Archived News

Members Only

Martin Pring's Market Roundup2w ago

Sentiment Is Near-Perfect for a Rally: One Thing Could Stand In the Way

Several sentiment indicators I follow have reached the kind of level of disbelief that has traditionally fueled a worthwhile rally or even jump-started a new bull market Read More

ChartWatchers2w ago

BSX Stock Slump? Discover This Winning Option Strategy

When the stock market lacks clear direction, options strategies can be a dependable friend. I often go through the OptionsPlay ChartLists in StockCharts to look for stocks that show potential trading or investing opportunities Read More

ChartWatchers2w ago

Get Paid to Buy Your Favorite Stocks Using This Options Strategy

Did you know you can generate more than a 5% monthly yield by utilizing an options strategy? In this educational video, Tony Zhang walks you through an income-generating options strategy using the OptionsPlay Strategy Center on StockCharts.com Read More

Don't Ignore This Chart!2w ago

AU Surges Above Resistance: Here's How to Take Action

As precious metals surge on safe-haven demand, some gold mining companies are following suit. One standout is AngloGold Ashanti Ltd. (AU), which has been riding this upward momentum Read More

ChartWatchers2w ago

Top 10 Stock Charts for April 2025: Big Breakouts Ahead?

Finding stocks that show promising opportunities can be challenging in a market that goes up and down based on news headlines. But, it's possible Read More

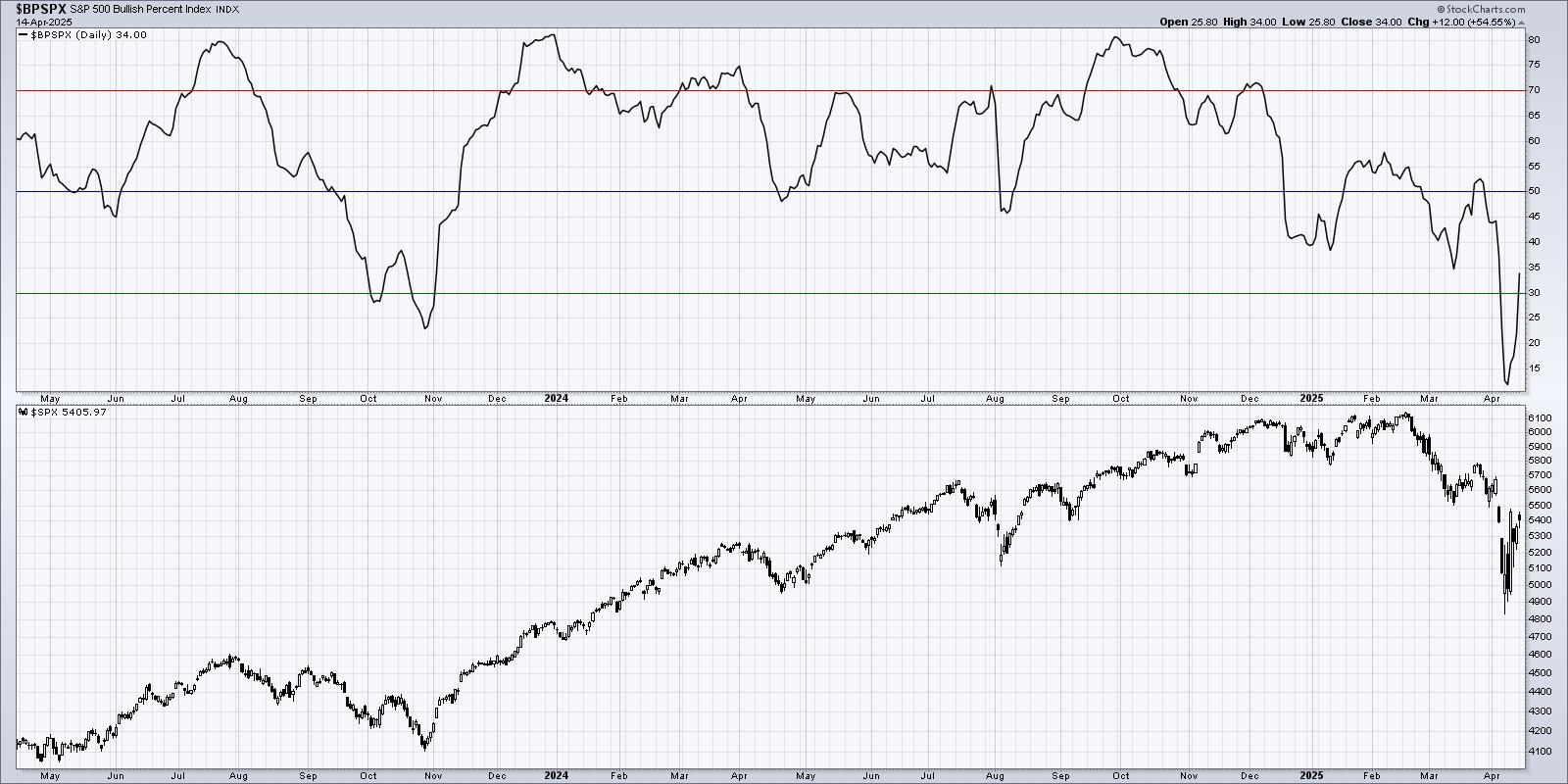

DecisionPoint2w ago

DP Trading Room: Magnificent Seven Stocks in Bear Markets

You may not know it, but all of the Magnificent Seven stocks are in bear markets. Given they are such an integral part of the major indexes, we have to believe that the market will follow suit and continue lower in its own bear market Read More

Trading Places with Tom Bowley2w ago

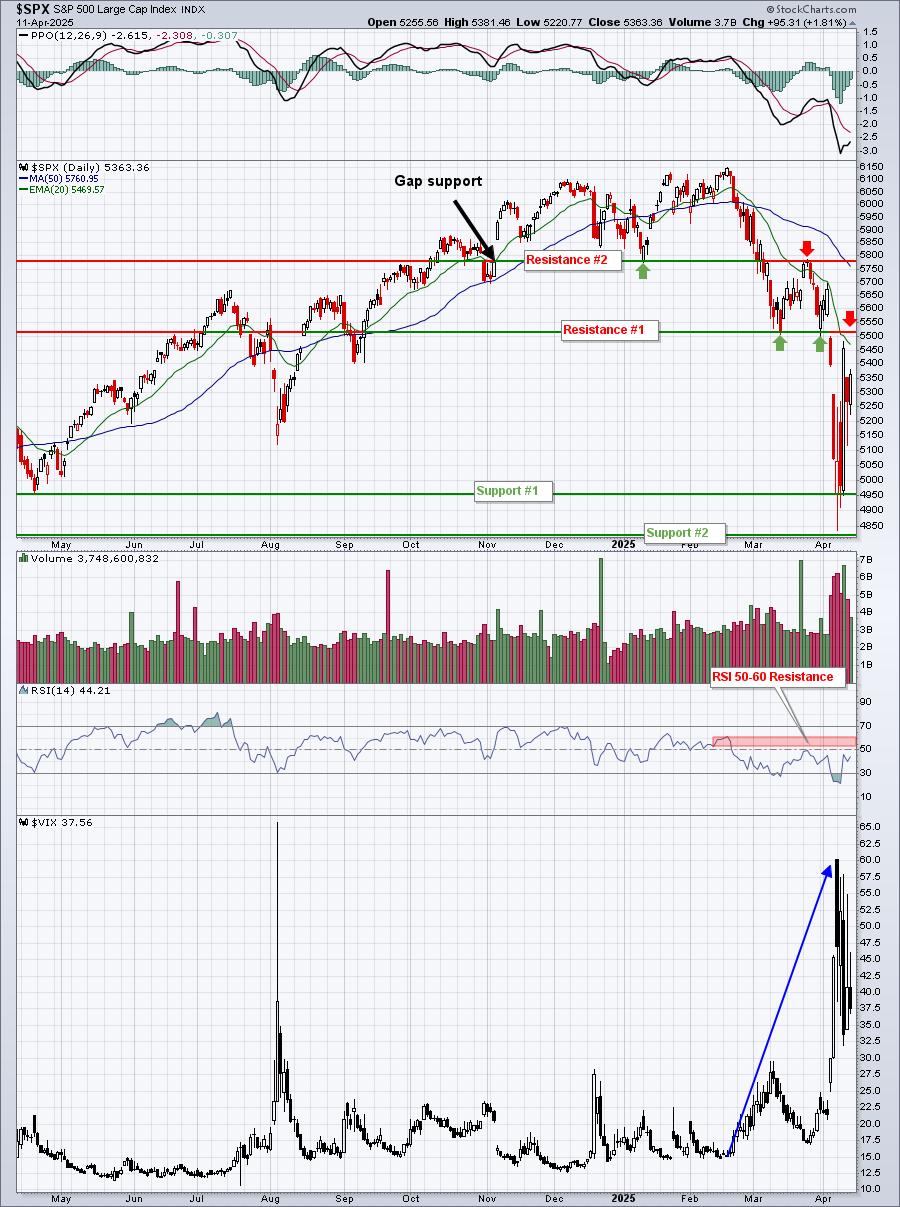

S&P 500 Drops Quickly to Test Key Support Amid Rising Volatility

Thank You! I've been writing at StockCharts.com for nearly 20 years now and many of you have supported my company, EarningsBeats.com, and I certainly want to show my appreciation for all of your loyalty Read More

ChartWatchers2w ago

Volatility Ahead: What Investors Need to Know Right Now

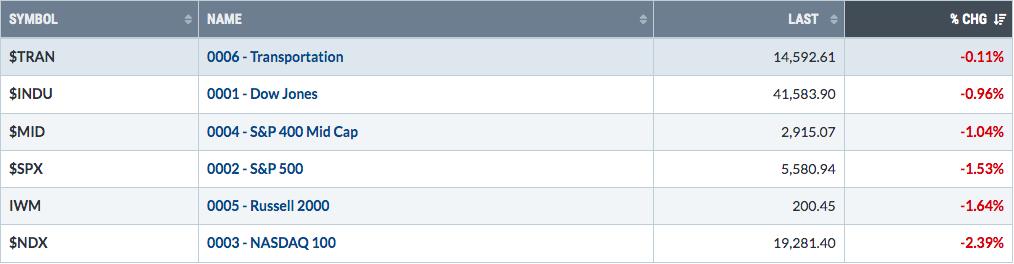

It was an ugly close to another roller-coaster trading week as the stock market struggled with several moving parts. Wednesday's Evening Doji Star in the S&P 500 ($SPX) showed its power. The trading week didn't end on a pretty note Read More

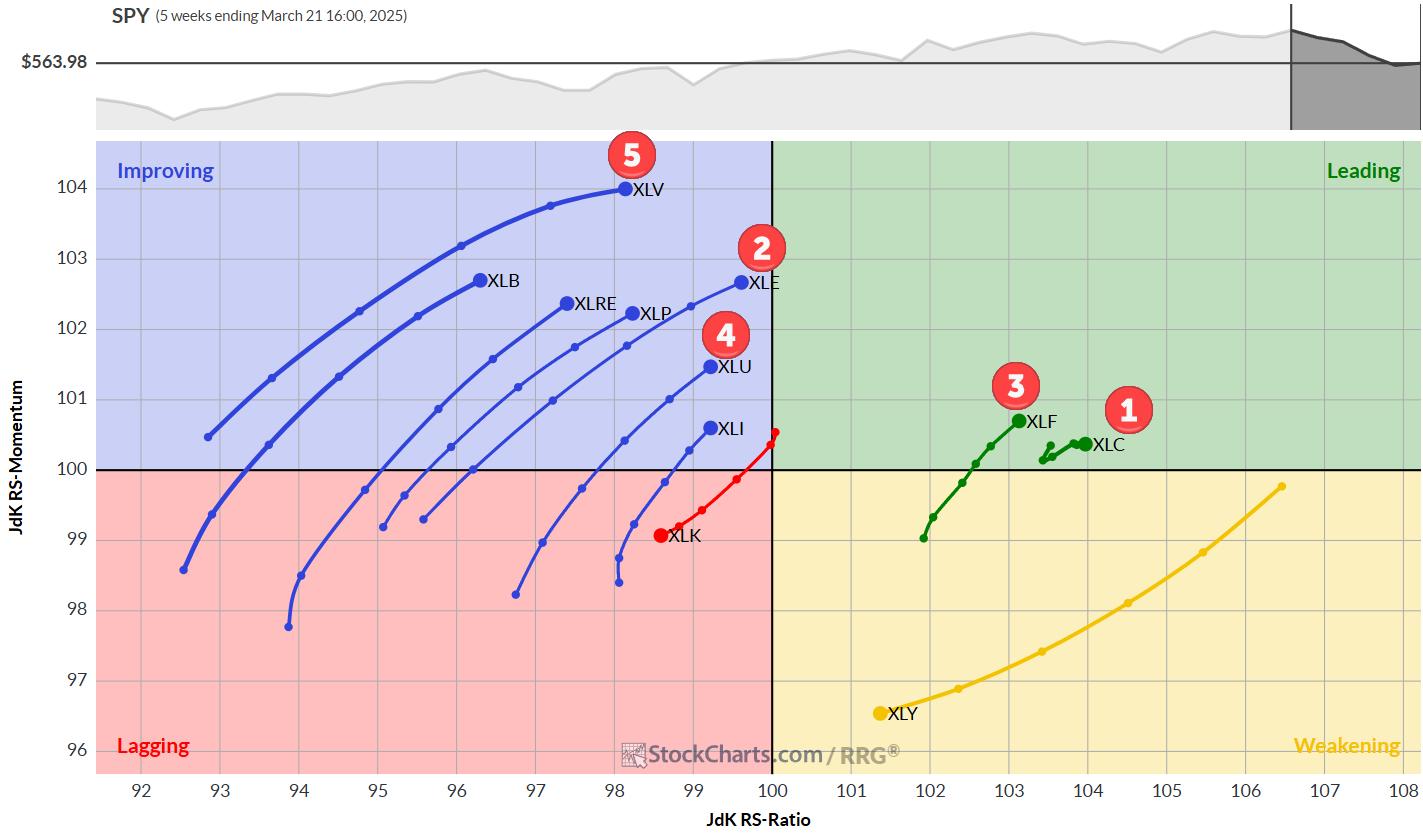

RRG Charts2w ago

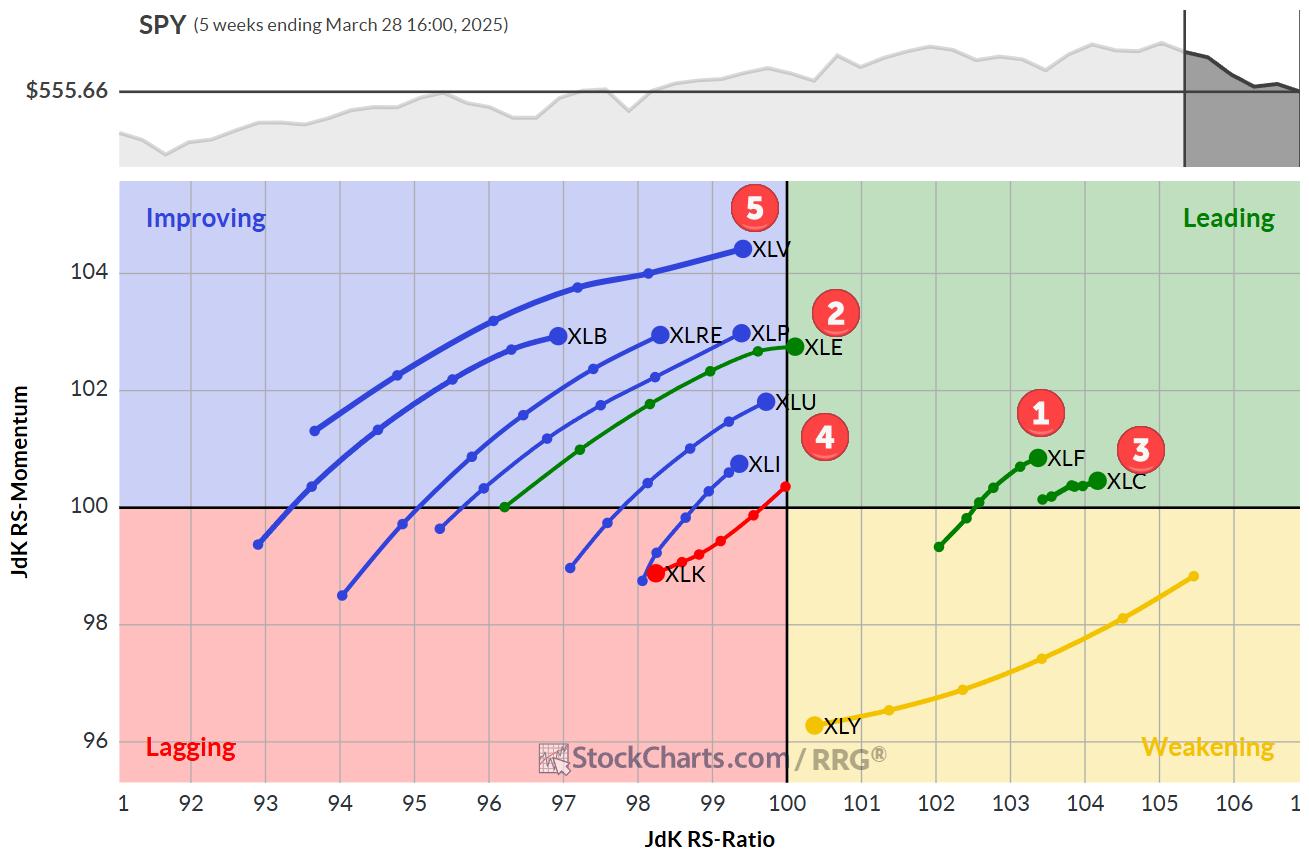

The Best Five Sectors, #13

Financials take the lead. No changes in the composition of the top 5 this week, and only one change of position within the top 5. Financials (XLF) leapfrogged to the number one position, sending Communication Services (XLC) to the #3 position Read More

The MEM Edge3w ago

These High-Yield Stocks are Still Winning Despite Market Chaos!

Is a new market uptrend on the horizon? In this video, Mary Ellen breaks down the latest stock market outlook, revealing key signals that could confirm a trend reversal Read More

Trading Places with Tom Bowley3w ago

S&P 500 Dives After Failed Test of Price Resistance; Bears Are in Control

The key resistance level I've been watching on the S&P 500 hasn't wavered. It's 5782. The bulls had a real chance this past week to clear this important hurdle and they failed. Badly. If this was a heavyweight fight, the ref would have called it after the first round Read More

RRG Charts3w ago

S&P & Tech Stocks: Will Seasonality Lead to More Pain?

Sector rotation is shaping the S&P 500's next big move! In this exclusive StockCharts video, Julius analyzes SPY support levels, key sector trends, and the latest seasonal patterns—which indicate further downside for Technology stocks Read More

A View From The Floor3w ago

Stocks In Focus: Three Charts to Watch

This week, we get back to earnings and, sadly, the pickings are slim. Given these turbulent times, we have two Consumer Staples stocks to examine — Lamb Weston (LW) and Conagra (CAG) Read More

DecisionPoint3w ago

Silver Cross Index Tops Beneath Signal Line on SPY

One of the indicators that Carl Swenlin developed is the Silver Cross Index. It is one of the best participation indicators out there! Here's how it works: We consider a positive 20/50-day EMA crossover a "Silver Cross". If a stock has a Silver Cross it has a bullish bias Read More

The Mindful Investor3w ago

Bear Flag Alert - Downside S&P 500 Target Update

Friday's overheated inflation data appears to have initiated a new downward leg for the major equity averages. This could mean a confirmed bear flag pattern for the S&P 500, and potentially much further lows before this corrective period is complete Read More

Art's Charts3w ago

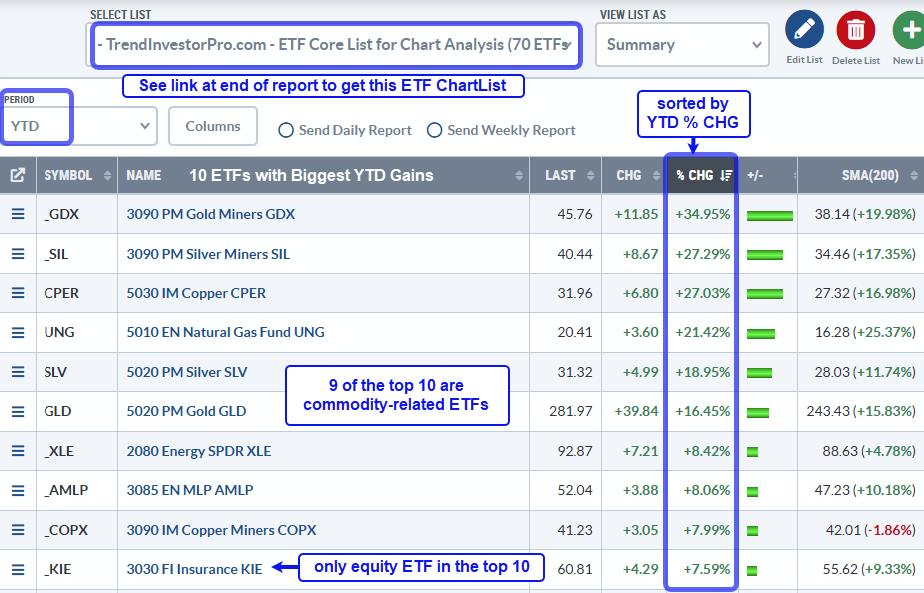

Performance Profile Paints Different Pictures for Commodity and Equity ETFs

The performance profile for 2025 says a lot about the state of the market. Commodity-related ETFs are leading, non-cyclical equity ETFs are holding up the best and cyclical names are performing the worst. Clearly, this is not a positive picture for the stock market Read More

ChartWatchers3w ago

Unveiling Market Trends: What's Triggering a Midweek Bearish Shift?

Wednesday's stock market price action revealed a caution sign, and with it, any hope that rose from Monday's price action just got buried. The Tech sector sold off, with the Nasdaq Composite ($COMPQ) falling over 2%. The chart of $COMPQ indicated hesitation Read More

The Mindful Investor3w ago

Three Growth Stocks Testing the Ultimate Trend Barometer

After a blistering snapback rally over last the week, a number of the Magnificent 7 stocks are actively testing their 200-day moving averages Read More

ChartWatchers3w ago

This Precious Metal is On the Verge of a Massive Breakout. Here's How to Catch It!

Gold at $3,100 and silver at $50? That might've sounded wild a year or two ago, but it's now the upper trajectory some analysts are eyeing Read More

Members Only

Martin Pring's Market Roundup3w ago

Is It Time to Buy Tesla?

Recently, there have been horror stories about individual Tesla owners being harassed and dealers being vandalized, all because people have decided they don't like Elon Musk or his recent DOGE actions Read More

Stock Talk with Joe Rabil3w ago

Master Multi-Timeframe Analysis to Find Winning Trades!

In this exclusive StockCharts video, Joe shares how to use multi-timeframe analysis — Monthly, Weekly, and Daily charts — to find the best stock market opportunities. See how Joe uses StockCharts tools to create confluence across timeframes and spot key levels Read More

Trading Places with Tom Bowley3w ago

Is the Correction Over? Or Are We Still Looking at a Bear Market?

The S&P 500, NASDAQ 100, and Russell 2000 fell 10.5%, 13.8%, and 19.5%, respectively, from their recent all-time highs down to their March lows Read More

ChartWatchers3w ago

Stock Market Momentum Slows Down: What This Means for Investors

The stronger-than-expected Services PMI reported on Monday injected optimism into the stock market. There was also some relief as news hit that the April 2 implementation of tariffs may be scaled back Read More

The Mindful Investor3w ago

Key Levels for AAPL, AMZN, NVDA — Will This Market Rally Hold?

In this video, Dave breaks down the upside bounce in the Magnificent 7 stocks — AAPL, AMZN, NVDA, and more — highlighting key levels, 200-day moving averages, and top trading strategies using the StockCharts platform Read More

Don't Ignore This Chart!3w ago

DRI Stock Breakout Confirmed: Here's What You Need to Know Now!

Markets surged out of the gate Monday morning, with all three major U.S. indexes notching early gains. But after a bruising two-week rout on Wall Street, the question facing investors is whether stocks can sustain the rebound Read More

DecisionPoint3w ago

DP Trading Room: Tariffs Narrowing, Sparks Market Rally

Over the weekend it was announced that tariffs will be narrowing and possibly not as widespread as initially thought. Negotiations are continuing in the background and this seems to be allaying market participants' fears. The market rallied strongly on the news Read More

RRG Charts3w ago

The Best Five Sectors, #12

Energy Jumps to #2 A big move for the energy sector last week as XLE jumped to the #2 position in the ranking, coming from #6 the week before. This move came at the cost of the Consumer Staples sector which was pushed out of the top-5 and is now on #7 Read More

ChartWatchers4w ago

Uncover the Week's Key Stock Market Movements

If one word could characterize this week's stock market price action, it would be "sideways." At least it's better than trending lower Read More

A View From The Floor4w ago

Stocks in Focus: 3 Stocks to Watch

Seeing that the earnings slate is light, this week we focus on certain stocks to watch during uncertain times. If you are jittery and risk-averse, we have two safer (boring) stocks, plus one tech stock that has shown great relative strength compared to its peers Read More

DecisionPoint4w ago

American Association of Individual Investors (AAII) Breaks Record

We wrote about the American Association of Individual Investors (AAII) poll results a few weeks ago. Since then, the bearish activity on the chart has broken a record for the poll Read More

Members Only

Martin Pring's Market Roundup4w ago

Confidence Ratios are in an Uptrend, But Looking Vulnerable

At this week's news conference, Jerome Powell mentioned that the Fed is cautious about making significant changes to interest rates due to unclear economic conditions, citing factors like trade policies and inflation, which have contributed to this uncertainty Read More

Art's Charts4w ago

Two Ways to Use the Zweig Breadth Thrust - Plus an Added Twist

The Zweig Breadth Thrust is best known for its bullish reversal signals, which capture a material increase in upside participation. There is, however, more to the indicator because traders can also use the "setup" period to identify oversold conditions Read More

The Mindful Investor4w ago

Will QQQ Retest All-Time Highs By End of April?

After reaching an all-time around $540 in mid-February, the Nasdaq 100 ETF (QQQ) dropped almost 14% to make a new swing low around $467 Read More

ChartWatchers4w ago

The Ultimate Guide to Building a Sector-Diversified Stock Portfolio

You already know about diversification. You've set your investment goals, picked a benchmark, and decided on the weighting of your allocations. Now, it's come down to selecting the assets—stocks or ETFs—to build your portfolio Read More

Stock Talk with Joe Rabil1mo ago

New SPX Correction Signal! How Long Will It Last?

In this exclusive StockCharts video, Joe breaks down a new SPX correction signal using the monthly Directional Lines (DI), showing why this pullback could take time to play out. He explains how DI lines influence the ADX slope and how this impacts shorter-term patterns Read More

Add-on Subscribers

OptionsPlay with Tony Zhang1mo ago

The Top Options Strategy Hedge Funds Use

In a volatile stock market, hedging your portfolio can go a long way in reducing your drawdowns. In this video, follow along with Tony as he uncovers one of the top options trading strategies used by hedge funds Read More

ChartWatchers1mo ago

Stock Market Shifts Gears: Indexes Plunge After Climb

Tuesday's stock market action marked a reversal in investor sentiment, with the broader indexes closing lower. The S&P 500 ($SPX), Nasdaq Composite ($COMPQ), and Dow Jones Industrial Average ($INDU) are still below their 200-day simple moving average (SMA) Read More

ChartWatchers1mo ago

Riding the Wave: What the Stock Market Rebound Means for Your Investments

Last week, tariff talks, recession fears, and waning consumer sentiment sent stocks lower. This week, the narrative may have shifted, as investors prepare for a macro-filled week and NVIDIA's annual GTC developers' conference Read More

The Mindful Investor1mo ago

4 Scenarios for Nasdaq 100: Bullish Surge or Bearish Collapse?

Can the Nasdaq 100 rally to all-time highs or break down below key support? In this video, Dave uses probabilistic analysis to explore 4 possible scenarios for the QQQ over the next 6 weeks — from a super bullish surge to a bearish breakdown below the August 2024 low Read More

DecisionPoint1mo ago

DP Trading Room: Upside Initiation Climax?

On Friday DP indicators logged an Upside Initiation Climax. This exhaustion events often mark the beginning of new rallies and could indicate that the market is indeed ready to rebound. However, we do question its veracity given lukewarm trading to begin Monday's trading Read More