Put a man on a bicycle and he’ll surprise you.

Put a man on a machine and he’ll amaze you.

Teach him asset allocation and he’ll electrify you!

Due to the unusual number of new subscribers who read my Traders Journal blog about Asset Allocation, I’ve decided to break protocol and write two Action Sequence blogs in a row.

For years, I’ve been preaching that individual investors should invest significant time in their asset allocation efforts. It seems as though you all are listening! Financial Valhalla is entered through the asset allocation door.

Ignoring that fact is as silly as honking at a driverless car. Ignore it at your peril. The list of pro athletes who choose to ignore prudent money management and asset allocation is mind boggling. Mike Tyson blows through $300 Million , baseball’s Curt Schilling rips through $112 Million, and even the great Johnny Unitas went bankrupt. In the celebrity and entertainment arena, the list of men and women who’ve gone bankrupt stretches from Los Angeles to San Diego.

My point is that ignorance is toxic when it comes to money and finances. If you are unable to galvanize your savings, spending and investing habits responsibly into a simple asset preservation methodology, then you will face future pain that’s enormous and ongoing. Unfortunately, the mantra for most is “live for today.”

I do understand the difficulties of to trying to corral the extravagant lifestyles of overpaid athletes and celebrated movie stars, as well as today’s well paid millennials. I’m sure it’s not easy to convince them to abstain from the immediate gratification of a sexy new Porsche in exchange for some vague future visions of a comfortable retirement. Convincing them today to bank both their dreams and their dollars is a very tough sell indeed. They see it as deprivation. The challenge is to make them re-imagine it as self-preservation.

In this fantasy world, let’s just assume that we have the savings portion nailed down! Now let’s move onto the protection stage. By chance, I currently have in front of me at my desk the annual report for a sector ETF. In it, this report lists in detail eight different classes of risk facing those who invest in this ETF. I could easily add another eight myself.

Therein is our objective with this Asset Allocation exercise. How do you minimize risks while producing a reasonable return through an entire business cycle? We do this by building a portfolio containing some assets that zig during certain phases while others zag. This is achieved by considering the historical correlations between different assets. It is a mathematical approach which looks at past performance and relationships over a time period of your choosing.

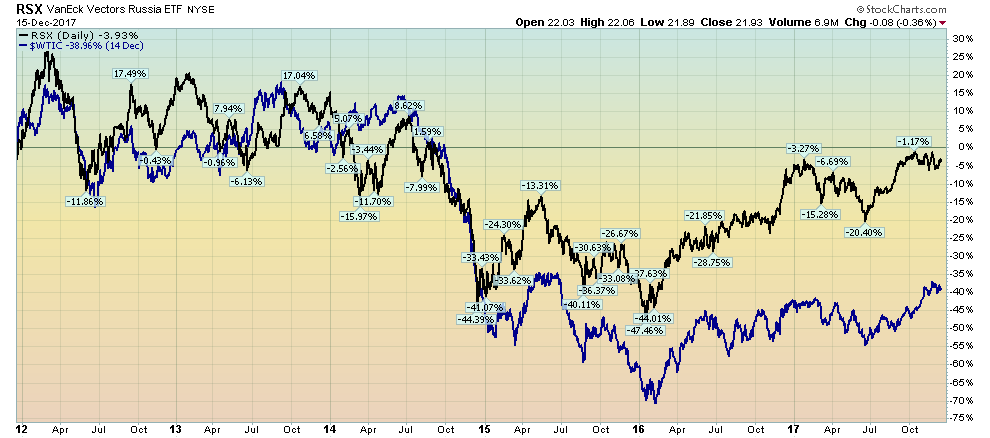

The reality is that many investors use the intuitive diversification approach. For example, they’ll pick an international country fund (such as Russia — RSX) ,the S&P 500 and a commodity (such as Light Crude Oil — $WTIC). From the chart, you can see that intuition fails. Diversification is not achieved because the Russia economy is basically a gas station masquerading as a country!

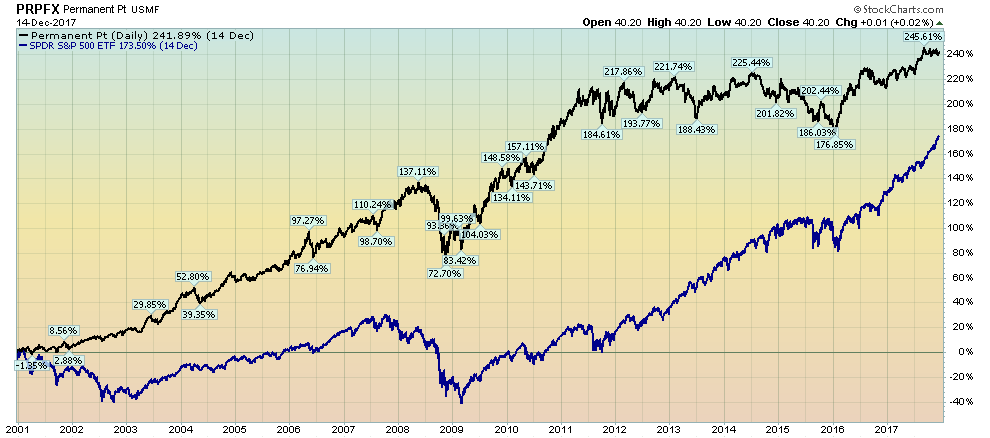

Let me toss you another chart. Back in 1982, the Permanent Portfolio mutual fund (PRPFX) began operation. Based on academic research, this fund assembled a broad array of asset classes and maintained “target percentages” in each. This is what I would label a fixed-mix allocation. The six asset classes are gold, silver, Swiss franc, real estate & natural resource stocks, aggressive growth stocks and dollar assets. I’ll let the fund’s PerfChart speak for itself. Since 1999, it has outperformed the S&P 500 by 85% through a variety of different market cycles. Asset allocation works!

Let me toss you another chart. Back in 1982, the Permanent Portfolio mutual fund (PRPFX) began operation. Based on academic research, this fund assembled a broad array of asset classes and maintained “target percentages” in each. This is what I would label a fixed-mix allocation. The six asset classes are gold, silver, Swiss franc, real estate & natural resource stocks, aggressive growth stocks and dollar assets. I’ll let the fund’s PerfChart speak for itself. Since 1999, it has outperformed the S&P 500 by 85% through a variety of different market cycles. Asset allocation works!

Refer back to the Action Practice #23 blog. From our book, you’ll see that we clipped the chart of the 59 asset classes. The exercise was for you to make some decisions regarding which six asset classes are most appropriate for you personally based on your age, savings, family situation, and life objectives, just to mention a few.

Refer back to the Action Practice #23 blog. From our book, you’ll see that we clipped the chart of the 59 asset classes. The exercise was for you to make some decisions regarding which six asset classes are most appropriate for you personally based on your age, savings, family situation, and life objectives, just to mention a few.

From the 59 Asset Classes, I’ve chosen my six asset classes plus the Vanguard Short Term Corporate Bond ETF (VCSH) as a cash / money market surrogate. I used a professional closed site to calculate my correlations. I suggest you use the correlation tracker at sectorspdr.com which allows you to stretch the historical look-back period (November 30, 2009, in my case). That’s the maximum data available for the tickers in my portfolio. (You are not allowed to quiz me as to why I did not use stockcharts.com correlations.) All correlations are calculated against VTI. So here is my diversified “Blog” portfolio of six asset classes with their correlations to VTI listed after each one.

- Vanguard Total Stock Market Index (VTI) = 1.00

- MSCI Europe, Australia and Far East — EAFE Index (EFA) = .85

- SPDR S&P Biotech ETF (XBI) = .60

- Powershares Commodity Index (DBC) = .57

- Dow Jones Global Real Estate (RWO) = .74

- iShares Gold Trust (IAU) = .07

In the real world, I actually allocate my personal portfolio across 20 asset classes divided into three types of investing objectives with unique risk profiles in each..

- CORE — an example would be VTI.

- EXPLORE — an example would be XBI.

- SUPER EXPLORE — for myself, this is ten individual equities.

So, there it is — an allocation that subtracts stress in my life and that can do the same for you. How did your portfolio compare?

This Week’s Action Practice:

Now that you’ve chosen your appropriate mix of six asset classes, the next step is to allocate funds into each asset basket in appropriate percentages. Whether you choose to employ a fixed-mix strategy (as the Permanent Portfolio fund did), or an equal weighted methodology where each of your six asset baskets is approximately 15-17% of your assets or a tactical strategy where you dynamically shift assets amongst the six asset classes — it’s a serious investment decision that will impact your bottom line. Bon chance. Till next time!

Trade well; trade with discipline!

- Gatis Roze, MBA, CMT

- Grayson Roze

- Author, Tensile Trading: The 10 Essential Stages of Stock Market Mastery (Wiley, 2016)

- Presenter of the best-selling Tensile Trading DVD seminar

- Presenter of the How to Master Your Asset Allocation Profile DVD seminar

- Developer of the StockCharts.com Tensile Trading ChartPack