This morning while broadcasting the final market update during the MarketWatchers LIVE show, I commented on the bifurcation of the market. Large-Caps in general were enjoying a rally, but mid- and small-caps were running to the downside. After the market close, I received an email alert that the S&P 400 and its sister ETF, IJH triggered Short-Term Price Momentum Oscillator (PMO) SELL signals. I took a peek at the S&P 600 ETF (IJR), and noted a very negative PMO configuration. Both indexes have bearish intermediate-term indicators.

This morning while broadcasting the final market update during the MarketWatchers LIVE show, I commented on the bifurcation of the market. Large-Caps in general were enjoying a rally, but mid- and small-caps were running to the downside. After the market close, I received an email alert that the S&P 400 and its sister ETF, IJH triggered Short-Term Price Momentum Oscillator (PMO) SELL signals. I took a peek at the S&P 600 ETF (IJR), and noted a very negative PMO configuration. Both indexes have bearish intermediate-term indicators.

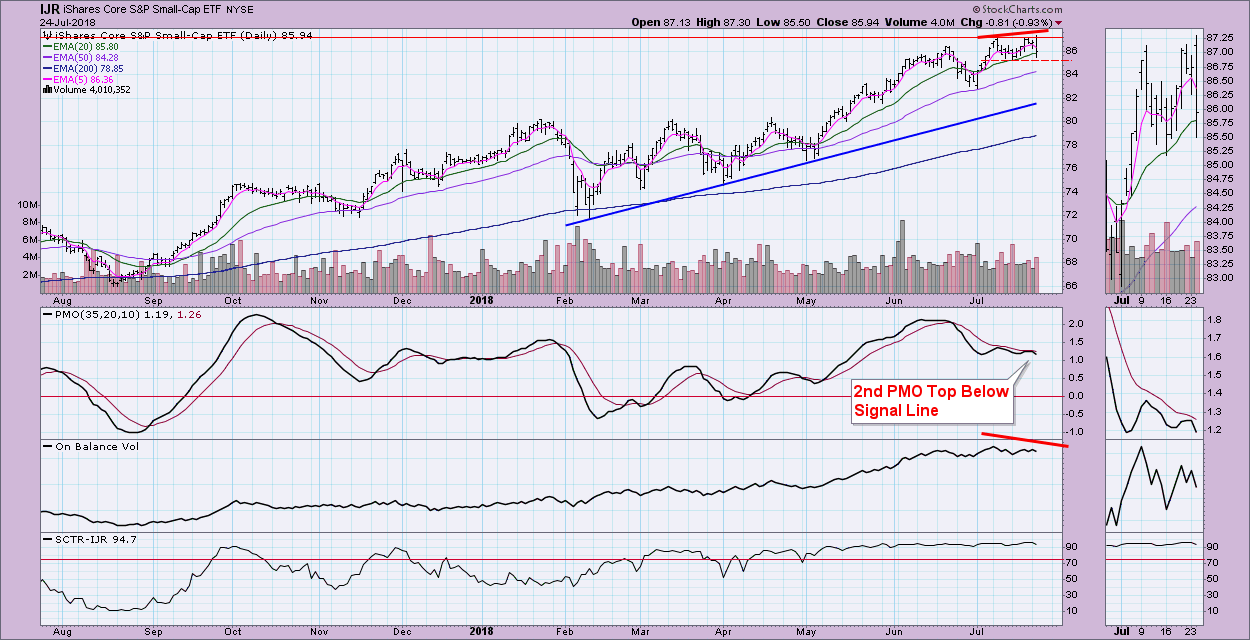

I've annotated the PMO SELL signal. Clearly the PMO is unsure of itself as it's triggered whipsaw signals in early July. Today's close just barely landed above support at the intraday lows of the previous bottom and January top. With the weakening SCTR and bearish confirmation between the OBV tops and price tops, I suspect we could see a test of the rising bottoms trendline.

While we have seen all-time highs hit on the S&P 600, momentum is deteriorating further and a negative divergence is set up with the OBV. Price is about to test the bottom of the current trading channel. This is the moment of truth. If we don't see that support hold up, we could see a test at the late June low, $82.50.

Looking at the intermediate-term indicators, the Intermediate-Term Breadth Momentum oscillator (ITBM) and Intermediate -Term Volume Momentum oscillator, we see negative crossovers and clear negative divergences. These charts will update later today, but based on price action, I don't expect to see changes in the bearish characteristics. Click on the charts to get the latest information.

The $MID ITBM has just initiated a negative crossover its signal line. What's especially concerning is the quick descent of the ITVM, this tells us that current price rises are not supported by volume.

The S&P 600 indicators are even more negatively configured. Not only is there a significant negative divergence, we have tops beneath signal lines.

Conclusion: Given the lack of momentum on these indexes and the very bearish intermediate-term indicators, I am expecting follow-through on today's pullback.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**