This is the tenth part of a series of articles about Technical Analysis from a new course we're developing. If you are new to charting, these articles will give you the "big picture" behind the charts on our site. if you are an "old hand", these articles will help ensure you haven't "strayed too far" from the basics. Enjoy!

(Click here to see the beginning of this series.)

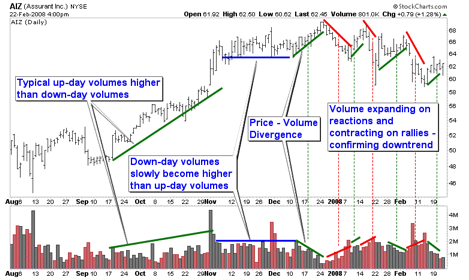

Volume Confirmation

In an uptrend, volume should expand as the prices move higher and contract as the prices pull back. As long as this pattern continues, volume is confirming the uptrend. The opposite is true for downtrends. Volume should expand as prices decline and contract during rallies to confirm a downtrend.

Negative divergences can occur if new price highs in an uptrend take place on declining volume. This type of volume activity is an indication of diminishing buying pressure. If the volume also begins to pick up on price pull backs, prices may begin consolidating or reversing into a downtrend.

The same concept is true for positive divergences in downtrends. If volume begins to contract on new price lows but expands during rallies, prices may begin consolidating or reversing into an uptrend.

This is the end of our section on Trends and trendlines. Next time, we'll dive into some of the fundamental price patterns that result from when two trendlines are in effect at the same time.