The July 4th fireworks came a bit more belatedly this year as the S&P 500 rose +4.86% in the holiday shortened week. This performance was rather impressive in terms of points and breadth, but certainly not in terms of volume. To us, this calls into question the veracity and staying power of the current rally.

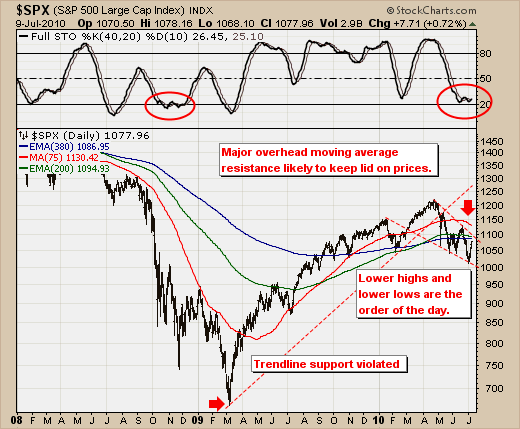

To wit, the current S&P rally has simply retraced back into major overhead resistance at the 380-day exp. and 200-day exp. moving averages at 1087 and 1095 respectively. Thus, we would expect to see prices fail at this zone given these moving averages are now rolling over to the downside. Further, we find the 40-day stochastic starting to "bottom feed" as near oversold levels, which is consistent with the downtrend in force as in the 2008 example. The puts the onus upon the bulls to reverse these negative developments; and perhaps they shall be successful. If prices do breakout above these levels, then one may conclude that the bull market is "back on."

From our trading perspective, we are now considering become aggressive short sellers against this zone,. with Consumer Discretionary shares being at the forefront of our trading strategy.