The Stock Market is a real-time place to see the true spirit of Greed and Fear come to the forefront. Technicians use the words Supply and Demand to study the market characteristics. Over the last few years, one of the most interesting areas of the market is the niche ETF for finding specific areas of investor interest.

This week marks the rollout of the 'Horizons Medical Marijuana Life Sciences' ETF (HMMJ.TO). For anyone interested in the ETF, a look inside its contents would probably be more helpful than the buzz around the concept.

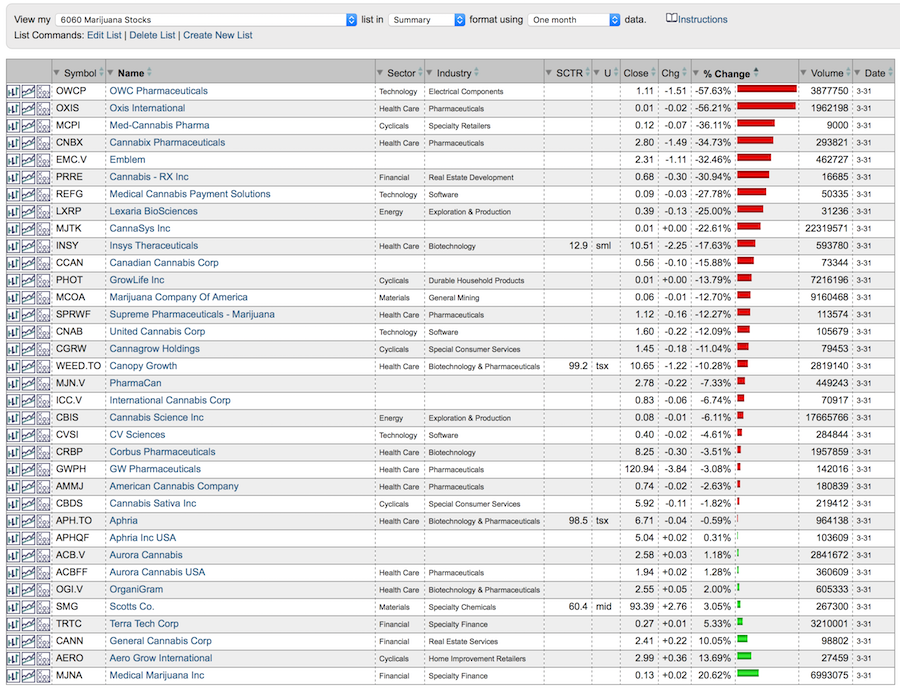

As a technician, I have compiled my own list of 35 stocks into a marijuana Chartlist. Here is the performance for the last month. 80% of them were lower and half of them were lower by 10% or more. Notice all four of the big gainers had a closing price less than $3.00.

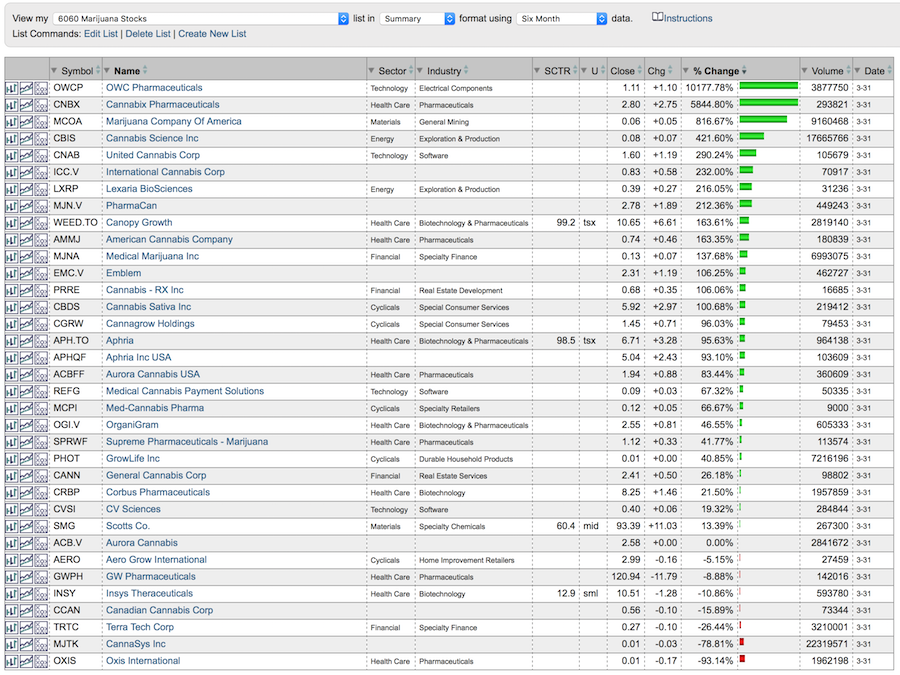

The picture looks much better if we discuss the 6-month view. Notice the box on the top right changed to Six Month view. Undoubtedly this will be the view that the marketers will focus on.

But here is the crux of the story. A Technicians view. The leading Medical Marijuana grower in North America is Canopy Growth Corp with a stock price around $10. At the start of October the price of the stock went from $4 to $17.86 in 7 weeks. We can afford groceries making those 400% returns. But this is a parabolic blowoff pattern. The resulting price action on the right hand side is no surprise to technicians. A 50% pullback ensued. The bottom line is that the gains in marijuana stocks were last years story.

But here is the crux of the story. A Technicians view. The leading Medical Marijuana grower in North America is Canopy Growth Corp with a stock price around $10. At the start of October the price of the stock went from $4 to $17.86 in 7 weeks. We can afford groceries making those 400% returns. But this is a parabolic blowoff pattern. The resulting price action on the right hand side is no surprise to technicians. A 50% pullback ensued. The bottom line is that the gains in marijuana stocks were last years story.

The chart is setting up to test the red trendline. The new ETF announcement on Tuesday will probably pop this stock through resistance and may or may not start a meaningful price surge. The MACD has just given us a positive crossover. Using today's low as a hard stop, this could be bought for a trade. For managing a fast moving speculative stock, I recommend something simple like a chandelier exit. Chandelier Exit article in Chartschool.

In this year with a bull market in more than just stocks, knowing where you want out is more important than buying.

If you would like to become a member of StockCharts.com and get access to 'member only blog articles' from some of the world's finest technicians, a basic membership subscriber can get all the market commentary. Take a 1-month Free Trial.

Martin Pring will be recording his market analysis this week and the link will be provided on his blog. I will be posting my Canadian Technician article early in the week and the Commodities Countdown recording will be out next weekend. This is a link to all my recent and future videos for those that would like to bookmark it.

On Sunday, April 9th, Tom Bowley and I will be hosting a webinar the The StockCharts Outlook. You can register here.

Have a great weekend.

Good trading,

Greg Schnell, CMT, MFTA.