ChartWatchers February 20, 2016 at 08:35 PM

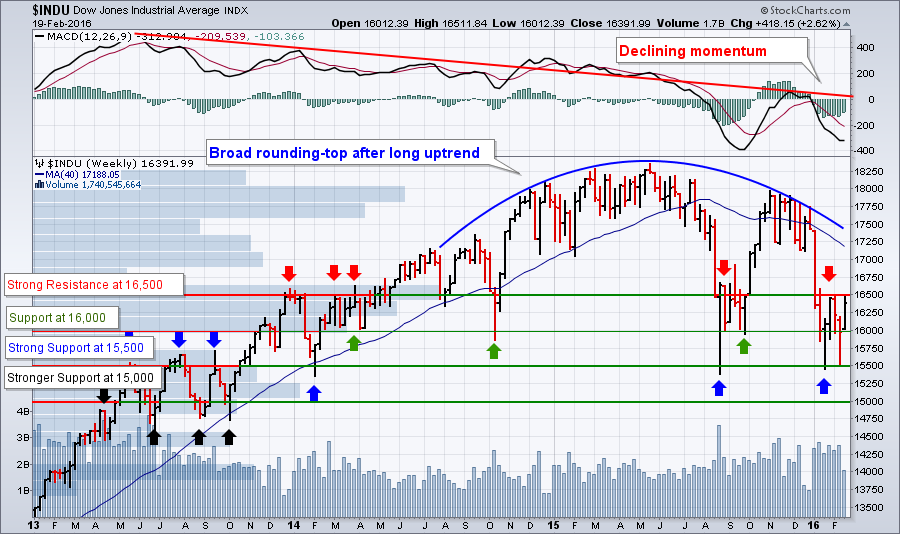

Hello Fellow ChartWatchers! I know, I know. I've shown the same chart again and again recently... Read More

ChartWatchers February 20, 2016 at 08:12 PM

From a short-term trading perspective, last week's rally was predictable. Positive divergences flashed all over the equity map on daily charts - globally, domestically, and within sectors, industry groups, and individual stocks... Read More

ChartWatchers February 20, 2016 at 02:19 PM

Many of my readers' and viewers' questions remind me of the Whitney Houston song, "How Will I Know?"... Read More

ChartWatchers February 20, 2016 at 02:16 PM

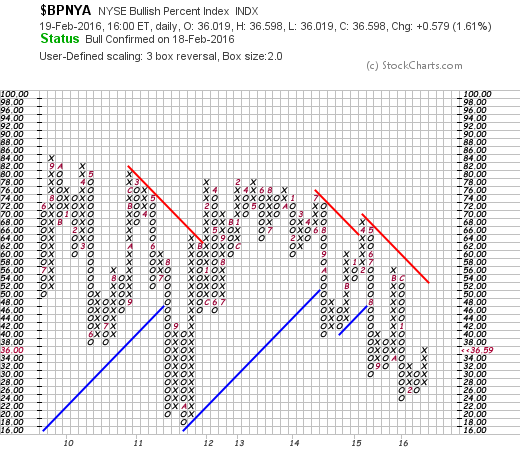

One of the widely watched gauges of market direction is the NYSE Bullish Percent Index ($BPNYA). That index measures the percent of NYSE stocks that are in point & figure uptrends. Chart 1 shows a point & figure version of that index... Read More

ChartWatchers February 20, 2016 at 02:09 PM

Our primary focus for a long time at EarningsBeats.com has been on those companies that beat earnings expectations and have strong charts. The reason being that companies with strong numbers and strong charts provide superior reward to risk trading opportunities... Read More

ChartWatchers February 20, 2016 at 12:15 PM

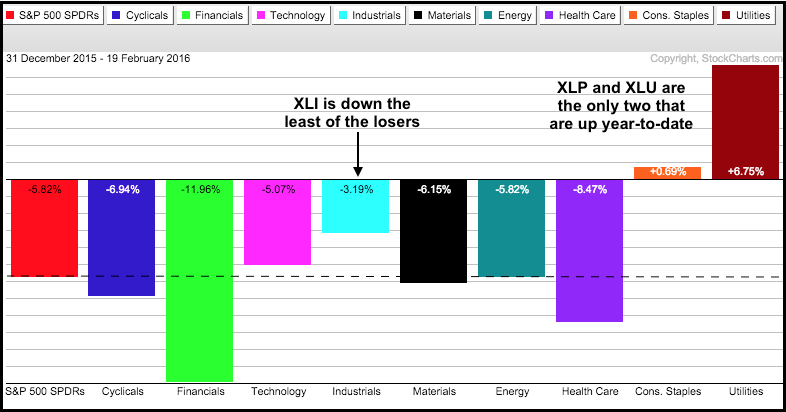

It has been a rough year for most of the stock market with seven of the nine sector SPDRs down year-to-date. The Consumer Staples SPDR (XLP) is up .69% and the Utilities SPDR (XLU) is up a whopping 6.75%... Read More

ChartWatchers February 20, 2016 at 12:11 PM

With the announcement of the UK / European Union deal late on Friday night, we have a good reason to look at the currencies compared to the US Dollar ($USD)... Read More

ChartWatchers February 07, 2016 at 01:12 PM

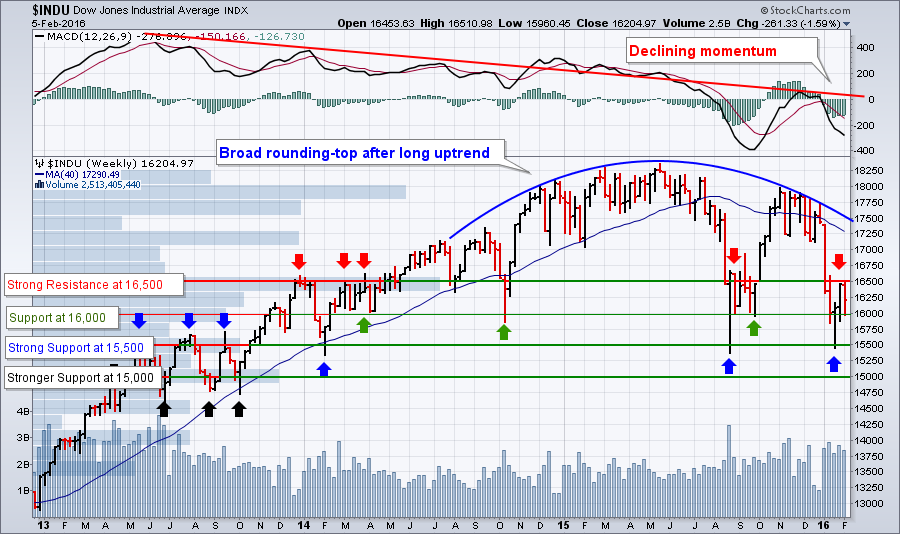

Hello Fellow ChartWatchers! Wow, people are all over the place with their emotions right now... Read More

ChartWatchers February 06, 2016 at 07:44 PM

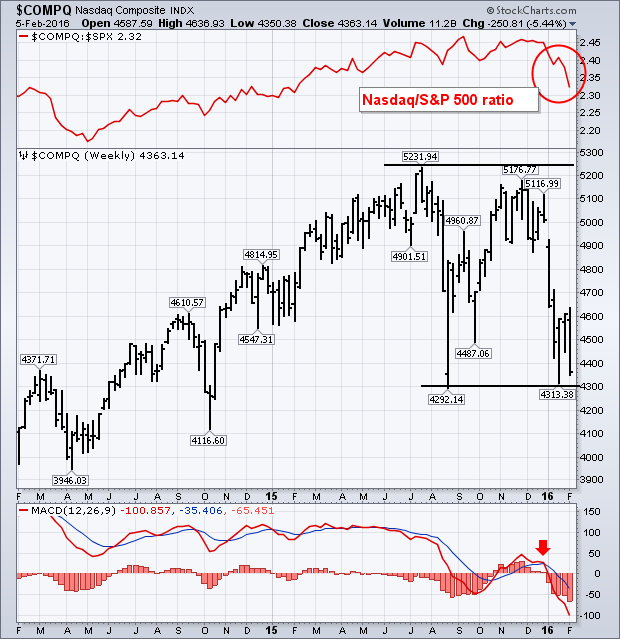

It's never a good sign to see the Nasdaq leading the rest of the market lower, which it did this week. A -3% plunge on Friday (and a -5% loss for the week) made it the weakest of the major market indexes. Heavy selling in software and internet stocks were especially troubling... Read More

ChartWatchers February 06, 2016 at 07:32 PM

In the best of times companies see their stock prices rewarded or punished based on earnings results. Even when a company misses its earnings per share or revenue forecasts by just a small amount it can have a meaningful, negative impact on its stock price... Read More

ChartWatchers February 06, 2016 at 03:33 PM

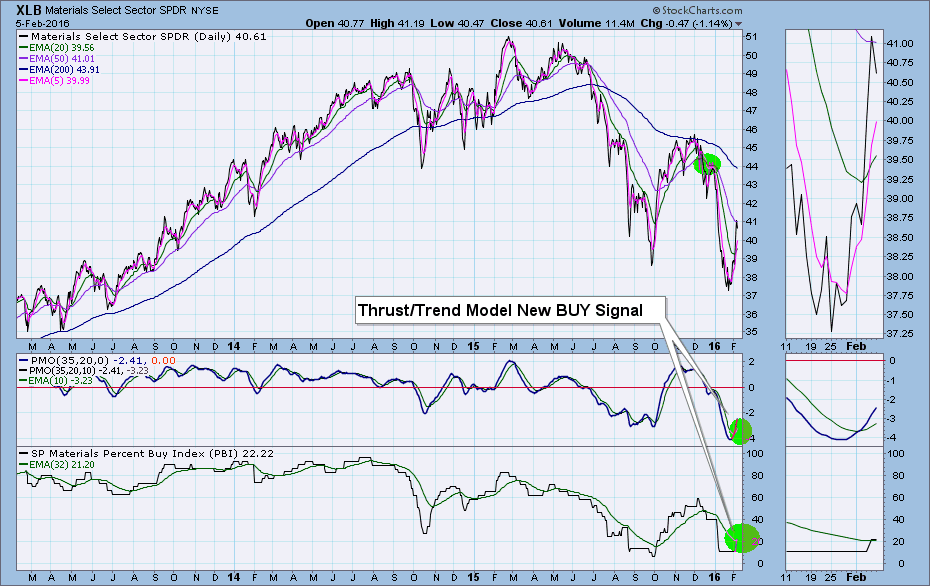

There has been renewed interest in the Percent Buy Index (PBI) ever since I spotlighted it during one of my webinars. The PBI is not related at all to the Bullish Percent Index (BPI)... Read More

ChartWatchers February 06, 2016 at 10:36 AM

There are no guarantees to this question, but we do have history and past technical indications to provide us a few guidelines. Trading strategies applied during a bull market simply won't work during a bear market... Read More

ChartWatchers February 06, 2016 at 10:02 AM

This bear market has ripped most portfolios apart. Some portfolios have been shredded. Recently, a money manager was on TV saying he really likes it when stocks are down this hard because there are so many bargains. I have two additional statements for that... Read More

ChartWatchers February 06, 2016 at 05:00 AM

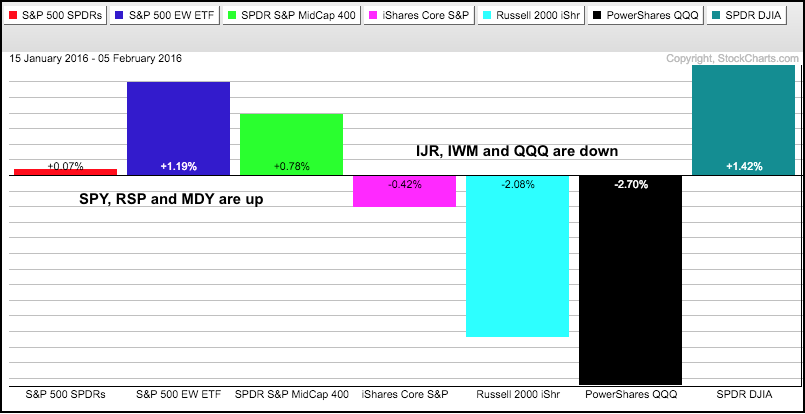

After sharp declines the first two weeks of the year, the stock market turned into one mixed up beast the last three weeks. The PerfChart below shows three-week performance for the seven major index ETFs... Read More