Hello Fellow ChartWatchers!

Now this will probably give away my age, but one of my first memories of television was from the educational children's show called "Sesame Street" and the song that they used to sing called "One of These Things is Not Like The Others". In case you aren't familiar with this, click here to see the song performed by one of the show's biggest stars.

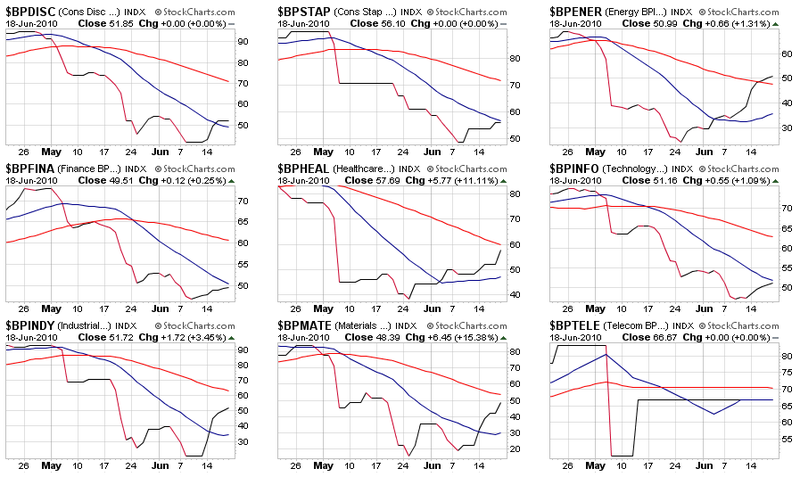

Granted, that game is seems pretty straightforward - even for a monster! - but I find myself thinking about that song every time I use our CandleGlance feature; especially when I use it in conjunction with our Sector Bullish Percent Charts:

These are nine of our sector-oriented Bullish Percent Indexes. They are based on the P&F charts of hundreds of stocks and show the percentage of those stocks that have "bullish" P&F chart signals. (For all the gory details, please see this article.)

But given this display, all we have to do is what Cookie Monster was doing - find the chart(s) that are behaving differently and see what that tells us about the market.

The first thing to notice is that almost all of the indexes have recently turned around and are moving higher - a very good sign for the market overall. Looking closer you should see that the Energy index ($BPENER) is the only index that is currently higher than it's 50-day Moving Average (the red line). Healthcare, Industrials and Materials are all positioned well above their 20-day Moving Average (the blue line) and just below their 50-day - a pretty good indication of strength returning to those sectors. Consumer Discretionary, Consumer Staples, Financial stocks and Technology stocks currently have the weakest looking BPIs - while all are now moving higher, they are all still under (or just over) their 20-day Moving Average and haven't displayed the same kind of strength that the other sectors have. You might also notice that the 20-day Moving Average for those stocks is still heading down which it has turned up for the others.

The fact that Consumer-oriented stocks as well as traditional bull-market sectors like Technology are still lagging should cause ChartWatchers to pause and reflect about the strength of the current rally. I'll be watching our BPI CandleGlance page closely for signs of more participation by Consumer stocks (bullish) or weakness in the Energy and Financial sectors (bearish) in the coming days.

- Chip