As always, next week's Fed meeting will be closely watched, with chartists in particular watching it uniquely. On the chart below, the blue lines represent Federal Reserve meeting dates. Friday marked a test of the 2823 level on the $SPX. The brown line at 2823 was the closing level on the first Fed meeting of Jay Powell's role as head of the Fed. It's déjà vu all over again as we closed at 2822.48!

The green line has marked an important resistance level for the index, with the $SPX having tested and rejected that level multiple times over the past year. Friday's close above that level puts the highs of 2940 in sight.

The Fed has been trying to soothe the equity market ever since the December meeting caused a downdraft over the following week. The January meeting was cheered and the market subsequently roared higher.

The Fed has been trying to soothe the equity market ever since the December meeting caused a downdraft over the following week. The January meeting was cheered and the market subsequently roared higher.

The Federal Reserve causes swings in the US Dollar as well. Not all meetings cause a change in direction, but the real question (for now) is whether the Dollar breaks out to new highs. New highs on the Dollar would also be significant as the Dollar has traded between 93.5 and 97.5 for 10 months. Although the new March high on the Dollar only lasted a day, I expect a higher Dollar to be a head wind for the stock market. The Dollar made its low when Jerome Powell started his chairman role. The $SPX sits at the same level as we were on that day, while the Dollar appears to be part of the resistance for US stocks.

The weak trend in the bond market yield curve is weighing on the market as well. Friday saw a little bounce up, but the yield is still near the lowest weekly closing levels in over a year. One encouraging sign is that the 30-year in black at the top looks like it is trying to make a higher low here.

When we compare the 10-year yield (lower panel below) to the Fed meeting dates, it's no surprise that the Fed inflicts changes on the chart. The real question for the bond market is will the Fed meeting start to raise rates? Currently, there is no appetite for that, but the chart seems to be ready for some upside move.

When we compare the 10-year yield (lower panel below) to the Fed meeting dates, it's no surprise that the Fed inflicts changes on the chart. The real question for the bond market is will the Fed meeting start to raise rates? Currently, there is no appetite for that, but the chart seems to be ready for some upside move.

The bottom line is that the equity markets, the currency markets and the bond market are all watching the outcome of the FOMC meeting intently. Will the stock market break out to new highs? Will the Dollar break out to new highs? Will the bond market yields break down to new lows? Stay tuned next week as there will be a lot of implications from this particular Fed meeting. It is not often that all three aforementioned markets are near 52-week extremes heading into the meeting.

The bottom line is that the equity markets, the currency markets and the bond market are all watching the outcome of the FOMC meeting intently. Will the stock market break out to new highs? Will the Dollar break out to new highs? Will the bond market yields break down to new lows? Stay tuned next week as there will be a lot of implications from this particular Fed meeting. It is not often that all three aforementioned markets are near 52-week extremes heading into the meeting.

Below is some information on other videos produced this week.

Here is a link to this week's Weekly Market Roundup video, with a lot more information on the transports and the industrials.

Wednesday's Market Buzz talked about the bank stocks. Click on the Market Buzz below to watch.

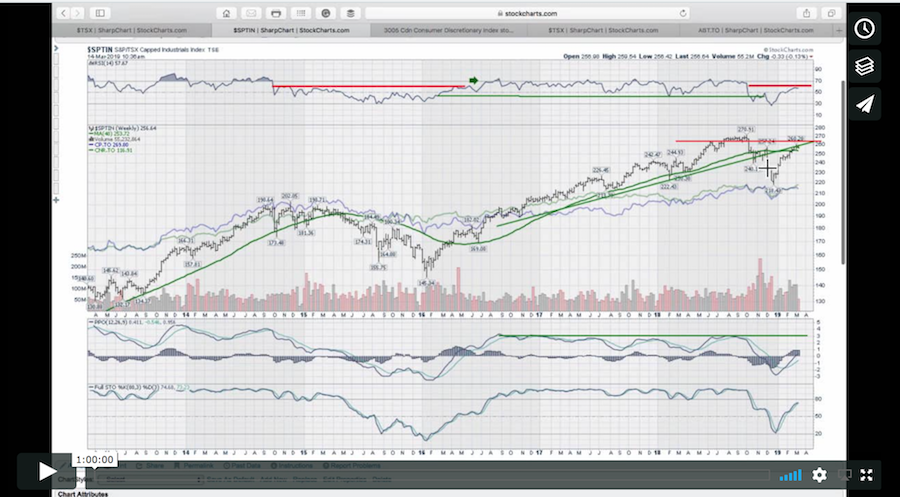

Here is the the Canadian Market Roundup for mid-March.

Here is the the Canadian Market Roundup for mid-March.

If you would like to learn more about the basics of charting, check out Stock Charts for Dummies. The first section of the book walks through all the chart settings you need to help you get the charts you want, the second section explores why you might use charts for investing and the third section is about putting it all together.

Click here to buy your copy of Stock Charts For Dummies today!

If you are missing intermarket signals in the market, follow me on Twitter and check out my Vimeo Channel. Bookmark it for easy access!

Good trading,

Greg Schnell, CMT, MFTA

Senior Technical Analyst, StockCharts.com

Author, Stock Charts for Dummies

Hey, have you followed Greg on Twitter? Click the bird in the box below!

Want to read more from Greg? Be sure to follow his StockCharts blog:

The Canadian Technician

Good trading,

Greg Schnell, CMT, MFTA