ChartWatchers January 31, 2020 at 06:57 PM

With stock markets in rapid decline this week, mindful investors should be looking around for opportunities... Read More

ChartWatchers January 31, 2020 at 06:00 PM

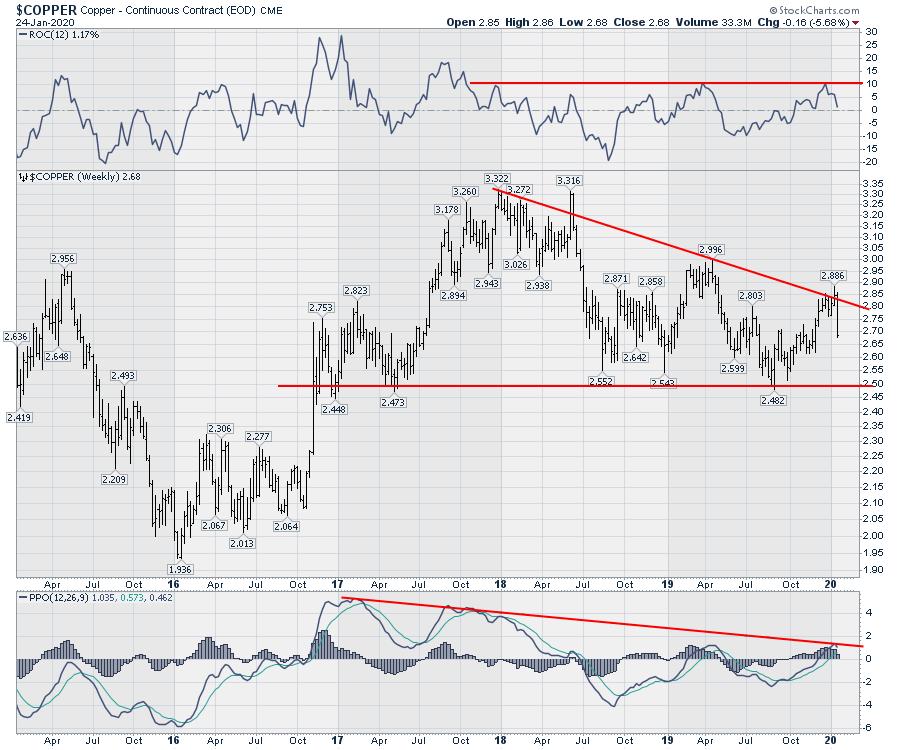

The stock market was roughed up by the coronavirus earlier in the week, but, under the surface, another battle has been going on -- the one between inflation and deflation, that is, as both yields and commodity prices have run up against key support levels... Read More

ChartWatchers January 31, 2020 at 04:26 PM

AMZN reported earnings yesterday. Wondering how I know that? You probably think it's because my Twitter feed was blowing up or some notification came across my screen after the close. But here's the real answer..... Read More

ChartWatchers January 31, 2020 at 04:20 PM

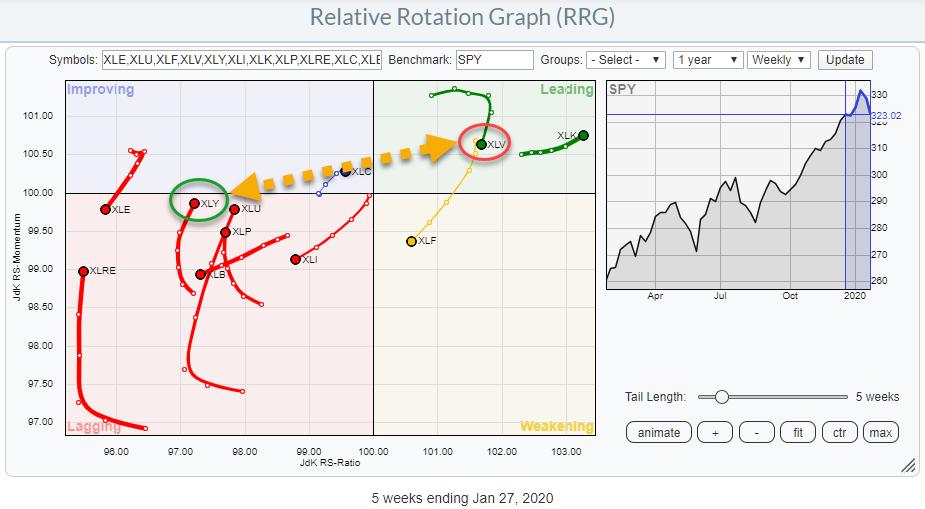

The Relative Rotation Graph above shows the weekly rotation for US sectors against SPY (S&P 500). While the S&P 500 chart is deteriorating and seems to be going into a correction, there are two tails on the RRG that suggest an interesting trade setup... Read More

ChartWatchers January 24, 2020 at 08:46 PM

Gold Miners have been on fire this week! Each Friday, I get a Weekly ChartList Report on the ETF Tracker ChartList that Carl and I have developed. If you would like it, you'll find it in the DP Trend and Condition ChartPack (free to Extra members and above!)... Read More

ChartWatchers January 24, 2020 at 06:44 PM

Yesterday's message showed bond yields falling (and bond prices rising) in a flight to the safety of government bonds. And further suggested that fears of the Chinese virus spreading was most likely behind that more defensive tone... Read More

ChartWatchers January 24, 2020 at 05:38 PM

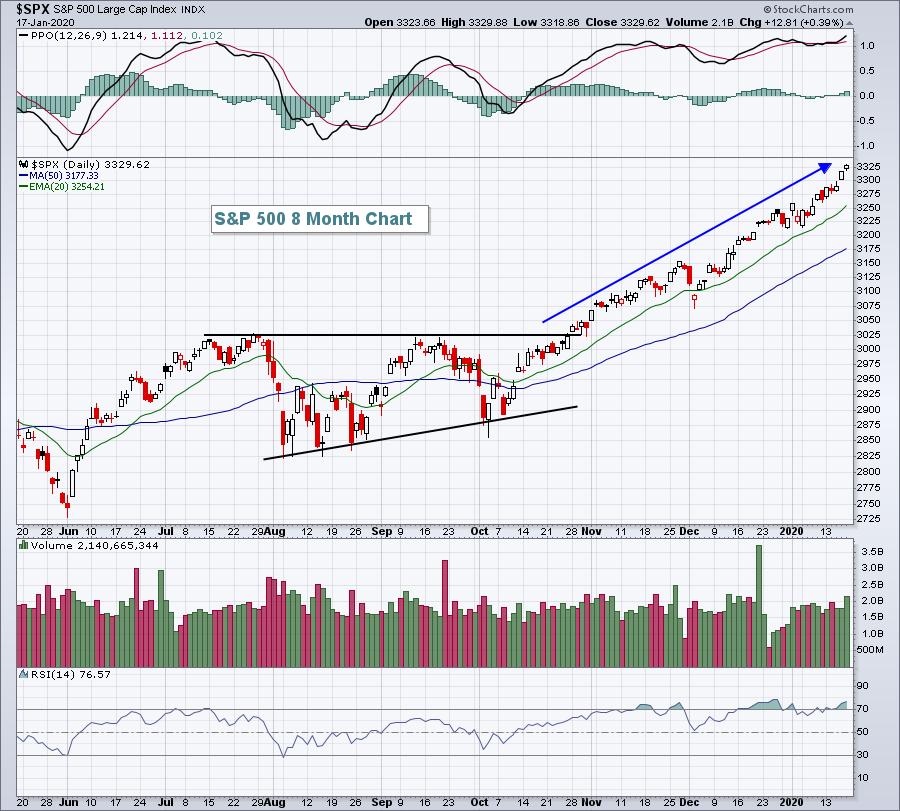

It's no secret that the market has reached frothy levels with virtually no relief since the beginning of October 2019. Thus, it makes sense that the VIX spiked on Friday, as it moved above all key technical intraday levels and many traders moved to the sidelines... Read More

ChartWatchers January 24, 2020 at 05:00 PM

One of the bigger themes this year has been the belief that a global pick-up in growth is underway. The USA/China tariff tennis slowed growth in commodities worldwide. The industrial metals index topped out in January 2018 as the tariffs roiled the markets... Read More

ChartWatchers January 24, 2020 at 04:39 PM

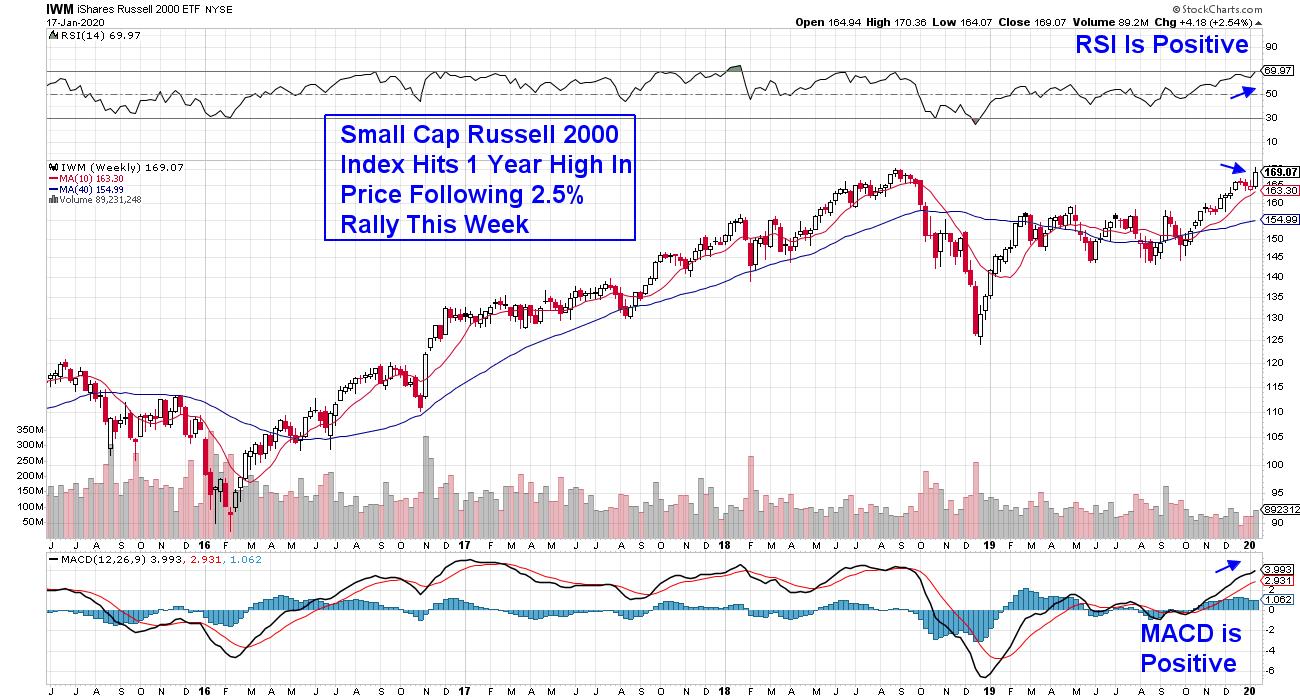

The Russell 2000 ETF (IWM) broke out of a pennant formation last week and then fell sharply this week. This puts price back in the pennant and near its make or break level. Flags and pennants are short-term continuation patterns that form after a sharp move... Read More

ChartWatchers January 18, 2020 at 12:00 AM

Last week, small-cap stocks were the highest performers, with the Russell 2000 gaining 2.5%... Read More

ChartWatchers January 17, 2020 at 09:58 PM

Calling tops in a secular bull market advance is not typically a wise thing to do, because it rarely works. But it's very difficult to ignore sentiment readings that border on the absurd... Read More

ChartWatchers January 17, 2020 at 07:24 PM

The Dollar Index has been rising in the last few sessions following its December decline, which has put it at a crucial technical juncture. Whichever way it breaks will have implications for commodities, gold and the relative performance of international equities to the US... Read More

ChartWatchers January 17, 2020 at 07:13 PM

While sectors like Technology of received much of the praise for leading the recent market upswing, the Health Care sector is comprised of a group of five industries that all have fairly attractive chart setups... Read More

ChartWatchers January 17, 2020 at 01:58 PM

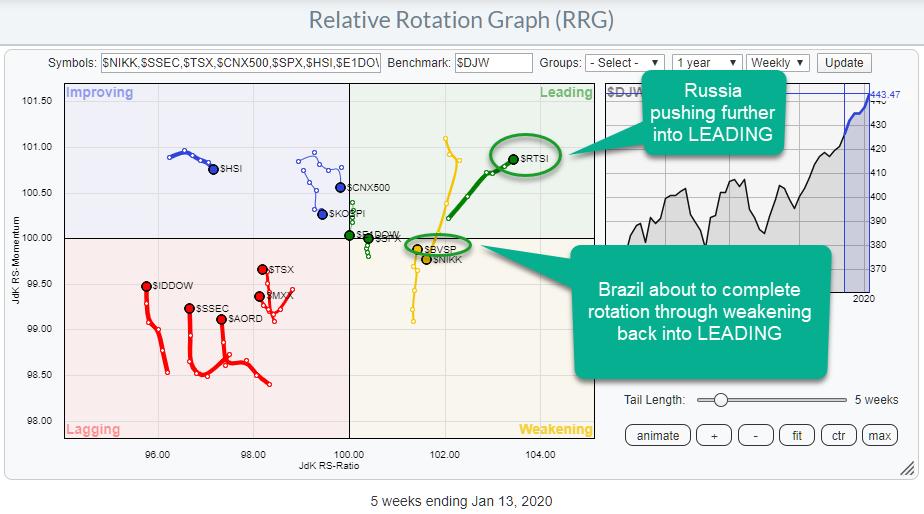

In my last article for the RRG blog, I wrote about the process of how to get from an idea, whether based on RRG analysis or something else, to a position in your portfolio... Read More

ChartWatchers January 10, 2020 at 08:55 PM

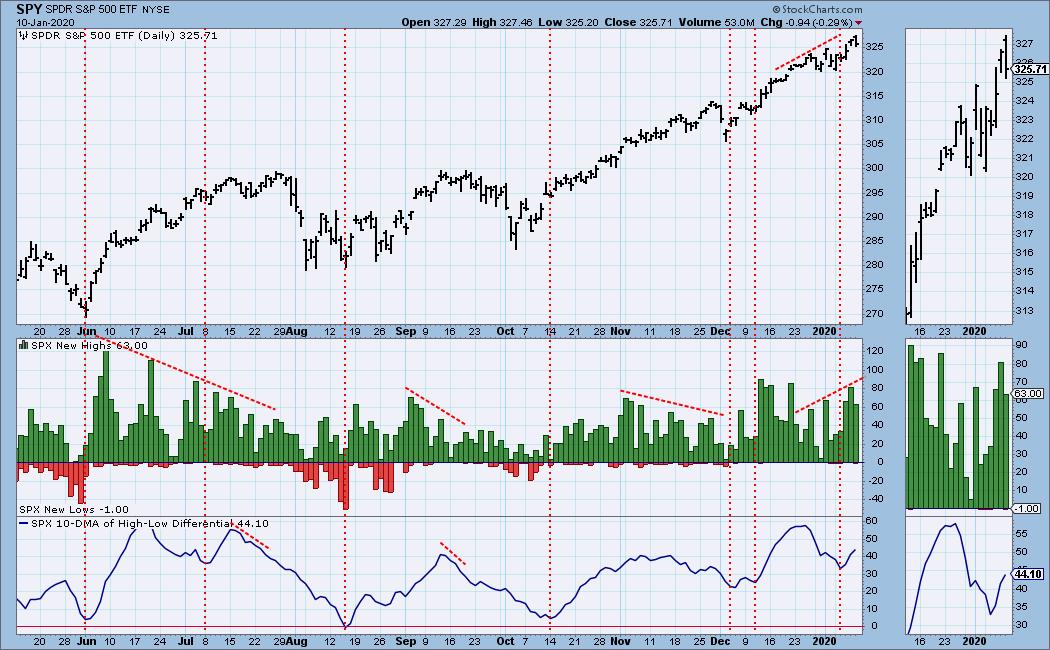

This is an excerpt from yesterday's DecisionPoint Alert [with updated comments & charts]. If you'd like to subscribe to DecisionPoint... Read More

ChartWatchers January 10, 2020 at 07:42 PM

Most of the talking heads on TV have gone out of their way to indicate that analysts have lowered their expectations for Q4 earnings... Read More

ChartWatchers January 10, 2020 at 06:51 PM

After several tense days, some calm is being restored to global markets... Read More

ChartWatchers January 10, 2020 at 06:09 PM

Ten of the eleven sector SPDRs are positive over the last three months. The Real Estate SPDR (XLRE) is the only sector sporting a loss (~.75%), but I am not concerned with relative weakness because the price chart looks bullish overall... Read More

ChartWatchers January 10, 2020 at 01:32 PM

It has been a 10-year parade of improving jobs numbers; naturally, December was no different. There was lots of rhetoric about one level vs. the other, but overall it was hardly a worrisome report. Canada improved this month, but last month was the worst jobs report since 2009... Read More

ChartWatchers January 03, 2020 at 08:56 PM

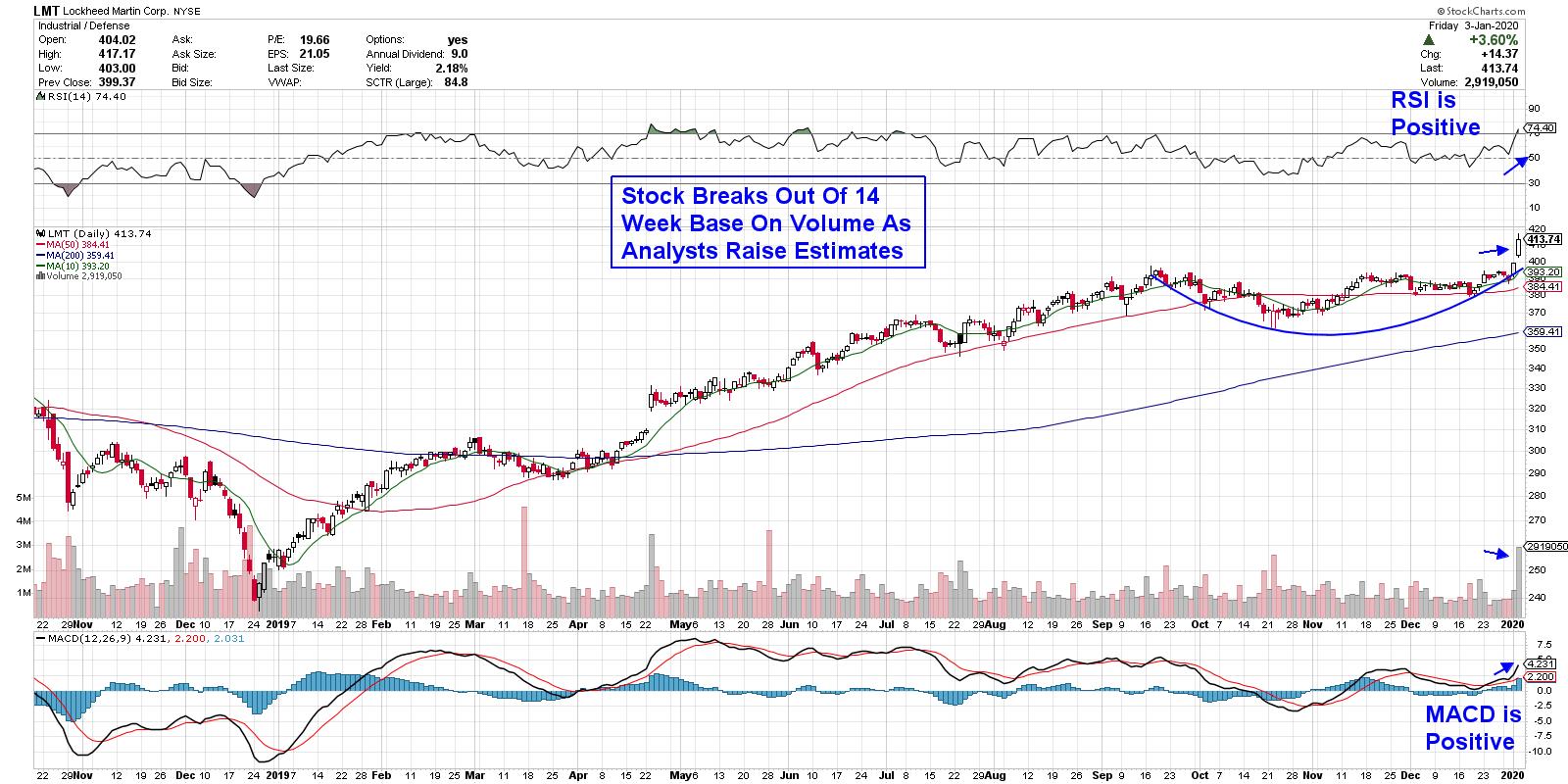

Defense companies had a strong rally this week after a U.S. airstrike in Iraq killed a key Iranian military leader... Read More

ChartWatchers January 03, 2020 at 07:43 PM

The final chart that I shared in my portion of the StockCharts 2020 Market Outlook (coming soon to our YouTube channel!) was a two-year chart of gold. After a pullback in the fall to Fibonacci support, gold appeared to be resuming its long-term uptrend... Read More

ChartWatchers January 03, 2020 at 06:00 PM

Thursday's price action in China resulted in a powerful signal that Chinese equities are headed significantly higher. That should be bullish not only for China but for the world as a whole... Read More

ChartWatchers January 03, 2020 at 02:40 PM

Happy New Year and welcome to a brand new decade! A century later, I believe the stock market is about to repeat itself as I'm expecting another roaring 20's! And yes, that could lead to another rough 30's decade, but let's worry about that later. One step at a time here... Read More

ChartWatchers January 03, 2020 at 02:10 PM

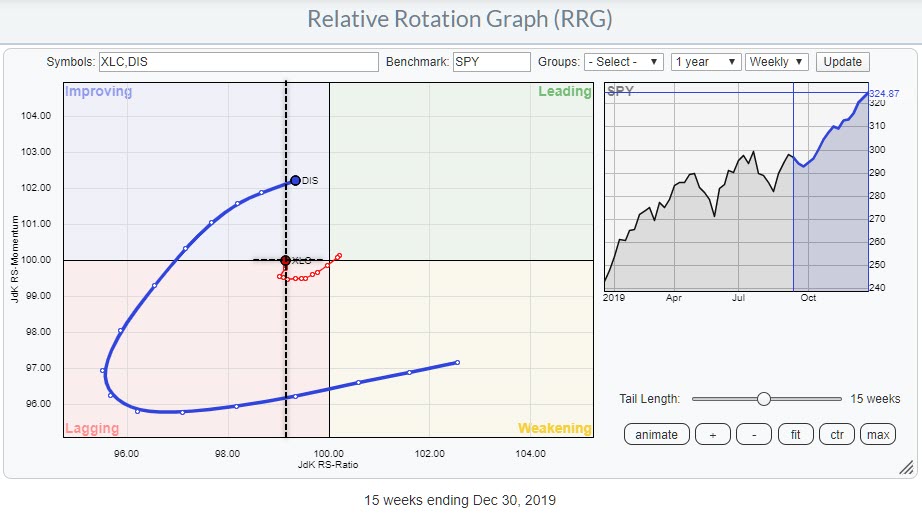

XLC, the Communication Services Sector, is sending some mixed signals. On the price chart, XLC convincingly cleared resistance at $51 in November, when it pushed above the horizontal boundary that ran over the highs (four in total) of 2018 and 2019... Read More