ChartWatchers January 21, 2012 at 10:49 PM

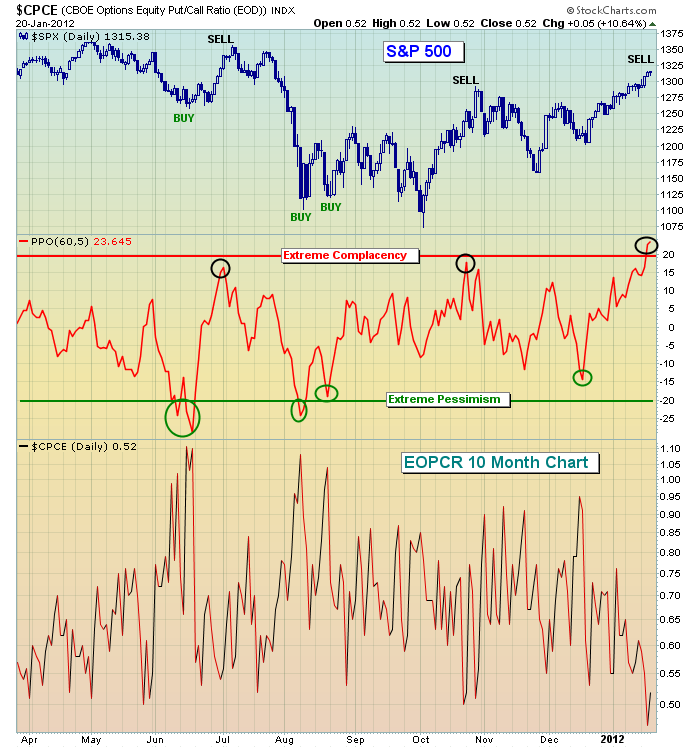

Ok, I'll admit I'm being a little dramatic. But everyone should know how I feel about my favorite sentiment indicator - Relative Complacency/Pessimism... Read More

ChartWatchers January 21, 2012 at 09:24 PM

Hello Fellow ChartWatchers! Early last year, we added Dr. Alexander Elder's Impulse System to our SharpCharts charting package and it has proven to be quite popular... Read More

ChartWatchers January 21, 2012 at 04:02 PM

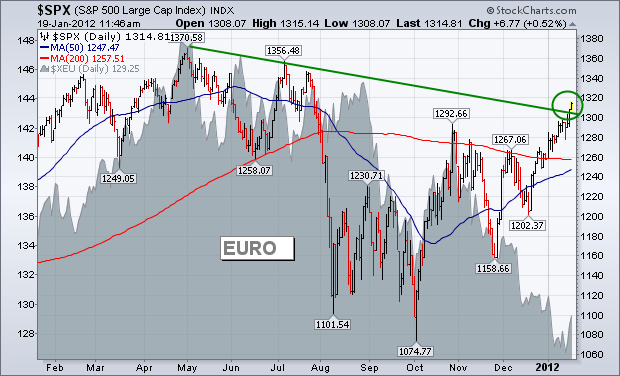

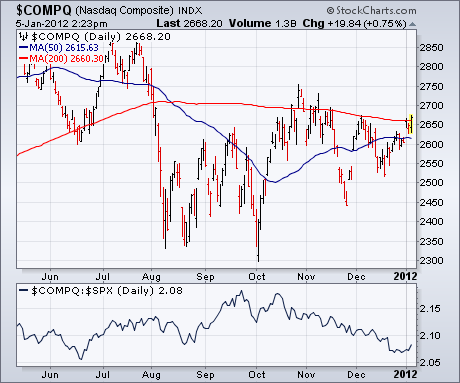

The U.S. stock market continues to lead the rest of the world higher. Charts 1 and 2 show the S&P 500 and Nasdaq Composite Indexes clearing their fourth quarter highs, which puts them in position to challenge the highs formed last summer and spring... Read More

ChartWatchers January 21, 2012 at 03:55 PM

Since the beginning of the year, we've seen both Gold ($GOLD) and her sister metal Silver ($SILVER) rally; but we've seen Gold under-perform during this rally. This is exactly what should take place in a metals bull market... Read More

ChartWatchers January 21, 2012 at 03:36 PM

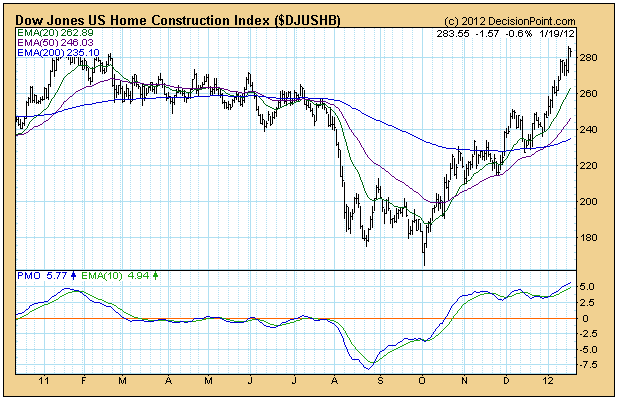

The market rally on Wednesday was driven in part by a surge in housing stocks, which was triggered by a favorable housing report... Read More

ChartWatchers January 21, 2012 at 12:05 PM

The FOMC meets next Tuesday-Wednesday and will make its policy statement Wednesday afternoon. With stocks surging and recent economic reports buoyant, the bond market may be looking ahead to this meeting with trepidation... Read More

ChartWatchers January 08, 2012 at 12:07 AM

The Dow Industrials and S&P 500 indexes have already cleared overhead resistance barriers. The Nasdaq market may be next. Chart 1 shows the Nasdaq Composite Index trying to close above its 200-day moving average... Read More

ChartWatchers January 08, 2012 at 12:01 AM

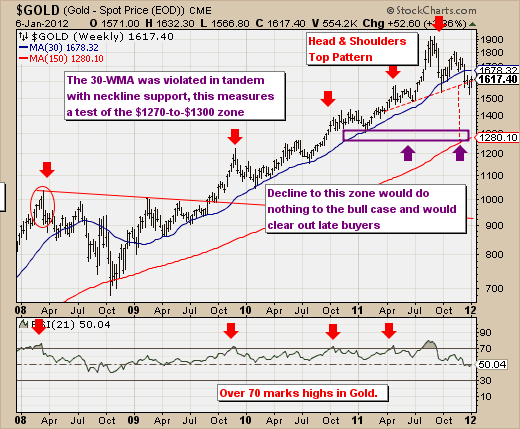

The downside violence in the Gold market as abated for the the time being given the reallocation and repositioning for the New Year... Read More

ChartWatchers January 07, 2012 at 11:57 PM

High volatility is generally associated with declining equity prices. The inverse is true as a declining level of volatility emboldens the bulls. Therefore, I follow the VIX continually to get a sense of DIRECTION... Read More

ChartWatchers January 07, 2012 at 11:49 PM

After reaching an all-time high in August, gold has corrected about -18%, but a recent bounce prompts us to take a closer look to see if the correction could be over. The most encouraging technical evidence is on the weekly chart... Read More

ChartWatchers January 07, 2012 at 08:40 PM

NEW eBOOK FROM ALEXANDER ELDER AVAILABLE EXCLUSIVELY FOR STOCKCHARTS USERS - Dr. Alexander Elder has just published a new eBook called "To Trade or Not to Trade, A Beginner's Guide". It is now available for instant download in the StockCharts Store for only $8.00... Read More

ChartWatchers January 07, 2012 at 08:14 PM

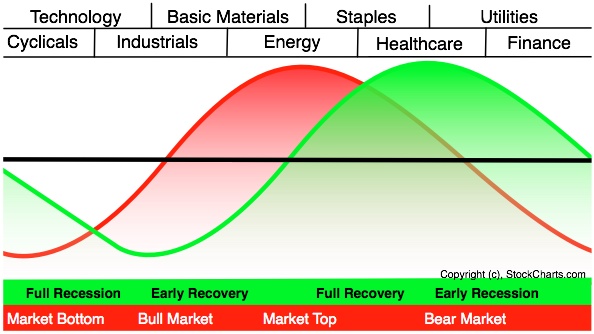

Hello Fellow ChartWatchers! Happy 2012! During his ChartCon 2011 presentation on Intermarket Analysis, John Murphy presented a great chart showing the state of Sam Stovall's Sector Rotation model as of July 2011... Read More

ChartWatchers January 07, 2012 at 12:35 PM

The Nasdaq 100 ETF (QQQ) is showing relative strength this year with a triangle breakout and surge above its early December high. On the daily candlestick chart below, QQQ surged in October and then consolidated in November-December... Read More