New trade deals were announced regarding US-EU tariffs and that seems to have given the market an adrenaline shot. However, on the flip side, Facebook's earnings report miss is wreaking havoc on after hours trading for the technology sector. It'll be interesting to see whether this follows through on tomorrow's trading.

New trade deals were announced regarding US-EU tariffs and that seems to have given the market an adrenaline shot. However, on the flip side, Facebook's earnings report miss is wreaking havoc on after hours trading for the technology sector. It'll be interesting to see whether this follows through on tomorrow's trading.

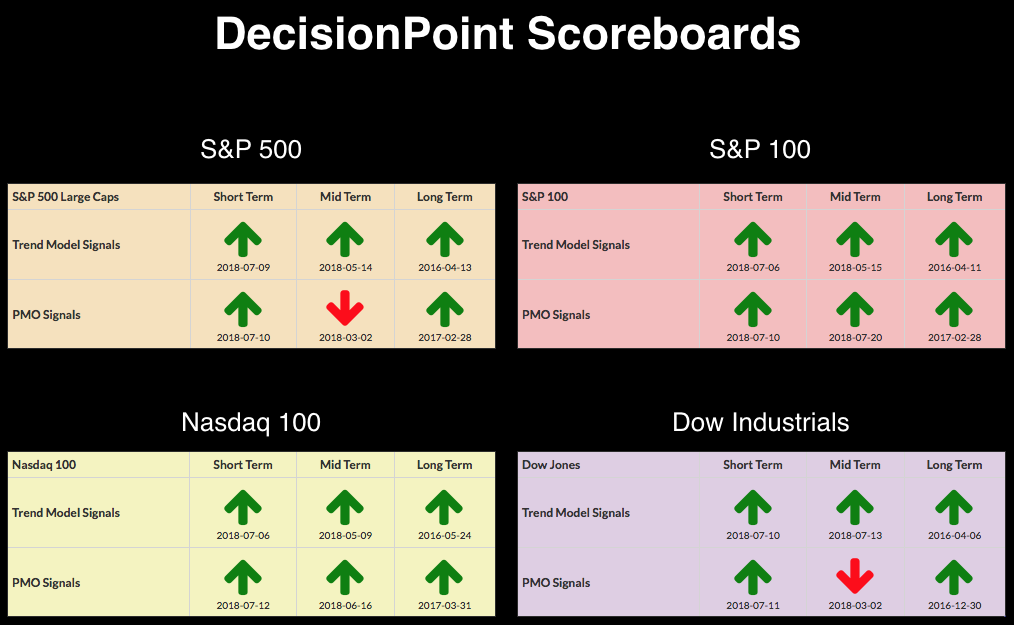

The DecisionPoint Alert presents an mid-week assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil, and Bonds.

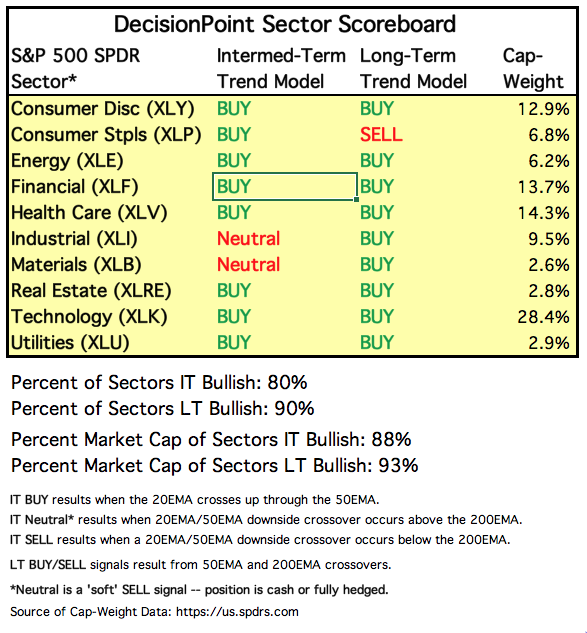

SECTORS

Each S&P 500 Index component stock is assigned to one, and only one, of 10 major sectors. This is a snapshot of the Intermediate-Term and Long-Term Trend Model signal status for those sectors.

As noted, the Financial SPDR (XLF) logged a new IT Trend Model BUY signal. This sector has been lagging, but with interest rates rising and good earnings being reported around the sector, it is starting to regain strength. Next up is strong overhead resistance along the May top near $28.50.

STOCKS

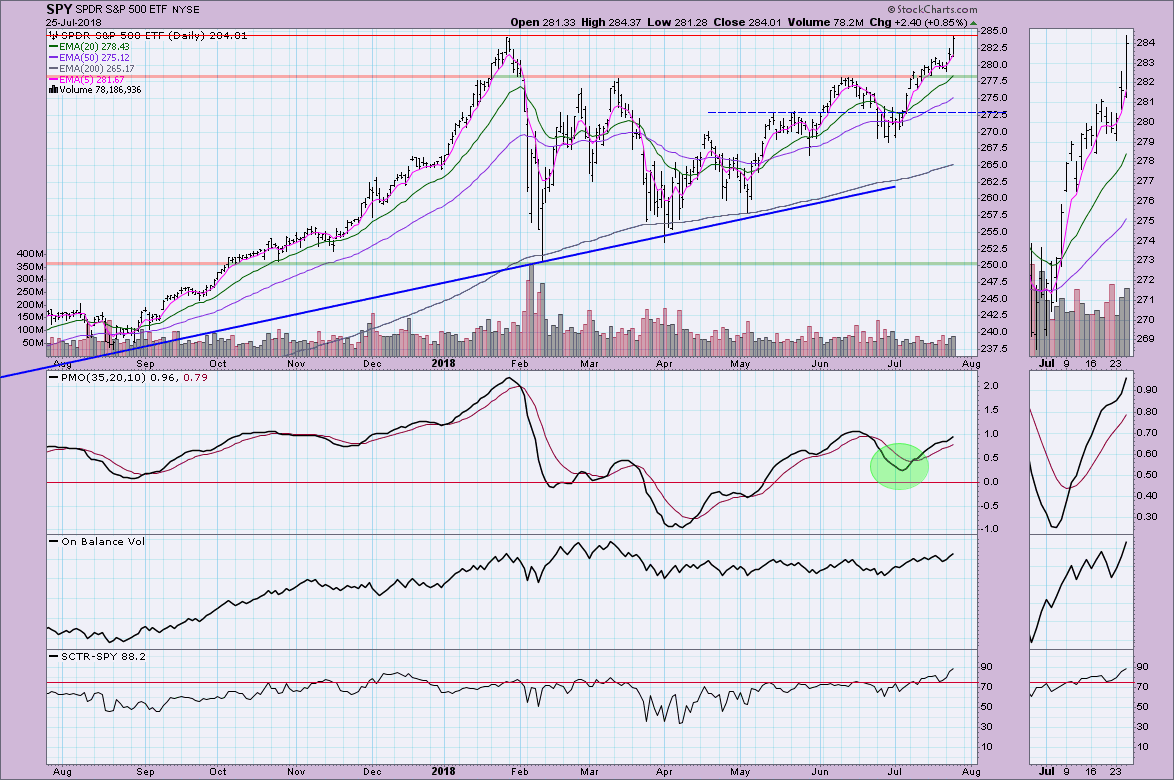

IT Trend Model: BUY as of 5/11/2018

LT Trend Model: BUY as of 4/1/2016

SPY Daily Chart: The SPY nearly logged a new all-time high. Given the trade talk euphoria that is seeping in, I expect we will see it very soon. I had thought that we'd see price pullback this week, but that really hasn't happened. The technicals are strong so I'm expecting a breakout to all-time highs...I just wasn't expecting this week.

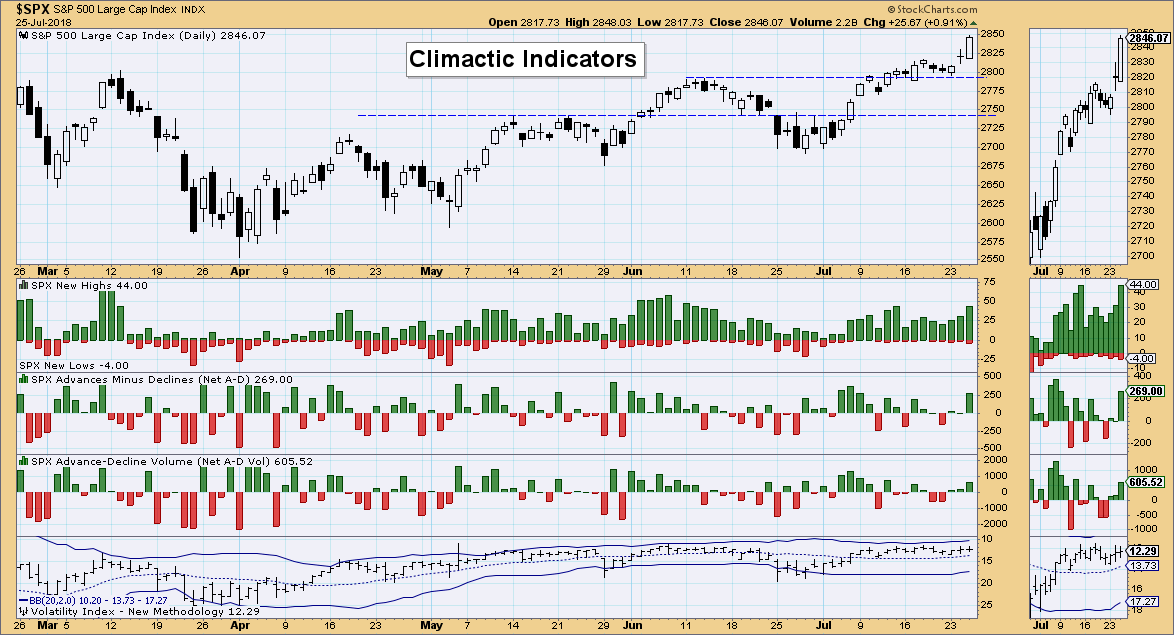

Climactic Market Indicators: We saw climactic readings in breadth and given the strong bullish white hollow candle, I would view those high breadth readings as a buying initiation.

Short-Term Market Indicators: With the strong finish today, the short-term indicators have turned up. They've been very twitchy and indecisive so I don't want to place too much emphasis on that.

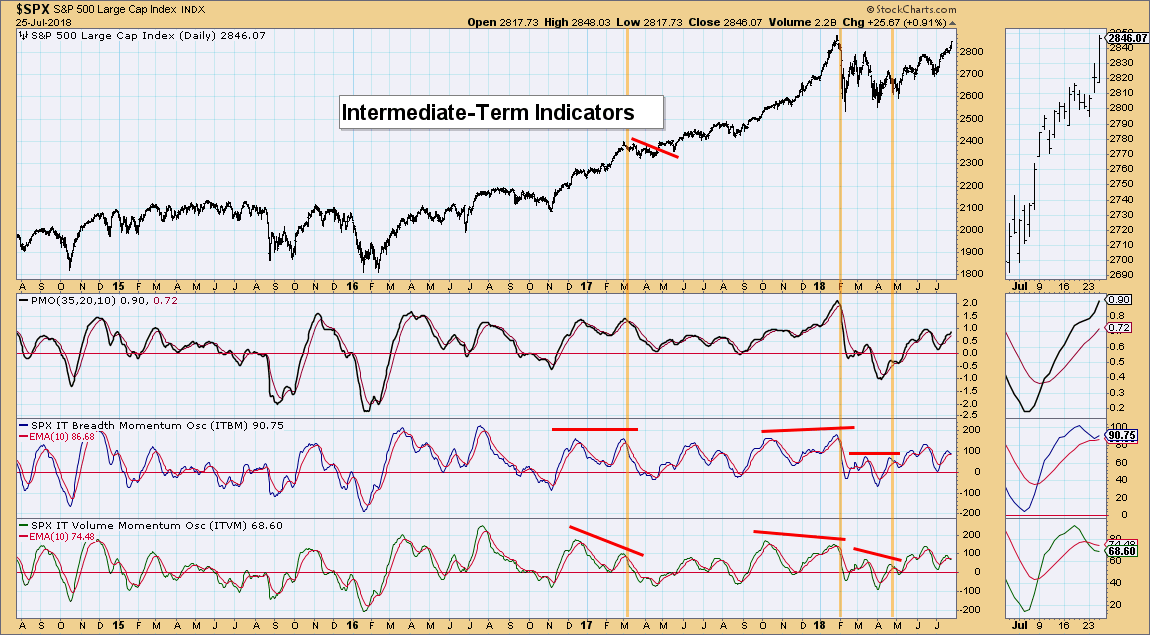

Intermediate-Term Market Indicators: It appears the ITBM is going to avoid a negative crossover and the ITVM will manage a positive crossover very soon. We saw some deterioration on these indicators last week, but they do seem to be turning around.

Conclusion: The market has been experiencing split personality disorder with mid-caps and small-caps showing relative weakness with large-caps and now we have possible problems for the NDX tomorrow based on Facebook misses. Trade tensions easing will be positive for the market in general, but after hours trading is suggesting it won't be enough for the NDX to overcome the Facebook debacle.

DOLLAR (UUP)

IT Trend Model: BUY as of 4/24/2018

LT Trend Model: BUY as of 5/25/2018

UUP Daily Chart: Looks like a messy double-top and an upcoming test of support at the confirmation line drawn from the July low. The PMO top below the signal line and its continued free fall suggests that support will not hold.

GOLD

IT Trend Model: Neutral as of 5/2/2018

LT Trend Model: SELL as of 6/22/2018

GOLD Daily Chart: We saw some of the highest discount rates this year on the $PHYS. This suggests very bearish sentiment. Sentiment being contrarian, I'd be watching for a rally.

CRUDE OIL (USO)

IT Trend Model: BUY as of 6/26/2018

LT Trend Model: BUY as of 11/2/2017

USO Daily Chart: The negative divergence between the PMO and price played out on the deep decline from the beginning of July. The PMO and DP Trend Models are all bullish here. Look for price to test overhead resistance at $14.75.

BONDS (TLT)

IT Trend Model: BUY as of 6/1/2018

LT Trend Model: BUY as of 7/13/2018

TLT Daily Chart: It appears price has found support around $119 and we could be looking at a bullish island reversal formation. The PMO is still very negative and OBV and SCTR look every bit as bad. I suspect Monday's gap will be a breakaway gap to the downside.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

**Don't miss any of the DecisionPoint commentaries! Go to the "Notify Me" box toward the end of this blog page to be notified as soon as they are published.**

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically, the DecisionPoint Trend Model. They define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)