Consumer Discretionary (XLY) is also referred to as Consumer Cyclicals (XLY) . This is the sector we would like to see break out to new highs. This week it did. Who could be not be bullish?

Every thing I see on the chart looks so good. I saw a pick up in some of the dining stocks, the homebuilders and AMZN within the broaden retailers. It all looks so good.

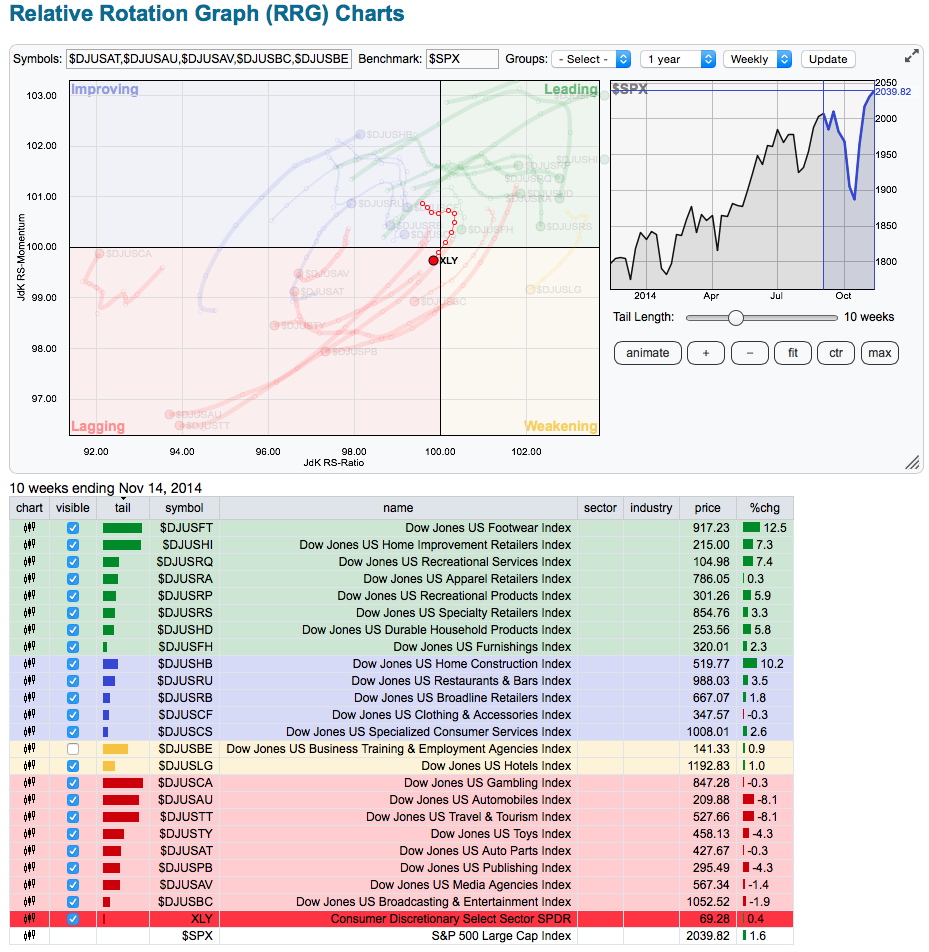

However, let's take a look at the RRG. In the last 2 weeks, the XLY on Chart 2 moved from the green quadrant to the red quadrant. Because it is so close to the centre it is performing very similar to the $SPX which is the centre point benchmark for this chart.Let's remember the $SPX is making new highs so that is not so bad.

Here is the link to the XLY RRG Charts shown below. By changing the check marks on the list below you can change the chart lines showing up on the graph.

Chart 2

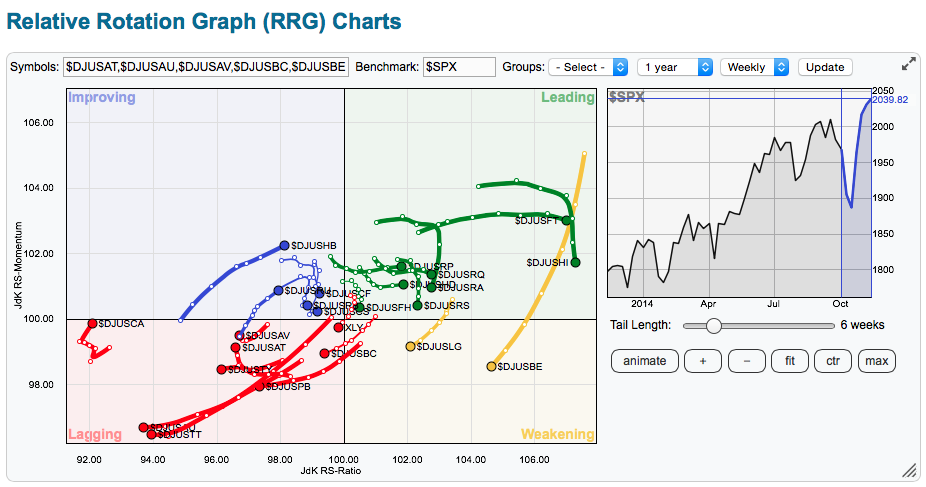

Chart 3 has all the industry groups showing. While there are some components with positive momentum, almost everything is pointed down which means the industry group is losing momentum which should add caution.

Chart 3

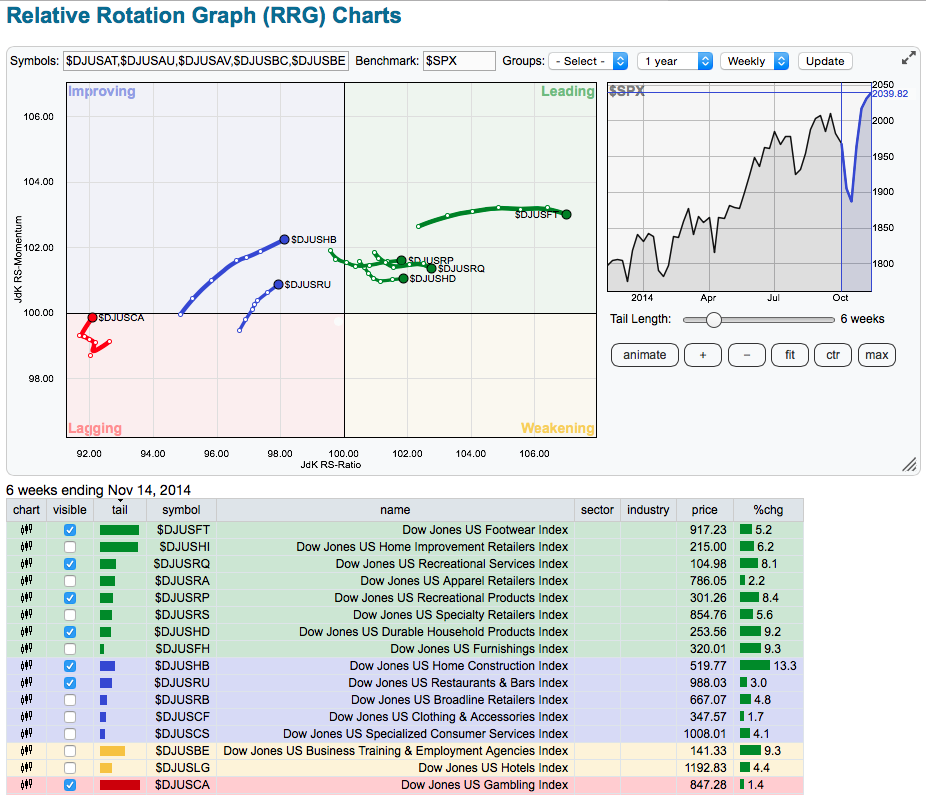

Here are the industry groups trending up in momentum. The best groups tend to be the ones heading towards the top right. Even 3 of those lost a little momentum this week (they moved down). If you look at the list under the chart you can see the actual name of those groups.

Chart 4

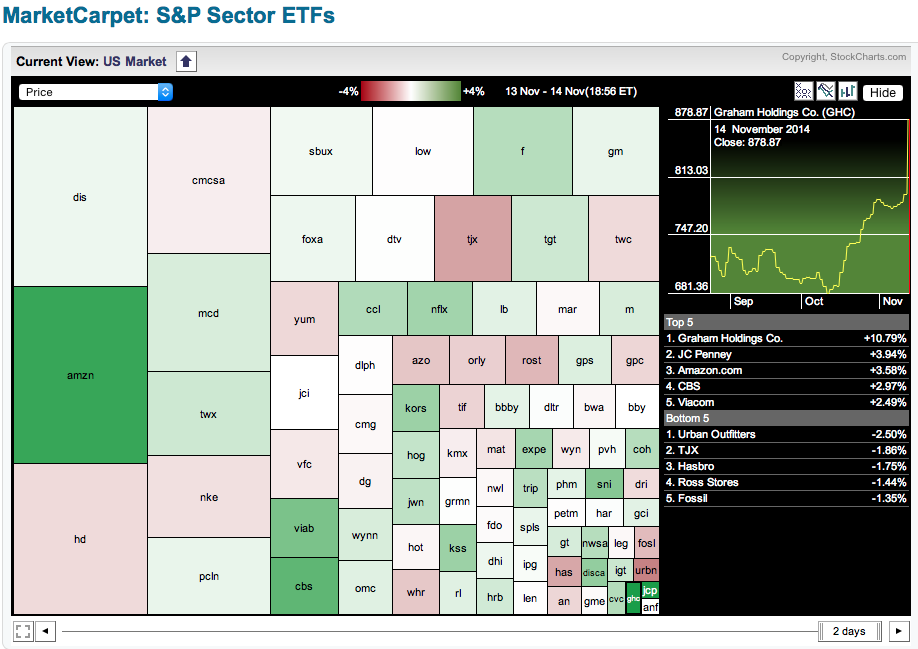

Amazon (AMZN) broke out of a downtrend this week, but it might not be enough to break the downward trend in the sector just yet. The majority of the sector is either losing momentum or performing weaker than the $SPX. While I feel strongly that the new high shown on the top chart should not be ignored, neither should the broad weakness in the sector from a momentum point of view. On Chart 5, we can see the relative market cap weightings of the companies in the XLY using the market carpet below. Click here for the S&P market carpet link. Double Click on the Consumer Discretionary sector to get this market carpet. Then right click to add the ticker symbols.

While this is not a complete list of the companies in the Consumer Cyclical Sector, it does point to 10 companies making up about 40% of the weight in the group. You may wish to study the price action of the top 10. In summary, the sector is performing in line with the $SPX right now but many components are losing momentum. So this adds a little caution to the new high. I'm still selectively bullish with the good price action in Amazon and McDonalds this week but worried about the broad sector. So to reiterate the title, when things break out to new highs its bullish. However, if the majority of the sector loses momentum it might be time to say good bye to owning the ETF for a while.

Good trading,

Greg Schnell, CMT