On Monday, May 9, Citigroup (C) stock will undergo a 10-for-1 reverse split. What this means is that 10 shares of C will be merged into one share, and holders of C will own one-tenth as many shares, but each share will be worth ten times the value of pre-split shares. Most people understand the concept, but many do not realize that a reverse split is essentially a negative event.

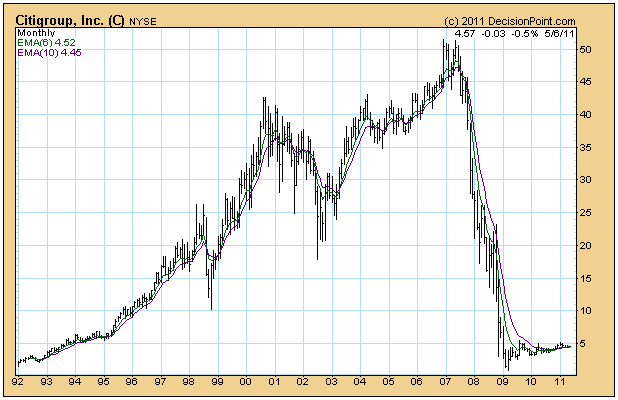

Let's take a look at the Citigroup monthly bar chart. Ugh! In about two years it went from an all-time high of 51.54 to what was probably an all-time low of 97 cents. In the two years since the low it has not been able to get above 5.00 except for brief periods.

I don't know the detail on Citigroup per se, but typically reverse splits are done to jigger the price up to a "respectable" level. For example, many investment funds are not permitted to buy stocks that are under a certain price, like 5.00, so after the reverse split C will open on Monday at around 45.00 (10 times Friday's close). All historical data are adjusted as well, so the chart will look just as ugly, only with much more downside potential. (Geeks Note: Whereas pre-split prices are multiplied by 10 for the reverse split, volume is divided by 10 so as to keep the price-volume relationship consistent.)

As a general rule reverse splits are not beneficial to future prices of the stock. Let's face it, Citigroup's chart tells us clearly that, whatever was wrong with the company at the top, is still a problem. Also, a stock trading this close to zero benefits from what I call "ground effect", meaning that the zero line tends to create a support zone several points above it. Reverse splitting the price up from 4.50 to 45.00 removes that support and allows more room (i.e 45 points downward) for the market to discount the stock price in order to reflect how bad off the market thinks the company really is. Yes, the price will be at a level where fund managers will be able to buy it, but will anyone want to?