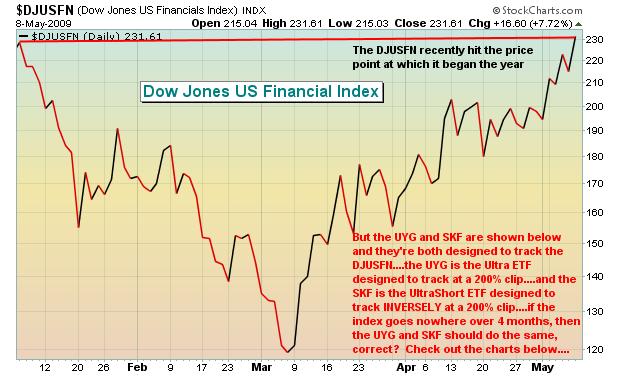

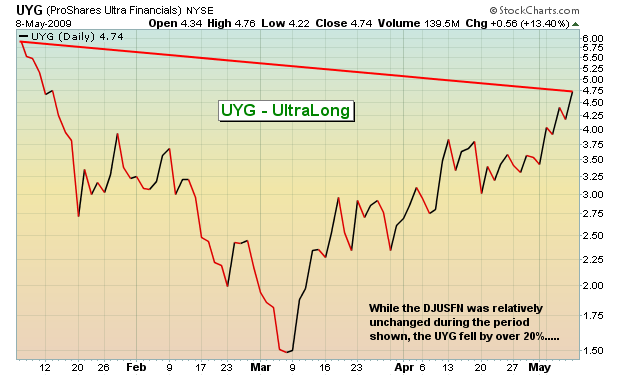

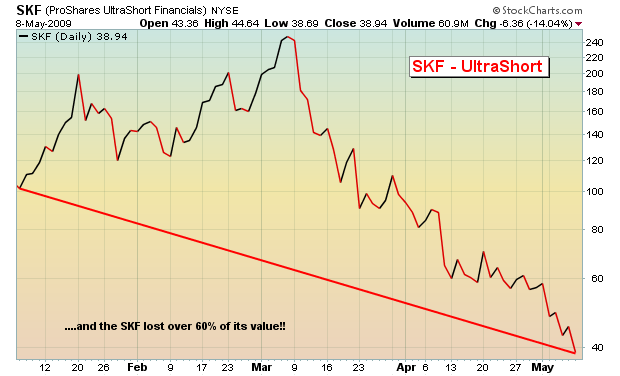

In February, I wrote an article discussing the fact that juiced ETFs (ETFs designed to double or inversely double the returns of an underlying index) do not perform as you might expect. There was a huge response to this article and mostly positive feedback. There are plenty of reasons why taking another look at juiced ETFs makes sense, but the inability to perform over longer periods is the primary one. To give you a recent example, the Dow Jones U.S. Financial Index fell precipitously early in 2009, but since has rallied strongly reversing earlier losses. From the January 6th high to the May 8th high, the index has been flat, but there was plenty of volatility in between. Because this index is the underlying index for the UYG (Ultra Financials ETF) and the SKF (UltraShort Financials ETF) and it was essentially flat over a four month period, it was an easy point of reference to determine how the UYG and SKF have performed in tracking that underlying index over time. Check out the 3 charts below:

One of the primary reasons I decided to re-visit this topic was the sight of a "professional" on CNBC last week touting that he was "building" a position in URE (the Ultra ETF that tracks the Dow Jones US Real Estate Index). You cannot "build" positions in juiced ETFs. Every day that you hold these ETFs, your risks rise and your potential returns dwindle. It doesn't mean this professional won't make money. It simply means that risks grow every day the URE is held and potential "juiced" returns decrease. Isn't the essence of trading the desire to generate above average returns with below average risk? Building positions in juiced ETFs will have the opposite effect. If professionals are trading these juiced ETFs incorrectly, it only stands to reason that thousands, perhaps millions of individual investors are doing the same.

So the next series of questions arise - are all juiced ETFs created equal? Do they all lose value at the same rate? Do some hold their values better than others? Should you even consider trading juiced ETFs?

I want you to benefit from my study. I studied the recent volatile period - from September 1, 2008 through May 6, 2009. There were periods of chaos within this study, from the panic-driven selloff in October and November to the surge in prices off of the March lows. I feel this is a representative sample to determine performance of various juiced ETFs. Included in my study were the following indices (and their related juiced ETFs):

* S&P 500 (SSO and SDS)

* NASDAQ 100 (QLD and QID)

* Russell 2000 (UWM and TWM)

* Dow Jones US Financial Index (UYG and SKF)

* Dow Jones US Real Estate Index (URE and SRS)

* Dow Jones US Oil & Gas Producers Index (DIG and DUG)

To view this study and the results, click here.

Happy trading!