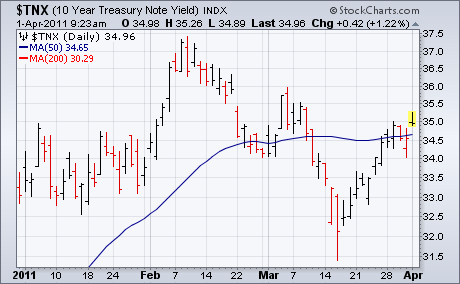

This morning's March jobs numbers reported U.S. payrolls jumping by 218,000 which was higher than estimates. In addition, the unemployment rate declined to a two-year low of 8.8%. The result is a jump in stock futures which points to a higher open today. Bond yields are also climbing on the jobs report. Chart 1 shows the 10-Year T-Note Yield hitting a one-month high after clearing its 50-day line earlier in the week. Rising bond yields are bad for bond prices (which trend in the opposite direction of yields) but are generally good for stocks. That's because rising bond yields are symptomatic of a strengthening economy. Arthur Hill has shown the upside breakout in small cap stocks. Chart 2 shows the S&P 400 Mid Cap Index having also exceeded their February high. That greatly increases the odds that large caps will do the same. Developed markets are also getting a lot of help from strong emerging markets.