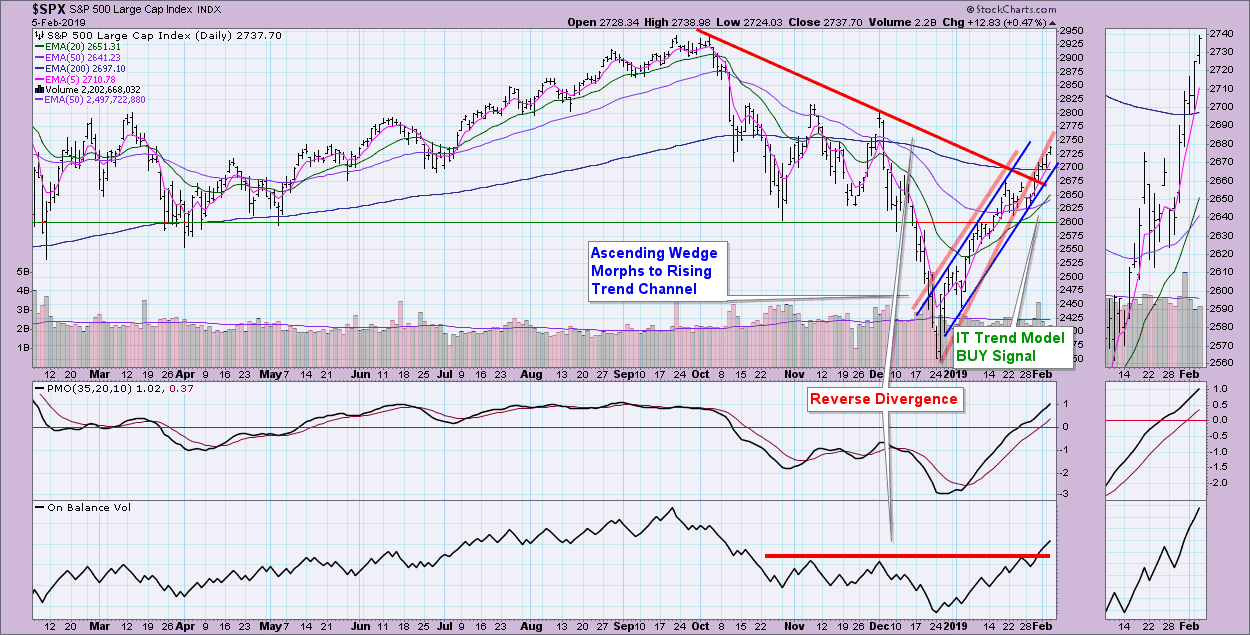

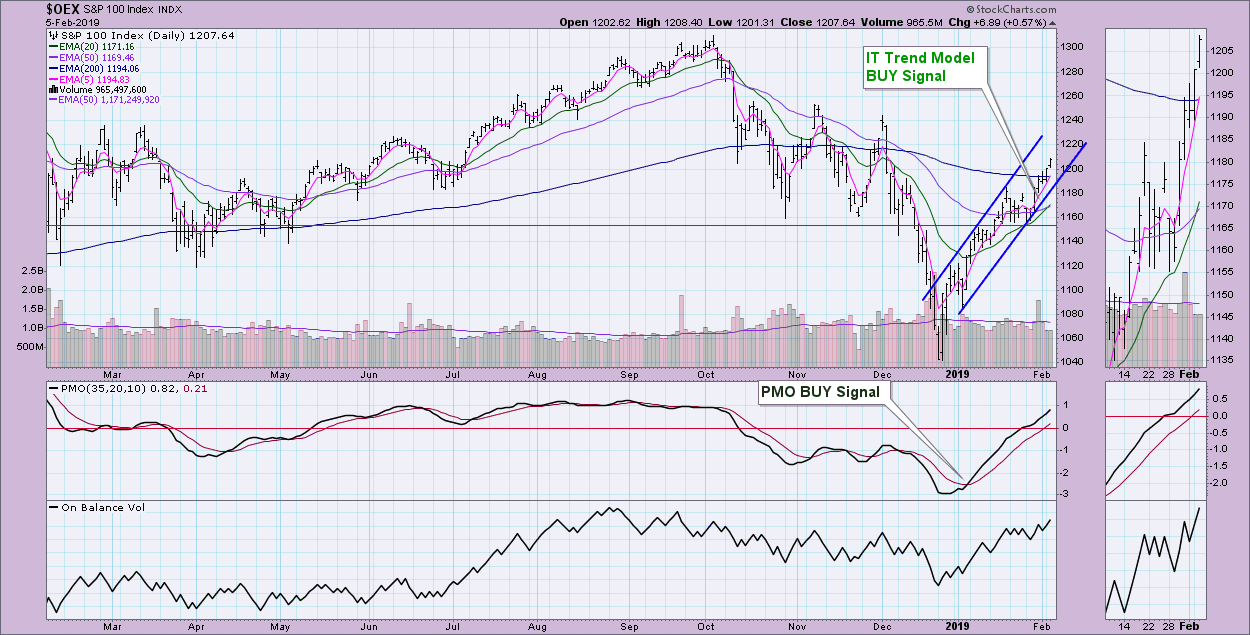

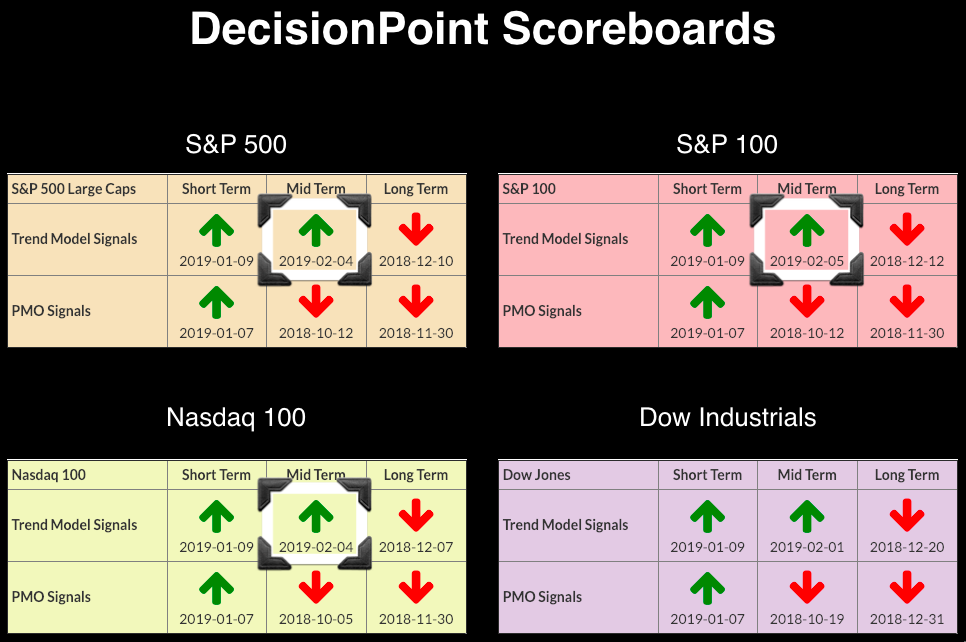

Just a quick bulletin to let you know that the SPX, OEX and NDX have triggered new IT Trend Model BUY signals. Though Dow got off to a head start, they are now all in line. The weekly PMO determines the IT PMO signal, which are not quite close enough to look for those BUY signals yet. You'll also notice in the charts below that all of the bearish ascending wedges have morphed into rising trend channels. It is hard to argue with such strength. At this point, we're ready for at least a pause, but it seems more likely that a throwback will break through the bottom of the channels. The current rising trend channels are steep and will be difficult to maintain.

PMOs can be considered overbought in a bear market right where they are. However, they aren't acting as if they want to turn lower yet. The reverse divergence with the OBV is troubling; volume was unable to push price tops higher. On the SPX, however, the OBV is certainly confirming the current rally.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on StockCharts TV, Fridays at 4:30pm EST, or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates."**