In our last commentary, we noted that the S&P Energy ETF (XLE) was in the process of forming a bearish consolidation that argues for sharply lower prices. And since then, prices have consolidated further, but

are now poised to breakdown below trendline support and the October-2008 lows. However, this sector remains a favorite of both fundamental and momentum traders as perceived safety plays. However,

we would argue that while they may be so now; they will not be in the future, and in fact - if the market does indeed rally at some point soon - they shall not lead the rally.

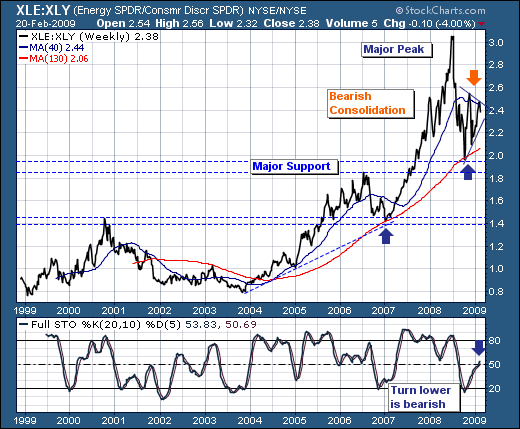

In support of this thesis, we look at the S&P Energy ETF vs the S&P Consumer Discretionary ETF (XLE:XLY). Arguably, in this horrid economy, one would think that you would have to be out of your

collective trading mind to buy anything related to the discretionary stocks. But, the ratio chart shows that XLE has under-performed XLY since June-2008, and we are more interested know in the fact a bearish

consolidation has formed, which would imply the trend that began in June-2008 is about to reassert itself in the weeks ahead. Moreover, we see the very same pattern when we look at XLE vs the S&P 500 Spyder (SPY). This leads us to conclude that XLE is not where one wants to hold long positions; either in bull or bear moves, for it is poised to under-perform rather dramatically - perhaps by as much as 25%

difference if our back of envelope technical measurement target a 1.8 ratio. What one was considered "safety", will soon become a source of funds for more "risky" assets. Be forewarned; be prepared.