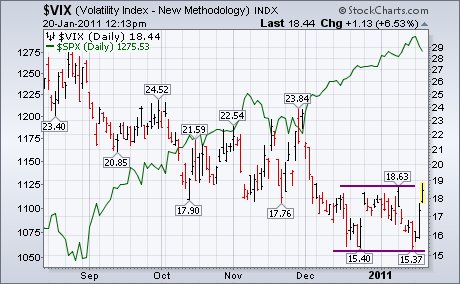

Two Thursday's ago (January 6), I showed the CBOE Volatility (VIX) Index having reached a potential support level at last spring's low near 15, and warned that a bounce off that level could cause a stock market pullback. That's because the VIX and stocks usually trend in opposite directions as shown in Chart 1. The reason I'm coming back to the VIX today is because it's climbing 8% and beginning to look like it's short-term trend is turning up. Chart 2 shows the VIX action more closely. After bouncing twice off support near 15 since mid-December, the VIX is challenging its early January intra-day high at 18.63. A close over that initial resistance barrier would turn its short-term trend higher and could signal an overdue pullback in the stock market.