ChartWatchers January 19, 2019 at 04:43 PM

Analysts meet with the management teams of companies and then return to their firms and either buy or sell based on the information they gather. It's the primary reason why technical price action precedes fundamental information... Read More

ChartWatchers January 19, 2019 at 09:54 AM

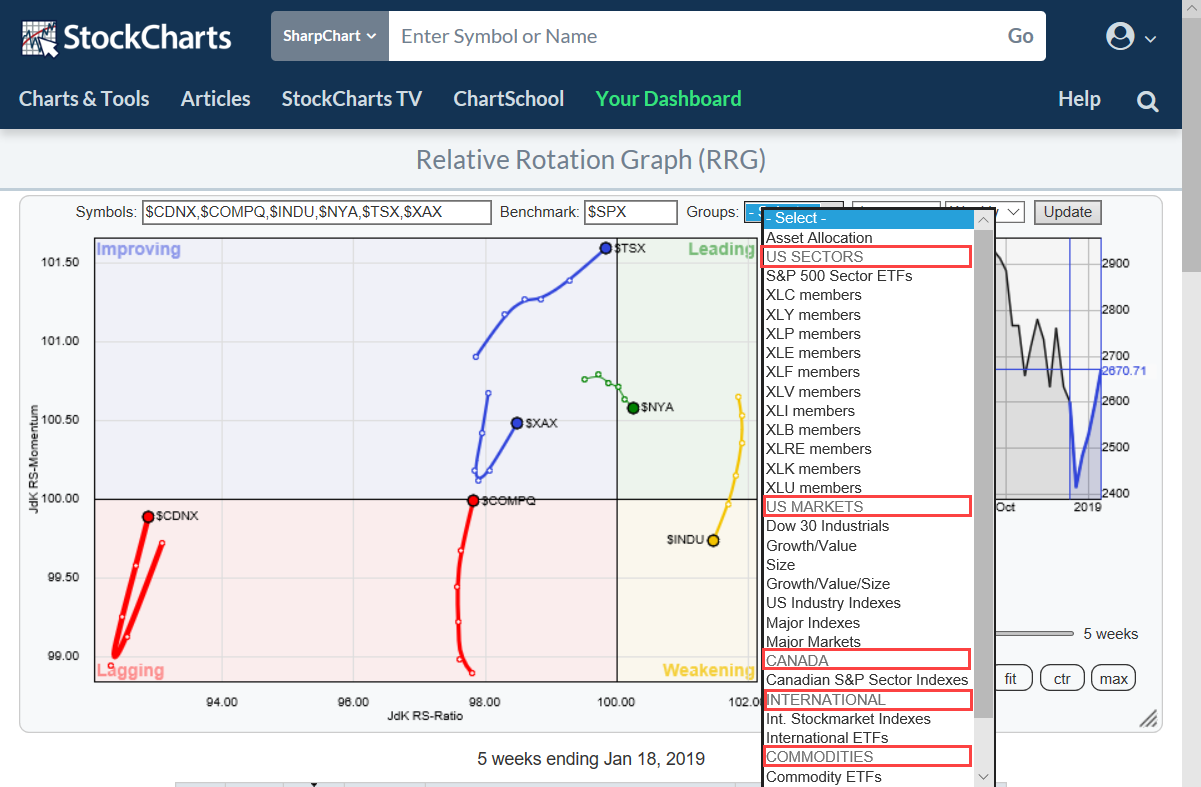

If you are a regular user of Relative Rotation Graphs you are probably aware of the pre-defined groups (universes) that you can choose from when you open the drop-down box at the top op the chart... Read More

ChartWatchers January 19, 2019 at 06:27 AM

The S&P 500 is in the midst of a big run that lifted most boats, especially financial stocks. Even though these stocks are leading with the biggest gains over the last three weeks, most big financials are still in downtrends overall and below their 200-day SMAs... Read More

ChartWatchers January 19, 2019 at 12:00 AM

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, January 18th at 11:01am ET. All major U.S. stock indexes have exceeded their 50-day averages (blue lines). That still leaves their 200-day averages to contain the rally... Read More

ChartWatchers January 18, 2019 at 08:41 PM

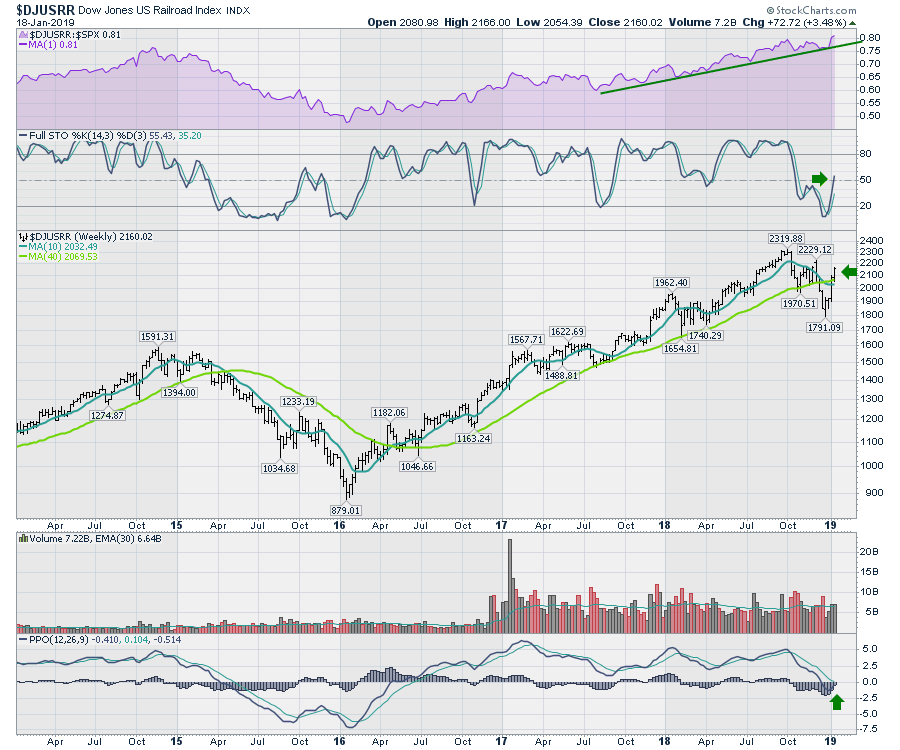

Railroads are back in an uptrend after the fourth-quarter correction. I like to keep track of the railroads and their relative strength compared to the $SPX. Most recently, the relative strength panel pulled down to the trend line and bounced off again; a nice bullish setup... Read More

ChartWatchers January 18, 2019 at 06:09 PM

Earnings season began in earnest last week, with major financial companies being rewarded and helping to lead the market higher... Read More

ChartWatchers January 18, 2019 at 04:18 PM

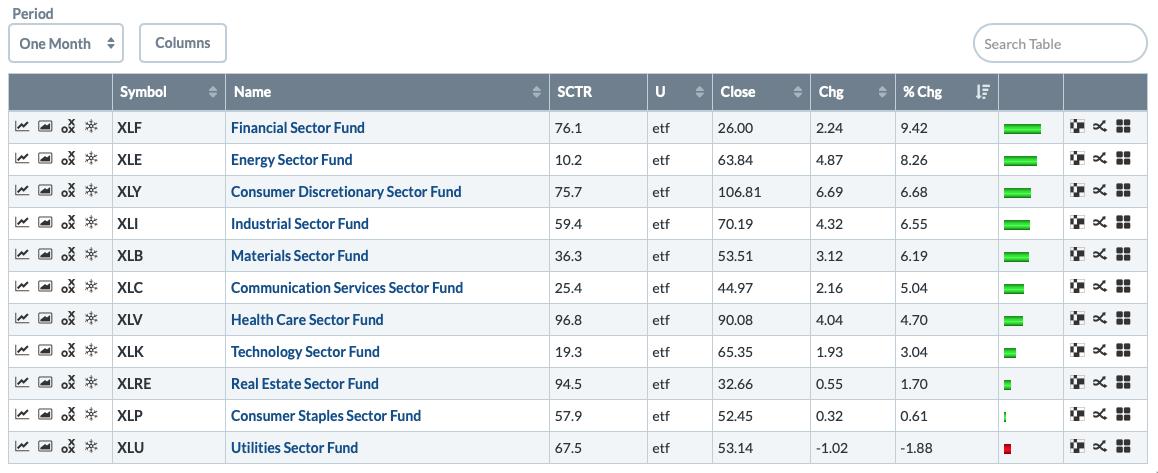

Sector rotation continues to favor the defensive sectors of Health Care, Consumer Staples, Real Estate and Utilities. Some of the more aggressive sectors are perking up now, with Financials actually making the biggest gain of the past month... Read More

ChartWatchers January 05, 2019 at 01:07 PM

Before I look ahead to what we might expect in 2019, let me rewind for a bit and check out last year's forecast. Here's a recap, summarizing a few of my "expectations". I've graded my predictions with a slight curve. Feel free to agree or disagree... Read More

ChartWatchers January 05, 2019 at 11:58 AM

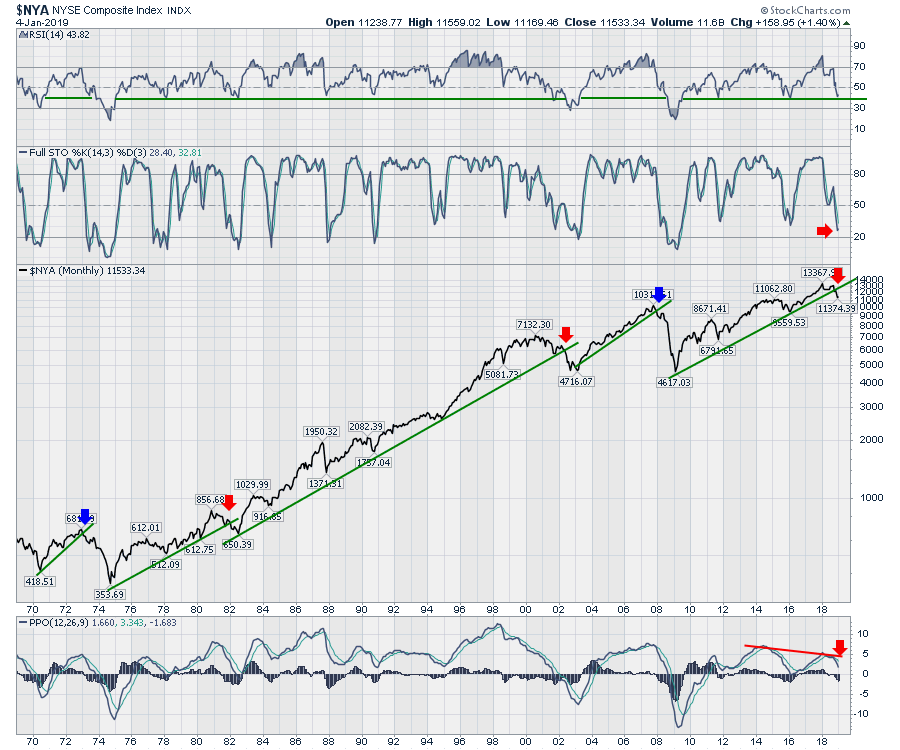

With a wretched finish for the fourth quarter of 2018, I found many colleagues and friends weren't so much ringing in the new year as they were wringing it in... Read More

ChartWatchers January 05, 2019 at 10:16 AM

S&P 500 earnings for 2018 Q3 have been finalized. The following chart shows us the normal value range of the S&P 500 Index... Read More

ChartWatchers January 05, 2019 at 08:55 AM

The broad market environment is perhaps the single most important factor to consider when selecting a trading or investing strategy for stocks. As with the weather, the broad market environment is subject to change and we need to adapt to current conditions... Read More

ChartWatchers January 05, 2019 at 05:42 AM

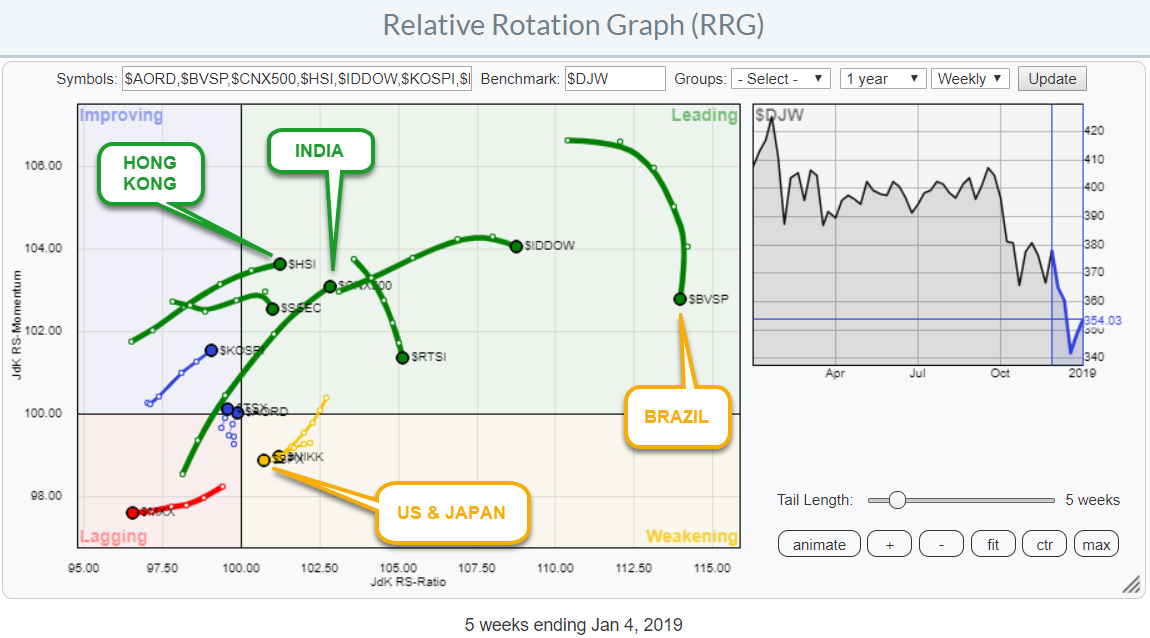

With the US stock market declining investors (may) need to look for alternatives in order to preserve capital. Sure enough, there are good opportunities in the US with bonds, IEF is doing very well, and cash is a very viable alternative if you do not "need" to be invested... Read More

ChartWatchers January 04, 2019 at 02:12 PM

Most of you who read my blog know the name of our service is EarningsBeats.com. The name makes sense since, for many years during the bull market, we've zeroed in on those companies that beat earnings expectations that could be prime long candidates... Read More

ChartWatchers January 04, 2019 at 11:18 AM

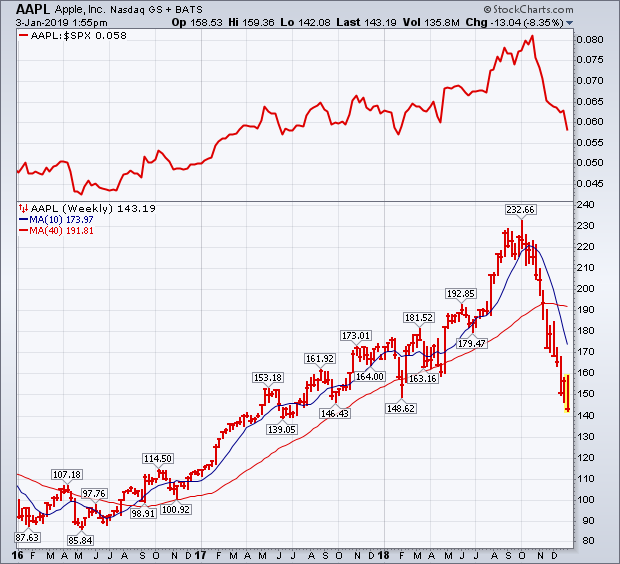

Editor's Note: This article was originally published in John Murphy's Market Message on Thursday, January 3rd at 1:59pm ET. The price of Apple is plunging today after issuing a sales warning for the first quarter. The stock was already in trouble before that announcement... Read More