ChartWatchers September 21, 2014 at 10:53 AM

Hello Fellow ChartWatchers! Several indexes including the Dow and the S&P 500 hit new all-time highs on Friday before pulling back slightly before the close. People who have been waiting for the market to correct are still waiting... Read More

ChartWatchers September 20, 2014 at 04:15 PM

Financial stocks are starting to show upside leadership at the same time that bond yields are starting to rise. Banks usually benefit from rising bond yields because they can charge higher rates for their loans... Read More

ChartWatchers September 20, 2014 at 04:11 PM

You should know by now that I'm a HUGE fan of the Moving Average Convergence Divergence (MACD) indicator. Other than the combination of price/volume and the use of candlesticks, it's probably my "go-to" indicator... Read More

ChartWatchers September 20, 2014 at 11:05 AM

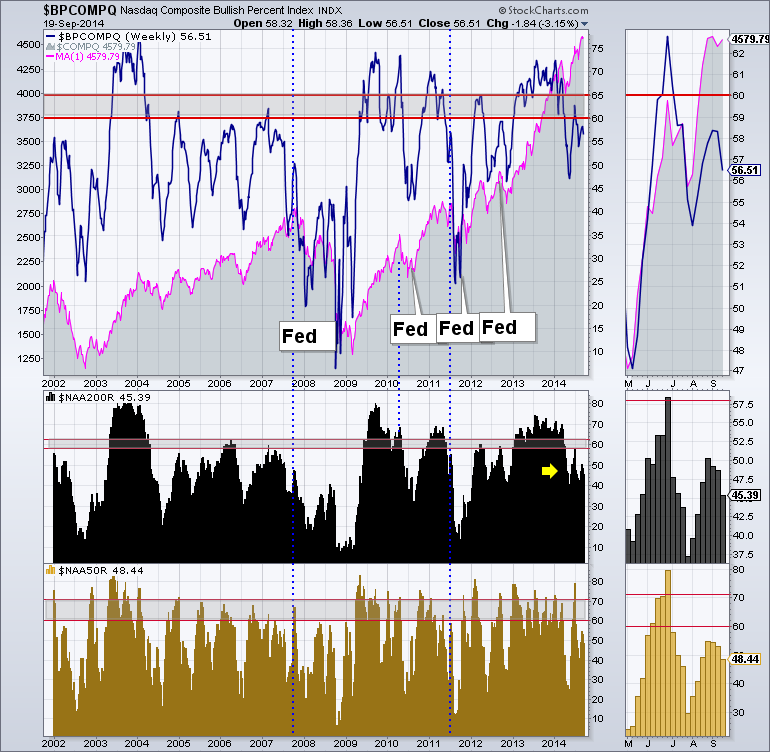

Bullish Percent Indexes ( BPI's) are helpful in telling us the underlying sentiment of a group of stocks. Here is the Bullish Percent Index for the Nasdaq Composite ($BPCOMPQ). The chart is a little busy, but follow along. The gray area with the pink line is the Nasdaq Composite... Read More

ChartWatchers September 19, 2014 at 09:57 PM

This afternoon while going over the DP Tracker Report for the S&P 500, I checked the new Price Momentum Oscillator (PMO) BUY signals on the SPX-Plus Tracker to see if there were any signals that looked promising. There was one--Monsanto (MON)... Read More

ChartWatchers September 19, 2014 at 11:04 AM

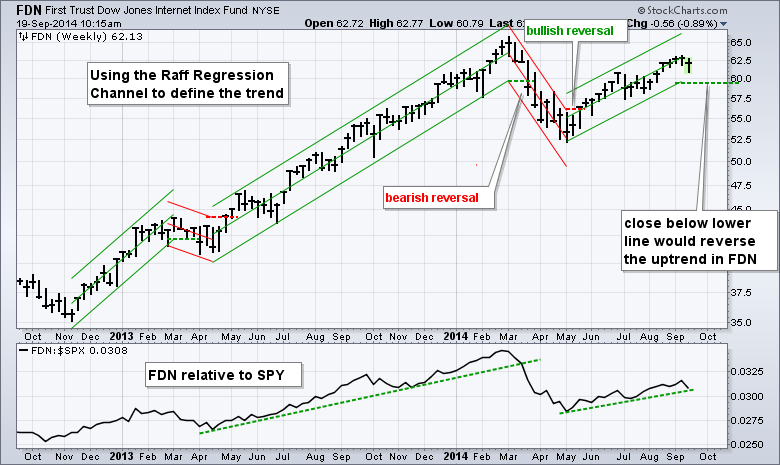

Today's article will show how the use the Raff Regression Channel to define the trend and identify reversals using the Internet ETF (FDN). I am particularly interested in FDN because internet stocks represent the appetite for risk... Read More

ChartWatchers September 07, 2014 at 04:04 PM

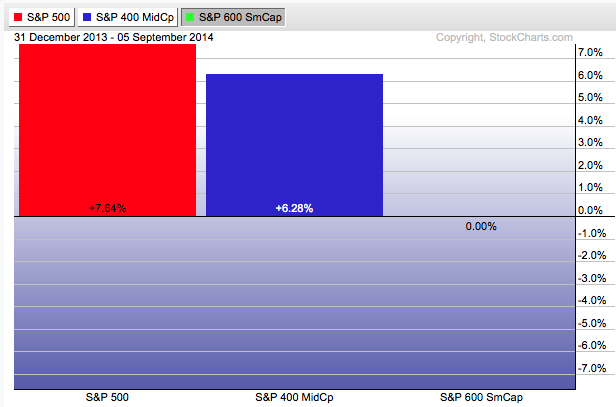

Hello Fellow ChartWatchers! The rally-that-just-won't-end continues. The S&P 500 is up over 8% for the year. It is up over 40% since the start of 2013. It is up over 58% since the start of 2012. Etc., etc., etc... Read More

ChartWatchers September 07, 2014 at 12:49 AM

My Wednesday message showed the Dow Industrials and Transports testing their summer highs. The bars on top of Chart 7 show that the Dow Transports have hit new highs (led by rails and truckers). The Dow Industrials, however, are still testing their July peak... Read More

ChartWatchers September 06, 2014 at 07:38 PM

Identifying a tradable gap can be quite profitable, but also frustrating at times. Awful news hits the wires and a stock gaps lower... Read More

ChartWatchers September 06, 2014 at 10:28 AM

Natural Gas ($NATGAS) is the heartbeat of Western Canada's economy and a huge part of the US Energy supply. Earlier in the spring, I felt $NATGAS might just be the biggest momentum trade of the year... Read More

ChartWatchers September 06, 2014 at 08:00 AM

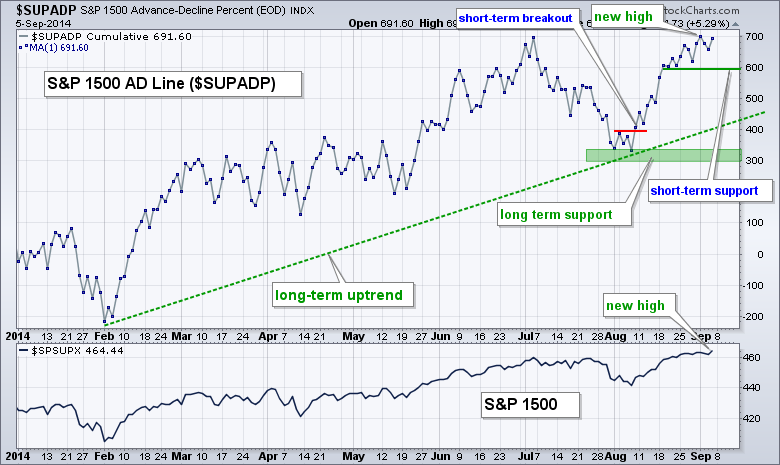

The S&P 1500 AD Line ($SUPADP) and the S&P 1500 AD Volume Line ($SUPUDP) hit new highs to confirm the overall uptrend. This is significant for two reasons. First, a bearish divergence is not possible... Read More

ChartWatchers September 05, 2014 at 06:58 PM

Central Gold Trust (GTU) is a closed-end mutual fund, which means that it trades like a stock on the NYSE. The fund owns only gold -- the metal, not stocks. Closed-end funds trade based upon the bid and ask, without regard to their net asset value (NAV)... Read More