ChartWatchers June 19, 2010 at 09:21 PM

While some money is starting to creep back into stocks, investors are still showing enthusiasm for bonds. And I'm not talking just about Treasuries. More impressive gains were seen in other bond categories like corporate bonds and TIPS... Read More

ChartWatchers June 19, 2010 at 09:12 PM

Hello Fellow ChartWatchers! Now this will probably give away my age, but one of my first memories of television was from the educational children's show called "Sesame Street" and the song that they used to sing called "One of These Things is Not Like The Others"... Read More

ChartWatchers June 19, 2010 at 08:20 PM

The market is at a crossroads short-term. We've been bouncing back and forth after that early May drubbing... Read More

ChartWatchers June 19, 2010 at 07:45 PM

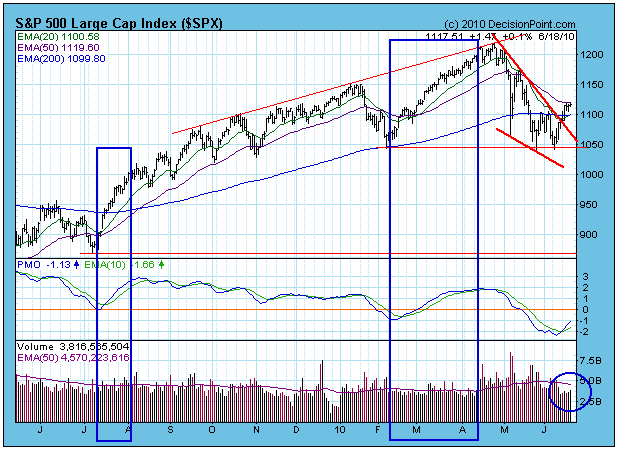

One of the issues that has concerned many analysts is the lack of volume supporting the rally from the June lows, but looking back over the last year we can see that volume has not been at all impressive for either of the rallies beginning in July 2009 or February 2010... Read More

ChartWatchers June 19, 2010 at 08:02 AM

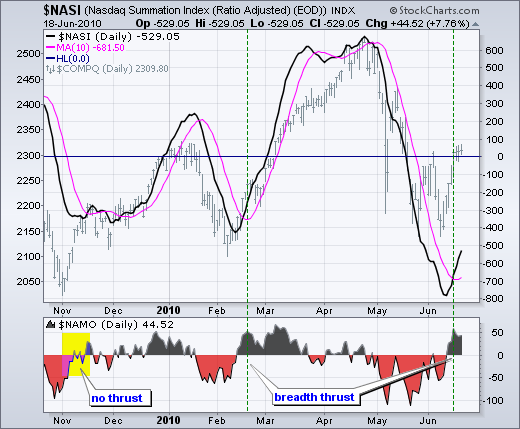

Before getting into this breadth thrust, let's review the McClellan Oscillator and McClellan Summation Index. Basically, the McClellan Oscillator is the 19-day EMA of Net Advances less the 39-day EMA of Net Advances (advances less declines)... Read More

ChartWatchers June 06, 2010 at 01:52 PM

A question from a subscriber yesterday prompted me to make a quick review of global markets. I rarely look at global markets because (1) my overriding focus is on the U.S. market and (2) it is my observation that international markets and the U.S... Read More

ChartWatchers June 06, 2010 at 08:46 AM

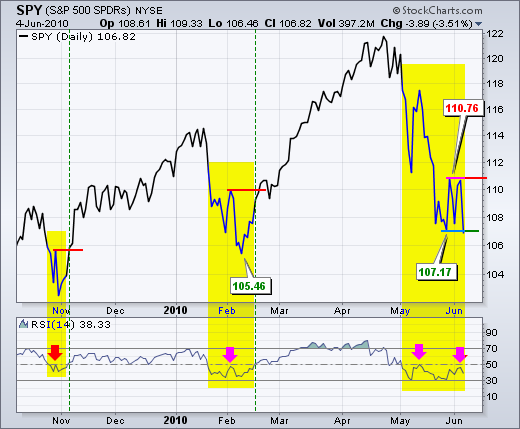

The Relative Strength Index remains below 50 and bearish for the S&P 500 ETF (SPY). Bounded momentum oscillators trade within a defined range. RSI trades between zero and one hundred with fifty as the centerline. Think of this level as the 50 yard line in a football game... Read More

ChartWatchers June 06, 2010 at 04:05 AM

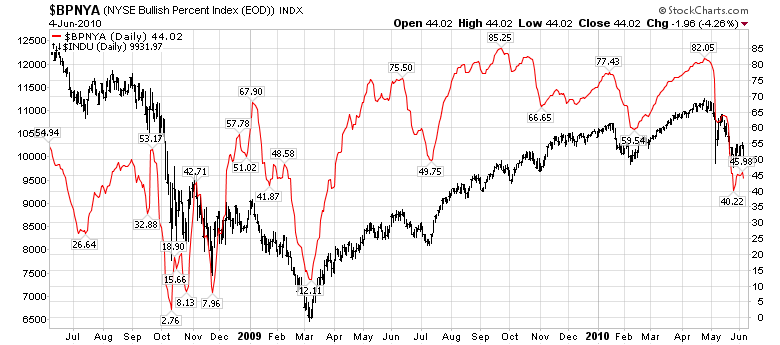

Technically, this hasn't been brain surgery. Our major indices broke down in early May on very heavy volume and, as technicians, we can never ignore that lethal price/volume combination. The weakness also came on the heels of some of the most extreme complacency that I've seen... Read More

ChartWatchers June 05, 2010 at 05:30 PM

Hello Fellow ChartWatchers! Back down below 10,000 we go. This is the fifth time in the past month that the Dow has dipped below that magic number... Read More