Editor's Note: This article was originally published in Martin Pring's Market Roundup on Tuesday, July 16th at 1:24pm ET.

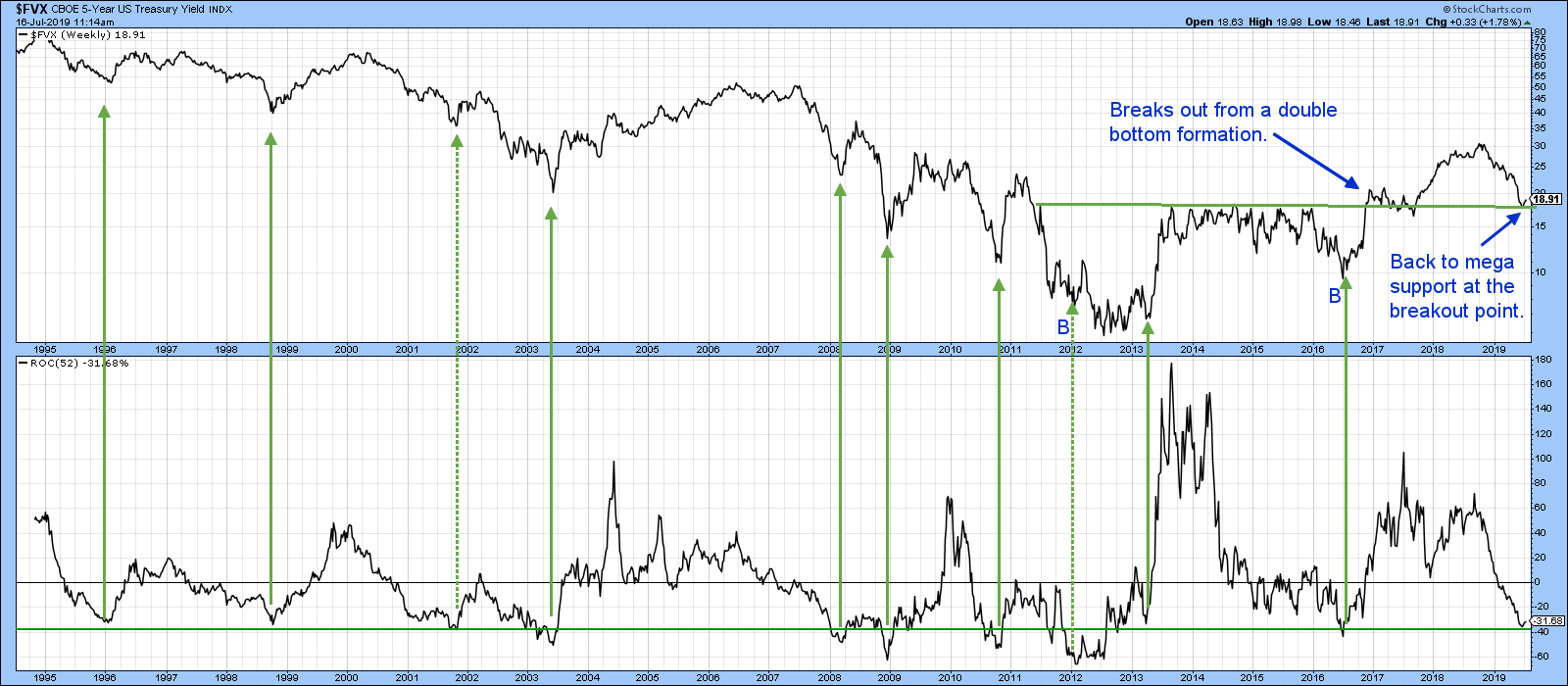

When we get to longer-dated securities, that's where I start to question if yields are likely to move much lower. Let’s start with the 5-year series, as shown in Chart 2. The red and green lines approximate primary trend movements. The main thing to note here is that the series of declining peaks and troughs, which had been in force since at least the 1990s, was reversed in 2017. This happened at around the same time the yield was crossing back above its 96-month (8-year) MA. At the time, this signaled to me that the secular downtrend for the 5-year yield had reversed to an upward one. During that very long-term yield decline, it was primary bear markets that experienced greater magnitude and duration, whereas bull markets in yields were more truncated. Now, that characterization ought to be reversed, as bear markets should be more limited in scope - hence the probability that the recent decline may have run its course. One currently negative indicator is the long-term KST. Assuming that my conclusion of a secular reversal is correct, we may well see it bottom out at a higher level than it did when the during the course of the secular bear.

Chart 2

Chart 2

Chart 3 argues that this is likely to be the case. The chart shows the history going back to 1995, where you can see that most upside reversals from the oversold -40% line for the 52-week ROC have resulted in rallies. Those that did not have been tagged with the dashed arrows. There aren’t very many of those. Last week, the ROC bounced from that oversold reading again, but not yet strongly enough to conclude that it represents the eleventh buy signal in the last 25 years.

Chart 3

Chart 3

Two factors suggest that this action will become more decisive. Firstly, the yield itself has fallen to very significant support in the area of the extended green breakout trend line. That line turned back numerous rallies prior to the upside breakout. Now, it should reverse that strong resistance role as equally formidable support.

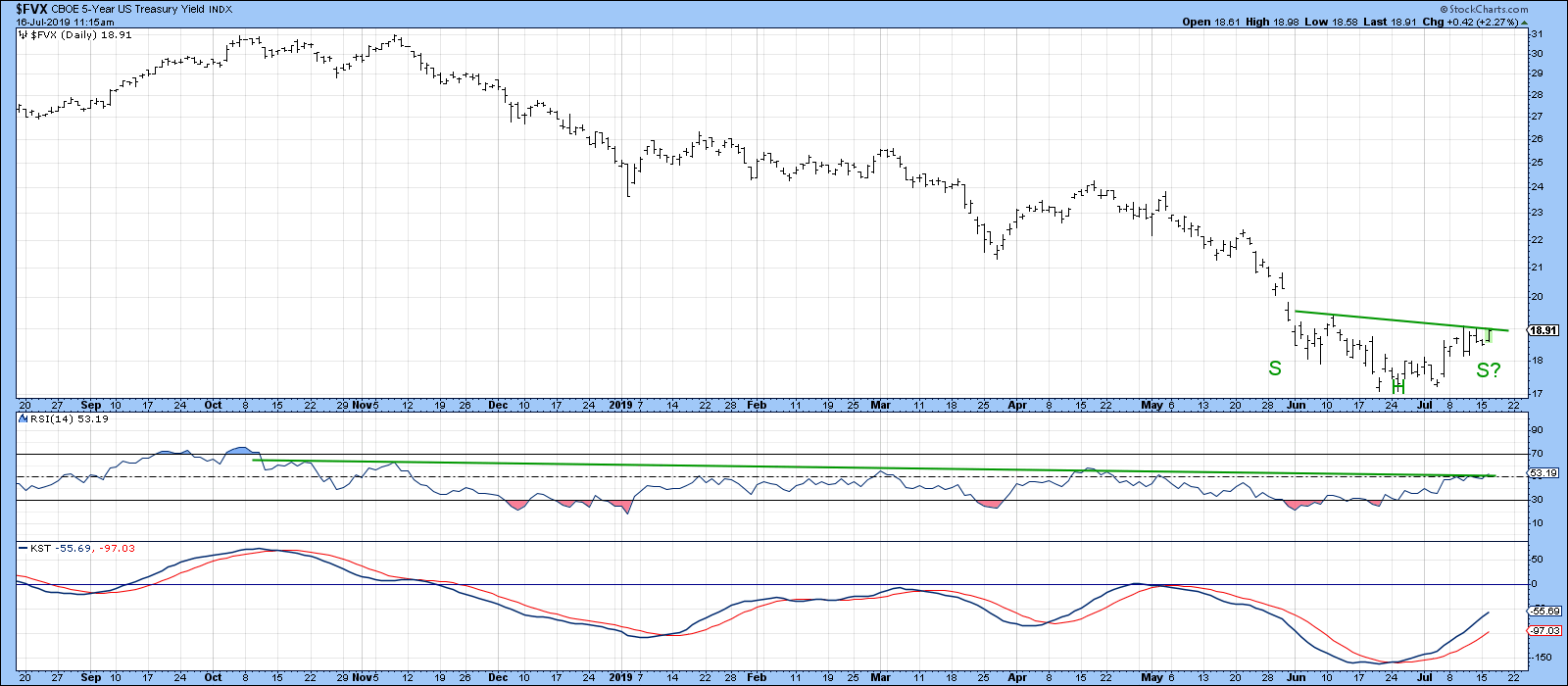

Second, Chart 4 tells us that the short-term KST is in a bullish mode and is by no means overextended. The RSI is in an overall downward trend, as it has been confined below its 2018-19 downtrend line. This could soon change, as the yield itself looks as if it is in the process of forming an inverse head-and-shoulders pattern. Until it breaks and holds decisively above the 1.9%, however, it’s still a potential and not an actual formation. If completed, though, it would certainly result in an RSI trend line break, thereby signifying that the yield rally had legs.

Chart 4

Chart 4

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates.