After sharp declines in late June and early July, gold and silver are testing important support zones from their prior lows. The fist chart shows the Gold ETF (GLD) hitting new 52-week highs in late June. These highs did not hold long as GLD declined towards support around 114-116. This zone stems from broken resistance, the May low and the February trendline. GLD remains in a clear uptrend as long as support holds. Failure to bounce and a support break would reverse the 4-5 month uptrend in gold.

Click these images for details

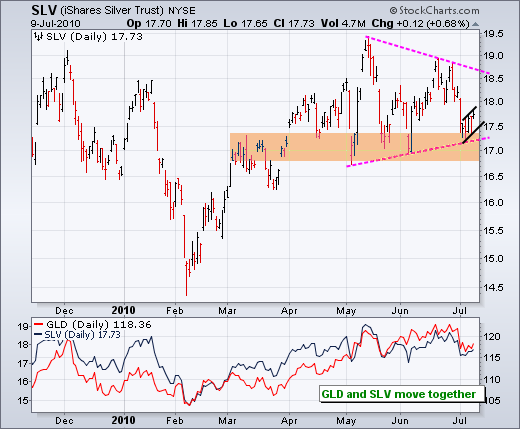

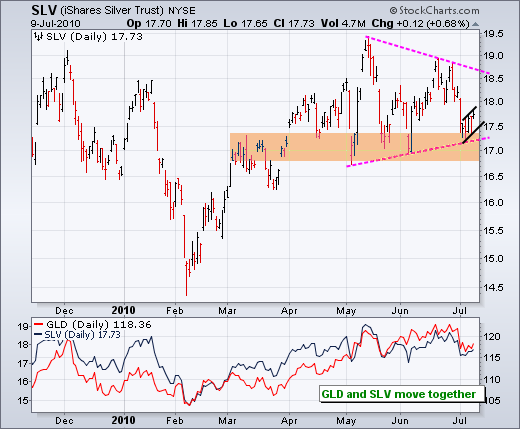

The second chart shows the Silver ETF (SLV) with a weaker pattern than gold. While gold exceeded its May high, SLV fell short of its May high and forged a lower high. Despite a sharp decline from this lower high, SLV firmed near its support zone around 17. Support in this area stems from the May-June lows and the lower trendline of a triangle. Looking closer, we can see a small consolidation over the last five days. A break below these lows would signal a continuation lower and project a break below the support zone. It ain't broken yet, but we need to watch this in the coming days. The indicator window shows GLD and SLV moving together throughout 2010. Even though gold is more precious and silver is more industrial, these two are still positively correlated.

Click these images for details

The second chart shows the Silver ETF (SLV) with a weaker pattern than gold. While gold exceeded its May high, SLV fell short of its May high and forged a lower high. Despite a sharp decline from this lower high, SLV firmed near its support zone around 17. Support in this area stems from the May-June lows and the lower trendline of a triangle. Looking closer, we can see a small consolidation over the last five days. A break below these lows would signal a continuation lower and project a break below the support zone. It ain't broken yet, but we need to watch this in the coming days. The indicator window shows GLD and SLV moving together throughout 2010. Even though gold is more precious and silver is more industrial, these two are still positively correlated.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More