ChartWatchers July 31, 2020 at 05:04 PM

(Financial) Markets rotate, that's a given. When we look at the stock market, we call it sector rotation, which is probably the most widely-used term. But there is definitely also rotational action going on in other markets or cross assets... Read More

ChartWatchers July 24, 2020 at 11:00 PM

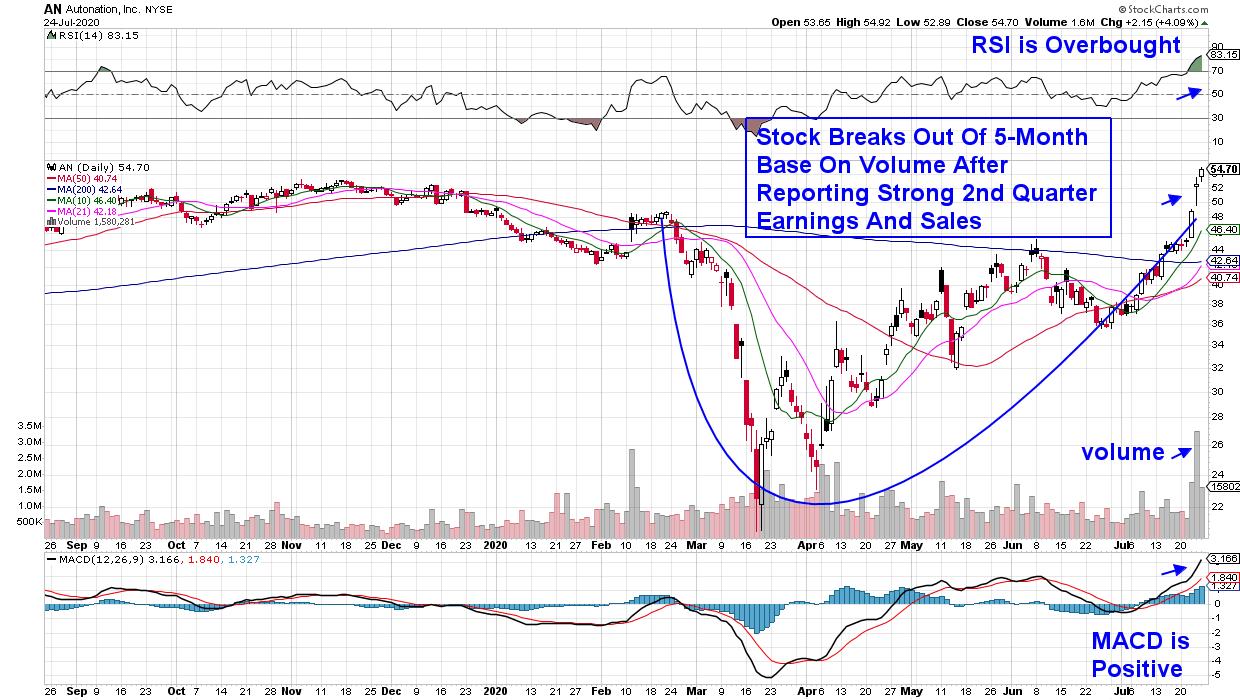

It's been proven that strong earnings are the number one driver of a stock's upward advance and with earnings season under way, there's no better time to vet the next set of stocks poised to trade much higher... Read More

ChartWatchers July 24, 2020 at 08:38 PM

When Tesla (TSLA) reported its earnings last week, they smashed all expectations, both on the top and bottom line. The immediate reaction was mixed, but then we saw the tech sector in general take a hit for a few days in a row, and TSLA did not escape the selling... Read More

ChartWatchers July 24, 2020 at 07:30 PM

A selloff in the biggest tech stocks is putting downside pressure on stocks today; and is helping make the Nasdaq 100 the day's biggest percentage loser. And it looks technically vulnerable to a deeper pullback... Read More

ChartWatchers July 24, 2020 at 05:47 PM

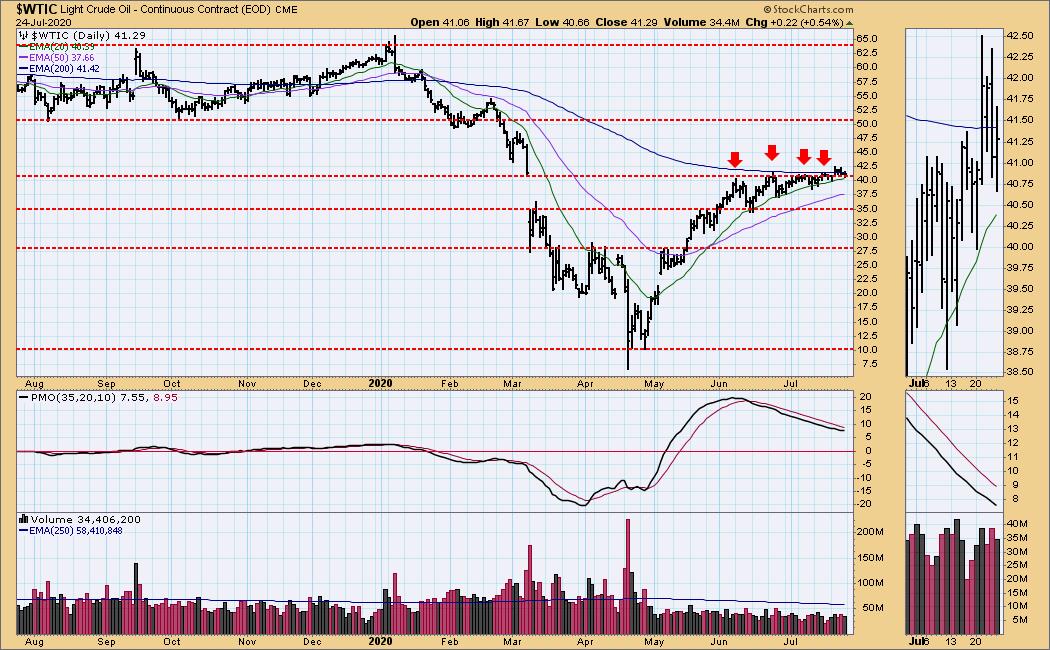

I have been watching the Energy sector closely this week... Read More

ChartWatchers July 24, 2020 at 05:04 PM

QQQ can do little wrong here in 2020, but the ETF is ripe for a corrective period as it becomes the most extended since 1999. Current conditions, while frothy, are not quite the same as they were in 2000 so I do not expect another crash... Read More

ChartWatchers July 24, 2020 at 01:54 PM

The US Dollar has been dropping for a few months now, but this week it accelerated lower on the break of the two-year trend line. I wrote about the dollar in this Canadian Technician article on Thursday, and its position as the global currency is clearly something to watch... Read More

ChartWatchers July 17, 2020 at 09:30 PM

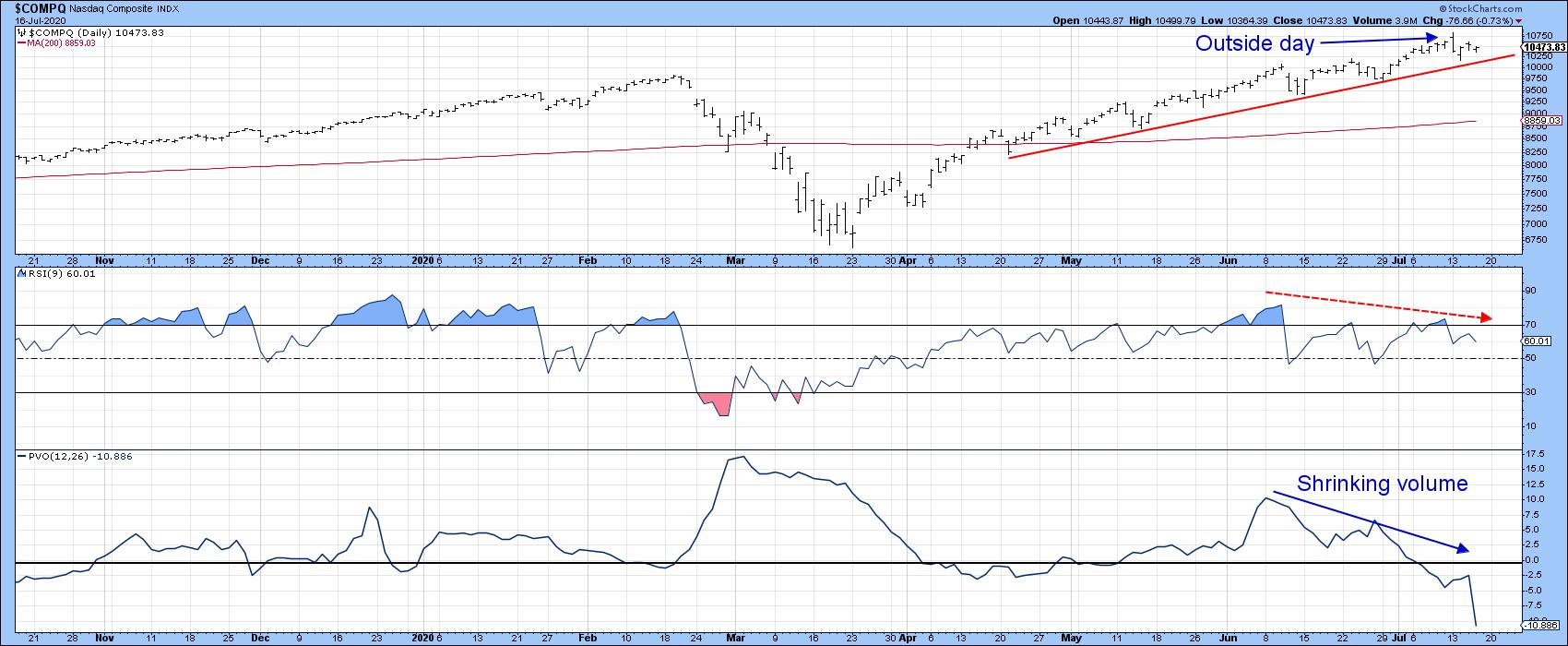

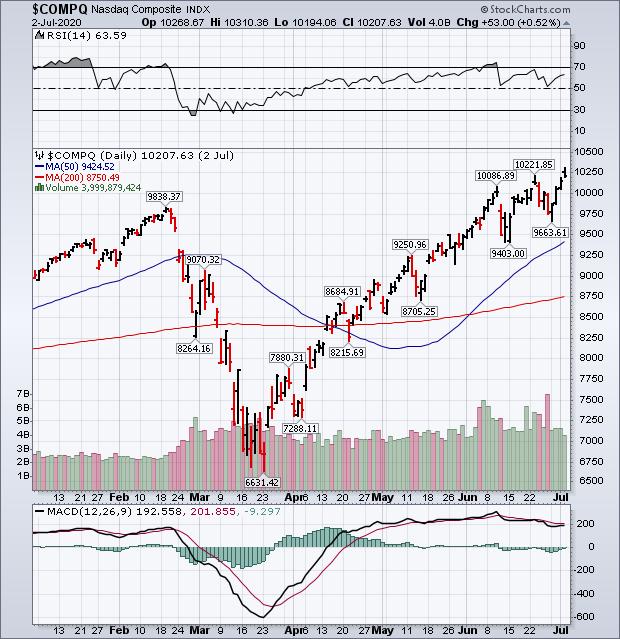

Technology About to Pause? The undisputed king of sectors so far this year has been technology. This week's price action from the tech dominated NASDAQ Composite ($COMPQ), though, suggests that this leadership may be rotating elsewhere... Read More

ChartWatchers July 17, 2020 at 08:21 PM

I've been patiently waiting for the BIG breakout, the one that really kickstarts this group. I believe we just saw it on Friday. Health Care (XLV) definitively made its move after already recently providing some very bullish clues... Read More

ChartWatchers July 17, 2020 at 06:22 PM

There were a number of Bollinger Band squeeze plays over the last two weeks and also a number of breakouts. These breakouts are bullish until proven otherwise, but chartists should also be aware of the head fake... Read More

ChartWatchers July 17, 2020 at 06:18 PM

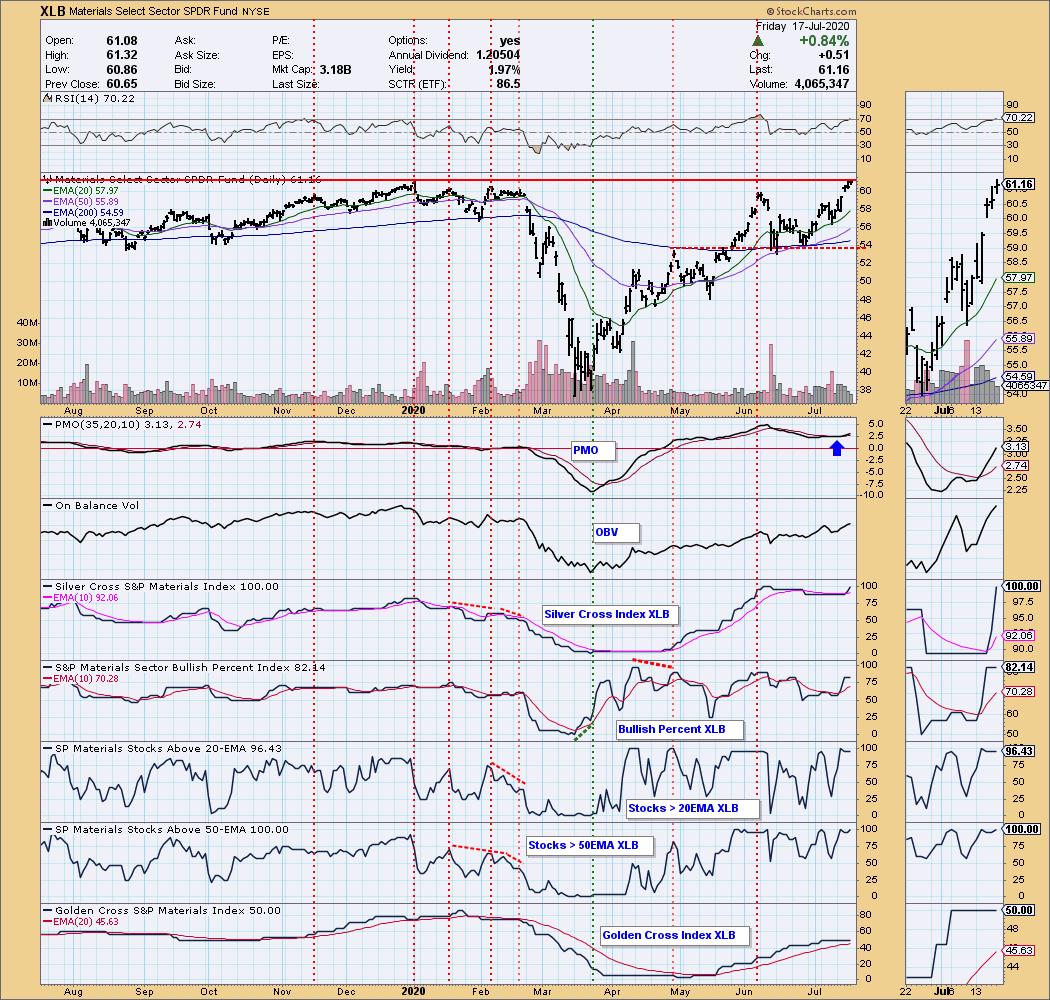

As part of my preparation of the "DecisionPoint Diamonds Report", I seek areas that are showing leadership, and the Materials sector has been doing just that. Materials was up 5.47% on the week, which was only second to Industrials at 5.87%... Read More

ChartWatchers July 17, 2020 at 03:37 PM

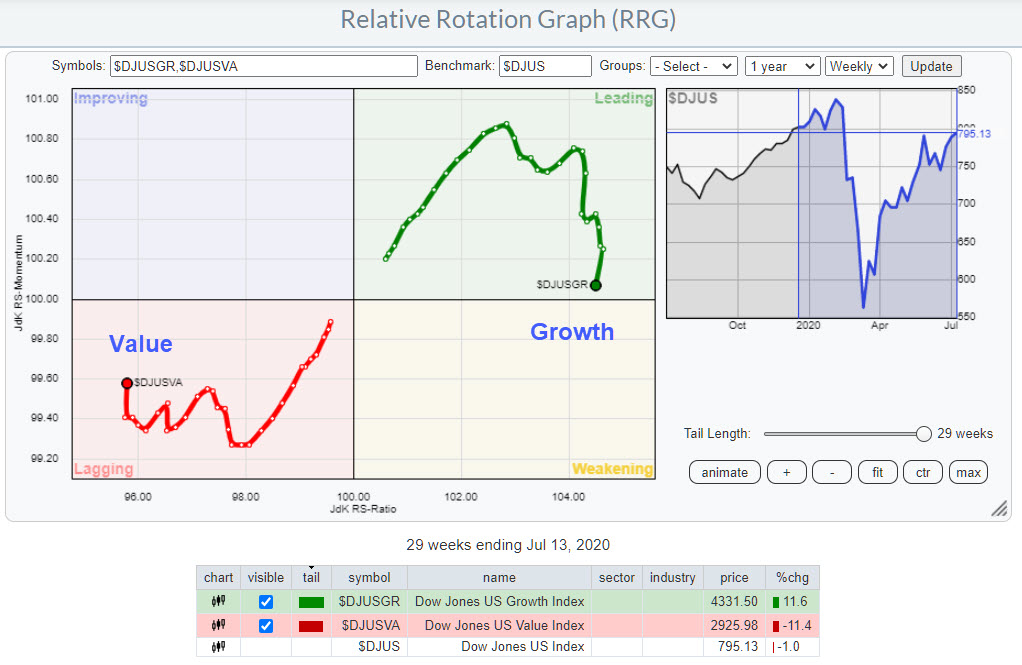

The last time Value took over from Growth was at the end of 2018, and even that was only for a short period going into and following the Christmas Crash. But that situation rapidly reversed a few weeks into 2019, when the uptrend in the Growth-Value ratio continued strongly... Read More

ChartWatchers July 10, 2020 at 11:00 PM

Recent messages showing the ongoing bull market in gold (and its miners) have stressed that a weaker dollar and historically low global interest rates have pushed the price of gold to the highest level in nearly nine years... Read More

ChartWatchers July 10, 2020 at 08:16 PM

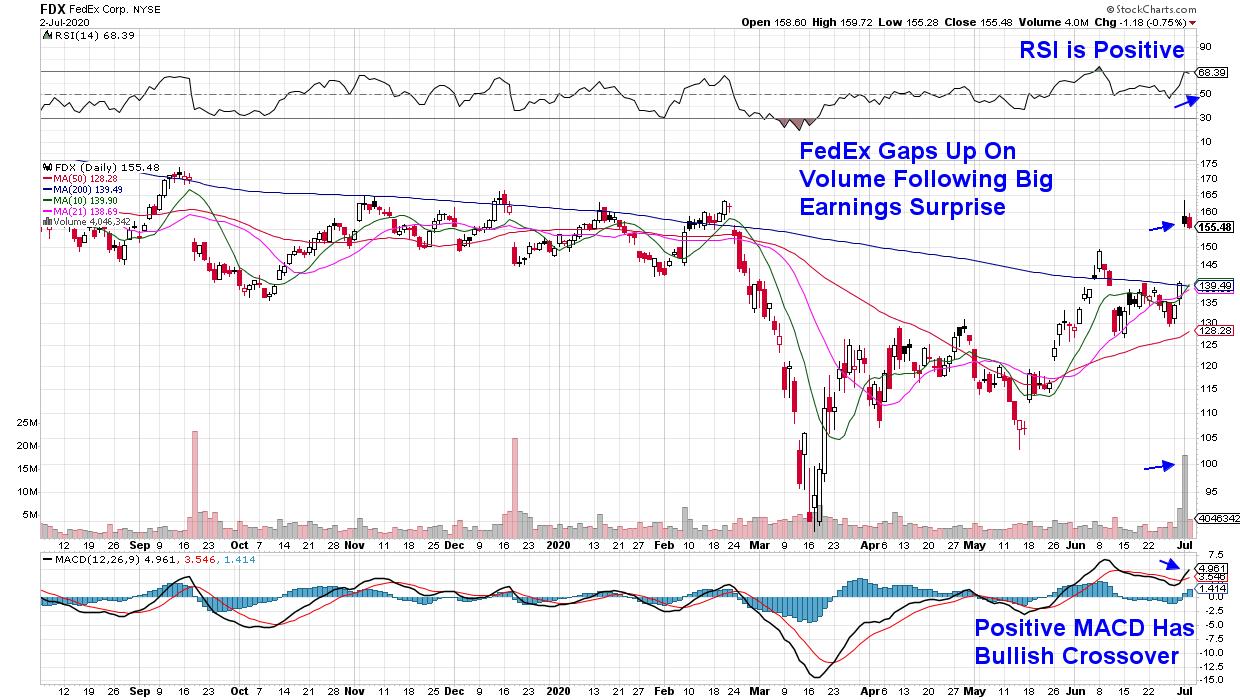

Let me start right off the bat looking at two companies that reported earnings over the past week or so: FedEx (FDX) and Bed, Bath and Beyond (BBBY). When FDX reported its numbers on July 1, the stock skyrocketed by 16%... Read More

ChartWatchers July 10, 2020 at 03:00 PM

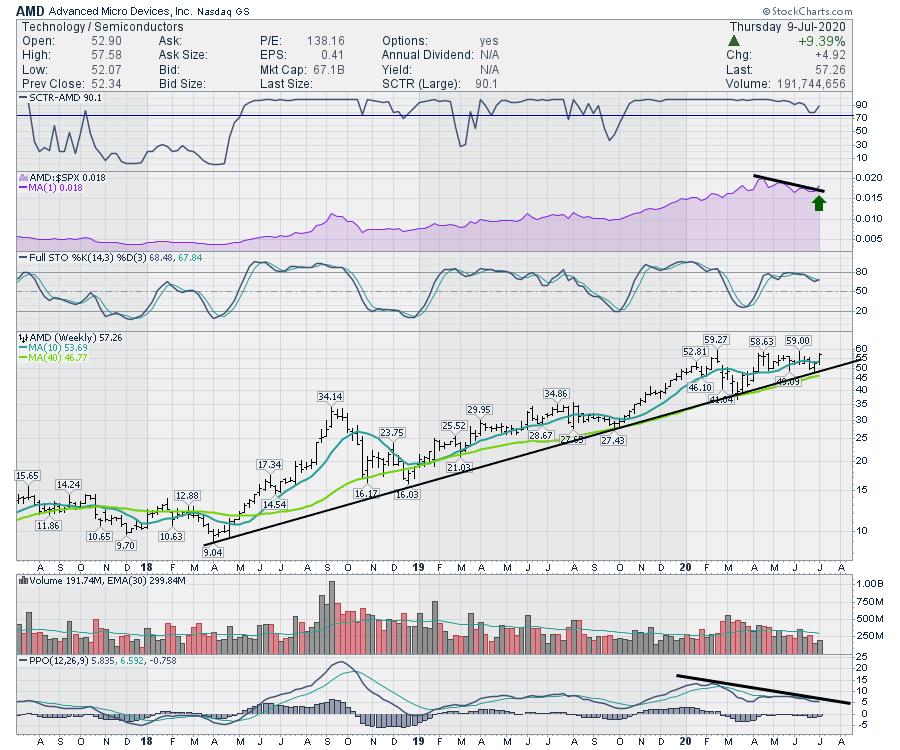

As the technology names pull away from the rest of the market, July has more semiconductor names set up to break out to new 52-week highs... Read More

ChartWatchers July 10, 2020 at 02:52 PM

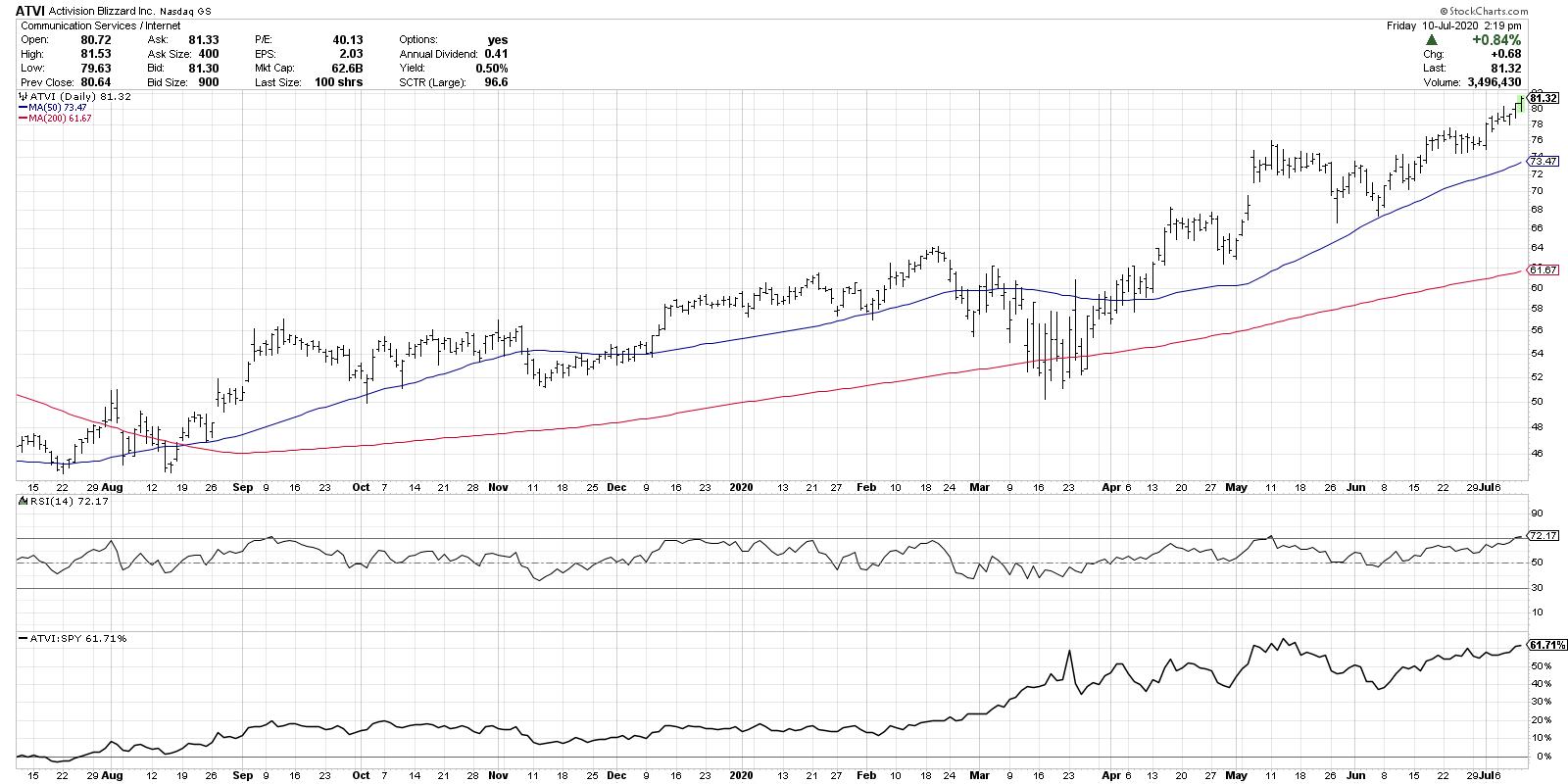

I've received many questions recently on stocks experiencing overbought conditions, from stocks like Activision Blizzard (ATVI), which recently broke above RSI 70, to Amazon (AMZN), which has an RSI that has breached 80... Read More

ChartWatchers July 10, 2020 at 10:38 AM

3 years, 3 months and 29 days. That's how long I've been waiting to write this article. Seriously – I took the time to go back through my notes and calendars to confirm it, right down to the day... Read More

ChartWatchers July 03, 2020 at 11:00 PM

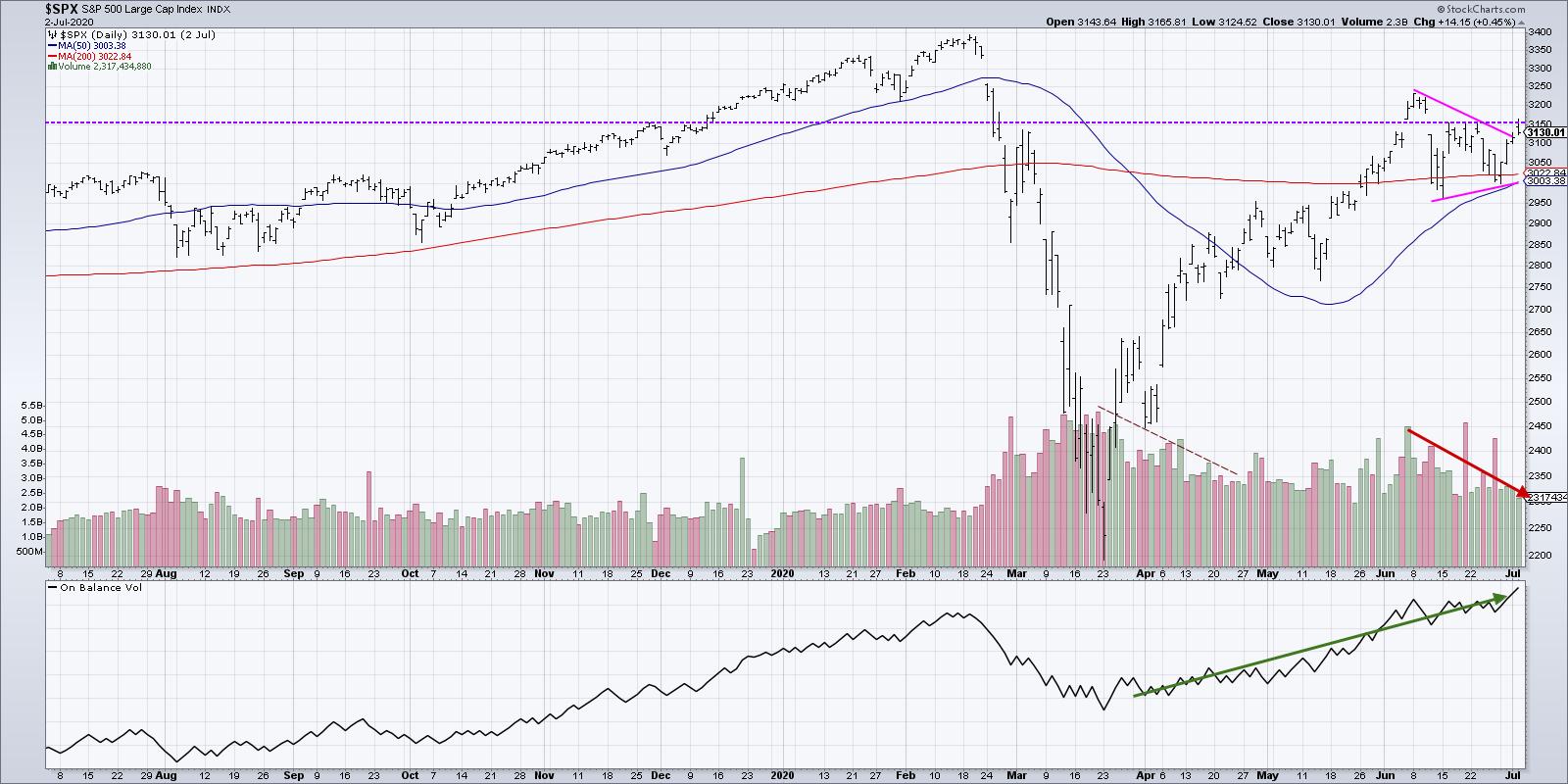

Despite gaining ground this past week, little has changed for the market's major stock indexes. Continued buying of technology growth stocks pushed the Nasdaq Composite to a new record (Chart 1). The rest of the market, however, continued to lag behind... Read More

ChartWatchers July 03, 2020 at 06:08 PM

The S&P 500 index has remained in consolidation mode, spending the shortened holiday week in a rally back to the upper end of the recent trading range... Read More

ChartWatchers July 03, 2020 at 04:51 PM

One of the ratios that a lot of market watchers and commentators look at is the relationship between Consumer Staples and Consumer Discretionary stocks... Read More

ChartWatchers July 03, 2020 at 02:00 PM

We may have gotten an encouraging preview to earnings season for select areas of the economy this week after global air-freight carrier FedEx Corp. (FDX) posted earnings that were well ahead of analyst's estimates... Read More

ChartWatchers July 03, 2020 at 11:13 AM

Fear is an almost uncontrollable emotion. And when you combine that with financial anxiety, it typically results in predictable fashion - a "throw the baby out with the bath water" selling event. But the good news is that, once the masses grow fearful enough, stock markets rally... Read More