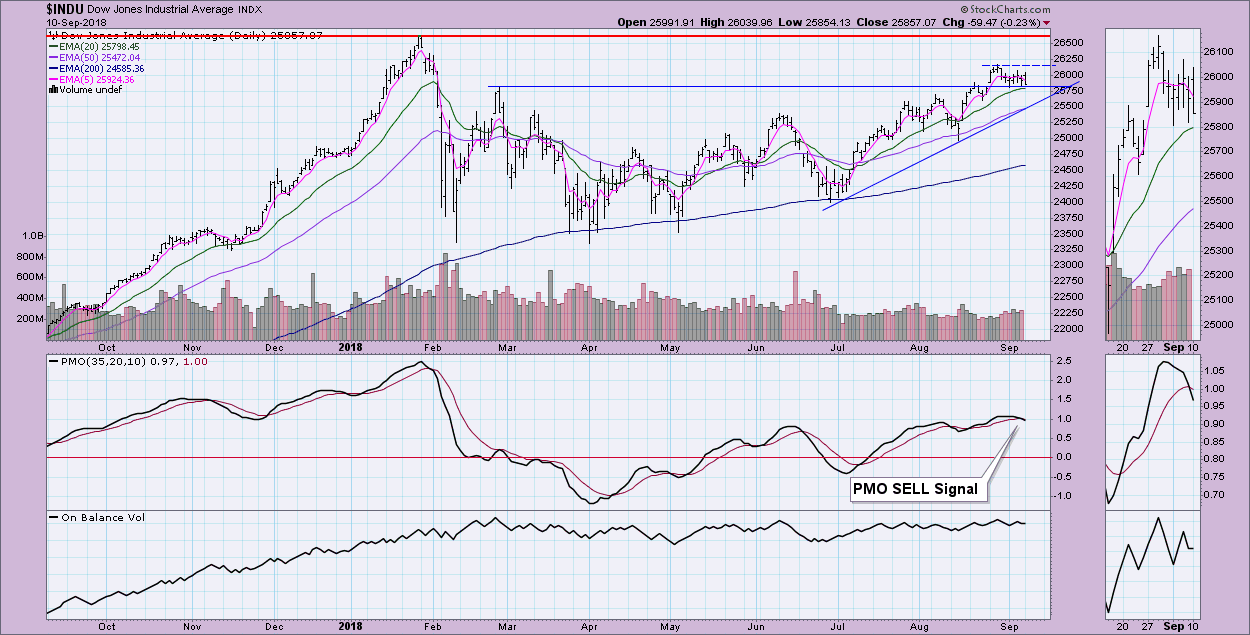

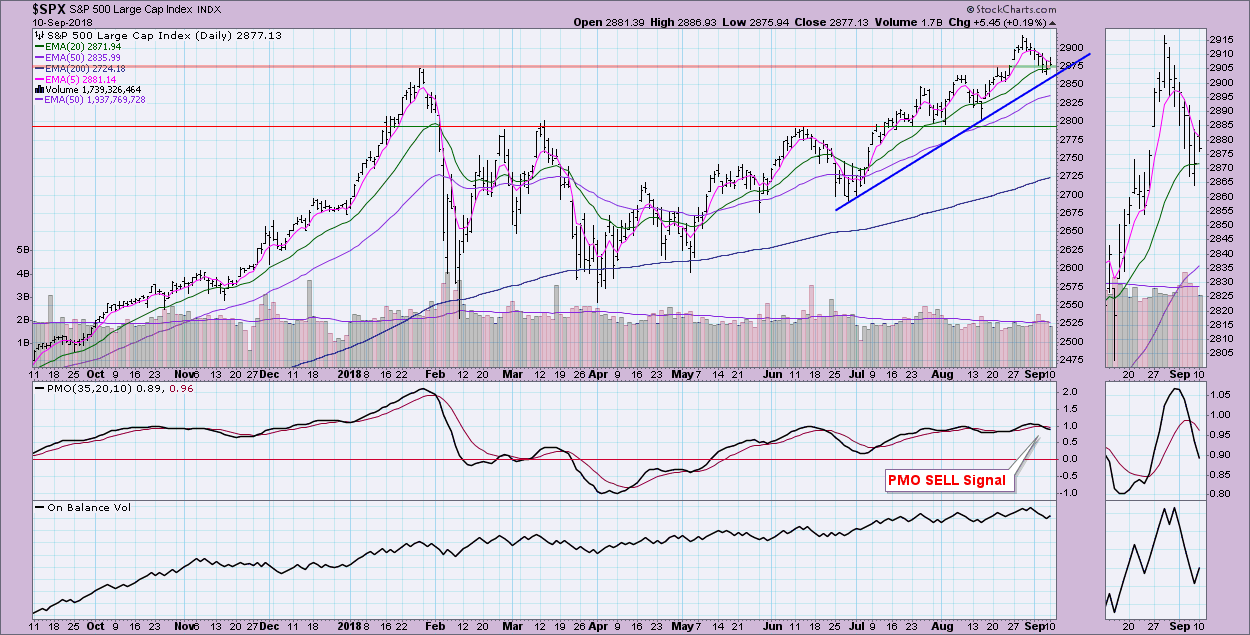

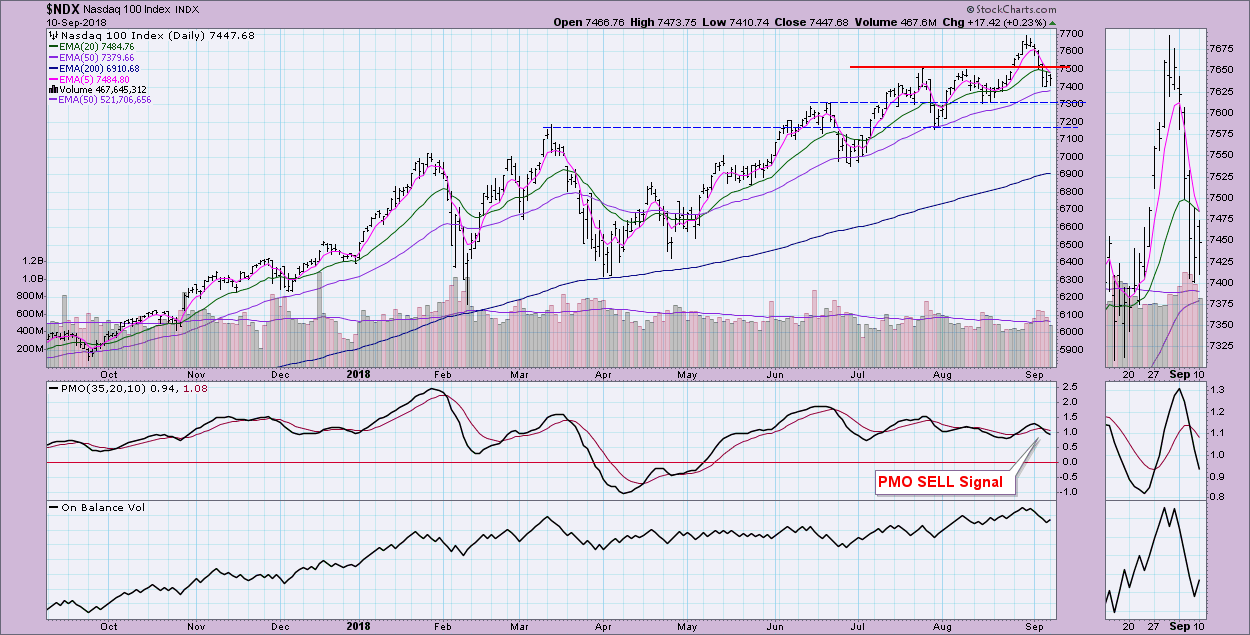

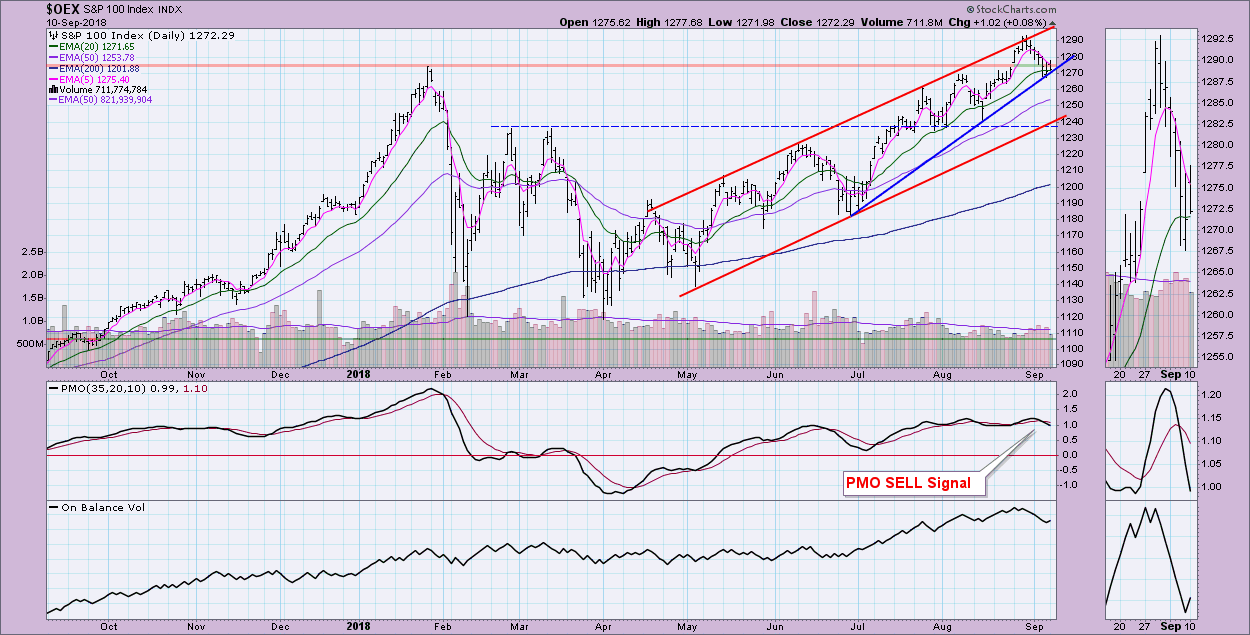

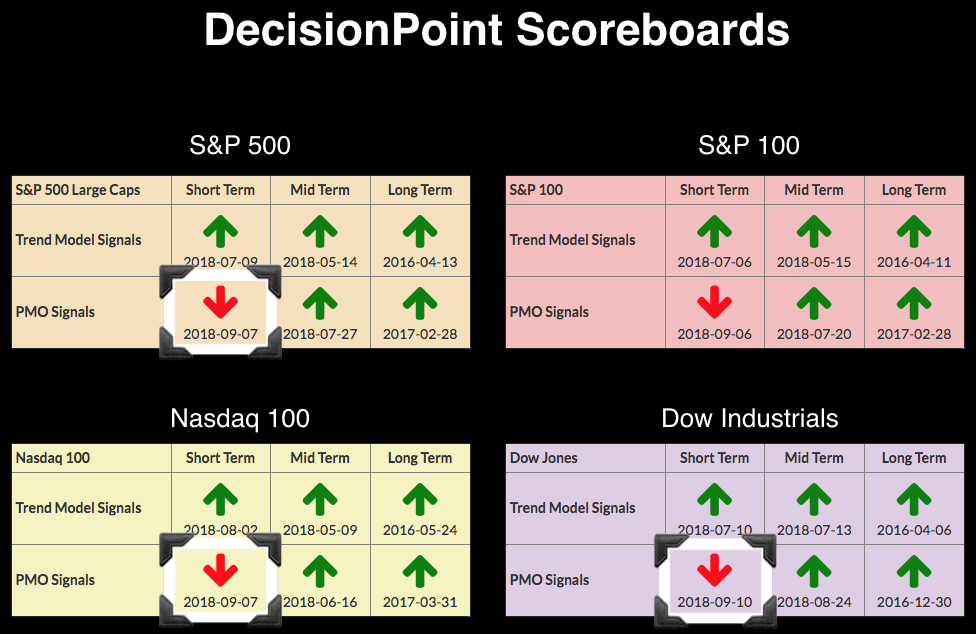

As of today's market close, all four Scoreboards have moved back to PMO SELL signals. The OEX was the first to go on Thursday, followed by the SPX and NDX on Friday and the Dow today.

Below are the daily charts for all four indexes with the new SELL signals annotated.

The Dow is within a trading zone, but I would expect a test of the rising bottoms trendline.

SPX held rising bottoms support, but I don't believe it will last. 2850 (July top) is safe support, but if it were to fail, the pullback could become more serious.

Watch for a move to support around 7300.

This rising wedge should execute to the downside. I would watch support at 1260 (also July top) as a likely test point.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**