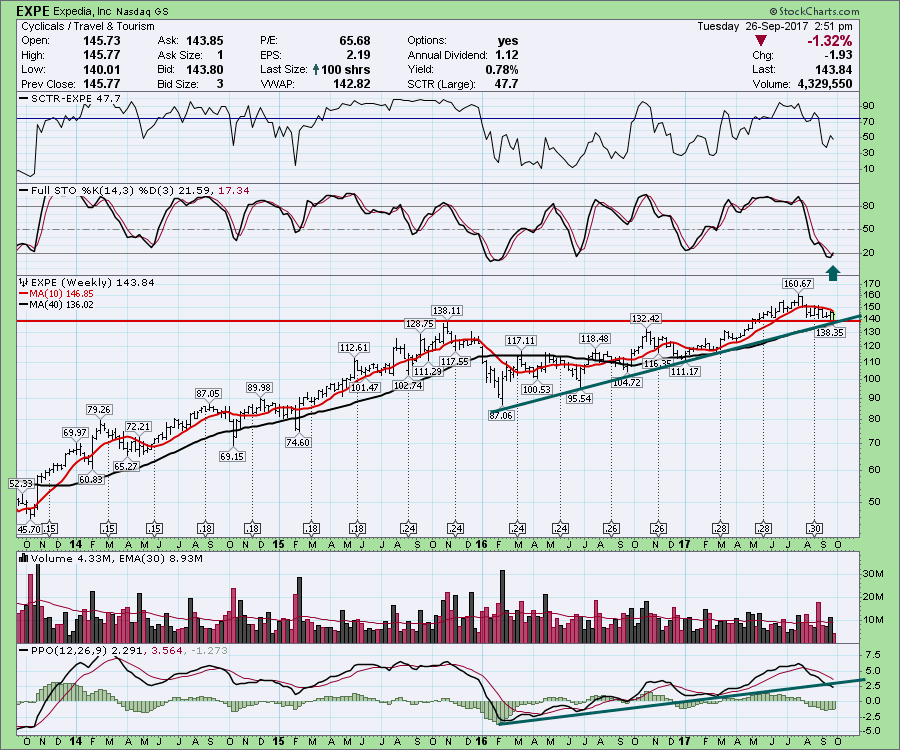

The Expedia (EXPE) chart demonstrates a lot of technical setups here. If the setup works, this could pay for your next holiday! Let's walk through them. First of all, the SCTR is a little weaker than I would like and needs to hold 50. The early half of 2016 has an SCTR below 50. When the rest of the stocks were rallying, Expedia was a little slow to take off. The crossover of the Full Stochastics back above 20 sets up a nice bounce location. Historically, this looks like a good signal.

The price action is finding support at horizontal support and trend line support. The confluence of both suggests a great place for an entry.

Last week's volume bounce looks very positive, but the price needs to get above the 10 Week Moving Average. This is also a reasonable place to expect a bounce off the momentum trend line on the PPO.

Last week's volume bounce looks very positive, but the price needs to get above the 10 Week Moving Average. This is also a reasonable place to expect a bounce off the momentum trend line on the PPO.

With a lot of support right here, this looks like a nice entry point. A break below the up trend line would be a good exit for a trailing stop.

Good trading,

Greg Schnell, CMT, MFTA.