DecisionPoint September 28, 2018 at 06:52 PM

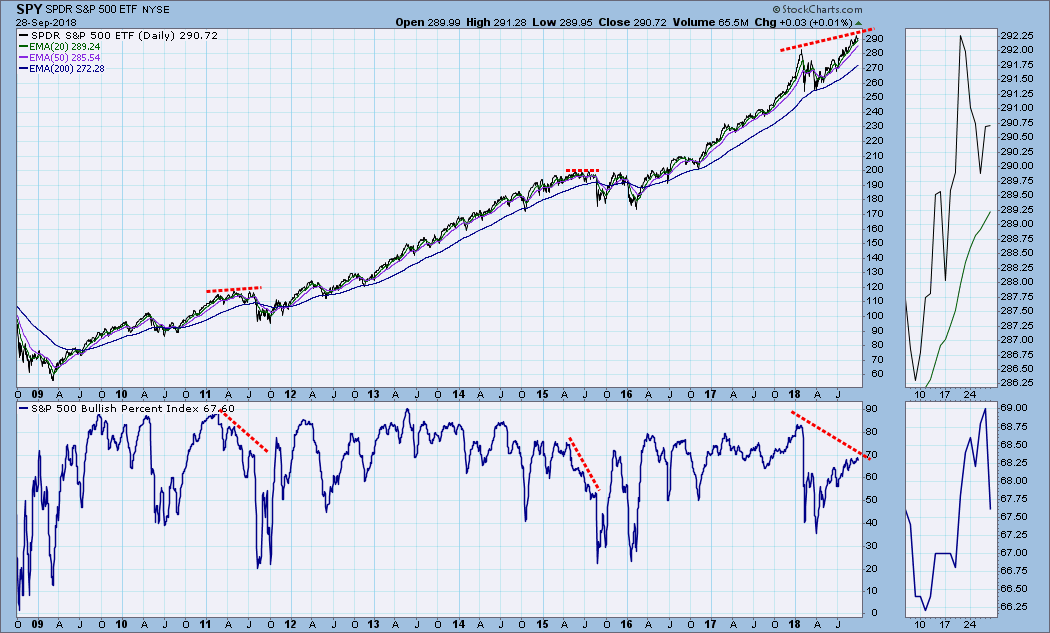

This chart was added almost as an afterthought in last Friday's DP Weekly Wrap, but throughout the week I kept thinking that it should elevated to the lead chart this week... Read More

DecisionPoint September 26, 2018 at 06:44 PM

Advances minus declines readings over the past few days are suggesting a short-term selling exhaustion. And, what's up with Gold? It's been poised to breakout for some time and we're still waiting... Read More

DecisionPoint September 25, 2018 at 05:27 PM

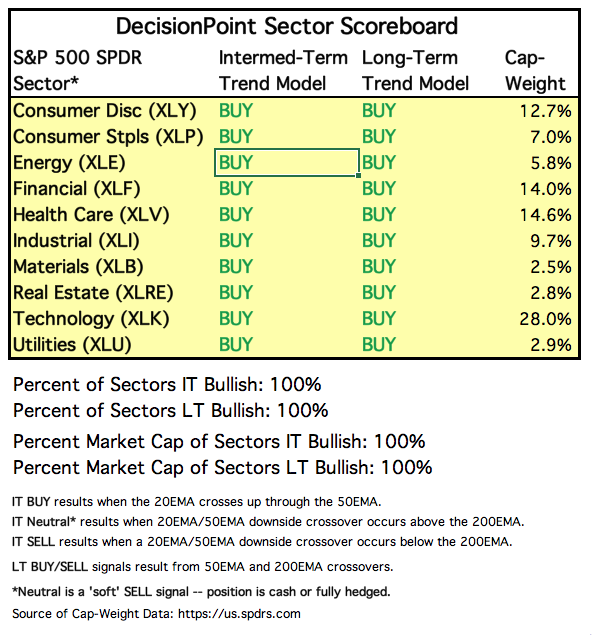

When I look at the DecisionPoint Sector Scoreboard, it is near impossible to be bearish in the longer term. When we see participation in all of the sectors that results in BUY signals across the board, the market is not generally vulnerable to a correction... Read More

DecisionPoint September 21, 2018 at 06:11 PM

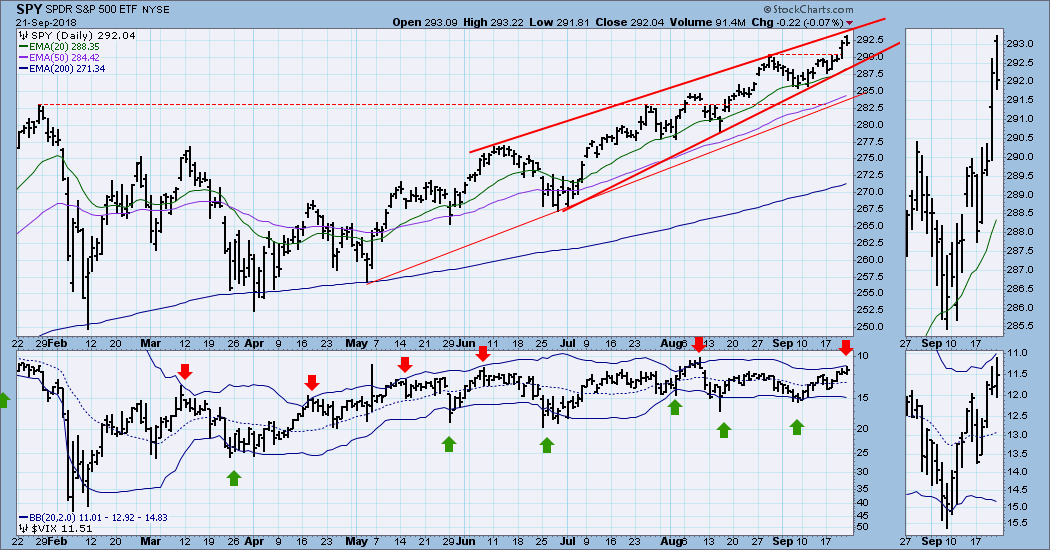

The market (represented by SPY) has nearly reached the top of a rising wedge formation, and the VIX has reached the top Bollinger Band on our reverse scale display. There is no guarantee, but there is a pretty good chance that a short-term top is very near... Read More

DecisionPoint September 20, 2018 at 06:38 PM

Today I received two bullish email alerts on Natural Gas (UNG). First, the Short-Term Trend Model had triggered a BUY signal. This means the 5-EMA just crossed above the 20-EMA... Read More

DecisionPoint September 19, 2018 at 07:48 PM

Big news today was a new Price Momentum Oscillator (PMO) BUY signal on the Dow. I've noticed the bifurcation of the markets. Today saw a positive close for the Dow, OEX and SPX, but the NDX, $MID and $SML all closed lower... Read More

DecisionPoint September 18, 2018 at 07:17 PM

I've been trumpeting the bearish horn on TLT for some time, but today marked a series of unfortunate events for TLT. Just last week we saw a new IT Trend Model Neutral signal and today, we got the LT Trend Model SELL signal... Read More

DecisionPoint September 14, 2018 at 05:45 PM

Last week I was concerned that the VIX had topped but had failed reach the top band on the chart -- a similar configuration occurred in January before the crash... Read More

DecisionPoint September 13, 2018 at 05:45 PM

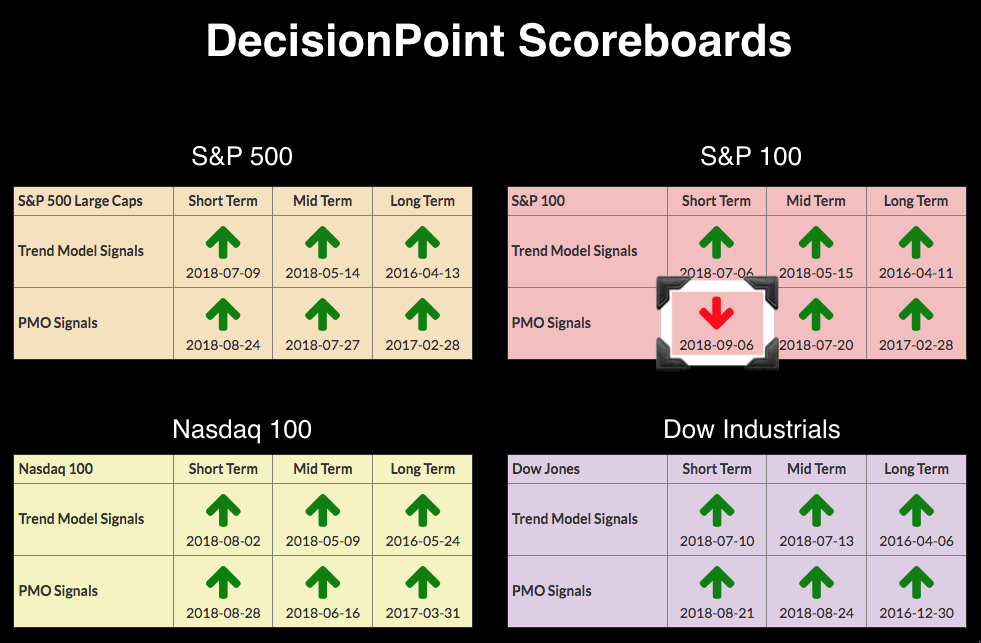

No changes to the DecisionPoint Scoreboards since the past week's PMO SELL signals were added. We've seen a slight rebound in the market the past few days and consequently, our short-term indicators are beginning to turn up from somewhat oversold territory... Read More

DecisionPoint September 10, 2018 at 05:19 PM

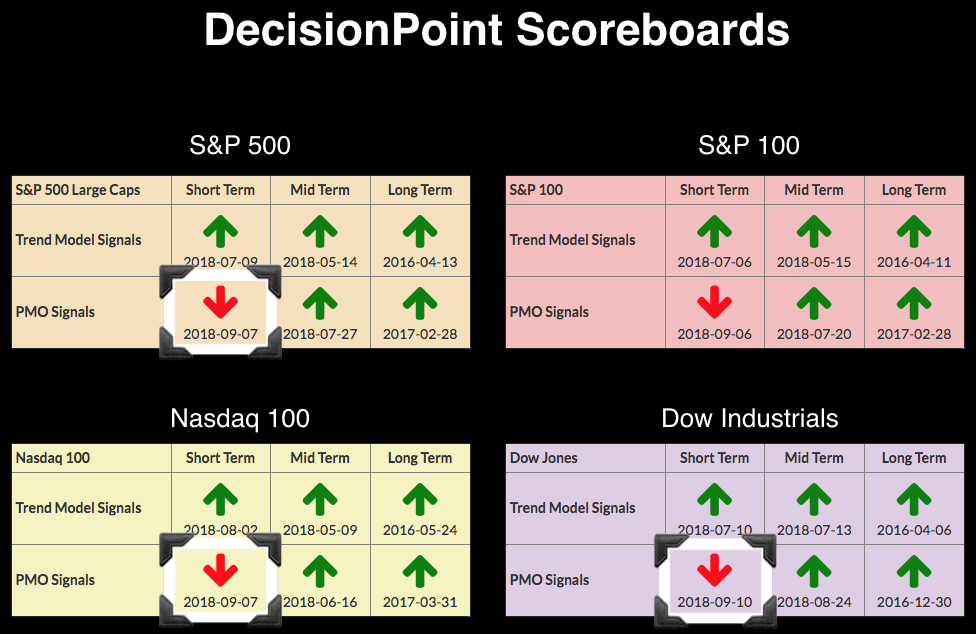

As of today's market close, all four Scoreboards have moved back to PMO SELL signals. The OEX was the first to go on Thursday, followed by the SPX and NDX on Friday and the Dow today. Below are the daily charts for all four indexes with the new SELL signals annotated... Read More

DecisionPoint September 07, 2018 at 06:51 PM

Last week we were looking at a possible bearish island reversal on one hand, and nascent parabolic advance on the other. This week's decline filled the island gap, making the island proposition moot... Read More

DecisionPoint September 06, 2018 at 05:24 PM

The market in general is pulling back since making all-time highs last week so it isn't surprising to see PMOs now in decline. The OEX couldn't hold on to its PMO BUY signal and I suspect another decline will start flipping the other three indexes' PMOs to SELL signals as well... Read More

DecisionPoint September 05, 2018 at 05:48 PM

The DecisionPoint Scoreboards remain completely green, meaning all four indexes are on BUY signals in all three timeframes as far as price trend and condition. While it seems a condition we would want to celebrate, it suggests to me that the market is overextended... Read More

DecisionPoint September 04, 2018 at 05:57 PM

There were some new developments on the 20-year Bond ETF (TLT) that are tipping the scales bearish. We were already noticing some problems for Bonds in general, but volatile trading had made it difficult to decipher... Read More