Central Gold Trust (GTU) is a closed-end mutual fund, which means that it trades like a stock on the NYSE. The fund owns only gold -- the metal, not stocks. Closed-end funds trade based upon the bid and ask, without regard to their net asset value (NAV). Because of this, they can trade at a price that is at a premium or discount to their NAV. By tracking the premium or discount we can get an idea of bullish or bearish sentiment regarding gold.

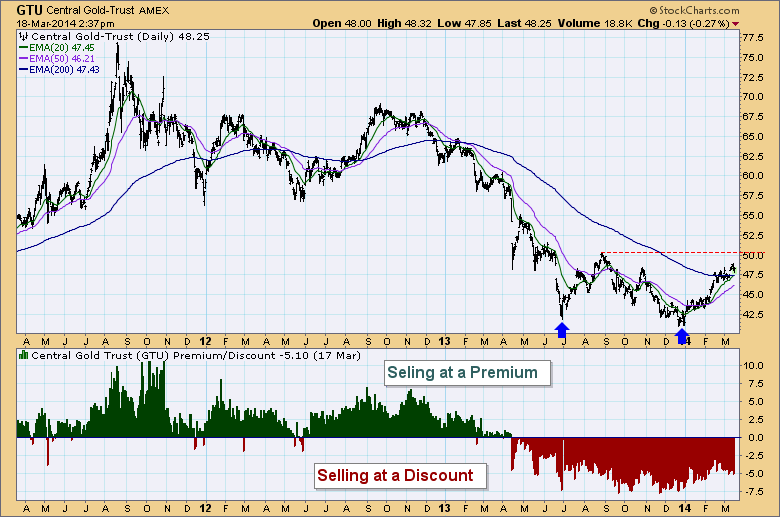

The following chart of GTU has a histogram showing the daily premium/discount on GTU shares, and they have been selling at a discount for nearly a year. This is not surprising, considering gold about -40% from the 2011 top. What does surprise me is that sentiment hasn't improved since a promising double bottom has formed.

(To see a live version of this chart click here.)

Sentiment should improve as price performance does, but at this point sentiment has remained sour in spite of what, in my opinion, is a substantial improvement in the outlook for gold. That would explain the somewhat tortured advance off the December low -- discouraged investors are still stinging from their losses.

If price can reach and break through the double bottom confirmation line (drawn from the July top), it may bring buyers back in with enough enthusiasm to get GTU selling at a premium again. To a certain extent a premium is a good sign because it shows confidence, but we need to beware of extreme readings that hint that irrationality has entered the market.

Watching the windsock,

Carl