Research published by Yale Hirsch in the "Trader's Almanac" shows that market performance during the month of January often predicts market performance for the entire year. The January "barometer" has been particularly prescient in odd years (the first year of a new Congress), with only two misses in 69 years (as of 12/31/2008). While the January barometer has a good record of prediction, I still put it in the "for what its worth" column, because I can't think of any sound reason why it should work, and in many years it seems that a correct forecast is simply serendipity.

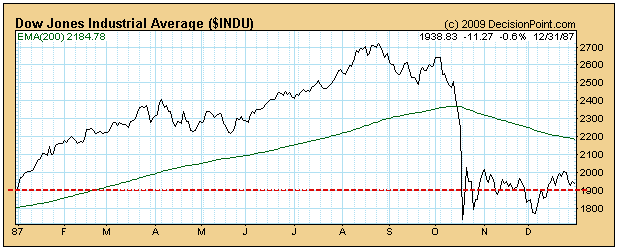

As usual we think you should view charts of actual market movement before making decisions based on reported average performance. For example, in 1987 the January Barometer forecast an up year. Well, it was an up year, but what a wild ride! On our website we have an extensive series of these charts going back to 1920. It is worth studying the charts so that you have an educated opinion of how this forecast device really works.

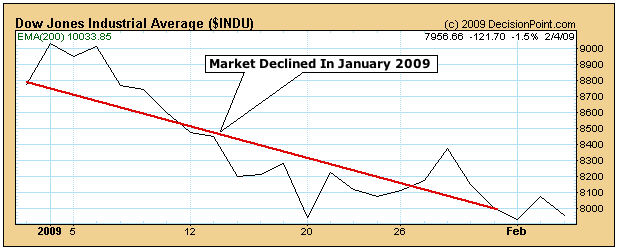

Bottom Line: The January barometer predicts that 2009 will be a down year. Regardless of what the barometer says, I think it is wishful thinking to believe that 2009 will be a winner. Consumers, which are 70% of our economy, are scared to death for their jobs. Until unemployment stops rising I think investor risk aversion will remain high.