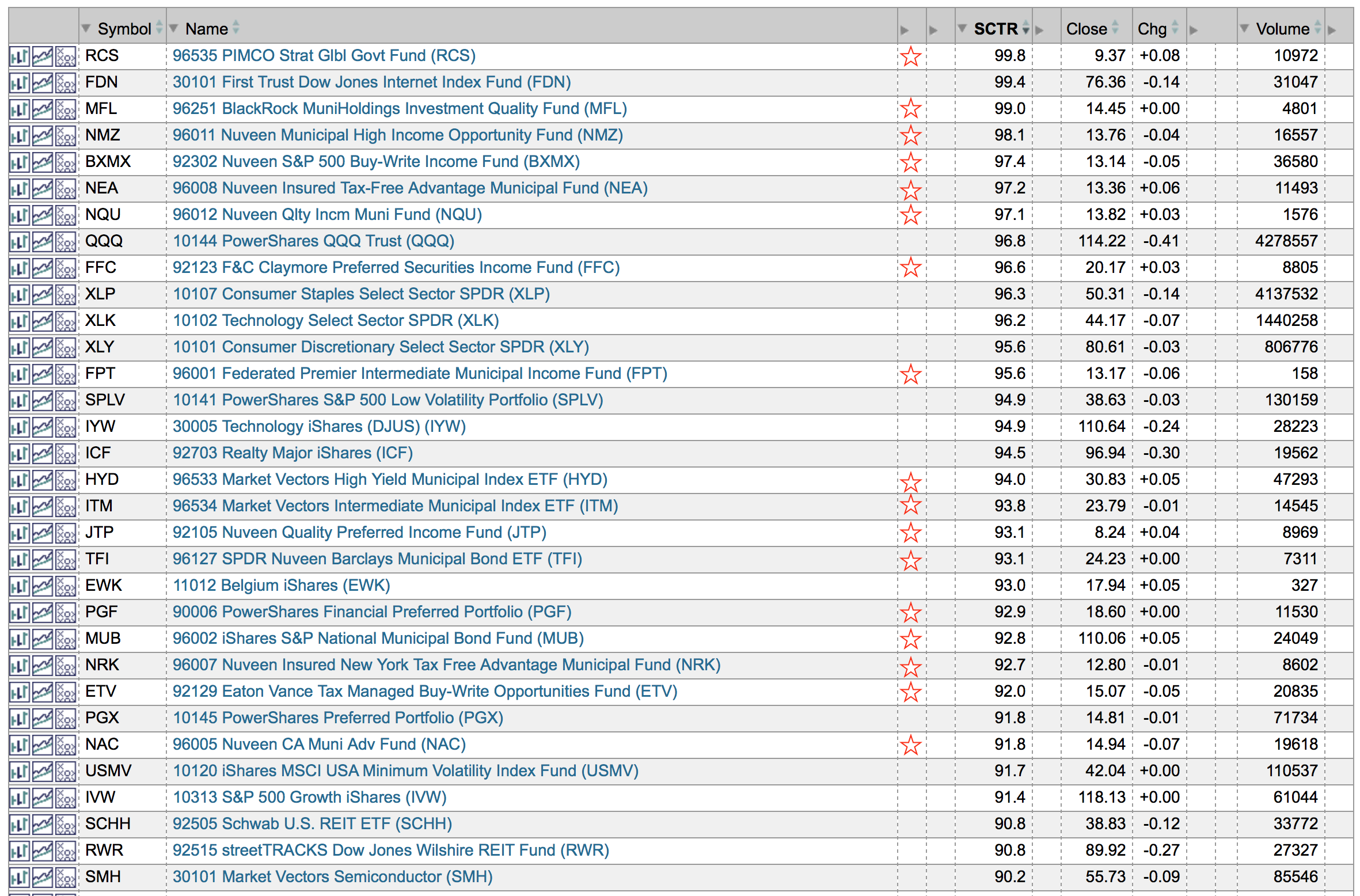

From a chartlist of ETF's that I have built, the vast majority of the list is led by different bond/fixed income/income strategies currently. Currently, the PIMCO Strategic Global Government Fund ETF (RCS) has an SCTR of 99.8 and the ETF is breaking out to new 52 week highs.

Scanning the top of the ETF SCTR list shows some crosswinds. While the list continues to be dominated by bond or income strategies, The Consumer Staples (XLP), The Technology ETF (XLK), and the Consumer Cyclicals (XLY) are high on the list, but the Financial ETF is not in the top 10%. The bond ETF's trade light volumes and the different approaches within the ETF's are percolating them to the top of the list.

While the Internet ETF (FDN) is one of the strongest, the list shows a tilt towards the income group. The volume is still in the main ETF's, but there is some nice performance from the income ETF's.

Let me add a footnote after an email from one of the financial advisors. H/T Mr. Rice. RCS is actually a closed-end fund. My point is that the income area is behaving very well. RCS might not be the tool to use, but it leads the list in performance currently. Look at each for your own needs.

Good trading,

Greg Schnell, CMT