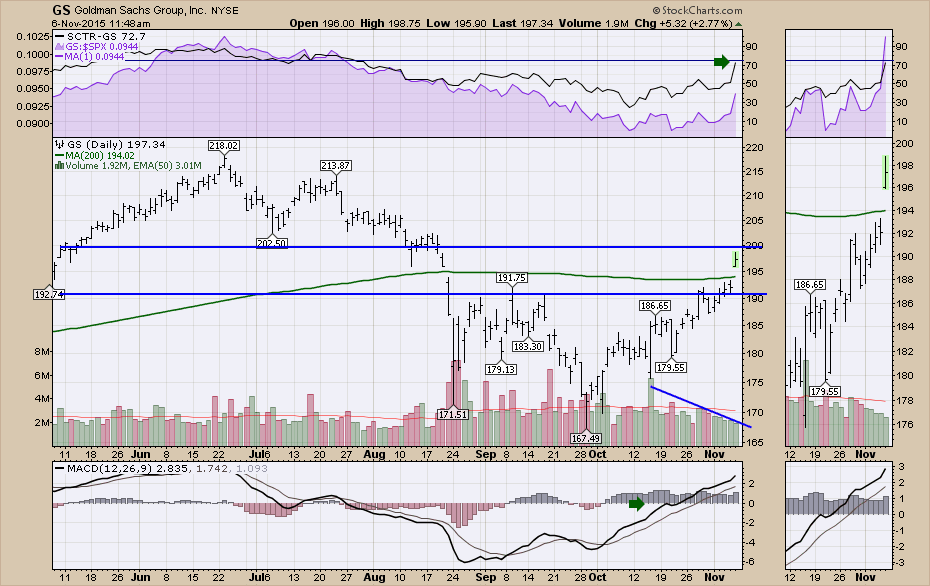

With the jobs report this morning being so good, the financials were off to the races on the news of a probable interest rate rise from the Fed in December. Goldman Sachs (GS) has been struggling to get back above the September highs even with the October surge. Well today, all that changed. Goldman gapped up in the pre-market action and since the open it continued to work higher. There is a little resistance at $200 but this is a big push higher on the back of the expected increase.

With all the euphoria around the financials and the interest rate sensitive stocks, perhaps we'll see Goldman test its June highs.

Good trading,

Greg Schnell, CMT

About the author:

Greg Schnell, CMT, MFTA is Chief Technical Analyst at Osprey Strategic specializing in intermarket and commodities analysis. He is also the co-author of Stock Charts For Dummies (Wiley, 2018). Based in Calgary, Greg is a board member of the Canadian Society of Technical Analysts (CSTA) and the chairman of the CSTA Calgary chapter. He is an active member of both the CMT Association and the International Federation of Technical Analysts (IFTA).

Learn More