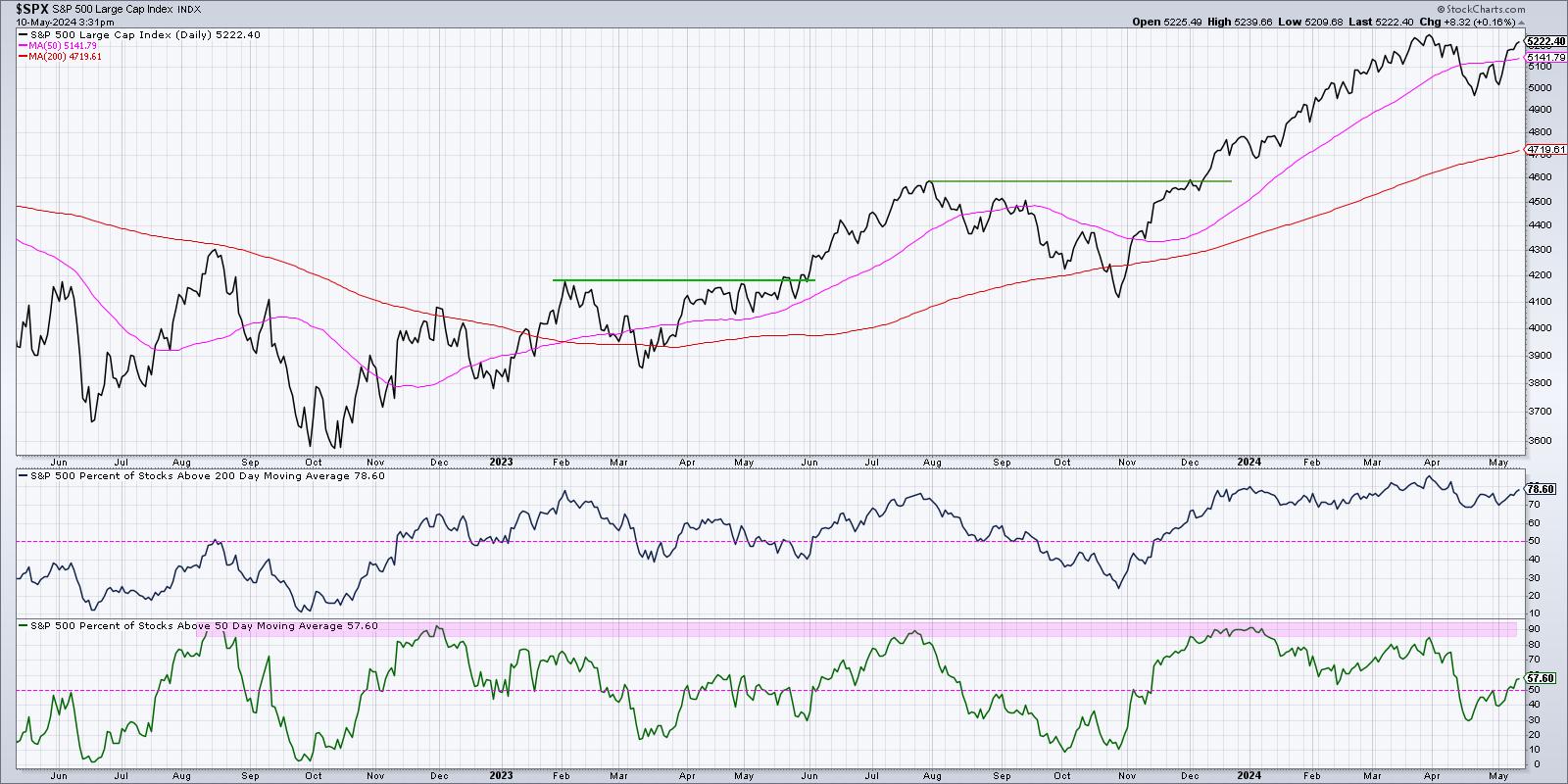

There's no denying the strength the major averages have displayed off their April lows. The S&P 500 finished the week within a rounding error of the previous all-time high around 5250...Read More

The Mindful InvestorMay 03, 2024 at 03:45 PM

As investors flock to Omaha, Nebraska in their annual pilgrimage to learn from the great Warren Buffett, it seems an opportune time to reflect on the technical evidence for Berkshire's biggest holding, Apple (AAPL)...Read More

The Mindful InvestorApril 26, 2024 at 08:08 PM

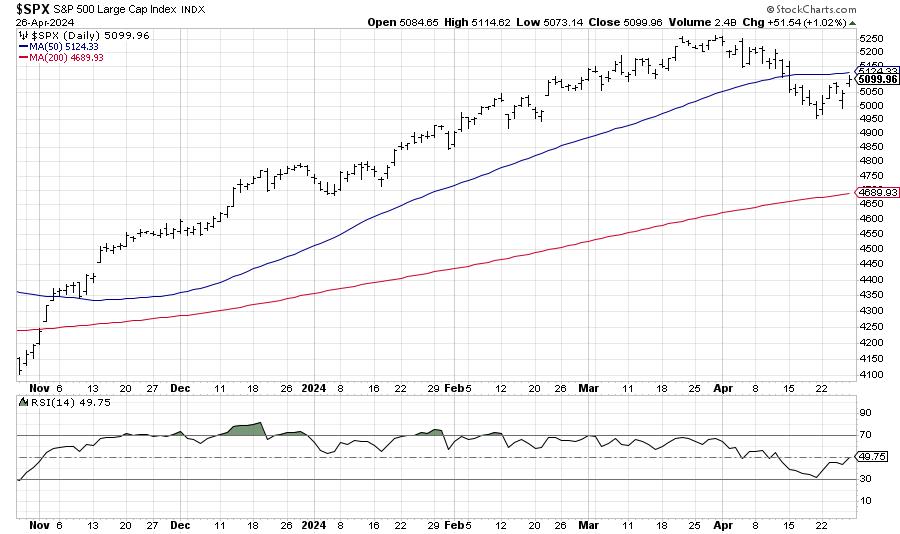

We've been covering the signs of weakness for stocks, from the bearish divergences in March, to the mega-cap growth stocks breaking through their 50-day moving averages, to even the dramatic increase in volatility often associated with major market tops...Read More

The Mindful InvestorApril 20, 2024 at 12:16 AM

While our major equity benchmarks showed incredible strength in Q1 2024, breadth conditions have been deteriorating since mid-March...Read More

The Mindful InvestorApril 12, 2024 at 10:57 PM

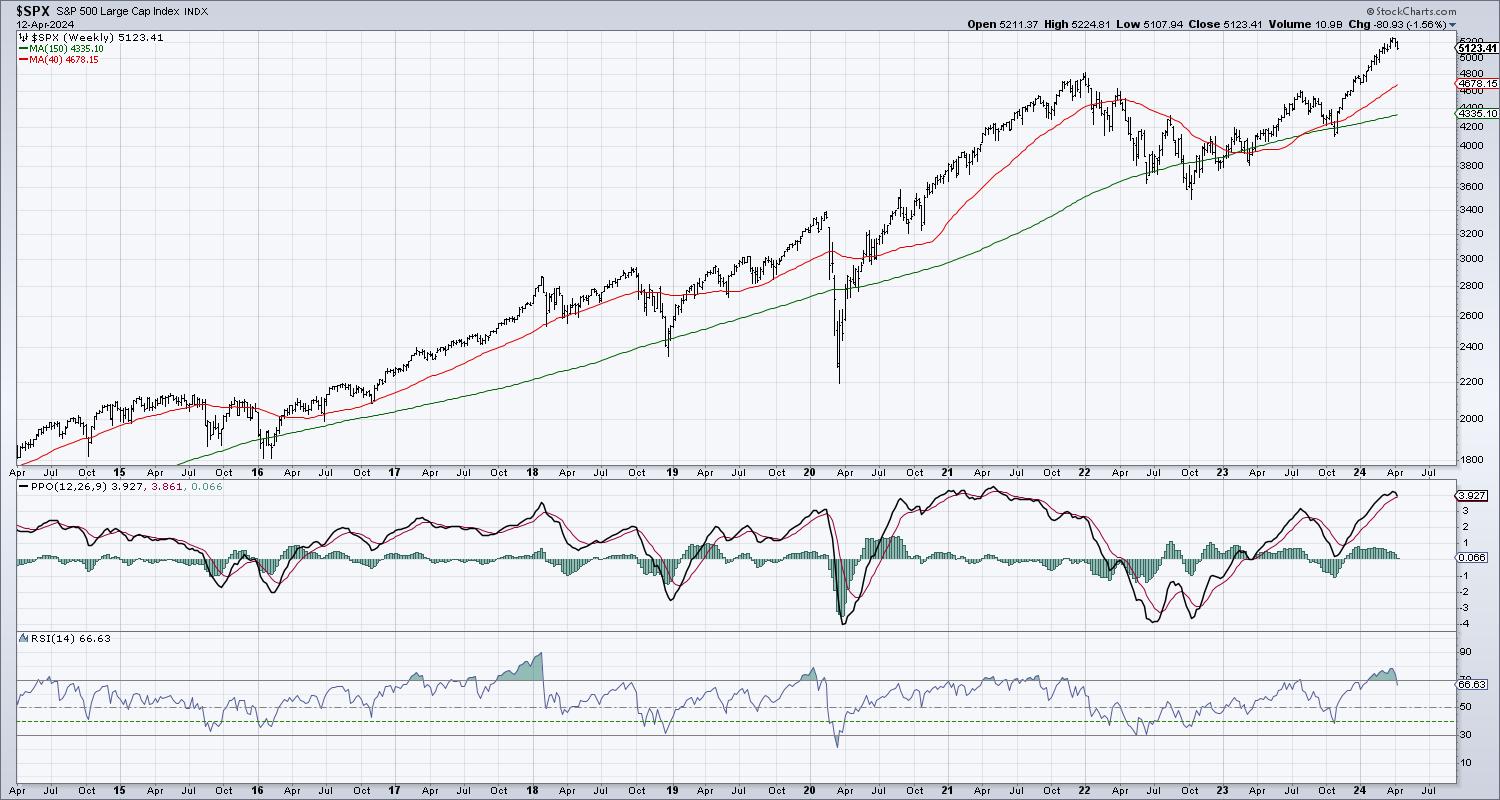

Toward the bottom of my Mindful Investor LIVE ChartList, there is a series of charts that rarely generate signals...Read More