With 25 years under his belt at Morningstar, Russel Kinnel, Director of Manager Research, has certainly earned my respect. So my radar went up when he wrote a column entitled “Lessons Learned.” Considering that Kinnel has been a keen observer of individual investor behavior for a generation, I believe all of us can profit by heeding his wisdom.

With 25 years under his belt at Morningstar, Russel Kinnel, Director of Manager Research, has certainly earned my respect. So my radar went up when he wrote a column entitled “Lessons Learned.” Considering that Kinnel has been a keen observer of individual investor behavior for a generation, I believe all of us can profit by heeding his wisdom.

In the Action Practice #22 blog, I presented my readership with a different kind of challenge for the first time ever. Instead of focusing on charts, I urged my readers to focus on themselves — on what we refer to in our book as the “Investor Self”.

In that blog, I did not disclose that the list of “dandy dozen” questions was from Russel Kinnel’s column on investing lessons learned — a list that was published recently in the Morningstar Fund Investor periodical. Therefore, I’d like to now give him richly deserved credit for those 12 insightful lessons, but I also want to add my own observations as well.

- Kinnel encourages investors to “Build a plan for multiple investment goals and stick to it.” I would like to add these three comments.Put it in writing (which may seem obvious already).Use the John Bogle model of Core & Explore to apportion your portfolio.Then blend it with your estate plan (which you should revisit every 2 years).

- Kinnel warns, “Align your investment with each goal.” At the risk of being called Mr. Obvious, I have seen long-term investors get tempted by the market and lured into silly, if not outright stupid, investments. Know thyself and stick to your knitting. In other words, focus; investing takes discipline.

- Kinnel cautions, “Keep your costs low!” Let me mount my soapbox. This is a hot button item for me because the investment arena is clearly an example of where you can “pay for what you don’t get.” I just saw a Morningstar research piece that showed a direct inverse correlation to starred mutual funds and their costs. It showed that 5-star funds had the lowest fees and the highest performance, whereas 1-star funds had the highest fees and poorest performance. As expected, two, three and 4-star funds aligned in the middle.

- Kinnel states, “Choose funds that are good bets to be keepers five years from now.” This is precisely why I avoid hot funds that have just one superstar manager. I prefer funds run by a tenured team with a long record of consistent outperformance over many years. And of course, I insist that those candidates have no loads, no 12b-1 fees and low expense ratios. Select funds from outfits like Primecap, T. Rowe Price and Vanguard typically qualify here.

- Kinnel heartens, “When monitoring funds, pay more attention to management and costs than changes in performance.” I maintain that great funds will have a year or two of underperformance, but a great management will rise up once again, and low fees will bail you out, too. It’s not quite as simple as that, but you get the idea.

- Kinnel states, “Build from the core out.” The core is where you start. The objective here is asset protection. From there, you can expand your “explore” portfolio to wherever you are hunting for growth. But your core should always be at least 80% of your portfolio. I’m personally at 80% core, 15% explore and 5% super-explore, but I’ve been at this for awhile.

- Kinnel cheers, “Be open to passive and active investing.” My “best-of-breed” approach maintains 20 PerfCharts of the 20 asset classes in which I invest. For some asset classes, such as USA mid-caps, I plot the best indexes, ETFs and mutual funds all on one PerfChart. When you do that, Primecap Odyssey (POAKX) clearly beats all others. This fund’s active management earns its fees and is justified by consistent outperformance. With the Biotech asset class, the indexes, ETFs and mutual funds lead me to invest in XBI which is a passive ETF. My point is that the passive-versus-active debate must be specific to each asset class.

- Kinnel tells investors, “Be patient.” Easily said! But for some investors, this is impossible to achieve. I’ve seen investors become traders because they pulled the trigger on a 10% profit and seemed to be genetically incapable of letting a trend run. Know thyself. Know thy investing time frame. Combining patience with the miracle of compounding is a wonder to behold if you are able to take advantage of it. If you can’t, then welcome to the traders’ circle.

- Kinnel gives notice, “Do not let news drive your investments.” By the time you see, hear or read the news, it’s already reflected in the price charts. The media is designed to sell advertising. It’s not designed to make you a profitable investor. News at the extremes sells advertising, so the news pendulum by its very nature is always swinging from one extreme to the other. When you layer on top of that the fact that Wall Street is notorious for generating disinformation, you’ll readily part with your portfolio if you trade the news.

- Kinnel admonishes, “Don’t let the price you paid for an investment drive your decision on whether to sell.” Grayson and I just presented a two-day “Investor Boot Camp” attended by very sophisticated experienced individual and professional investors. The topic that the attendees most wanted to discuss was selling. Selling is clearly a behavioral challenge. This may come as a shock, but once you buy an equity, the markets simply do not care what price you paid for it. Focus on returns and what the chart is now telling you. Holding a losing equity until you get back to even is not a rational strategy.

- Kinnel pleads, “Don’t worry about a fund’s net asset value (NAV).” As an investor, you are obligated to learn the language of investing. For example, you should know the difference between a market order and a limit order. Similarly, I maintain that you are obligated to understand the consequences and the implications of distributions (dividends, short-term capital gains and long-term capital gains), the consequences of reinvesting your distributions, and the significance of distribution dates (don’t buy just before the dates). You should also understand how proper charting adjusts for those distributions that reduce NAV, and so on. This is precisely why StockCharts.com offers plots of past distributions which one can chart below the equity of choice. Remember that stocks, ETFs and mutual funds may all make distributions. (Note: Be aware of other charting sites that do NOT adjust for distributions.)

So, there you have it — Russel Kinnel’s “dandy dozen” with my own comments tossed in the mix as well. Powerful observations!

This Week’s Action Practice:

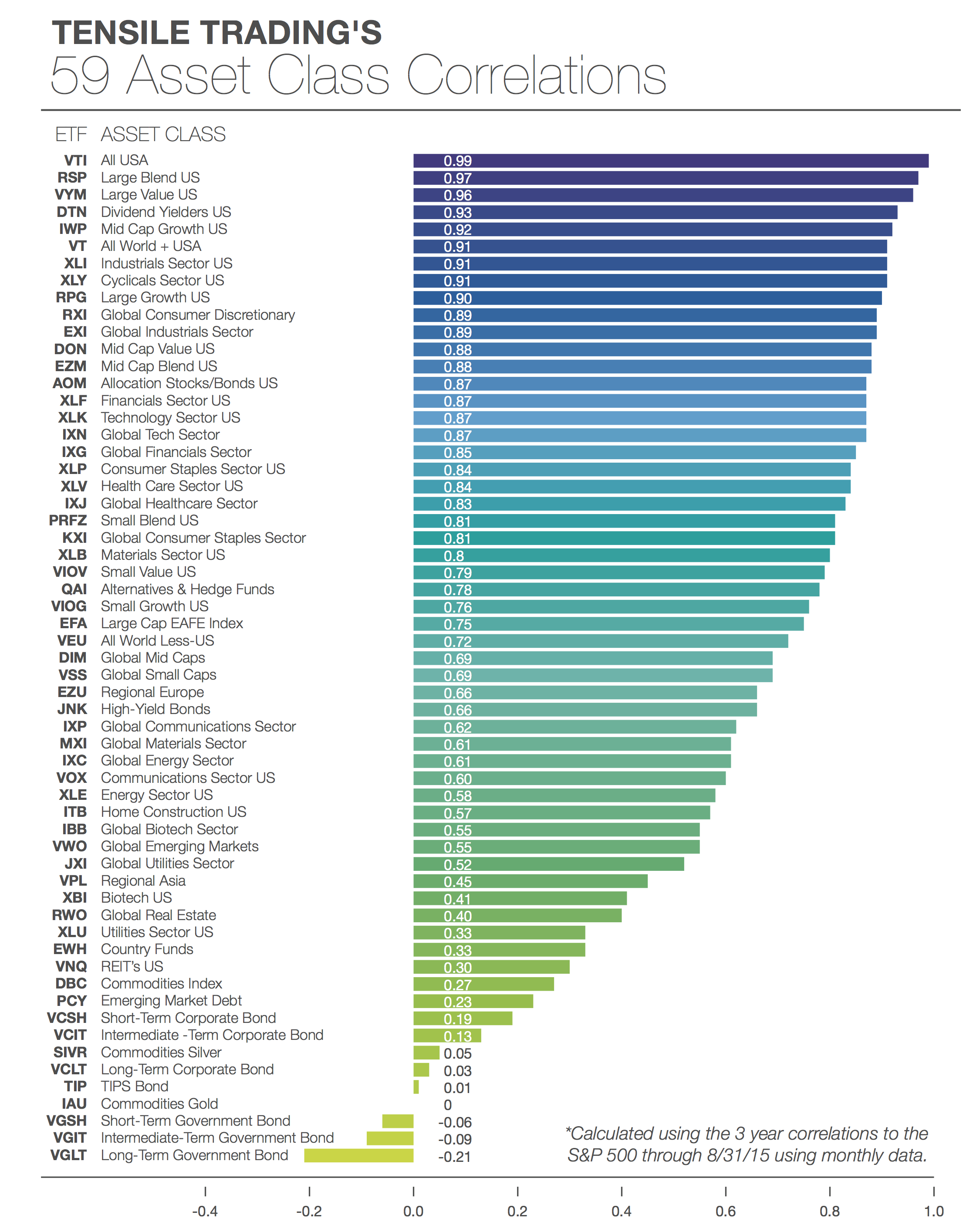

I mentioned the Boot Camp earlier. Another topic that was of great interest to attendees was how to master asset allocation. Therefore, this week’s exercise will be to select six asset classes and to build a diversified portfolio with appropriate correlations that will do two things: (a) protect your assets, and (b) provide some growth through a complete economic business cycle.

For those of you who have the Tensile Trading ChartPack, the 59 asset classes are all in ChartList #10.07 — Asset Allocations. For those of you who have our book, see page 23. t can also be found on our Asset Allocation DVD.

The back story to the 59 asset classes graphic is that it was a momentous effort involving many many investors and friends to whittle down the thousands of asset classes on ETF.com and the hundreds more on Morningstar in order to have a manageable set of 59 that included all of the essential categories. I hope you feel that we’ve achieved that objective.

We look forward to revisiting this exercise in a few weeks — just a reminder that my blog The Traders Journal is now published once every two weeks.

Trade well; trade with discipline!

- Gatis Roze, MBA, CMT

- Grayson Roze

- Author, Tensile Trading: The 10 Essential Stages of Stock Market Mastery (Wiley, 2016)

- Presenter of the best-selling Tensile Trading DVD seminar

- Presenter of the How to Master Your Asset Allocation Profile DVD seminar

- Developer of the StockCharts.com Tensile Trading ChartPack