ChartWatchers May 28, 2021 at 08:17 PM

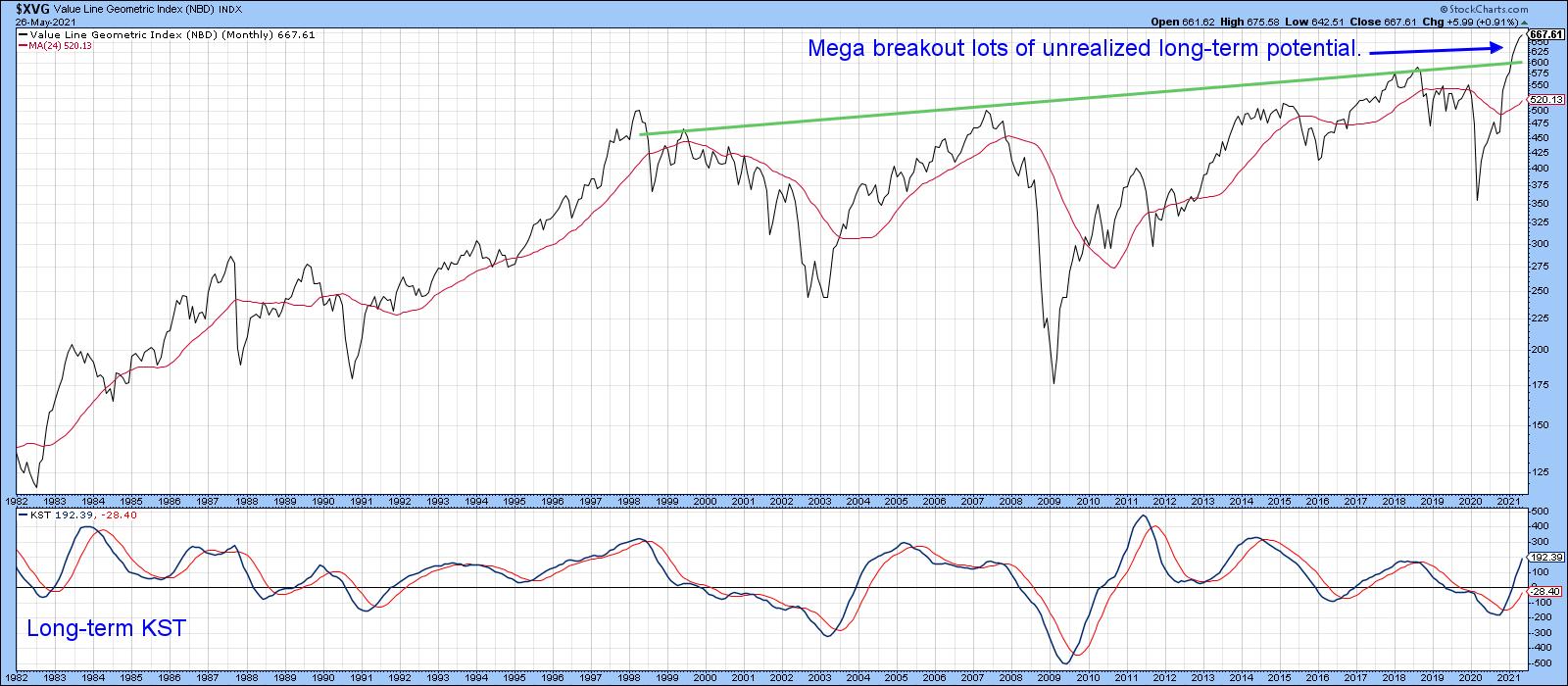

The Big Picture Before we get into the subject of corrections, it's important to make sure that we do not lose focus on the big picture. For instance, take Chart 1, which features the Value Line Geometric Average... Read More

ChartWatchers May 28, 2021 at 08:01 PM

The Reddit crowd was at it again this past week as they mounted a full-out assault on short sellers, with some stocks making meteoric rises... Read More

ChartWatchers May 28, 2021 at 07:40 PM

On Tuesday, I let DecisionPoint Diamonds subscribers know that weed stocks were the place to be. While this area can be speculative in nature, there are some strong winds at the back of these stocks... Read More

ChartWatchers May 28, 2021 at 05:54 PM

Some of the old Ford and GM cars can still rev their engines, but the sound of a revving engine could go the way of the dodo with EVs. Perhaps, I should say that the Global Auto ETF (CARZ) price chart is revving its engine and poised for a breakout... Read More

ChartWatchers May 28, 2021 at 12:58 PM

This crazy world has so many unique twists and turns. The turn that absolutely baffles me is the move to green energy without the planning. Not just in one country, but worldwide... Read More

ChartWatchers May 22, 2021 at 12:23 AM

I don't have to tell you it's been tough for most investors to make headway in the markets this month. We're navigating a landscape that's never before been traveled... Read More

ChartWatchers May 21, 2021 at 08:45 PM

This is an excerpt from today's subscriber-only "DecisionPoint Weekly Wrap": It has long been our belief that gold should be doing a lot better, considering the reckless spending and borrowing that is currently in progress... Read More

ChartWatchers May 21, 2021 at 06:57 PM

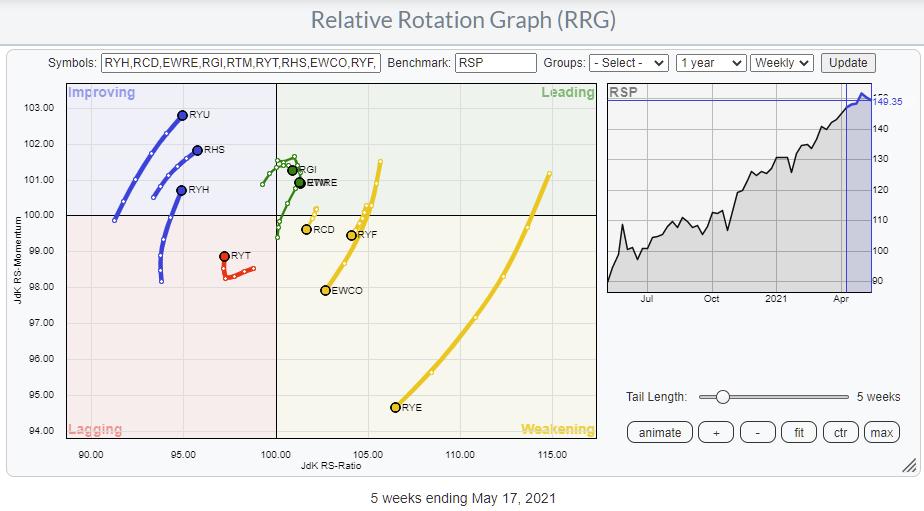

The Relative Rotation Graph shows the rotation of the Invesco family of equal-weight ETFs. These sector ETFs are often used to eliminate the dominating weight of some individual stocks in specific sectors... Read More

ChartWatchers May 21, 2021 at 10:48 AM

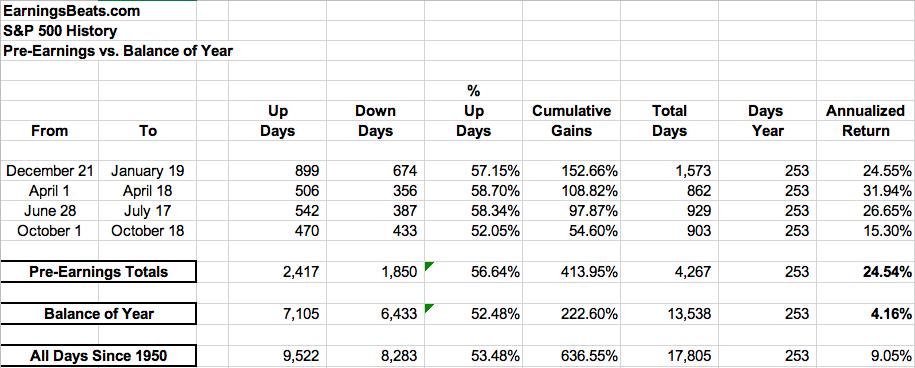

The stock market has a history of running higher in anticipation of earnings season. On the S&P 500, for instance, here are the annualized returns for the following periods since 1950: This is 71 years of daily data, which is certainly statistically relevant... Read More

ChartWatchers May 14, 2021 at 08:40 PM

When a market makes a quick move lower from an established peak, then quickly rebounds back to the upside, you will hear the dreaded phrase "dead cat bounce" emerge on trading floors... Read More

ChartWatchers May 14, 2021 at 06:52 PM

The volatility we've seen in the market of late can be linked to some recent reports showing that inflationary concerns are becoming problematic. More specifically, the Labor Department reported that CPI rose by 0.8%, while the rate of inflation over the past year climbed 4... Read More

ChartWatchers May 14, 2021 at 05:28 PM

The Cybersecurity ETF (CIBR) was hit with the rest of the tech sector over the last few weeks, but it held the March lows and is on my radar as a possible triangle forms over the last few months... Read More

ChartWatchers May 14, 2021 at 02:42 PM

I fired through some scans this morning and only one Gold name popped up. Then, after I altered my scan criteria slightly, a plethora of nice setups showed up. In a few weeks, StockCharts will have some new shows regarding scanning... Read More

ChartWatchers May 08, 2021 at 12:25 AM

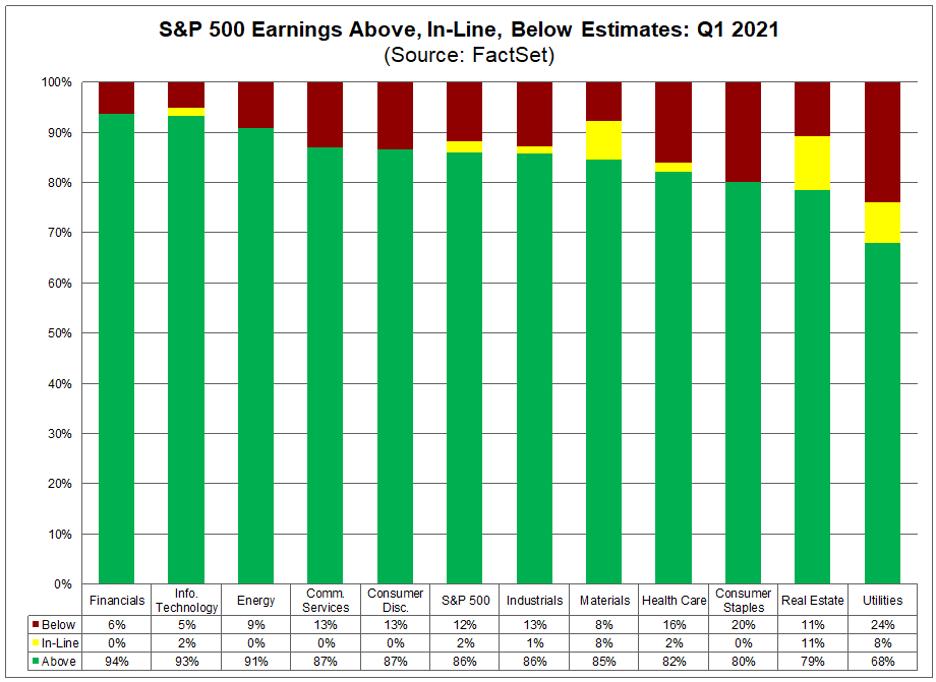

The S&P 500 is reporting the highest year-over-year earnings growth since the markets were emerging from the '08-'09 recession. In fact, over 85% of corporations are reporting first quarter results that are well above their estimates... Read More

ChartWatchers May 08, 2021 at 12:02 AM

I could provide a solid list of earnings season failure nominees like semiconductors ($DJUSSC), software ($DJUSSW) and medical equipment ($DJUSAM). However, I'm going to give the award to gambling ($DJUSCA)... Read More

ChartWatchers May 07, 2021 at 08:02 PM

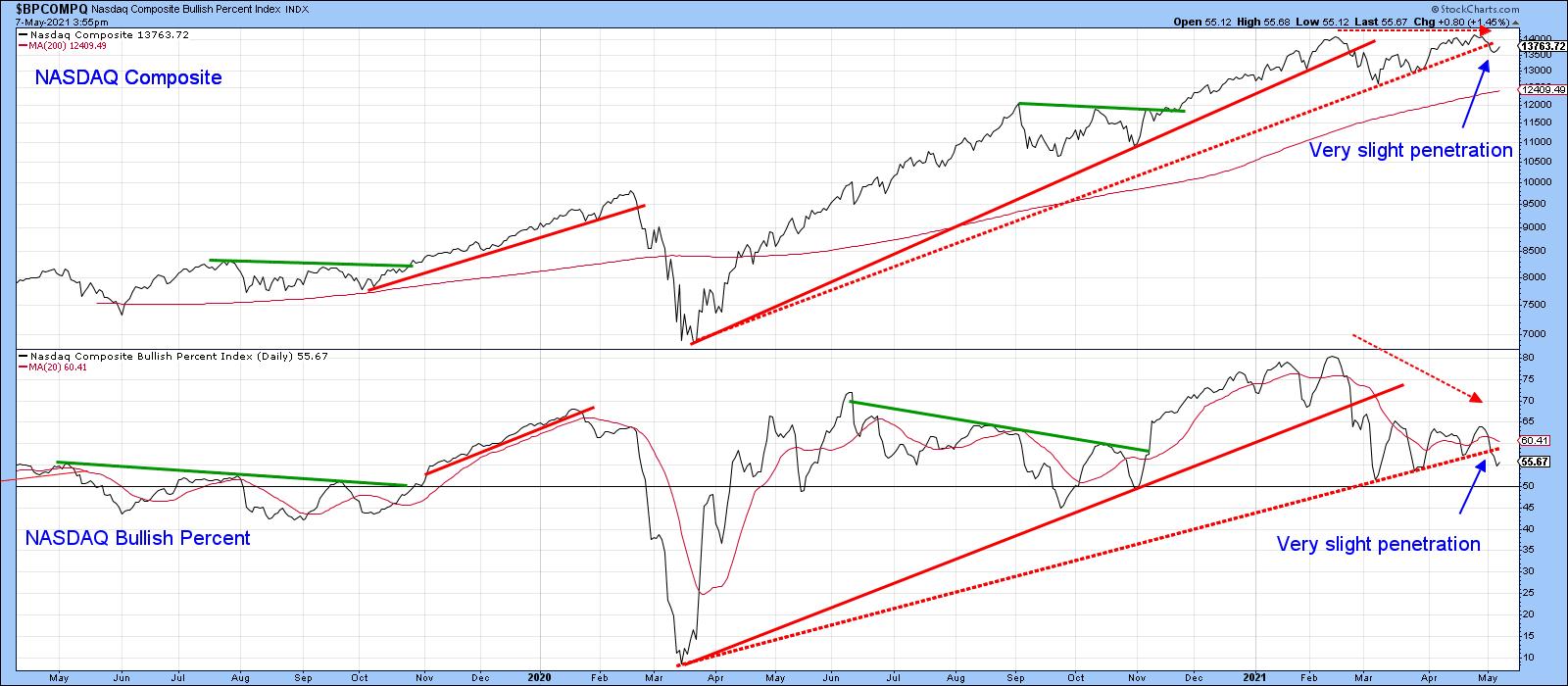

A couple of weeks ago, I posted an article questioning whether the tech-dominated NASDAQ still had the mojo to lead the market higher. At the time, many sub-surface indicators, such as breadth, volume and relative action, looked weak... Read More

ChartWatchers May 07, 2021 at 07:21 PM

One of the main characteristics of a Relative Rotation Graph is the "tail," which shows us the sector's trajectory through recent history... Read More