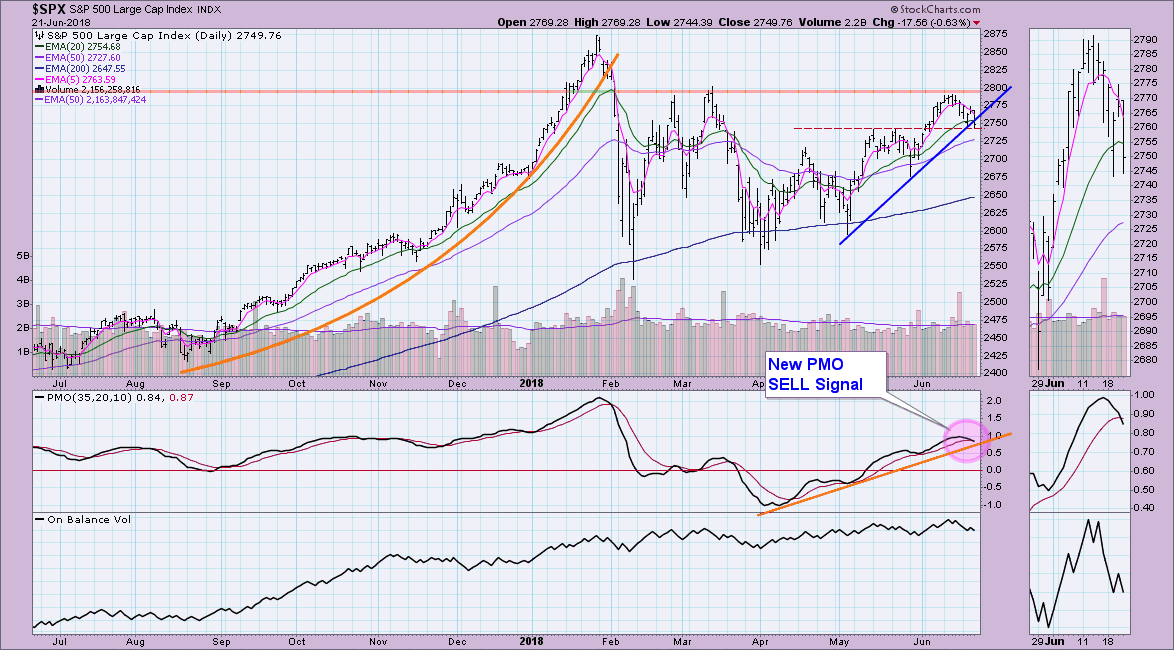

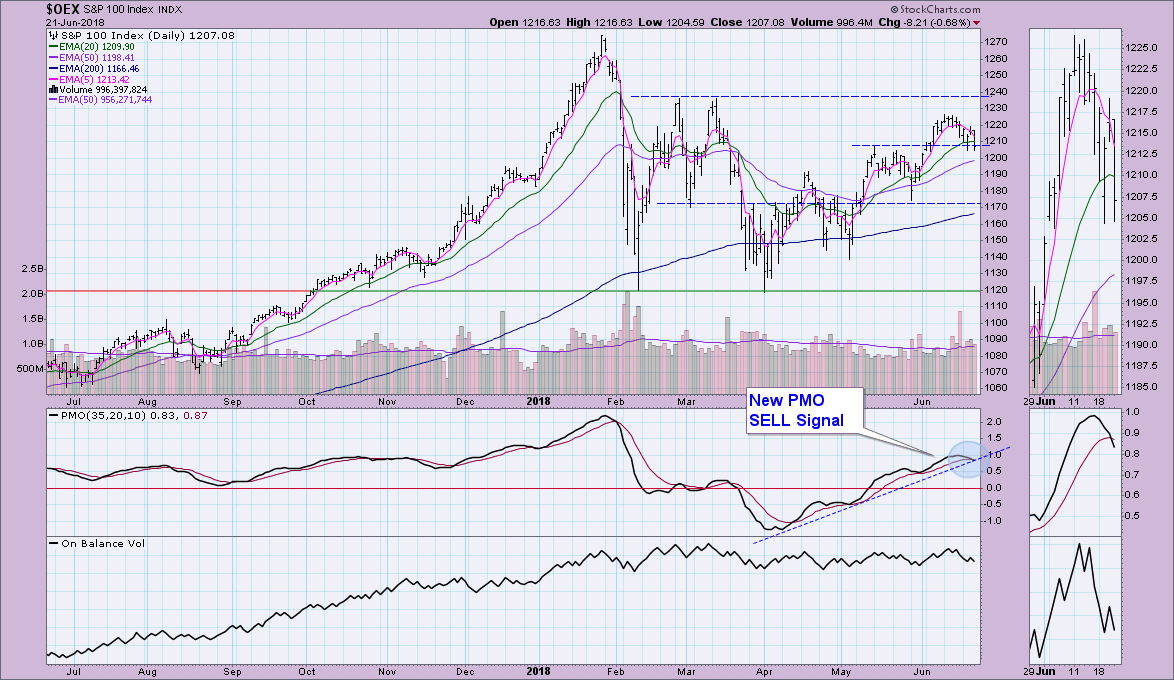

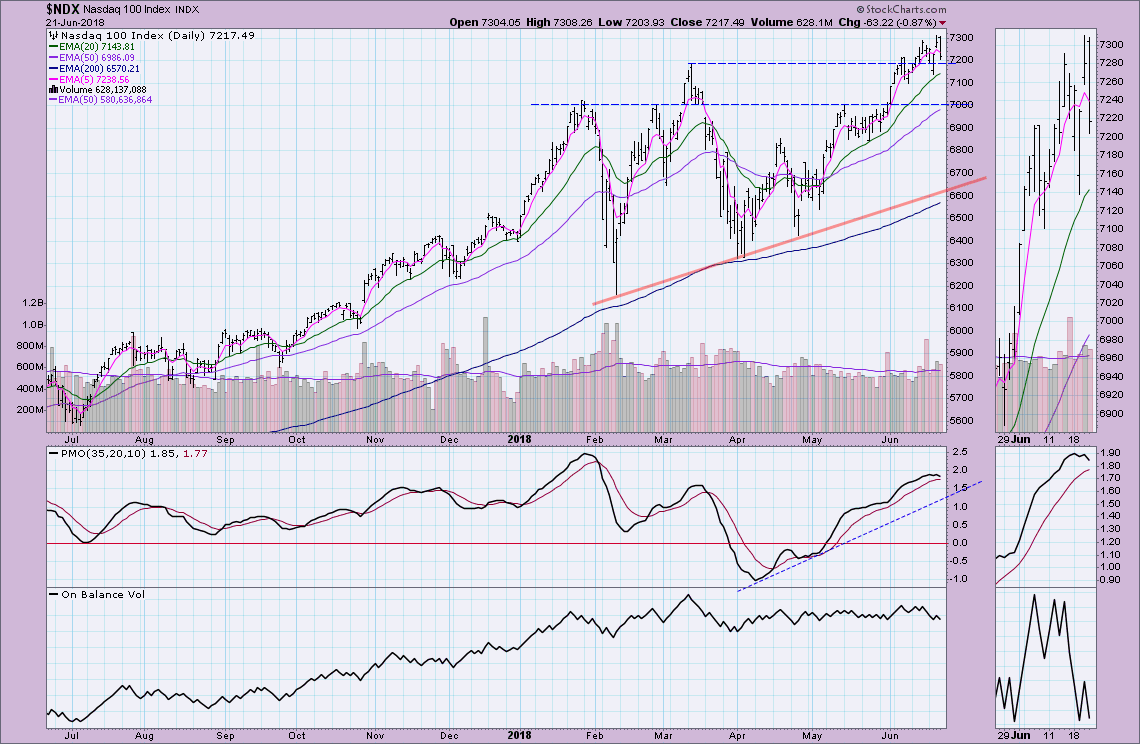

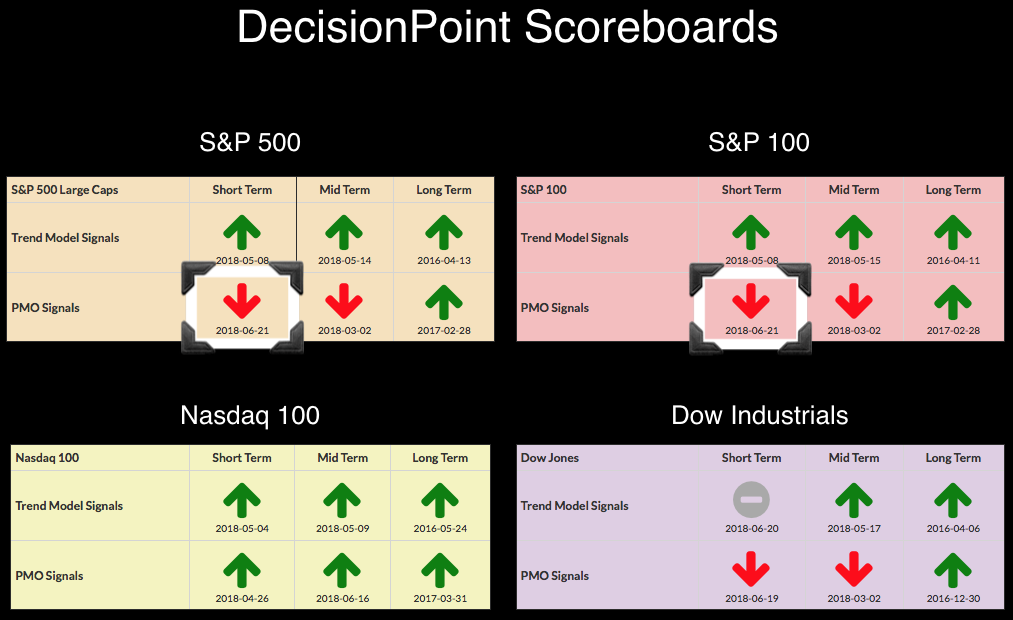

We added two more SELL signals to the DecisionPoint Scoreboards. Both the SPX and OEX triggered Price Momentum Oscillator (PMO) SELL signals. Apparently someone forgot to tell the NDX that it was time to relinquish BUY signals. However, maybe its hearing the whispers given it tumbled a bit farther today than both the SPX and OEX.

As far as the SPX, today marked a failed test of the rising bottoms trendline, but managed a save, holding onto support at the May tops. The rising trend on momentum hasn't yet been broken, but unless we see a nice bounce tomorrow, it likely will be broken.

The OEX has already put its toes in the water below the May top, but so far is closing above it. However, the loss of 20-EMA support and the near miss by the PMO staying just on the rising bottoms trendline. I'd say the OEX is clinging to life right now as it stubbornly holds support.

The NDX is a different story, not nearly satisfied with outdoing its May top, it continued rising and is making new all-time highs. The PMO is a bit healthier on the NDX. It's declining, but there is still some margin to cover before it generates a SELL signal. However, if today starts a new trend of it deteriorating more quickly than the others, look for that PMO SELL signal and a test of its rising trendline.

Conclusion: The market is topping and pulling back. So far support levels are being held, but barely and the PMOs are challenging their rising trends. I would expect some more decline. For the NDX, back down to its May top. For the SPX and OEX, I think a drop to the 50-EMA might suffice.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**