Editor's Note: This article was originally published in John Murphy's Market Message on Thursday, January 31st at 12:34pm ET.

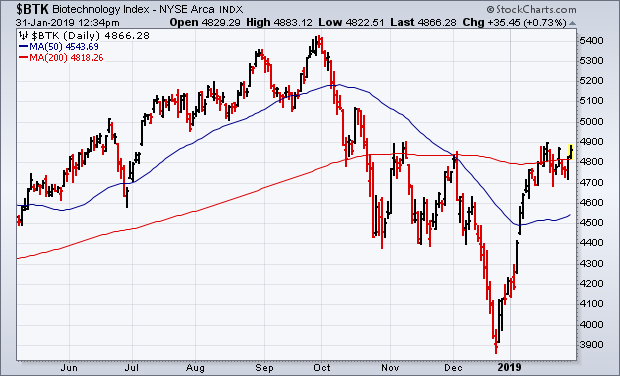

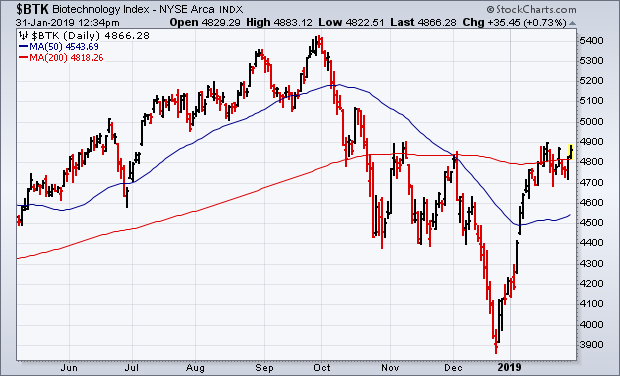

Chart 4 shows the Consumer Discretionary SPDR (XLY) trading above its 200-day line in today's trading. That a positive sign for the economically-sensitive sector and the market. It's usually a good sign for both when cyclical stocks are leading it higher. Chart 5 shows the Biotechnology Index ($BTK) also trading above its 200-day line. That's giving a boost to the healthcare sector and the Nasdaq market. Interestingly, defensive stock groups like consumer staples are also having a strong day. That's likely the result of falling bond yields.

Chart 4

Chart 5

About the author:

John Murphy is the Chief Technical Analyst at StockCharts.com, a renowned author in the investment field and a former technical analyst for CNBC, and is considered the father of inter-market technical analysis. With over 40 years of market experience, he is the author of numerous popular works including “Technical Analysis of the Financial Markets” and “Trading with Intermarket Analysis”. Before joining StockCharts, John was the technical analyst for CNBC-TV for seven years on the popular show Tech Talk, and has authored three best-selling books on the subject:

Technical Analysis of the Financial Markets,

Trading with Intermarket Analysis and

The Visual Investor.

Learn More