Latest News

The Mindful Investor4h ago

When in Doubt, Follow the Leadership

Reflecting on the price action over this shortened holiday week, I'm struck by how the leadership trends have not really changed too much Read More

ChartWatchers4h ago

Stay Ahead of the Stock Market: Key Bond Market Signals Explained with Charts

It was another erratic week in the stock market. There were several market-moving events sprinkled throughout this short trading week, including earnings, escalation of tariff wars, and Chairman Jerome Powell's remarks at the Economic Club of Chicago Read More

StockCharts In Focus7h ago

Breadth Maps Are A Bloodbath, BUT Has The Bounce Begun?

In this video, Grayson unveils StockCharts' new Market Summary ChartPack—an incredibly valuable new ChartPack packed full of pre-built charts covering breadth, sentiment, volatility data and MUCH MORE! From there, Grayson then breaks down what he's seeing on the current Market Su Read More

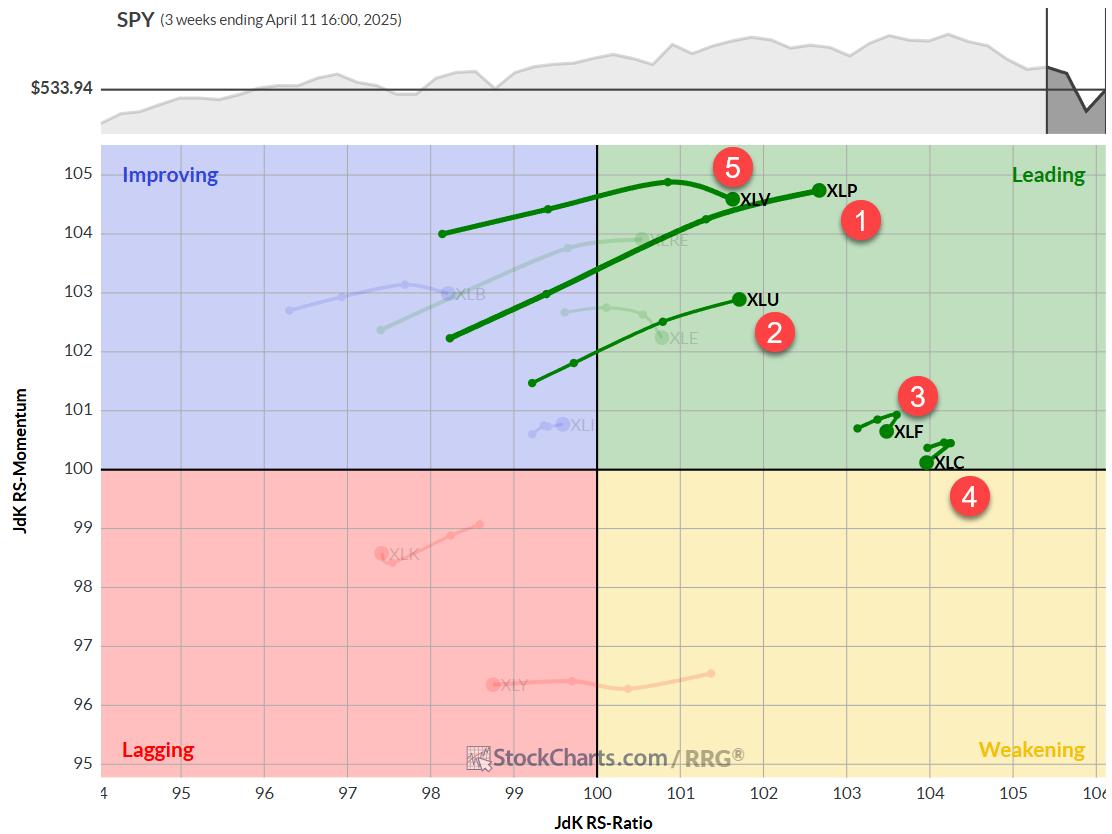

RRG Charts7h ago

Sector Rotation Update: Value Stocks and Bonds Lead the Way!

Stocks vs. bonds? In this video, Julius breaks down the asset allocation outlook and why defensive sectors, large-cap value, and bonds may continue to outperform in this volatile market Read More

Trading Places with Tom Bowley8h ago

This is the Group to Watch for the Next Bull Market Phase and Separating Noise from Reality

Technically, it's rather clear that we remain in a downtrend. However, not all downtrends are created equal. Some are built to last, while others can turn around quickly. Recognizing the difference is obviously quite important Read More

The Mindful Investor1d ago

200-Day Moving Average Confirms Bearish Phase

When markets get more volatile and more unstable, I get the urge to take a step back and reflect on simple assessments of trend and momentum Read More

Stock Talk with Joe Rabil2d ago

Trade Pullbacks Like a Pro: Simple Moving Average Strategy That Works

Moving average strategy, trend trading, and multi-timeframe analysis are essential tools for traders. In this video, Joe demonstrates how to use two key moving averages to determine if a stock is in an uptrend, downtrend, or sideways phase Read More

Add-on Subscribers

OptionsPlay with Tony Zhang2d ago

How to Time Your Trades For Faster Gains

When working with probabilities, you want to place trades that maximize your returns while minimizing your risks. In this OptionsPlay members-only video, Tony Zhang walks you through the techniques professional traders use to identify optimal entry points Read More

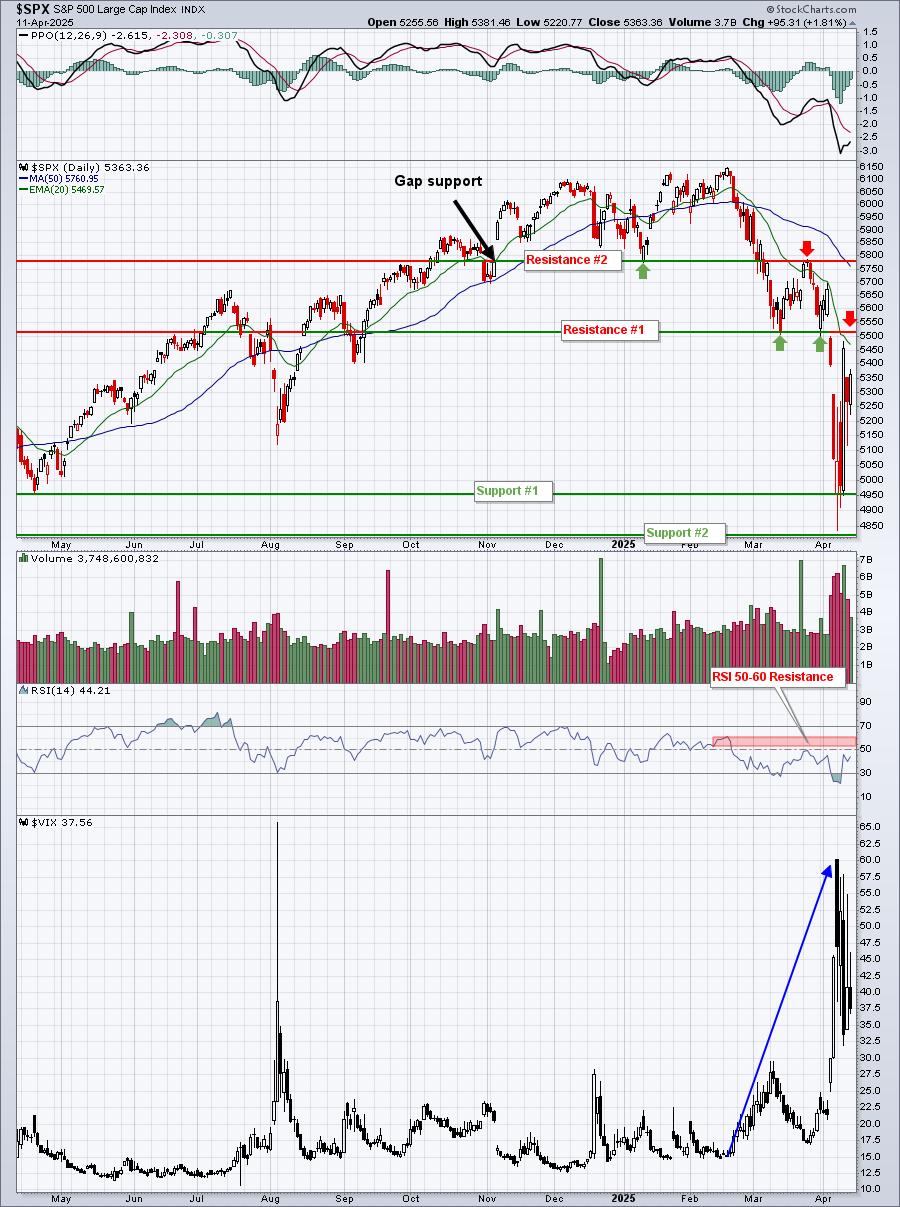

ChartWatchers2d ago

Secure Your Retirement Happiness: Check Your 401(k) Now!

With so many articles and videos on popular media channels advising you not to look at your 401(k) during this market downturn, avoiding taking the other side is tough Read More

ChartWatchers3d ago

Is This the Confidence Trap That Could Wreck Your Retirement Portfolio?

If last weekend's tech tariff exemptions teach us anything, it's this: trying to make near-term market forecasts based on tariff assumptions is a fool's errand Read More

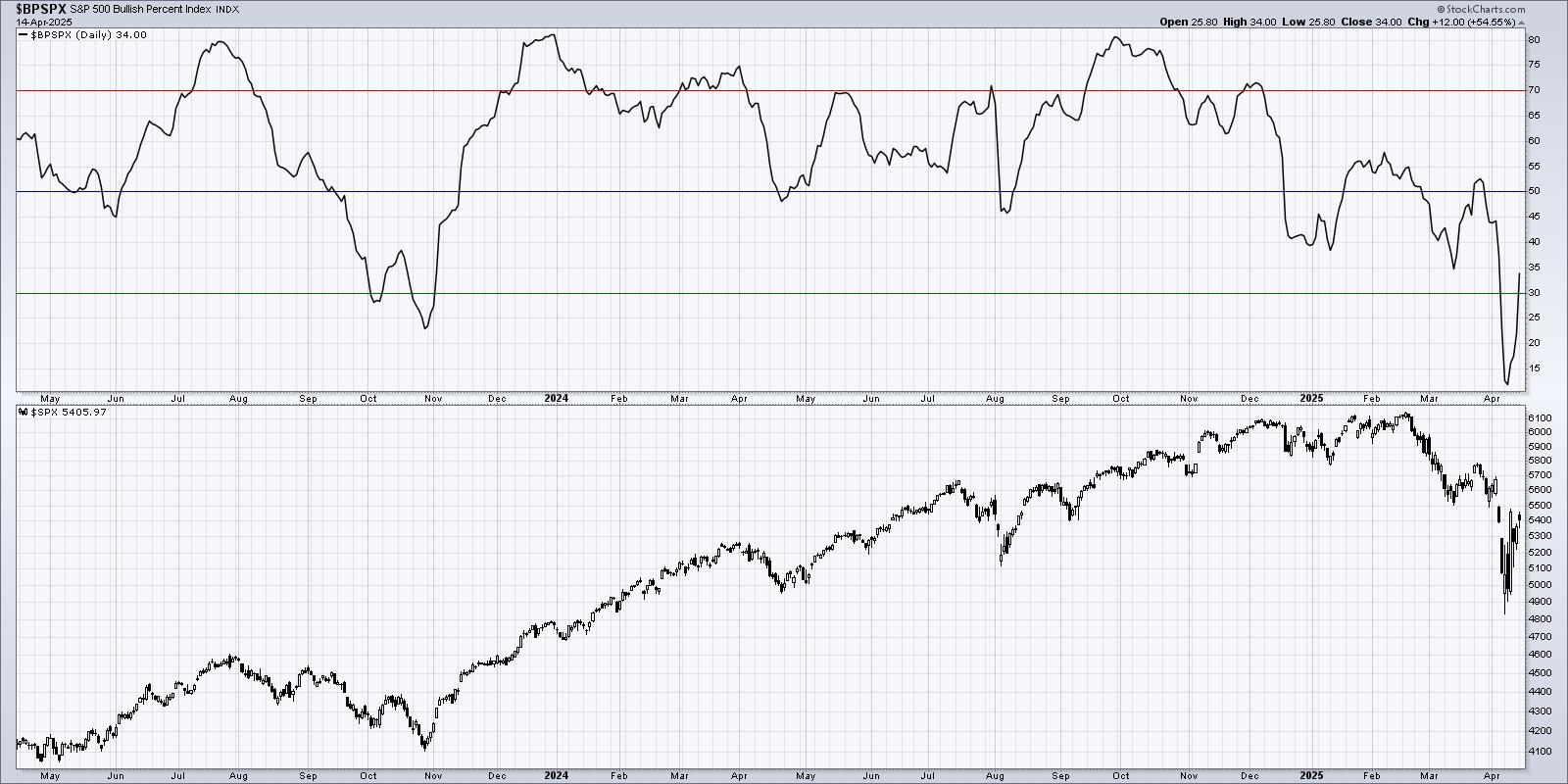

The Mindful Investor4d ago

Bullish Percent Index Confirms Short-Term Rebound

One of my favorite market breadth indicators remained in an extreme bearish reading through the end of last week, standing in stark contrast to growing optimism after last Wednesday's sudden spike higher Read More

Members Only

Martin Pring's Market Roundup4d ago

Gold is at a Record High -- Is There a Message?

The recent rally in the gold price has not yet attracted the kind of gold fever associated with the 1980 peak Read More

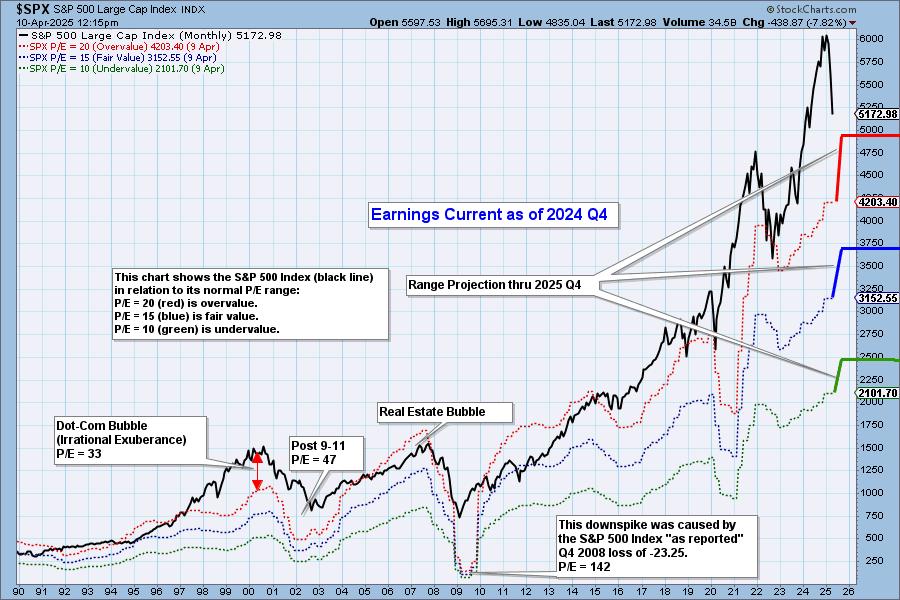

DecisionPoint4d ago

DP Trading Room: SPX Earnings Update

The market has been overvalued for some time but how overvalued is it? Today Carl brings his earnings chart to demonstrate how overvalued the market is right now. We have the final data for Q4 2024 Read More

RRG Charts4d ago

The Best Five Sectors, #15

Healthcare Re-Enters the Top 5 After a wild week in the markets, the sector ranking got quite a shake-up. Although only one sector changed in the top 5, the entire top 5 changed positions. In the bottom half of the ranking, only two sectors remained stationary Read More

Art's Charts4d ago

An Oversold Bounce is One Thing - A Bullish Breadth Thrust is Another

Panic selling and oversold extremes gave way to a rip higher last week. Stocks are poised to open strong on Monday as the market reacts positively to tariff news. Last week's bounce is considered an oversold bounce within a bear market Read More

Trading Places with Tom Bowley5d ago

The Bottom is Here or Rapidly Approaching

I pay attention to technical support levels as the combination of price support/resistance is always my primary stock market indicator Read More

Analyzing India6d ago

New US Tariffs and Intensifying US–China Trade War: Economic Implications and Opportunities for India

In 2024-2025, the United States significantly escalated its trade conflict with China through new tariffs, including a substantial 100% tariff on electric vehicles and 50% on essential technologies like semiconductors and solar products Read More

Analyzing India6d ago

Week Ahead: NIFTY May Continue Staying Volatile; Focus On These Levels

The previous weekly note categorically mentioned that while the markets may continue to decline, the Indian equities are set to outperform its global peers relatively Read More

The MEM Edge6d ago

Market Rally or Fakeout? How Politics and Earnings Are Driving Stocks

Stock market rally, sector rotation, and earnings movers dominate this week's analysis with Mary Ellen McGonagle. In this video, Mary Ellen reviews where the market stands after last week's bounce and explains how White House activity drove major price action Read More

ChartWatchers1w ago

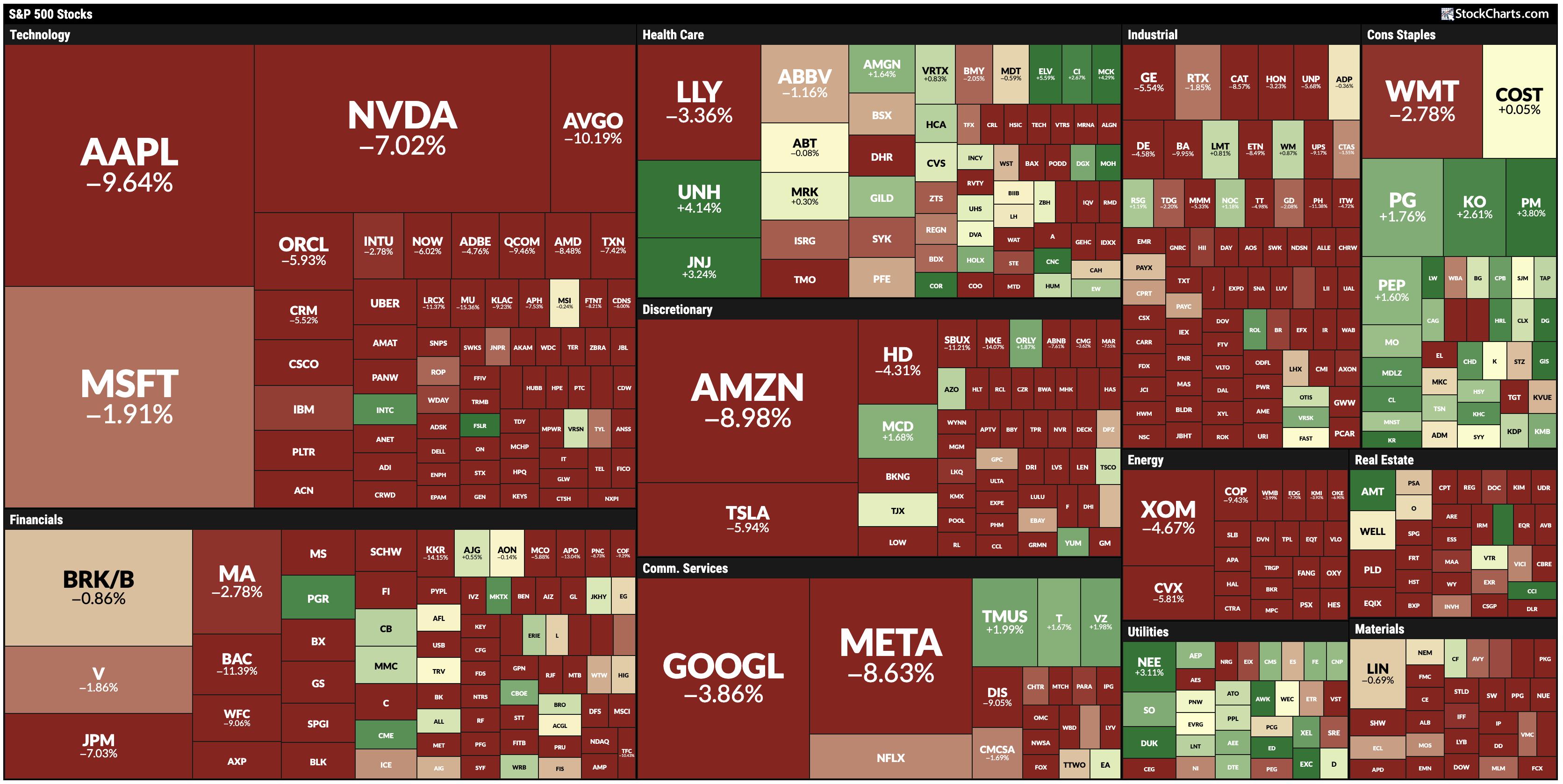

Investors on the Move: A Visual Guide to the Stock Market

Another interesting week in the stock market comes to an end. The past few days were flooded with the twists and turns of President Trump's reciprocal tariffs, which were later put on a 90-day pause except for China, which got hit with higher tariffs Read More

A View From The Floor1w ago

Earnings From These 3 Stocks Could Be Key

This week, we're getting back to earnings season during the shortened four-day period. Goldman Sachs Group, Inc. (GS) reports on the heels of JP Morgan's solid results that saw its shares rally by 12.3% and recapture its 200-day moving average Read More

StockCharts In Focus1w ago

Master the Market: A Guide to StockCharts' New Market Summary Page

Stock market analysis, technical indicators, and market trends are crucial for informed investing. StockCharts is making those things easier, and Grayson Roze is here to show you how. In this video, Grayson provides an in-depth walk-through of the all-new Market Summary Page Read More

ChartWatchers1w ago

Trade War Mayhem? Here's How to Cut Through the Noise!

The current tariff environment is full of sudden moves that could have broad and long-lasting effects Read More

Art's Charts1w ago

This Report Might Self Destruct in 5 Days

In the opening scene of Mission Impossible 2, Ethan Hunt receives a message at the top of a sandstone butte. He puts on the glasses and listens to the message, which ends with the computer-generated phrase: "This message will self-destruct in five seconds Read More

The Mindful Investor1w ago

Is the Stock Market Getting Ready to Bounce? Key Market Breadth Signal Explained

When the stock market slides significantly, it's natural to question if the market has bottomed and getting ready to bounce. In this video, David Keller, CMT highlights the Bullish Percent Index (BPI) as a key indicator to monitor during corrective moves Read More

DecisionPoint1w ago

S&P 500 Final 2024 Q4 Earnings: Still Overvalued

S&P 500 earnings are in for 2024 Q4, and here is our valuation analysis Read More

ChartWatchers1w ago

Stock Market Volatility: Pain Points, Bright Spots, and Strategies

Is the stock market volatility making you nervous? In this video, Grayson Roze and Julius de Kempenaer unpack the volatile market environment and discuss pain points, some of the "bright spots" they are seeing in the market, and the StockCharts tools they are using to identify sh Read More

ChartWatchers1w ago

Mastering Stock Market Turbulence: Essential Insights for Investors

Tariff turmoil continues sending the stock market into a turbulent spin. Tariffs went into effect at midnight, which sent equities and bond prices lower Read More

Members Only

Martin Pring's Market Roundup1w ago

Are the Tariffs Bullish or Bearish for the US Dollar?

Tariffs have been front and center of market attention, but one asset class that has been relatively subdued in its response has been the US Dollar Index Read More

Stock Talk with Joe Rabil1w ago

Key Levels for the S&P 500: Has It Bottomed?

Is the stock market on the verge of crashing or has it bottomed? In this video, Joe Rabil uses moving averages and Fibonacci retracement levels on a longer-term chart of the S&P 500 to identify support levels that could serve as potential bottoms for the current market correction Read More

DecisionPoint1w ago

DP Trading Room: Key Support Levels for the SPY

The market is in a tailspin as tariffs add volatility to the market. Carl and Erin believe the SPY is in a bear market given key indexes like the Nasdaq are already in bear markets. It's time to consider where the key support levels are Read More

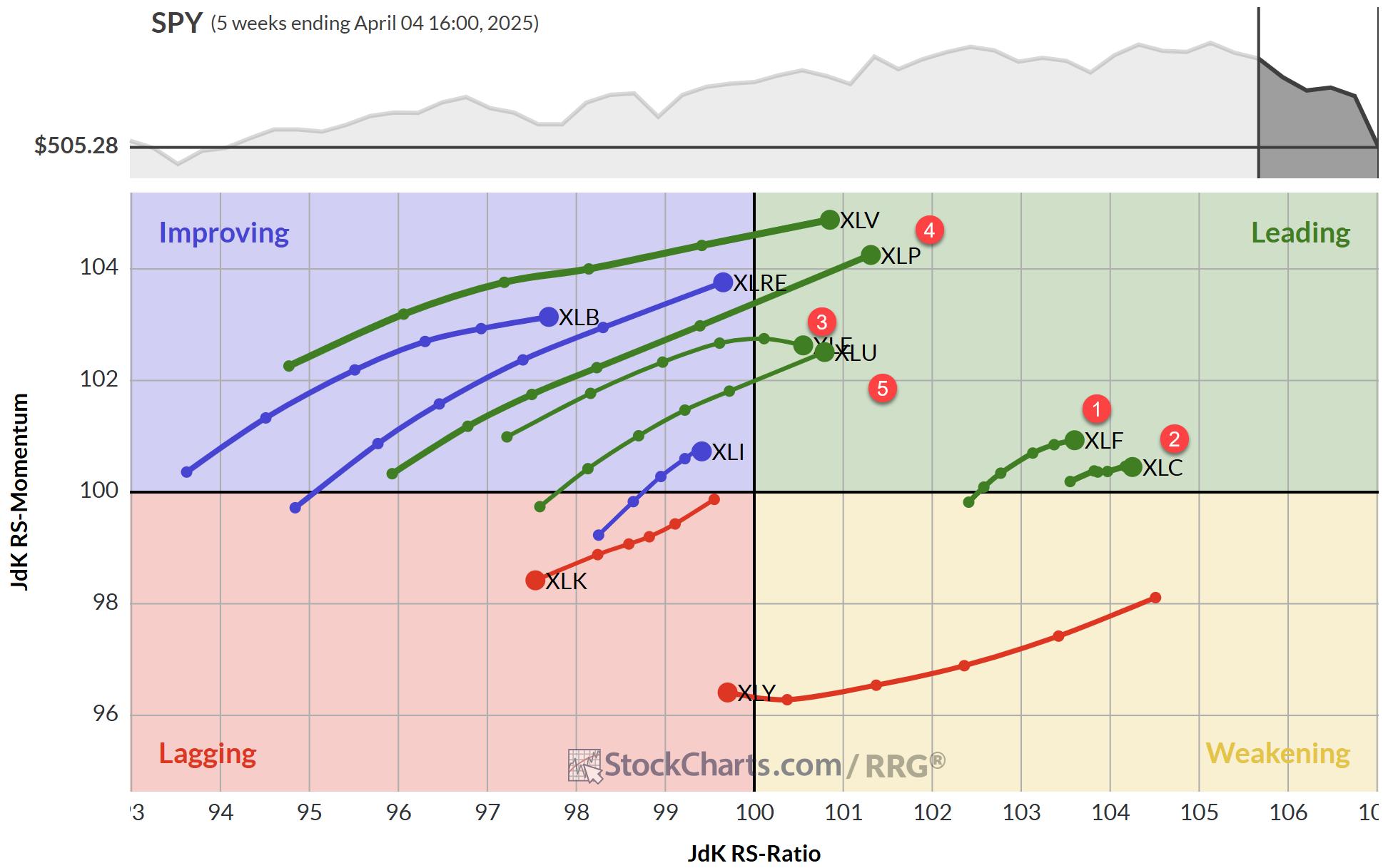

RRG Charts1w ago

The Best Five Sectors, #14

This article was first posted on 4/4/2025 and contained only rankings and charts Read More

The MEM Edge1w ago

Market Drop Compared to 2020: What You Need to Know Now

How low can the S&P and the Nasdaq fall? More importantly, how can an investor navigate this volatile environment? In this eye-opening video, Mary Ellen McGonagle delves into the stock market's fall, identifies key support levels, and compares them to past bear markets Read More

Analyzing India1w ago

Week Ahead: NIFTY Set To Open Lower; Relative Outperformance Against Peers Expected To Continue

The previous week was short; the Indian markets traded for four days owing to one trading holiday on account of Ramadan Id Read More

ChartWatchers2w ago

Demystifying Tariff Impact: Essential Insights for Every Investor

The stock market hoped for curtailment of tariffs on Wednesday, but that didn't happen. Even the better-than-expected March non-farm payrolls weren't enough to turn things around Read More

A View From The Floor2w ago

Three Stocks to Watch: Utilities, Banks, Airlines

When markets are sliding lower, where should you be investing? Here are three stocks to consider Read More

Art's Charts2w ago

Bitcoin Holds Up, but Remains Short of Relative Breakout

Stocks are in a freefall with selling pressure spreading into industrial metals and other economically sensitive commodities. There are few places to hide in bear markets, and the list of alternatives continues to shrink Read More

The Mindful Investor2w ago

Three Defensive Plays for Post-Tariff Survival

With the S&P 500 and Nasdaq dropping quickly after this week's tariff announcements, investors are scrambling to identify areas of the market demonstrating strength despite broad market weakness Read More

Stock Talk with Joe Rabil2w ago

Trend-Following Stocks: How a Low ADX Can Signal Huge Breakouts!

In this exclusive StockCharts video, Joe Rabil shows you how to use the ADX on monthly and weekly charts to find stocks with massive breakout potential. Joe walks you through several examples of stocks and ETFs that broke out of an extended period of trading sideways Read More

Members Only

Martin Pring's Market Roundup2w ago

Sentiment Is Near-Perfect for a Rally: One Thing Could Stand In the Way

Several sentiment indicators I follow have reached the kind of level of disbelief that has traditionally fueled a worthwhile rally or even jump-started a new bull market Read More