As the markets have rallied off the March 9th bottom, we find it rather interesting that the Emerging Markets have taken a lead role and have outperformed rather handily. The growing consensus believes that when the worlds' stock markets do bottom, then the Emerging Markets will take the role of "leader" once again. However, we would caution, for rarely do the leaders of past bull markets lead new bull markets. Moreover, and from a fundamental perspective - much of the Emerging Market economic growth was built upon the back of Western credit expansion and conduits to these countries rather than internal growth. Western banks were simply "reaching for yield"; and with higher yields come higher risks. We can only look at the debacle occurring in Eastern Europe; but that is a discussion for another day.

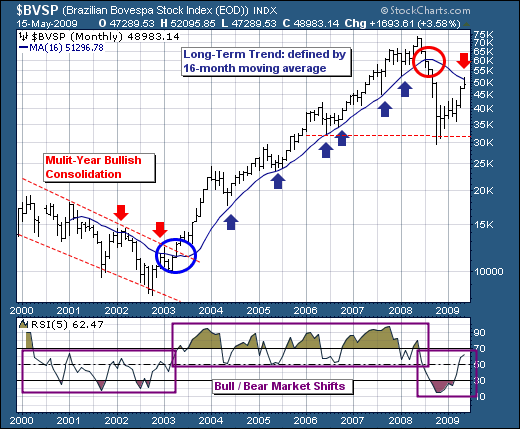

We would like to look at Brazil's BOVESPA Index, for it is quite simple from a technical perspective to delineate both bull and bear markets. And, it appears an inflection point / delineation point has just been reached - the 16-month moving average. For now, prices are weakening from this level, and if the 2000 to 2003 bear market is any guide, then the weakness we've seen from this level will continue and perhaps will result in a test of the lows quite far below current levels. If not, and prices rally above this level - then we can be rather comfortable with believing a new bull market has been born, and we should do nothing more than be buyers.

For now, the risk-reward favors selling short Brazil, and one can do that via EWZ; however, if the 16-month is violated to the upside, then one should be a buyer. We believe a bear market is in force given the manner in which the 5-month RSI is trading, but our battle line at the 16-month is drawn, and now we can asses our risk and trade around it.

Good luck and good trading,

Richard