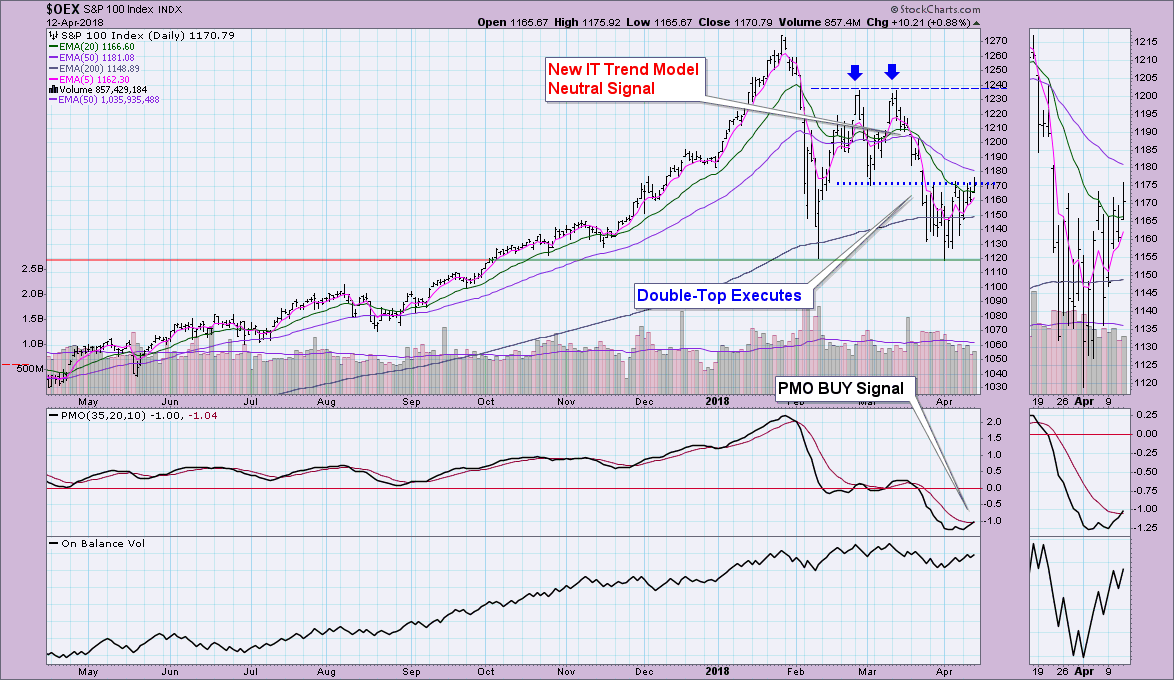

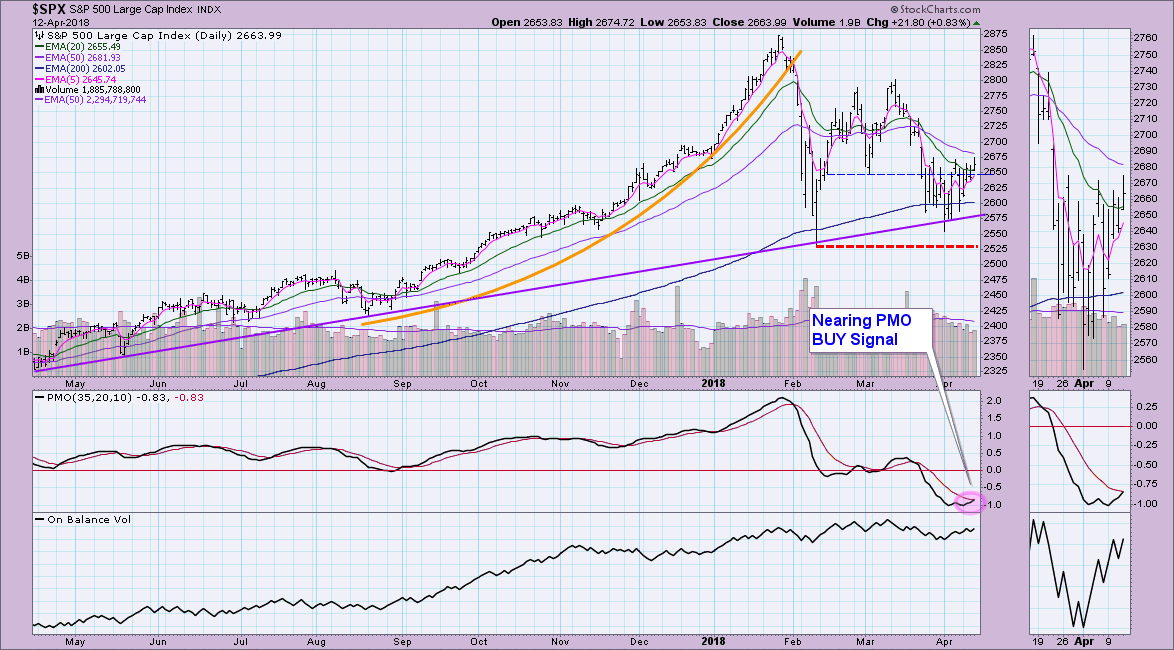

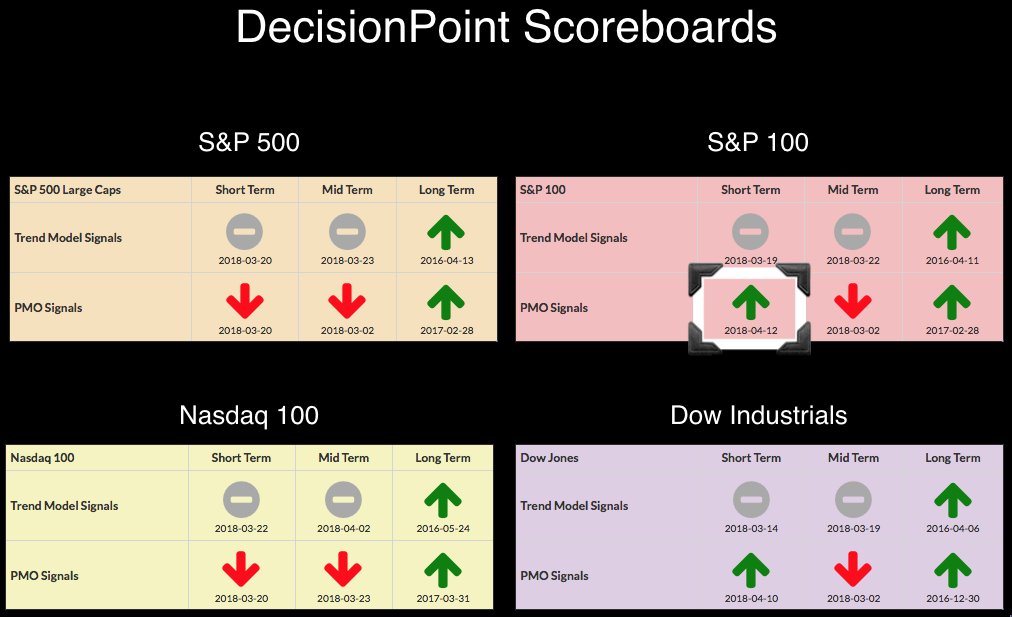

Another new signal to report on the DecisionPoint Scoreboards, the OEX has logged a Price Momentum Oscillator (PMO) BUY signal to join the Dow which triggered its PMO BUY signal yesterday. The NDX PMO has some distance to close before we'll see its signal change. Tomorrow, the SPX will change to a PMO BUY signal, the PMO only missed that BUY signal by less than .01.

The double-top on the OEX triggered when price dropped below the confirmation line at the early March low. It fell and successfully tested support at the February low and has since been chopping around between that support level and the original confirmation line of the double-top. I'd feel more optimistic about today's signal had we seen a close above 1180. However, the markets seem to be ready to resume at least a short-term rally.

We see that the SPX held support not only at the February low (didn't even go all the way down to test it), but also along the rising bottoms trendline. Price traded above prior resistance at the early March low. Volume has turned positive and is confirming the recent price rise as well.

Conclusion: I'll likely be posting another bulletin tomorrow when we see the new SPX PMO BUY signal (barring a dreadful decline). I'll be keeping a close eye on the NDX as well, but that signal will likely not change until next week.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**