Complacency, complacency and more complacency. While the media worries about a correction in the strong cyclical bull market, they should quite simply be considering whether or not the cyclical bull has indeed topped out and a cyclical bear market has begun. This is the nature of higher prices; market participants tend to extrapolate the present far into the future - and this is what most market participants are doing right now.

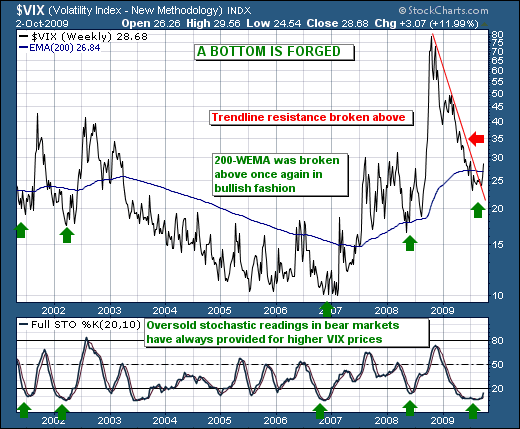

To wit, note the CBOE Volatility Index ($VIX) has forged a low at the 23 level after having traded to mind-numbing 80. Where everyone was bearish the broader market at the highs; they are bullish at the lows. But the lows now look to be turning higher once again, and we should see traders start to notice that trendline resistance was in fact given in bullish fashion; we should further note that the weekly stochastic is turning higher from oversold levels once again. In the past, this has increased the probability of a larger market decline than not; so buyers should be beware. The time to have been bullish is past; the time to consider bearish positions is here. Rallies are to be used to put on short positions; not dips to be buyers. There is a distinction; and it is important to one's trading health.