Banks in the USA have been hit, but nearly as hard as the rest of the world. While JPM broke a four-year trend line this week, WFC bounced down to six-year lows.

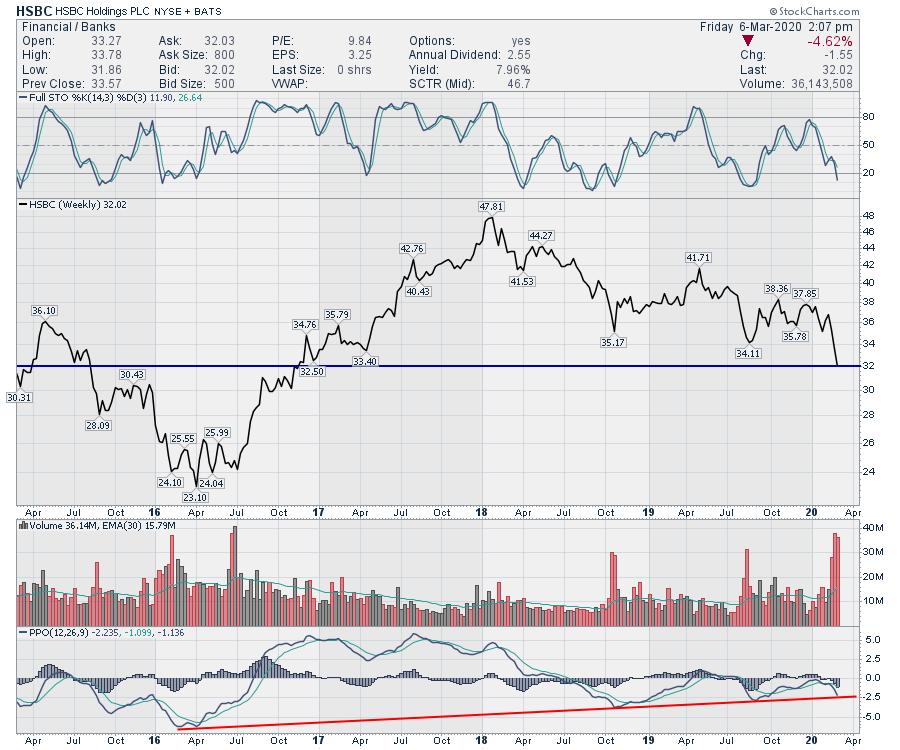

Europe looks dismal. Let's look at HSBC. It is hard to get excited when this chart has been trending down for two years but holding the $34-$35 lows. Now, the lows are just drive-through levels. Woosh!

Deutsche Bank (DB) and Commerzbank (CRZBY) both look rough. Commerzbank looks a little worse than DB, but neither are selling hope.

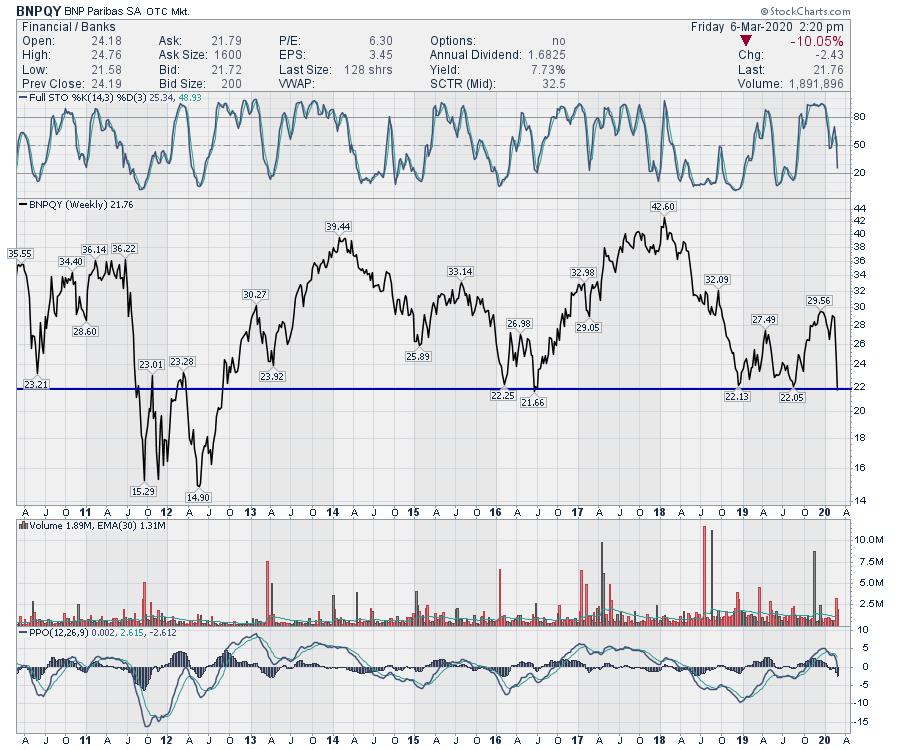

The French bankers are not faring well either. I think the best chart is the BNP Paribas chart (BNPQY).

Looking over to Australia, the same movie is playing out. It is not a positive when banks are underperforming. I don't expect the problem to start in America. For Bear Stearns, it was only a few days before the bankruptcy. Are we going to watch one of these charts just drop next week and never recover?

It is a vicious slowdown, but these banks have been ill for a while. The real question is, can they get any mojo or do they all start to spiral?

Be cautious.

Good trading,

Greg Schnell, CMT, MFTA

Senior Technical Analyst, StockCharts.com

Author, Stock Charts For Dummies

Want to stay on top of the market's latest intermarket signals?

– Follow @SchnellInvestor on Twitter

– Connect with Greg on LinkedIn

– Subscribe to The Canadian Technician

– Email at info@gregschnell.com