SBI Life Insurance Company Ltd (SBILIFE.IN)

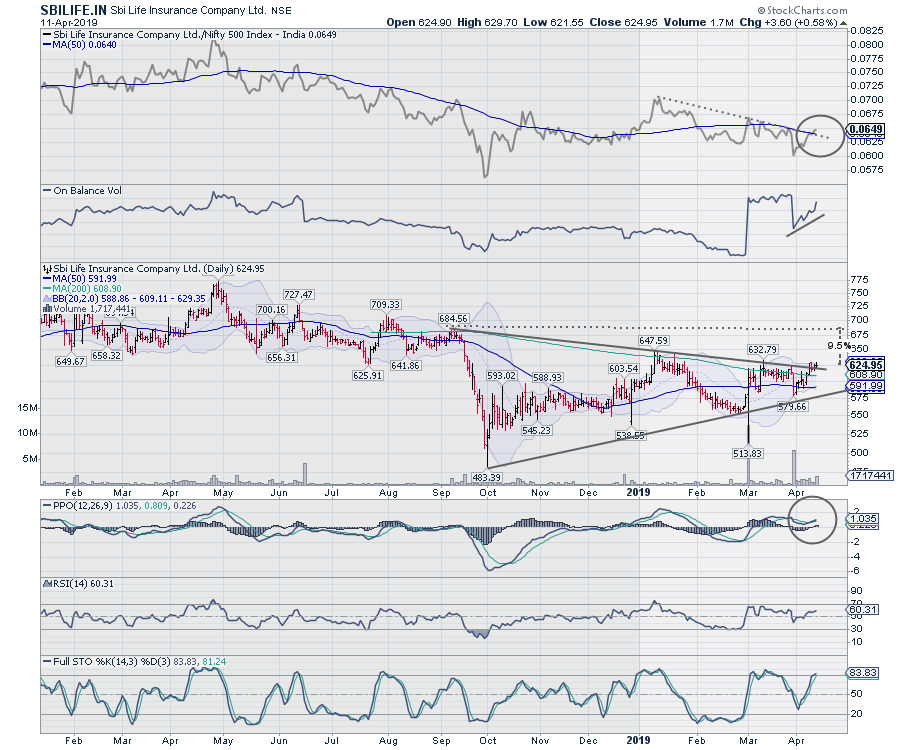

This stock has a relatively short listing history. It originally listed in October 2017 and marked its high near 772 in middle of 2018, with a subsequent low near 483 in the corrective move that followed in late 2018. Presently, the stock is set to offer some upside potential.

A large Symmetrical Triangle is seen on the daily charts. As the price attempts to move out, we can see a sharp rise in On-Balance Volume (OBV), which acts as a strength on the volume front. The PPO has turned positive and MACD has shown a positive crossover.

A large Symmetrical Triangle is seen on the daily charts. As the price attempts to move out, we can see a sharp rise in On-Balance Volume (OBV), which acts as a strength on the volume front. The PPO has turned positive and MACD has shown a positive crossover.

The RS Line, when compared against the broader CNX500 index, is moving higher and has penetrated its 50-DMA.

If the present pattern is resolved on expected lines, the stock could potentially return ~9% from its current level of 624.95. Any move below 600 will be negative for the stock.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia

Disclosure pursuant to Clause 19 of SEBI (Research Analysts) Regulations 2014: Analyst, Family Members or his Associates hold no financial interest below 1% or higher than 1% and have not received any compensation from the Companies discussed.