ChartWatchers November 27, 2020 at 09:00 PM

The decline in the U.S. dollar continues. Chart 1 shows the Invesco US Dollar Index (UUP) dropping to the lowest level in two years. Previous messages have described some of the intermarket side-effects of a weaker greenback... Read More

ChartWatchers November 27, 2020 at 05:37 PM

Boring and lagging ETFs turned into exciting leaders in November as we saw breakouts in the Regional Bank ETF (KRE) and REIT ETF (IYR)... Read More

ChartWatchers November 27, 2020 at 09:00 AM

The charts continue to roast the bears. It's been an aggressive run; they are hanging on, but it seems they are getting knocked off every perch. The Nasdaq even joined the party on Wednesday, finishing up on a down day for the Dow and $SPX... Read More

ChartWatchers November 25, 2020 at 06:58 PM

The market rotation of late has resulted in some explosive moves in some "forgotten stocks." This has been particularly true of those stocks that have a high percentage of shares short. As an example, take a look at the two charts below... Read More

ChartWatchers November 25, 2020 at 01:05 PM

We have all heard that "a rising tide raises all boats," and at DecisionPoint.com we have come to think of the direction of the market tide as being a bias that can benefit or work against our trading positions... Read More

ChartWatchers November 21, 2020 at 01:51 AM

With the move into Cyclical stocks continuing to expand, sectors such as Industrials have stocks with multiple reasons to continue to trade higher... Read More

ChartWatchers November 20, 2020 at 10:36 PM

I'm going to keep this article short and sweet. We're going higher. If you're still convinced that the U.S. stock market is staring at a doom-and-gloom environment, I don't know what to say... Read More

ChartWatchers November 20, 2020 at 08:29 PM

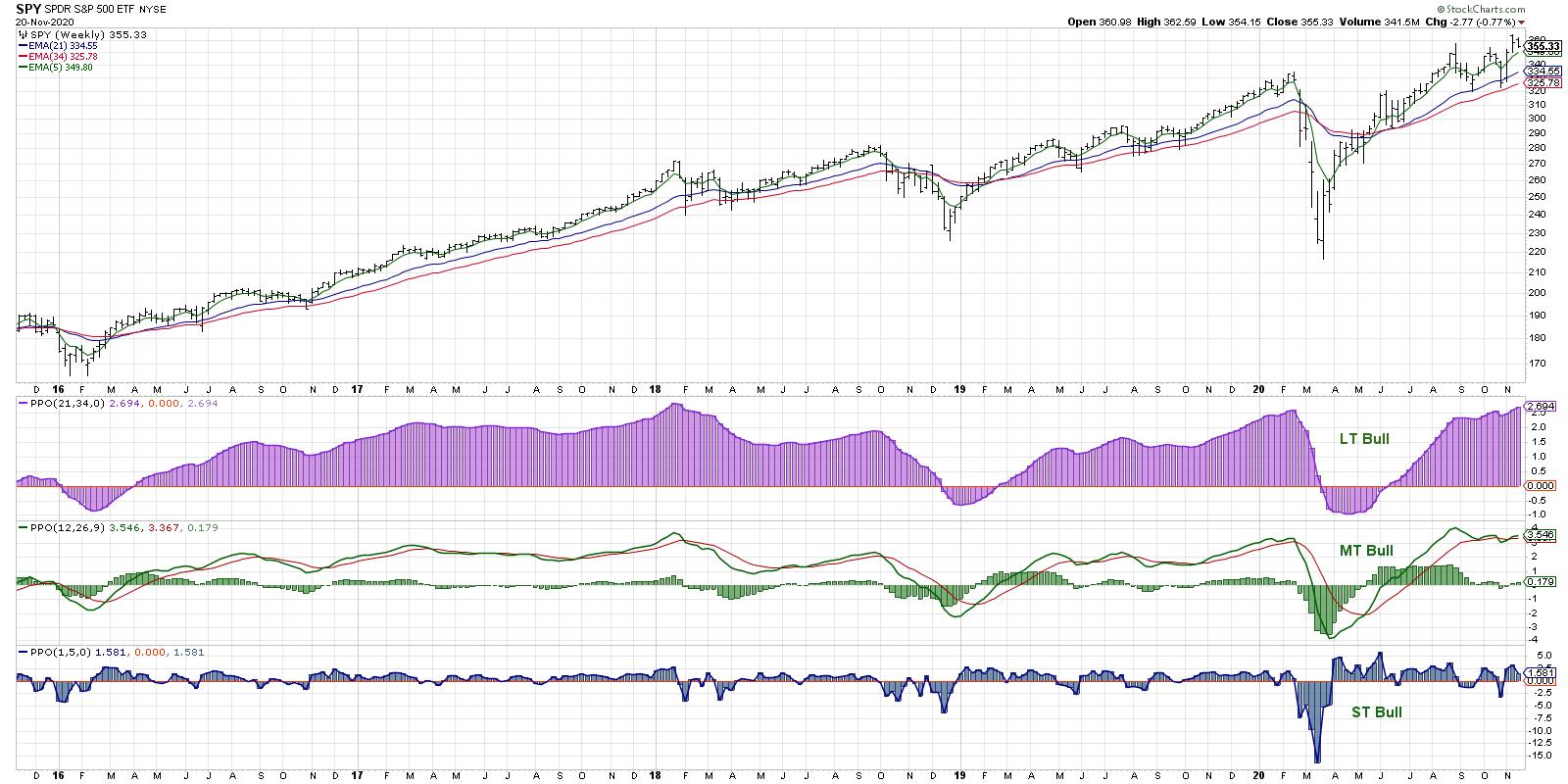

"Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria." - Sir John Templeton My macro process has three key steps: Price, Breadth and Sentiment... Read More

ChartWatchers November 20, 2020 at 08:00 PM

Major stock indexes continue to consolidate their November gains, and remain above recent support levels. Chart 1 shows the Dow Industrials pulling back over the last three days, but remaining above underlying support along their October peak and recent low near 29,000... Read More

ChartWatchers November 20, 2020 at 12:04 PM

When I was preparing for last week's episode of Sector Spotlight and writing an article for the RRG Blog on the Growth/Value Rotation, I had to think back to an article that I wrote for this newsletter back in August... Read More

ChartWatchers November 13, 2020 at 09:00 PM

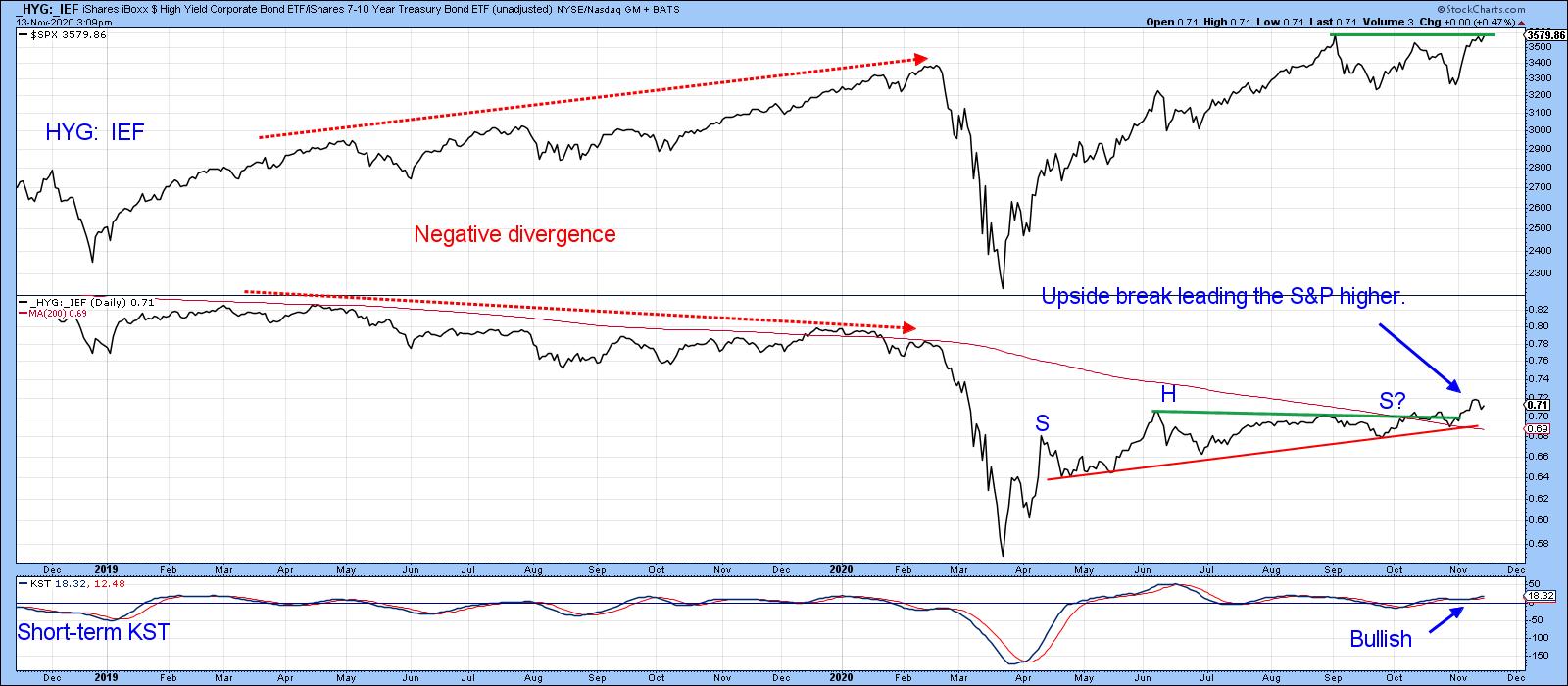

Pfizer (PFE)'s announcement about a vaccine may have triggered a sharp rally on Monday, but its real effect was to boost confidence, which improved the status of a lot of different relationships that I follow, portending further gains for stocks and commodities down the road... Read More

ChartWatchers November 13, 2020 at 07:55 PM

This past week, we saw traders turning their attention away from some of the high-flying "Stay at Home" tech stocks to some other sectors that could fare well if the recently announced COVID vaccines have the promising effect that is hoped for... Read More

ChartWatchers November 13, 2020 at 07:15 PM

Energy was the big winner this week as it gapped up on the open Monday. Since then, price has consolidated somewhat and could be forming a reverse island formation. Looking under the hood at our indicators for XLE, we have quite a few that are very overbought... Read More

ChartWatchers November 13, 2020 at 04:56 PM

Even though the Biotech ETF (IBB) and the Biotech SPDR (XBI) represent the same industry group, their composition is very different and one is clearly outperforming the other... Read More

ChartWatchers November 13, 2020 at 03:29 PM

After the bludgeoning of the travel sector this year, it seems almost remarkable that these names could already be hitting new 52-week highs. It's not just one area, either - there are multiple areas related to travel that are hitting new highs... Read More

ChartWatchers November 06, 2020 at 11:00 PM

The U.S. dollar continues to weaken against both developed and emerging market currencies. Chart 1 shows the Invesco Dollar Bullish Fund (UUP) nearing a test of its yearly low. A drop below that level would put the dollar at the lowest level since early 2018... Read More

ChartWatchers November 06, 2020 at 10:44 PM

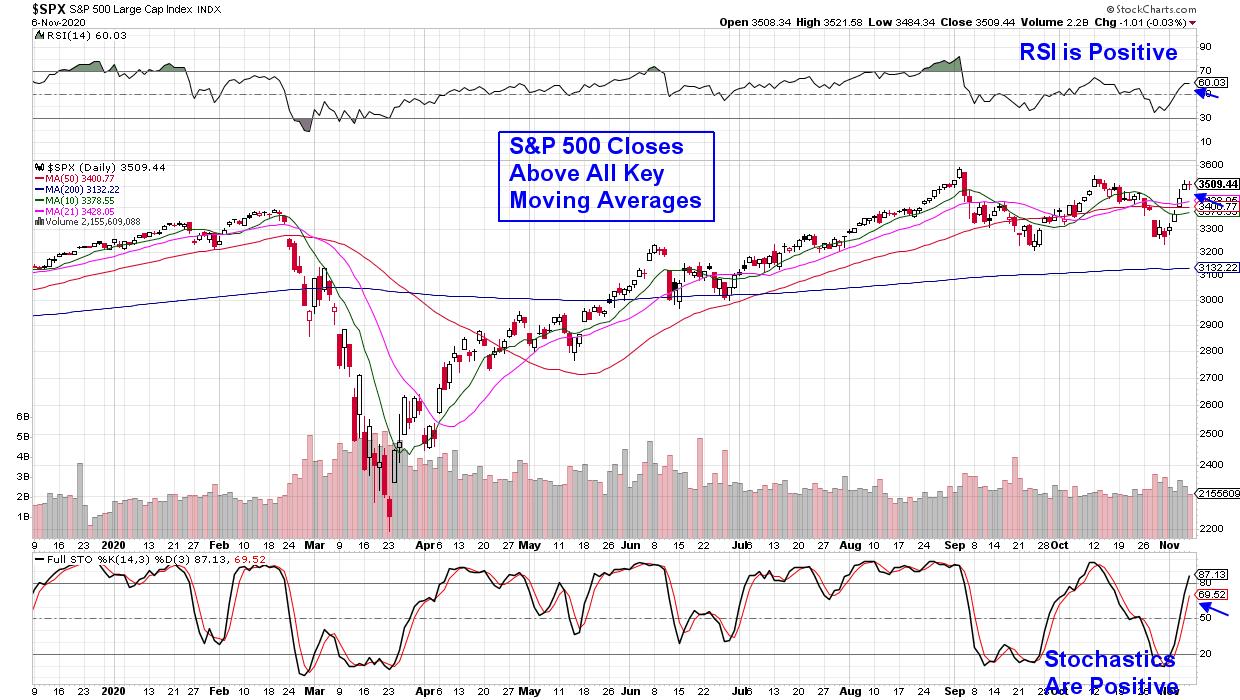

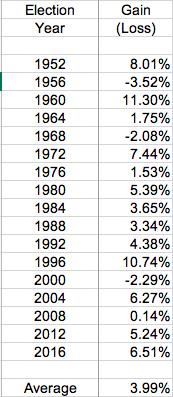

The markets posted their biggest weekly percentage gains since April as investors set their sights on a Biden win with a Republican-dominated U.S. Senate. This creates a gridlock in Washington and, as the CIO of Bank of America (BAC) puts it: "Gridlock = Goldilocks... Read More

ChartWatchers November 06, 2020 at 08:46 PM

Well folks, we're all seeing stars this week. And no, not because of that mind-bending +9.67% gain the Technology sector printed this week (although wowza, what a move)... Read More

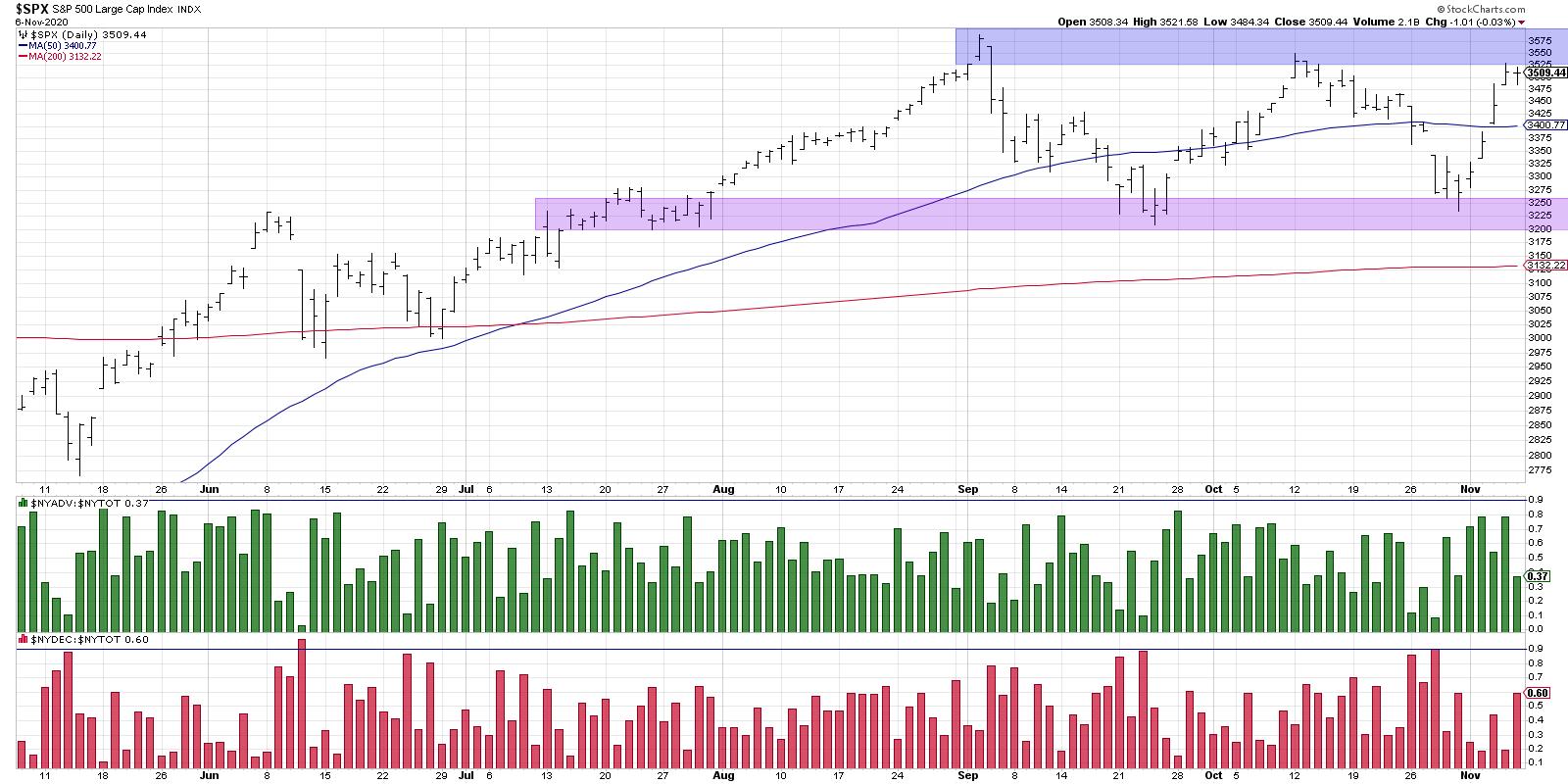

ChartWatchers November 06, 2020 at 08:33 PM

The S&P 500 wrapped a rather volatile week by settling in at the upper end of the 3200-3600 range. One key breadth indicator shows clear similarities to the bull run in early October, and also provides a prescription for bulls looking for validation of further upside... Read More

ChartWatchers November 06, 2020 at 07:52 PM

Every first Tuesday of the month in Sector Spotlight, I go over the completed monthly charts for the prior month... Read More

ChartWatchers November 06, 2020 at 11:51 AM

Let me preface my article by saying that I'm very bullish. I mean, like, extremely bullish. No, really, I'm talking CRAZY bullish... Read More